Grayscale Effect Update

It's Do or Die

Dust off your toolboxes.

Now is the time to double check everything. Make sure it's in a place you can instinctually grab it without hesitation.

Fumbling around to decide how a tool works or where it’s located can result in a massive opportunity.

I say this because the next two months might become the most exciting time for crypto to date.

This feeling stems from something I decided to finally unveil about five months ago. Many of you are aware of the Grayscale Effect. For those unfamiliar with the concept, it's a rather counter intuitive theory.

If we distill the theory down to its core components we get this: Bitcoin’s price rises shortly after fresh GBTC shares mint and become tradable.

If you are thinking that sounds backwards, please take the time to read the Grayscale Effect. I understand it goes against the grain… How can the dilution of GBTC result in higher bitcoin prices?

In the essay I break it down by analyzing each major unlocking event, what happened after each unlocking, how the Trust operates, and what Grayscale investors tend to do during an unlocking event.

Once caught up, come back here to read this update. It’s not going anywhere.

Time to Step Up

The clock is nearing the 11th hour on The Effect. We will soon find out if it's still in play.

If we see outsized GBTC discounts and / or lower prices for bitcoin in late May, then it’s likely over for the Grayscale Effect. But if price starts to rip in the coming weeks, saddle up.

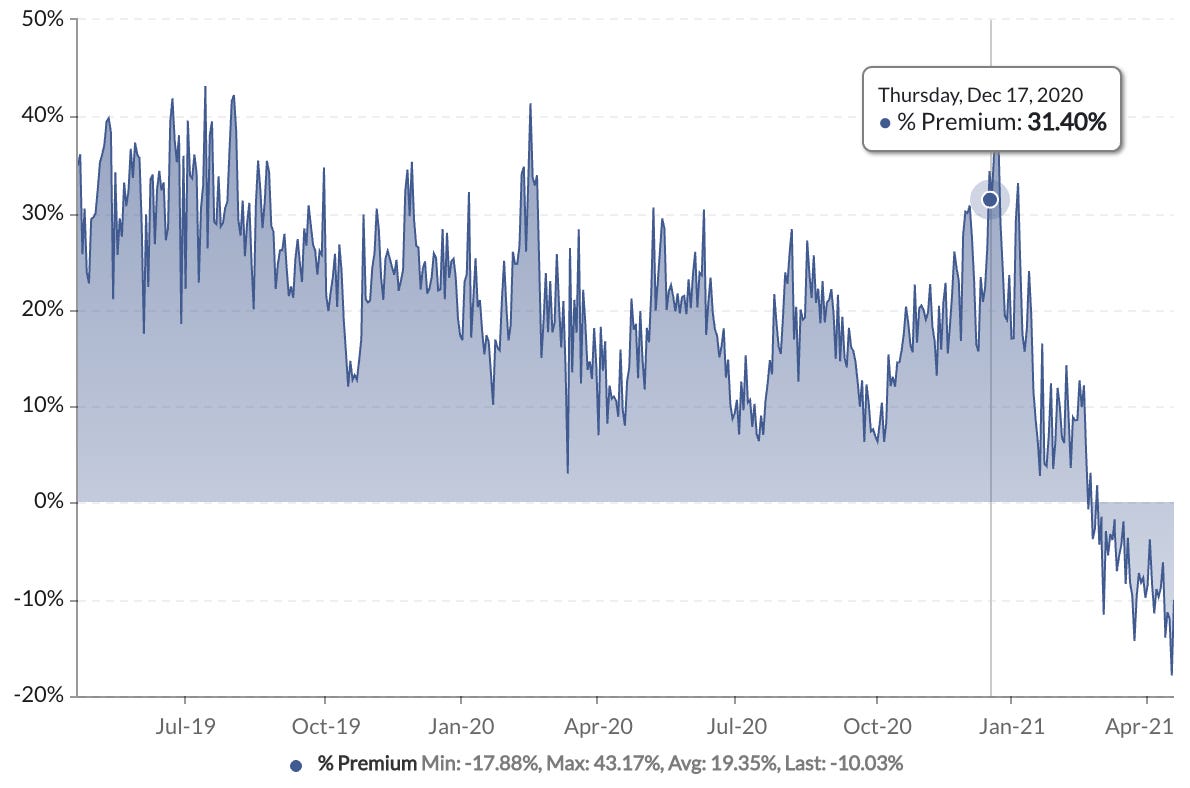

Now, before getting into the timing of everything I want to address the negative P.R. on Grayscale. It stems from the discount it’s realizing. A discount means GBTC shares are trading at a discount to its underlying - bitcoin’s spot price.

This can happen because Grayscale charges a yearly fee on the assets under management of 2.5%.

Now if you decide to hold BTC for several years, this fee begins to approach major chunks of your holding. Most bitcoin investors (55% as of right now) hold their tokens for greater than one year. We know this thanks to HODL waves created from on-chain analysis.

So if you charge the fee over a span of several years then fair value for the Trust should sit somewhere between -2.5% to -7.5%. That's if you compare it to the alternative, buying BTC on spot markets.

OK, now about why the premium vanished earlier this year and finally became a discount?

The answer is share dilution…

I know what you’re thinking… "You said the dilution of GBTC results in higher bitcoin prices?"

You would be correct. But this dilution doesn’t impact price until the unlockings have run their course. Here’s what I mean…

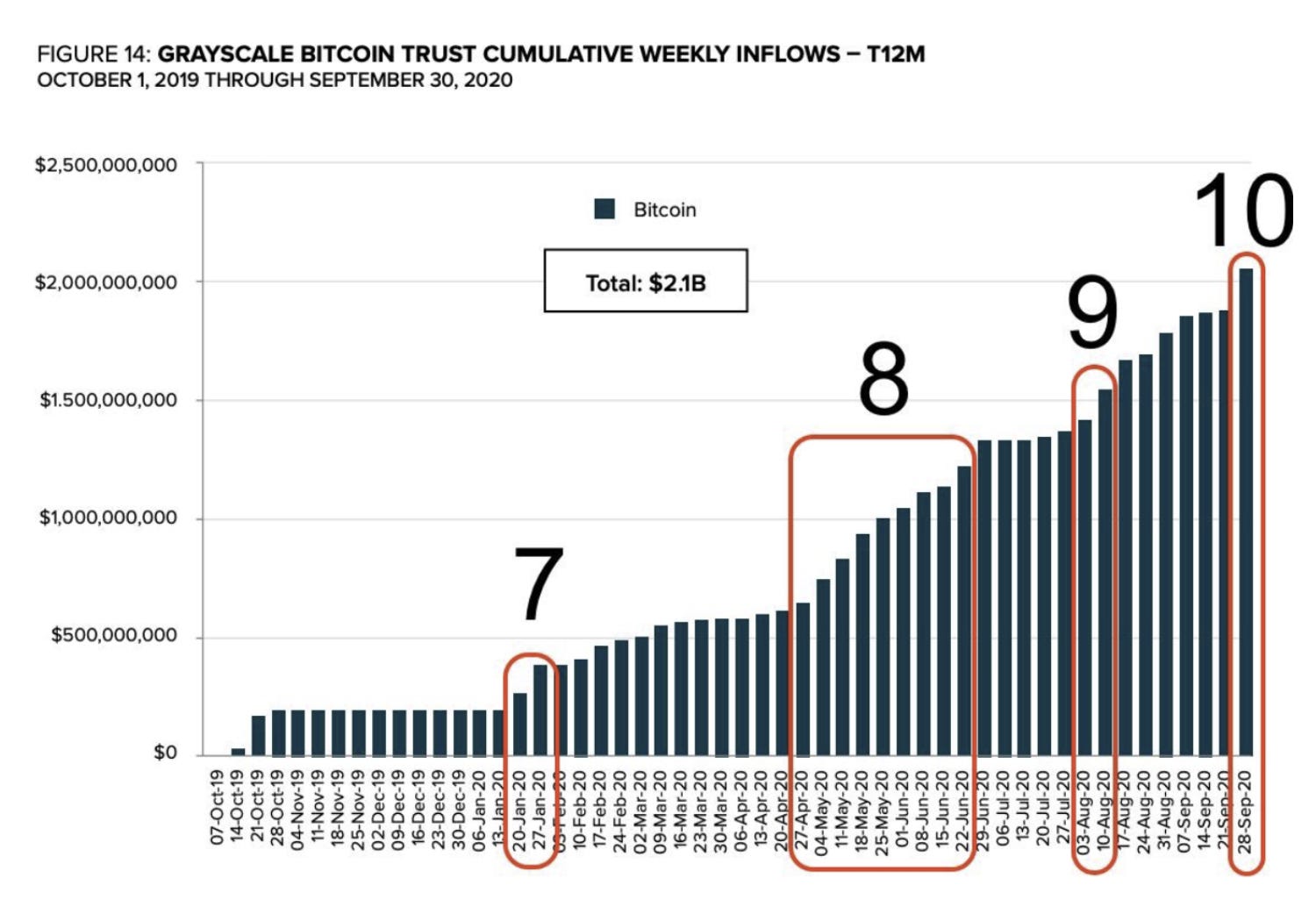

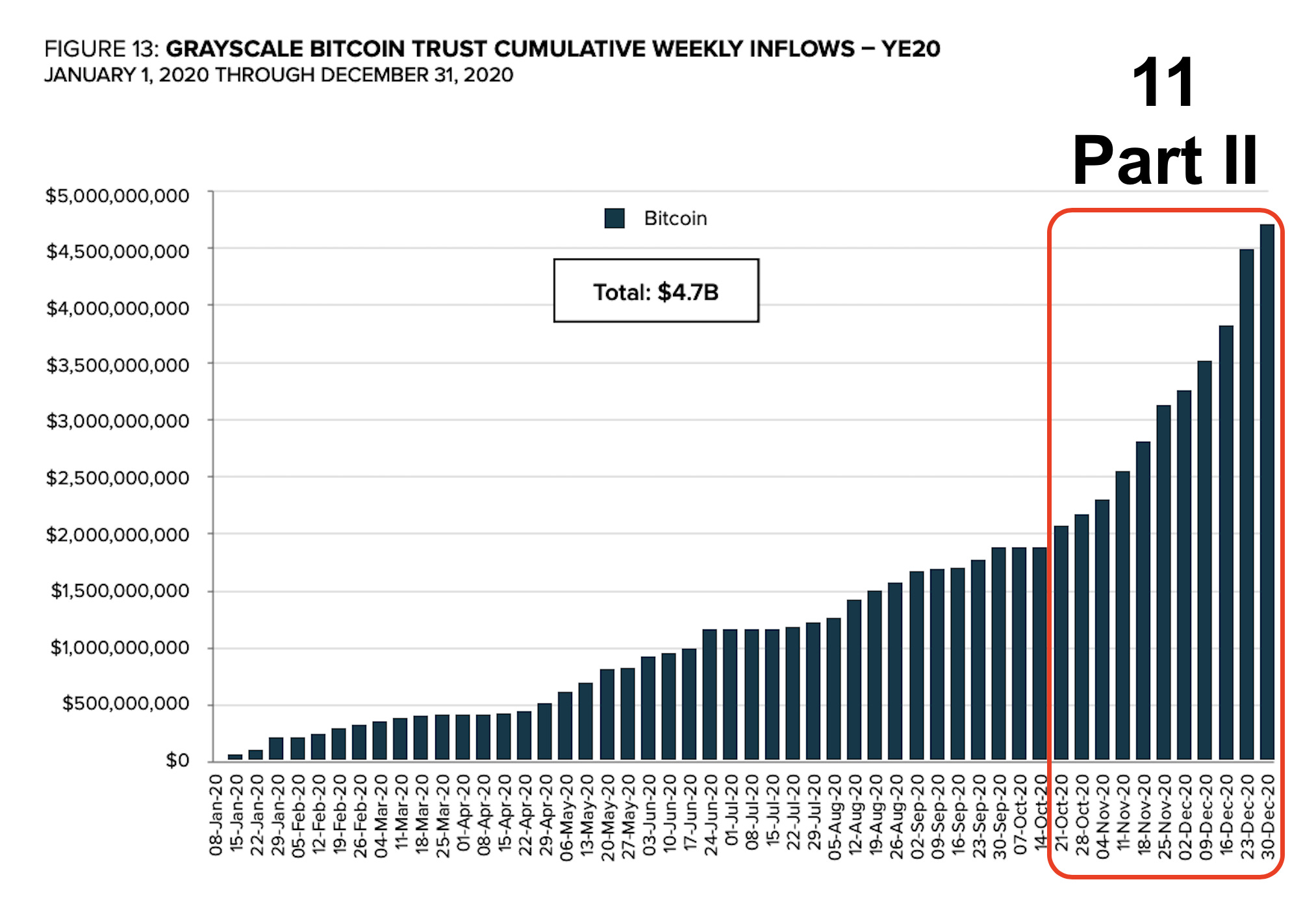

The amount of new shares created from the end of October to the end of December were excessive. The growth was much larger than what is normal.

This happened because six months prior there were record inflows of capital to the Trust.

It was tranche 8 in the report. And new shares are available to trade six months after the inflow in the Trust happens.

Now, near the end of 2020 price ripped higher as over $500 million of GBTC became tradable. At the time investors likely repurchased their BTC on spot. And this repurchasing rocketed price higher while generating retail FOMO.

The FOMO got so extreme that the premium rose from single digits to over 40% in that stretch.

This is what I mean when I say price rose while the market got diluted. A Bloomberg Terminal is where you can view the increase in shares outstanding over time. If you don’t have access to a Terminal, check out the 8-K SEC filings published during this time span. You can find them at the SEC website here.

It’s insane.

Dilution was in full force.

Price didn't begin to sag until the historic unlocking event was well past and investors no longer needed to rebuy BTC on spot markets. Without this need to replenish ones coffers price and the GBTC premium got whacked.

From late December to most recently, the premium went from 40% to -15%.

And today, many wonder if the Trust will ever recover. Even many Espresso readers are wondering if the Grayscale Effect is still alive.

I say yes. And that’s what we are going to cover for the rest of today’s issue.

The Case

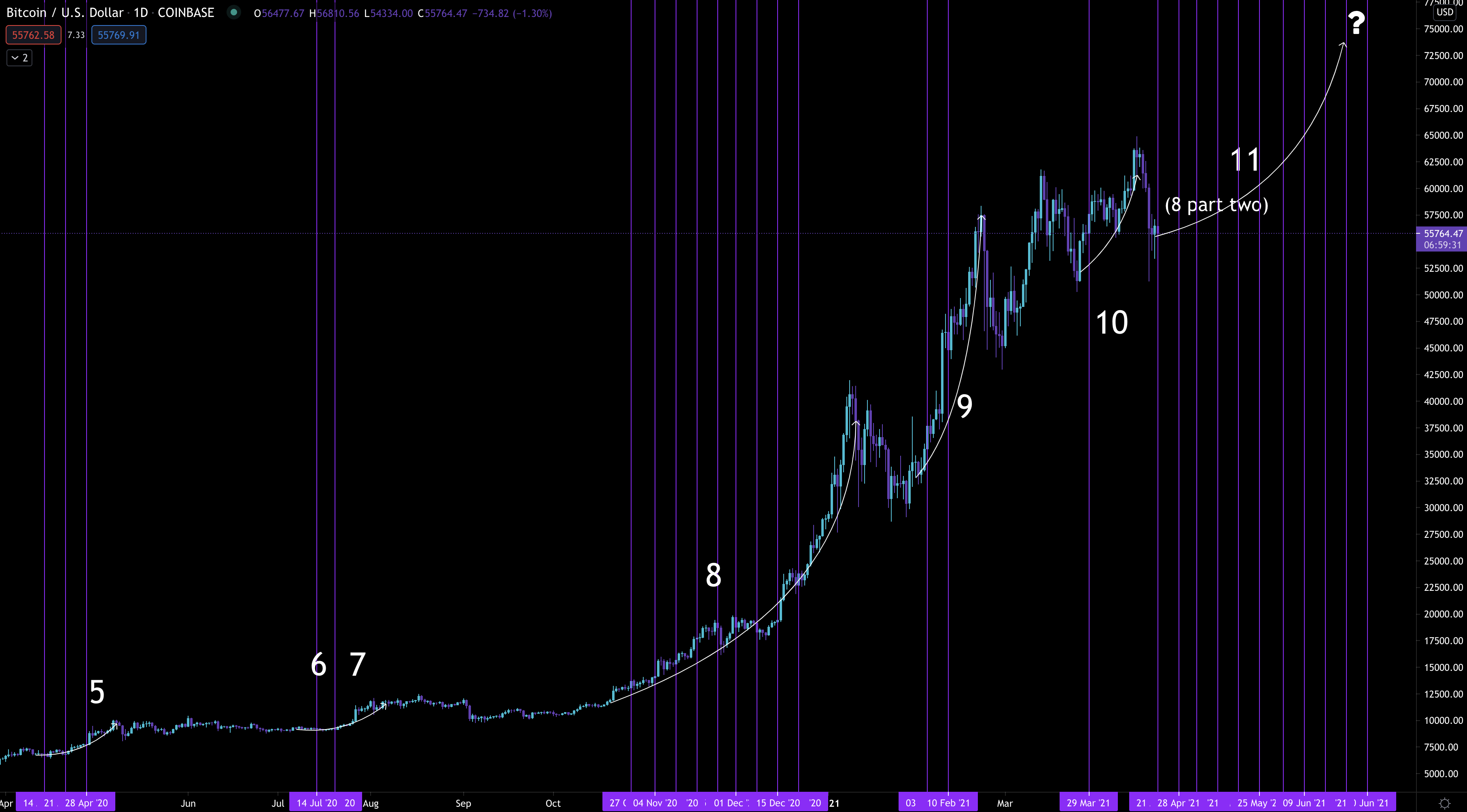

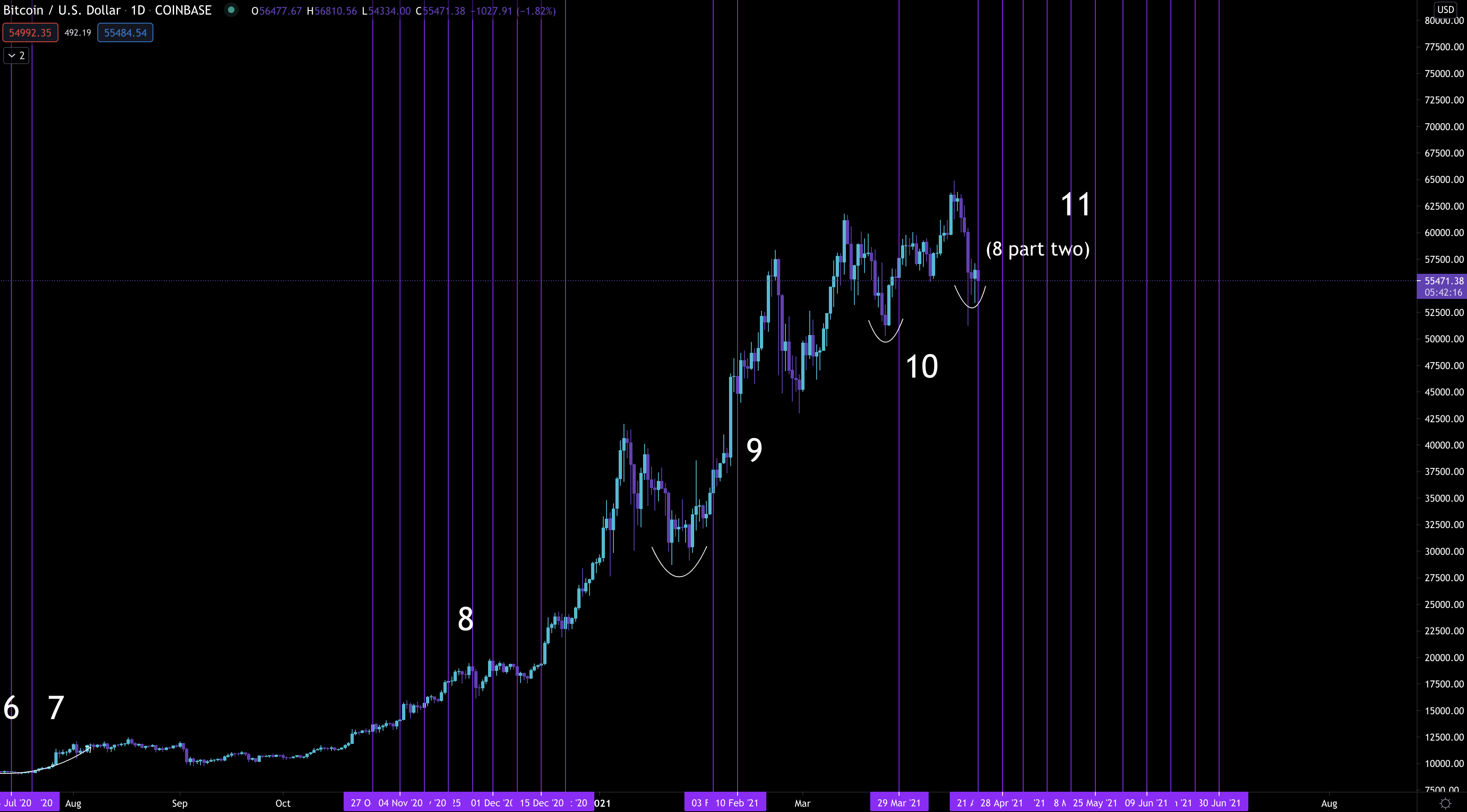

Here’s the Grayscale Effect chart I update about once a month. The purple vertical lines are major unlocking events. Major in the sense that a quick eyeball test says it’s a big uptick.

The numbers are self labeled tranches I refer to in the original report.

The investors who took part in tranche 8 are about to come full circle. During tranche 8 the incentive to reinvest in the Trust was present due to a large premium in the Trust.

Also, here’s what the inflows looked like as those unlockings took place late last year. Over $3 billion dollars. Most of the capital was likely from investors doing a "rinse in repeat". Meaning they sold GBTC, rebought BTC, and then transferred it over to the Trust.

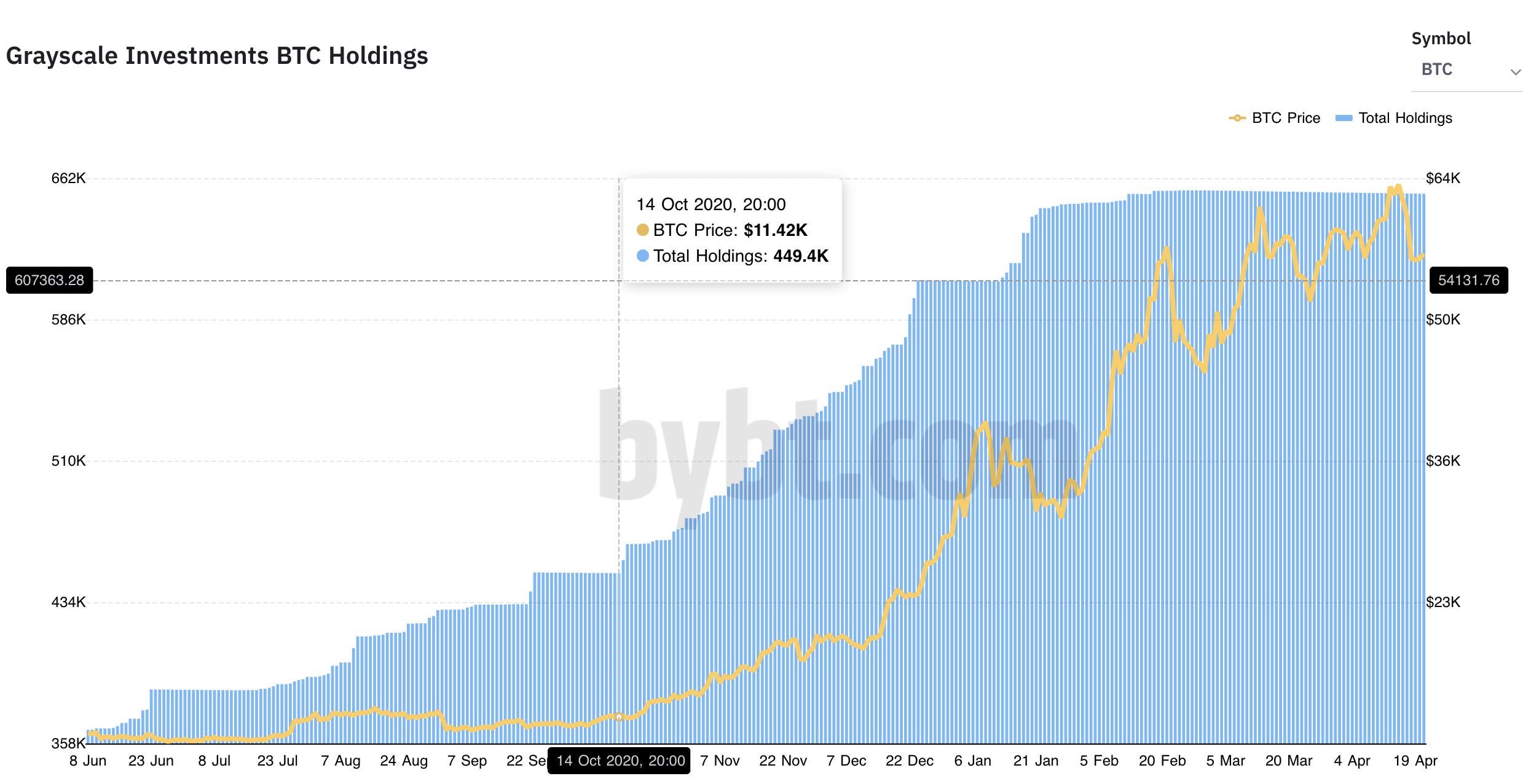

When viewing that amount in terms of bitcoin… Here’s a chart from Bybt.com showing the inflows in that time period. Nearly 160k BTC.

What we should also make note of is BlockFi and Three Arrows Capital are both in this tranche. BlockFi will unlock their shares any day while Three Arrows is at the tail end of June. (You can go to that SEC link above if you want to see for yourself.)

The there's the company behind Grayscale, Digital Currency Group (DCG). The company can buy GBTC shares off the open market thanks to a recent SEC filing.

So let’s take a step back real quick and explain what this means.

DCG, Three Arrows Capital, and BlockFi. These are the biggest entities in the space.

Let's try to think about what their incentive might over the next few months. In doing so I maybe we can better understand what might unfold.

Assuming BlockFi and Three Arrows Capital sell their GBTC shares, they will likely replenish their BTC holdings. This is likely to unfold on the spot market.

We know BlockFi will likely do this since they conduct operations in BTC. And Three Arrows will likely follow suit. This is based purely on their long-term belief in cryptocurrency being foundation of the future economy. Note that this is more of a ‘feeling’ based on Su Zhu commentary.

These two players alone are responsible for about 10% of GBTC holdings. If they go back to the well via the spot market, this is significant buy side pressure.

If this pressure translates to higher prices than FOMO will return to the market. Then the ultimate side effect will be GBTC trading at less of a discount and perhaps a premium once again.

Pile on to this argument by glancing over at DCG who is sitting on the sidelines ready to act at any moment. These guys can place even more buying pressure on GBTC when the time is ideal.

Keep in mind, DCG is an entity that’s rolling out new Trusts. They have a massive incentive to ensure their biggest investors make out like bandits.

That's because the more Grayscale investors profit in GBTC the more likely they invest in Ethereum, Link, Decentraland, and other Trusts. This is something you should want as well. Because in turn we'll see more “Effects” similar to what we’ve seen with GBTC over the past couple years.

It's a trend we can profit on.

And the simple fact Grayscale and DCG want AUM in its new Trusts, we can expect they will look out for players like Three Arrows Capital and BlockFi.

These guys are coming due over the next few months.

This is team “UpOnly”.

The 11th Hour

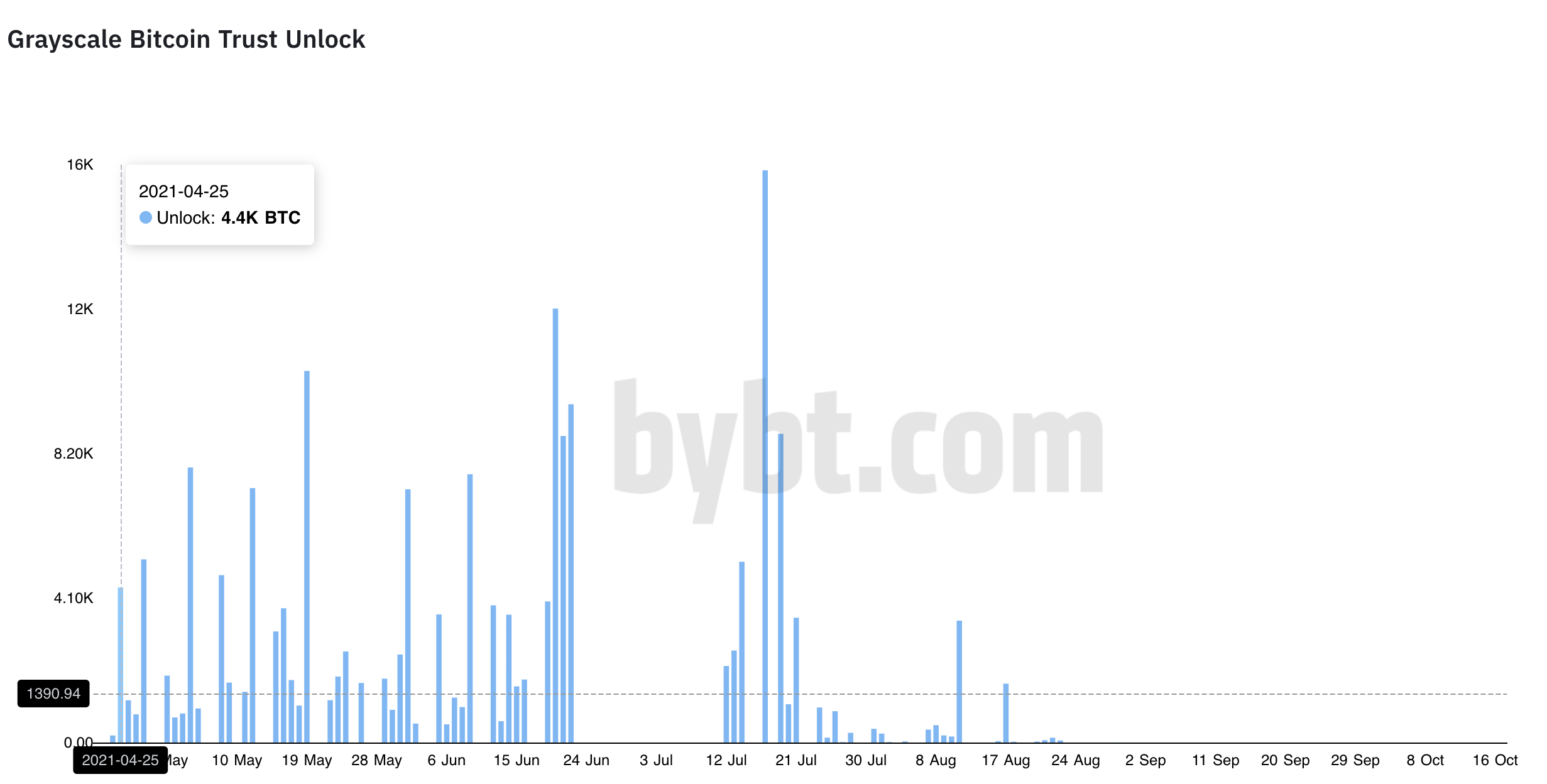

So here we are on the cusp of tranche 11. It’s massive. The Trust is trading at a discount. Some of the market’s largest players are involved. And the biggest crypto asset manager does not want to look like a fool.

For these facts and the history of the Grayscale Effect, we will see higher prices in the coming months.

And it starts now.

The first uptick in unlockings from tranche 8 was October 21st. Six months later puts us at today.

Bybt.com’s inaccurate chart puts it at April 25th… Inaccurate you ask? Because April 25th is a Sunday - a non trading day in the equities market.

Let’s call it April 26th then. I think that’s a safe bet.

Pulling up a chart… Seems we’re experiencing selloffs prior to bullish moves.

Selloffs tend to reset funding rates and create bearish sentiments in the market. This creates a perfect environment for price to build momentum in.

Whether this “flush out” is intentional or not, I don’t think so. I’m not a “it was manipulation” type of analyst. To me that’s an excuse and laziness. If you dig you’ll find a reason. More importantly I believe major movements happen as several factors start to get in synch with one another. Similar to how I wrote about the selloff from last weekend.

So April 26th unlocking combined with a cleanse in funding rates sets the table up for Tranche 11. It's a tranche that will unfold until the end of June.

This means we're just placing our toes at the starting line.

And during this multi-week sprint we have major players in our corner. There hope much like ours is for higher prices and premiums.

When we combine these facts with bullish on-chain readings per my article from last week, BTC and ETH liquidity crises unfolding making supply scarce in the market, and of course that institutional chatter that’s always ongoing...

Your spidey senses begin to tingle.

The only things standing in the way is regulatory measures. Any curve ball from these players isn't likely to happen until June. This is something I covered in prior issues of Weekly ChainPulse Reports.

What I find entertaining with this potential timeline is the coincidence factor. Let's say the timing for regulatory news does in fact drop in June... Just as the market is in full euphoria from Grayscale...

It’d be choreography at its finest. I wouldn't second guess any selling in that scenario.

Now, with all this uber bullishness, let’s throw in a few words of caution…

What I’m laying out here is some very bullish pieces all coming together at once. I encourage you to question me and force me to consider bearish alternatives. I’m in a unique situation in that Jarvis AI does my trading.

That means my style is not discretionary. My positions in the market change on a dime sometimes without my knowledge.

It’s a style created from finding effects in the market that are then modeled. Once modeled the AI technology does the trading . This is how our team removes our bias. It’s also why I have so much time to write!

Anyways, it’s important for you to understand that because everybody's situations differ.

And frankly, I might have blinders on. Always question my work.

But assuming what I laid out unfolds, consider this your last reminder to get your toolboxes in order. Things might start getting crazy as early as next week.

Your Pulse on Crypto,

Ben Lilly

P.S. - Pablo likely sold this week. Similar to the last two instances, he seems to have sold into the “V” bottom. I’m starting to really like this signal for timing a bottom.

P.P.S. - Did you tell somebody about Espresso lately? If not, hit the share button below and send this issue to somebody you know.

Remember, when we get 10,000 subscribers we will unveil our data analytics platform, ChainPulse.ai. When this happens we will also start reserves spots for our ChainPulse Report.

We plan to only allow a limited number of readers in order to preserve alpha.