Network Resiliency

The Weekly ChainPulse Report

The Cavendish banana is defenseless to Tropical Race 4 (TR4).

It’s a pesticide resistant pathogen that lives in the soil. An infected Cavendish banana tree feels its wrath via a chokehold, preventing it access to water and nutrients.

The tree is not only a goner, but the land it sits on becomes quarantined to save the farm. One infected tree likely means total destruction of the farm’s crop.

The worse part about TR4 is where you can find it.

TR4 is not constrained to one region or country of the world. Instead it’s global, threatening the entire world’s supply of this seemingly ubiquitous banana. There is no cure for this pathogen that’s rapidly spreading across the globe, and we have no solution in sight.

For anybody that enjoys the most popular banana, its presence might come to an end.

Now, when we look at why the Cavendish is on the verge of extinction, diversity is the paramount reason. It’s mere lack of it highlights a crucial reason for why diversity matters. If the Cavendish was able to breed, mutate over time, and evolve against diseases like TR4 then the threat of the entire globe’s supply would not be a potential outcome.

And when it comes to bitcoin… The Cavendish’s weakness is why bitcoin is gaining resiliency.

During this halving cycle a remarkable effect is taking place that is best viewed through the lens of diversity. And as I’ll show you today, it’s this diversity that is enabling bitcoin and crypto to be resilient.

Now, I sat down to write this essay after listening to a few podcasts while I worked in the yard. Each were decent on their own. One had a government official on discussing bitcoin, another detailing how NFTs solve a problem the guest was dealing with, and another one was with two financial advisors describing the buildout of custodians, brokers, and educational tools to bring bitcoin to their customers.

The perspectives were quite varied. And as I neared the end of the third podcast I was not only an intermingled mess of dirt and sweat, but starting to think about how diverse the professional backgrounds were of these new market entrants.

In my six years of following the space I never came close to thinking of this. In fact, the only other time I did was during a bitcoin conference. While waiting for the next presentation I started to count the amount of “suits” and “hoodies”. That year there was a noticeable presence of small shop venture capitalists making the trip.

It’s like there were only two market participants, and you either fell into the ethos of the hoodie or the tailored suit. Sure, the breakdown is a grotesque oversimplification. But I make it because it’s something you can likely relate to based on your own experiences.

Also, it helps me explain the new diversity of bitcoin and crypto as a whole.

In the last week here are some news items that came across my desk.

- An artist and musician teamed up to create a limited release of digital art embedded with music.

- A sports team owner said NFTs solve problems he has with copyrighted material.

- The Miami governor is looking to allow its employees to accept their salary in bitcoin, and he wants to encourage crypto innovation in the city.

- Suit and tie wearing financial advisors are heading up a project to more easily bring the trillions of dollars of client wealth into crypto.

- A New Zealand pension fund reported a $17.5 million investment into bitcoin.

- Another Wall Street bank.

- And two of my close friends finally made the plunge - most importantly.

This list represents retail, Wall Street, institutional retirement vehicles, financial advisors, government, artists, musicians, the uber wealthy investors.

Bitcoin has never been this diverse when it comes to its participants. And it’s why the network is getting stronger.

Think of it not only from the point of view of the banana and being more resilient through genetic diversity. But a diverse network of users.

Go ahead and visualize a decentralized biological network in your mind. I always think of fungal networks in the soil.

If a network is attacked, resources are rerouted to help itself defend. After it successfully wards off the threat, it’s can more easily defend itself from the same attack.

This is what’s happening with bitcoin.

Granted, most of the fighting and defending is taking place with bitcoin maximalists, Ethereum maxis, LINK marines, and many more. But make no mistake, if there’s a threat from outside the crypto network, these diverse entities… Plus the entities encompassing the government, Wall Street execs, corporations, artists, musicians, athletes, sports team owners, VCs, investors… will rise in unison to defend the network.

It’s when all the various internal sect sparring will be put towards defending crypto as a whole.

And while the threat isn’t necessarily imminent, the ability for the crypto network as a whole to defend itself is growing by the day. The new wave of entrants help create a more resilient and stronger network in turn. And each new attack on the network results in a wave of defendants (i.e. - mining is boiling the oceans).

What’s more… The U.S. government and FED are considered to be the primary threats to bitcoin and crypto’s existence. As more of their constituents and bits of itself start to immerse itself with cryptocurrencies, the harder it is to reverse the current course.

It’s one of the main reasons why this cycle is truly unique. The way in which it plays out will probably take all of us by surprise. Which is why we take it one week at a time.

To help navigate us in such a manner is the purpose behind this edition of Espresso - The Weekly ChainPulse. It’s designed to help guide you through this uncharted territory.

So without going too far down the banana talk, let’s dive into it.

For those that are new, I’d first like to welcome you to Espresso. Every Monday we publish the Weekly ChainPulse Report. It’s a rundown on how bitcoin and crypto look through three different lenses. The global macro financial system, the macro 10,000 ft view of bitcoin or crypto, and the weekly structure.

It serves as the starting point for the rest of the week as we’ll reference it frequently.

Macro

The buildup of last week being a barometer of the months to come for crypto was anything but.

Federal Chairman Powell and Co. said little to pacify concerns that a future standoff against crypto is looming. This makes me believe we won’t hear more until either an ETF is in the process or the U.S. central bank digital currency (CBDC) is imminent.

In the meantime we’ll need to watch the markets to get an idea of when the FED is needing to step in and try to prevent financial collapse thanks to massive money supply growth, constant quantitative easing efforts that can’t disappear, and unsustainable debt loads.

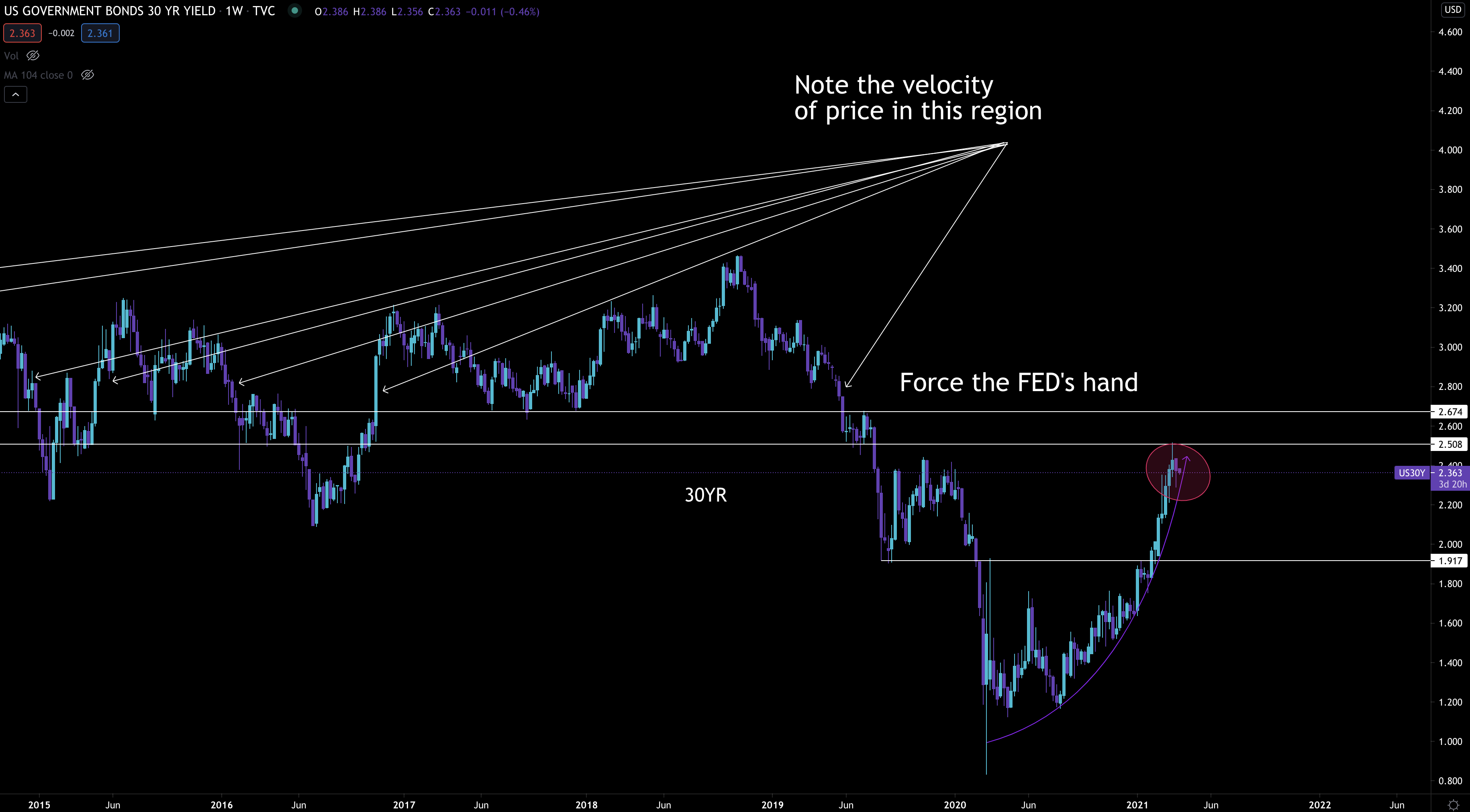

A rise of rates is one of the indicators we’re watching as it’ll force Powell to ease the pressure valve in a manner that is bullish for bitcoin.

If he doesn’t do it fast enough, then bitcoin can get swept up in a market wide selloff in the near term. While the long-term case for bitcoin isn’t likely to change any time soon, the potential for bitcoin to suffer whiplash in a selloff is real.

Looking at the 30yr yields of U.S. government bonds, a fast movement in yields could be cause for a reaction by Powell. In the chart I point to some historical instances of fast price action happening just above the 2.67% level. If 30yr yields enter this region, there’s potential for this to be enough for Powell to pull one of the few levers still at his disposal.

What’s interesting here is that yields look poised to break this parabolic trends that’s been forming for about a year. For assets that are deemed risker than a blue chip stock, this is a good thing. I’m crossing my fingers that yields break the parabolic trend and go sideways or towards prior lows.

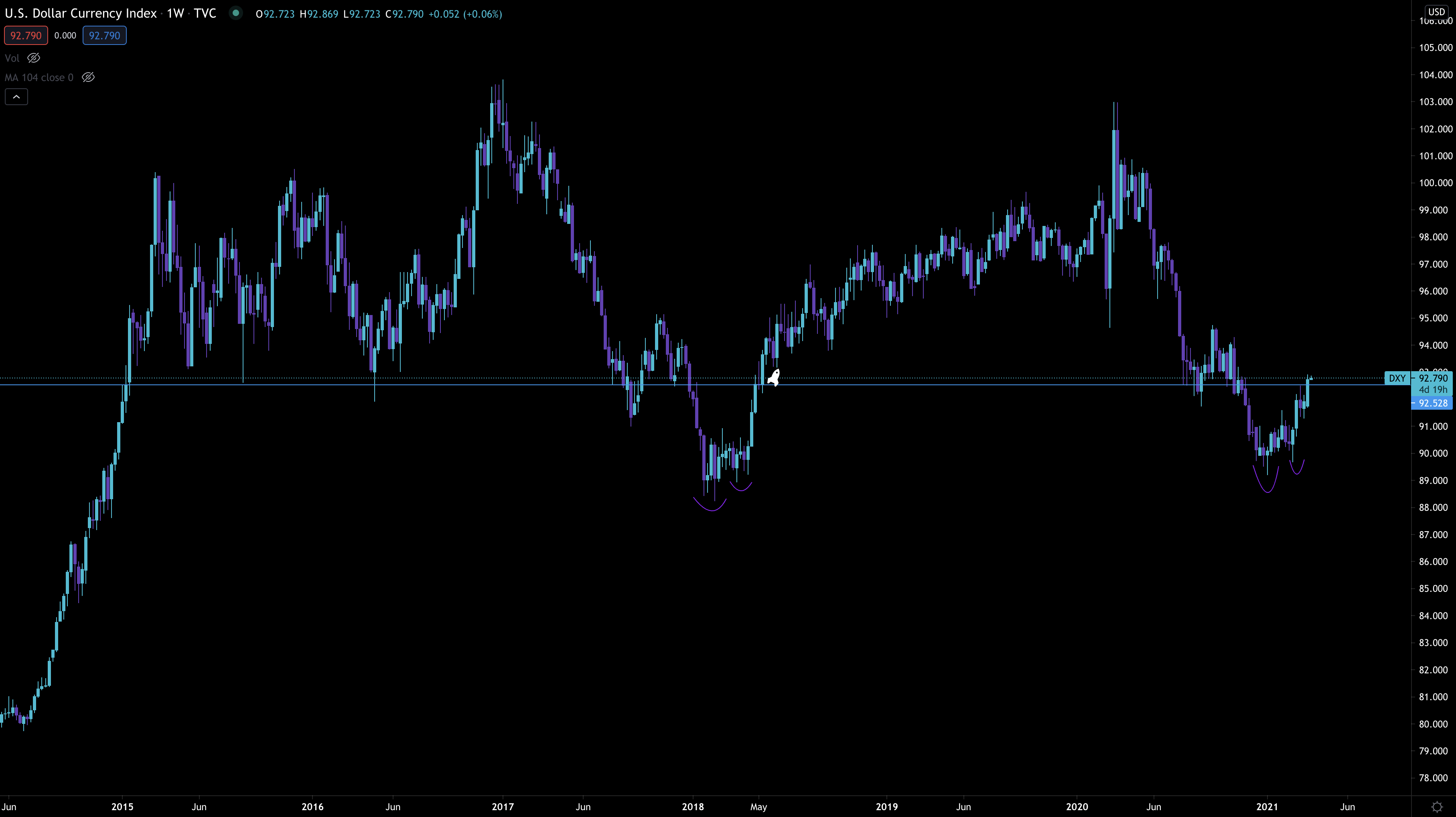

The other chart I’m watching is the U.S. Dollar index (DXY). This week it’ll begin to navigate through what has historically been a range where short or long-term reversals tend to happen. If there’s upside momentum here, this can lead to some near-term bearish price action for bitcoin.

Both of these charts are butting up or entering some pretty important areas that can result in a spillover effect for bitcoin. That’s because of how fast prices or yields can move, which act as a “yank” across the market.

Moving on to what bitcoin looks like…

Macro On-Chain Crypto Beat

Today I’d like to make this and the section that follows very quick and to the point. That’s because little as changed from the prior week, and I don’t want to get unnecessarily redundant.

To avoid redundancy, I’m breaking down some charts we’ve looked at recently and giving a quick one liner on them. I’m only touching on metrics we’ve discussed recently. Go ahead and click the metric if you’re unfamiliar with it, you’ll be guided to the essay where we break it down for you.

Keep in mind, these metrics are to help us gauge when we’re at a potential top. Neutral means it’s not near it’s reading of bitcoin being at a top.

Market Cap to Thermocap Ratio - Rising, but not nearing the oversold area. This is neutral and the market is paying a fair price for bitcoin security.

The Pi Cycle Indicator - The two moving averages have not crossed yet. When they do, it’s historically been within days of a top. The price action of late as increased the gap between these two. This is neutral.

Mayer Multiple - We’ll be covering this one tomorrow, so I’ll hold off on that until then.

Puell Multiple - This is our melt up indicator. When it’s in the overbought zone we can be prepared for the last parabolic push. It’s neutral.

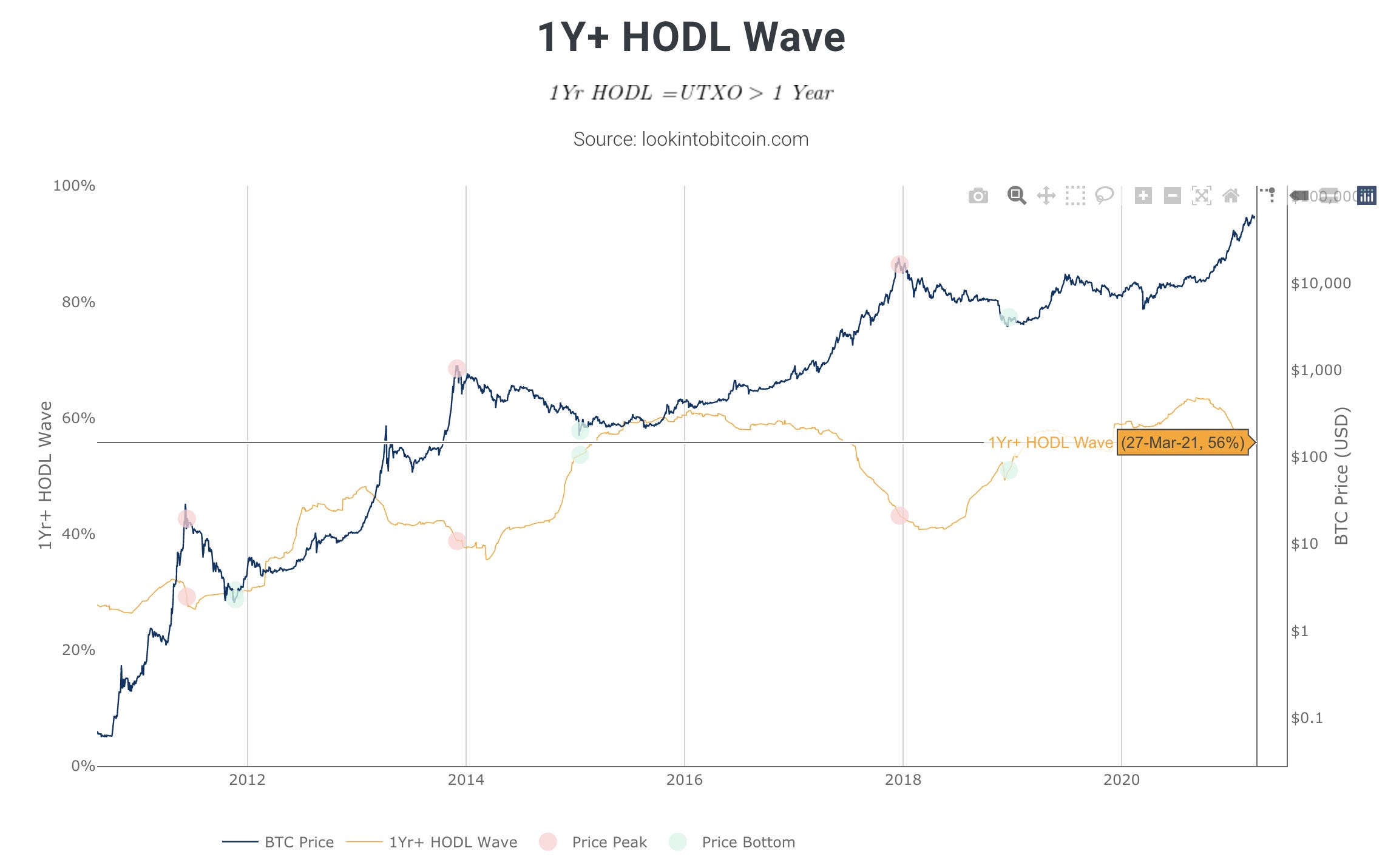

1 Year+ HODL Wave Chart - The amount of supply being HODLed for one year or greater stands at 56%. Once we dive below 50% then we’ll start taking note as it’ll indicate HODLers believe the price won’t rise any further. You can view the chart below.

We’ve covered a lot more than what I list here. However, I narrowed this list down because we can start to watch for what I believe to be an upcoming succession of events.

The scenario might be where the HODL wave chart drops below 50%, then a couple days later we see Puell light up, and then a few days later the Pi Cycle crosses. Or something similar.

If we see such a quick succession then it’s a strong indication that we need to consider taking some money off the table, hedge ourselves, or purchase some downside derivatives.

For now, we’re not at that point yet. If anything, price looks ready to charge in the coming week… Which is where the next section comes in.

ChainPulse

Last Friday we gave a recap of what unfolded over the last week. If you missed it, please take a few minutes to give it a read. It’s a helpful breakdown on where we’re going. More importantly, nothing has changed.

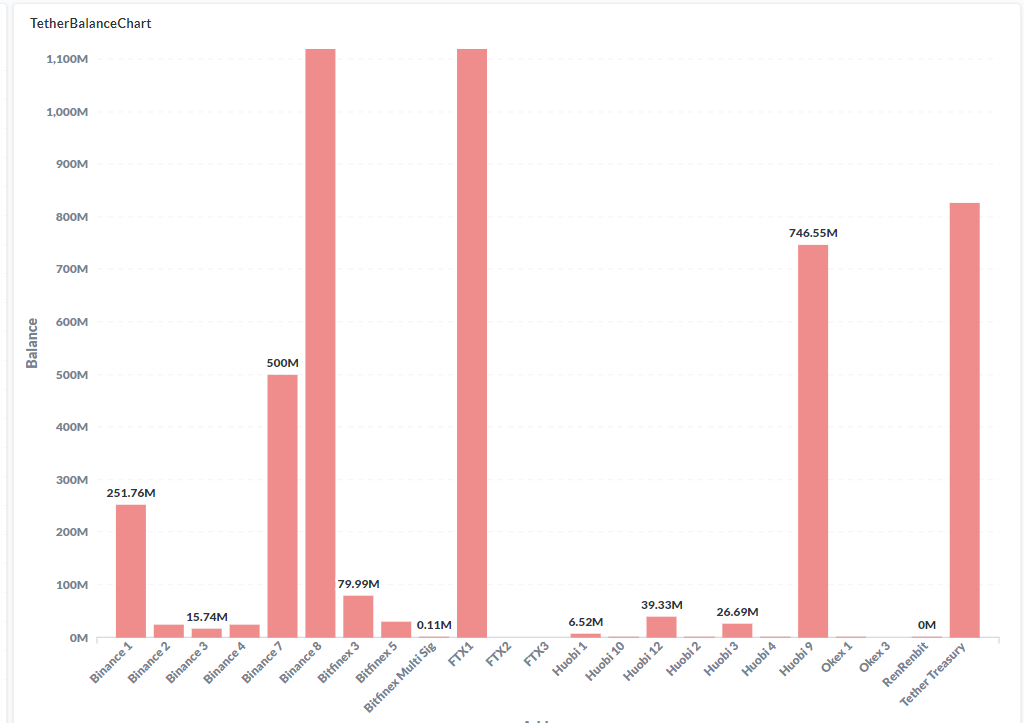

Dry powder in the market is still at mountainous levels.

Almost a billion USDt are sitting at Tether ready to get doled out.

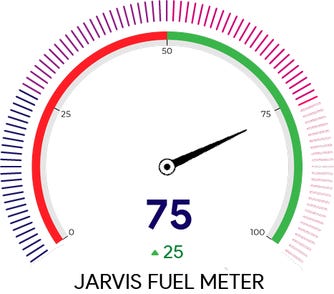

Our risk meter remains the very low relative to the last six months, and the amount of fuel to drive the market is incredible as the Fuel Meter sits at 75.

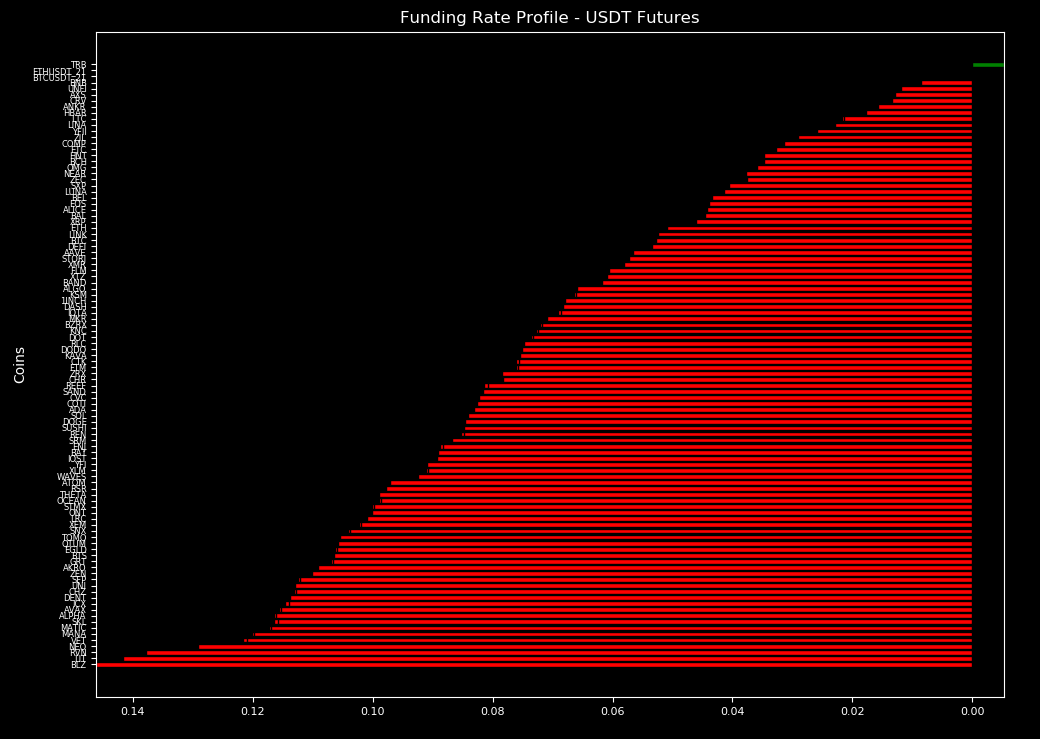

And lastly, the funding rates still look good. There was a bit of a jump over the weekend in light of the massive options expiration date passing. But now that we got a slight pull back, here’s where we stand.

The stage is set to drive price higher. Now we just need the whales to step up and commit to a direction as everything else is ready.

That’s it for today. Hopefully you enjoyed this issue, if you did please spend 30 seconds to share this with your friends or network. We’re looking to hit 10,000 subscribers in the next month. If you and us can do it, then we’re introducing two new services where we can introduce more alpha to you.

Thanks for your help.

Your Pulse on Crypto,

B