The Grayscale (GBTC) Effect

What will you do with this knowledge?

It started with a solitary alert.

In the days that followed the alerts progressed into a deluge of signals indicating the spot market was driving the market. Not the derivatives market.

The last time we saw this was 2017.

As the alerts continued to rattle off in the following weeks it was clear bitcoin was not just heating up, the entire market was an inferno.

The reality of this macro shift settled in and we’d come to terms that the bull market was not something to question, it was here.

The only thing we struggled to understand was where the spot buying was originating from.

The cacophony of signals showed an organized effort. Not the type of effort reminiscent of a coordinated whale pump. Instead it was a new species leaving their footprints on the blockchain for the first time. And it had no regard to price.

In October news broke Grayscale experienced $300 million of inflow in a single day back.

The new species was Wall Street.

Now that the new species was identified, it was time to get our hands dirty and begin digging into spot buying data and who Grayscale was.

The tools at our disposal were 8-k reports, 10k’s, 13G’s quarterly reports, a cell phone, and Jarvis AI.

For those who don’t know, Jarvis is our artificial intelligence machine that tracks real-time blockchain data across several networks. We use it to help manage 32 algorithms that minimize risk, pinpoint timing, and generate signals. Jarvis AI uses all of this to autonomously trade spot, futures, perpetual futures and options.

So when it came to Grayscale, we wanted to see what forewarned Jarvis AI the spot market was heating up before price started its parabolic rise.

First up was to figure out how Grayscale operates. Once we started getting our hands dirty what we found is they are the biggest driving force in crypto. And their effect on the market generates one of the best opportunities for trading and today I’ll break it down for you.

The in’s and out’s of Grayscale

To sum it up, Grayscale is an entity of the Digital Currency Group that has cornered the market, accumulating a total of 606k BTC to date.

Their unique structure is what makes it possible. It’s essentially structured to hoard Bitcoin. BTC and USD (which is then used to purchase BTC) flow in while nothing comes out.

The way Grayscale achieves this one-way flow is in the way they distribute shares. Accredited investors or ‘wealthy individuals’ can sign up for Private Placements to receive shares.

These accredited investors then give BTC or USD to Grayscale. In exchange, Grayscale gives them an equal value of shares. If each share equals 0.001 BTC (In reality it’s 0.00095085) then for every BTC handed over to Grayscale, the accredited investor receives 1000 GBTC shares (minus a small fee).

The catch is the private investor must wait six months before selling the shares on the market. That’s where the non-accredited retail investor comes in. Aka the ‘not so wealthy’ buyer.

Now, it might seem fair, the exchange of shares for BTC, but in reality, it’s anything but fair. That’s because GBTC almost always trades at a premium. non-accredited or retail investors looking for a pure-play into BTC within the stock market are paying anything but fair value.

Here’s what I mean… Recently GBTC closed at $28.25. Bitcoin according to the BraveNewCoin Liquid Index closed at $22,830. According to the Grayscale website each GBTC share equals 0.00095085 BTC. Meaning fair value for GBTC is $21.71. The current price represents a 30% premium just because the buyer isn’t wealthy. And that’s a 30% premium going straight to the accredited investor who handed over their BTC.

This strategy is how Grayscale created a Trust where Bitcoins essentially flow one way, into the trust. What accredited investor who owns Bitcoin is not interested in growing their balance in terms of Bitcoin? It doesn’t matter if the price is $5,000 or $20,000. The value in terms of BTC grows as long as there is a premium.

It’s an almost risk free 30% return in six months. In a year, 69% if each 6 month period is a 30% return.

The 30% return is pretty impressive, and natural economic pressures should bring this premium down to 0%. Yet, for some reason we just haven’t seen that happen yet. That’s because of the way it operates and no other option being available. But don’t let that bother you… Let me show you how to use this to your advantage.

The Effect

Before we get into the nitty gritty analysis, let’s first break down what ‘The Effect’ is.

Grayscale experiences inflows into its Trust. The investors providing the inflow receive GBTC shares in return. These shares are locked for six months.

When the shares are unlocked, the investors participating in the arbitrage process buy BTC on the spot market for the next six month cycle.

That’s what we’re cued in on here. When does the biggest buyer enter the market.

Now, because these investors are price agnostic, meaning they care more about the number of bitcoin in their account not the amount of USD, they care less about what the spot price is.

We also know this because most funds received by Grayscale (70–80%) are what’s called “like exchange” meaning its BTC not USD.

This Effect drives the spot market and by employing tools like derivatives, traders can essentially go with the flow of this market dynamic.

The proof…

The Evidence

The easiest way I found to explain the Grayscale effect is by breaking down various periods of high inflows into the fund and looking at Bitcoin’s spot market price action shortly after the date shares are unlocked.

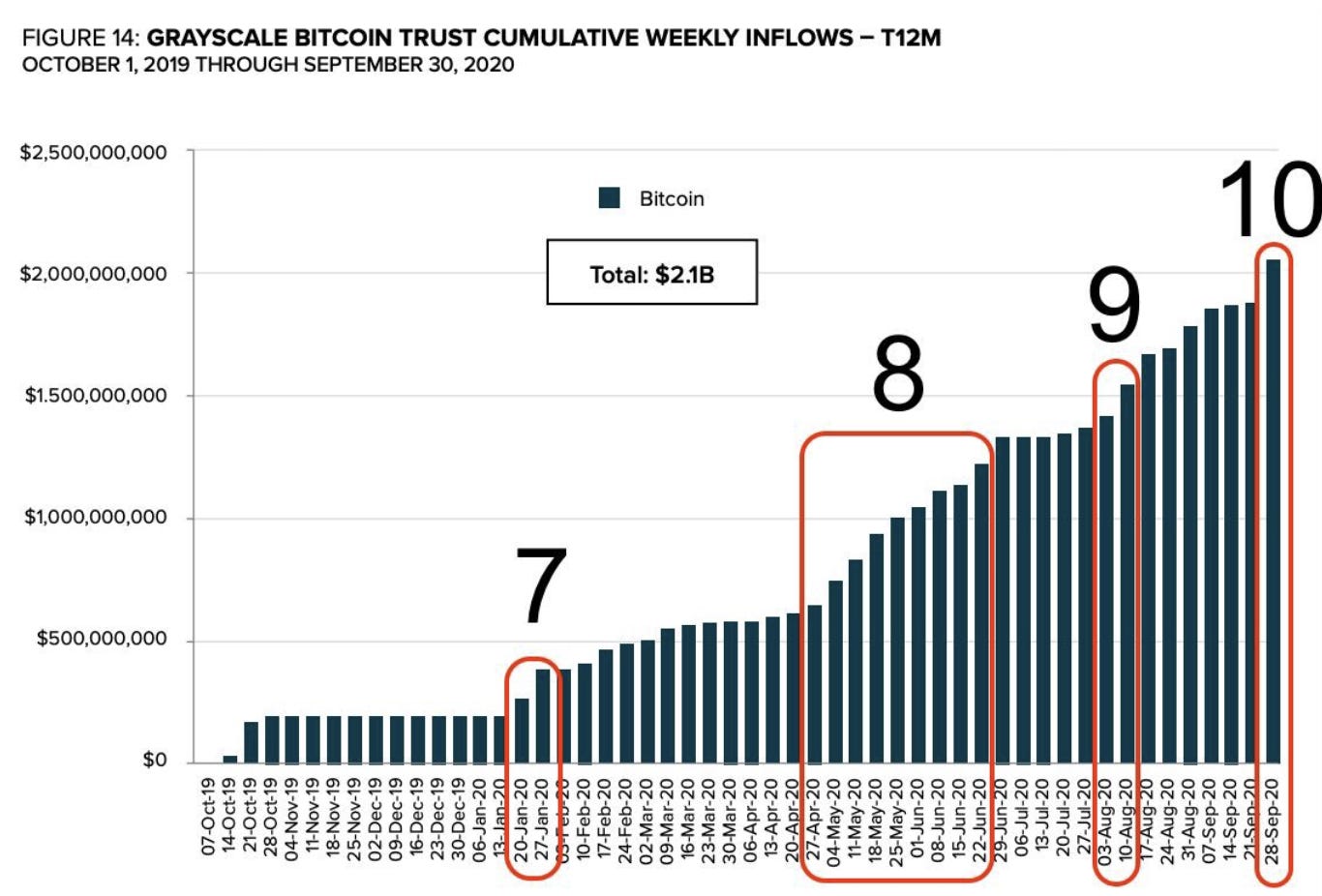

To understand this better I broke high inflow periods into 10 tranches. I’ll be running through each one.

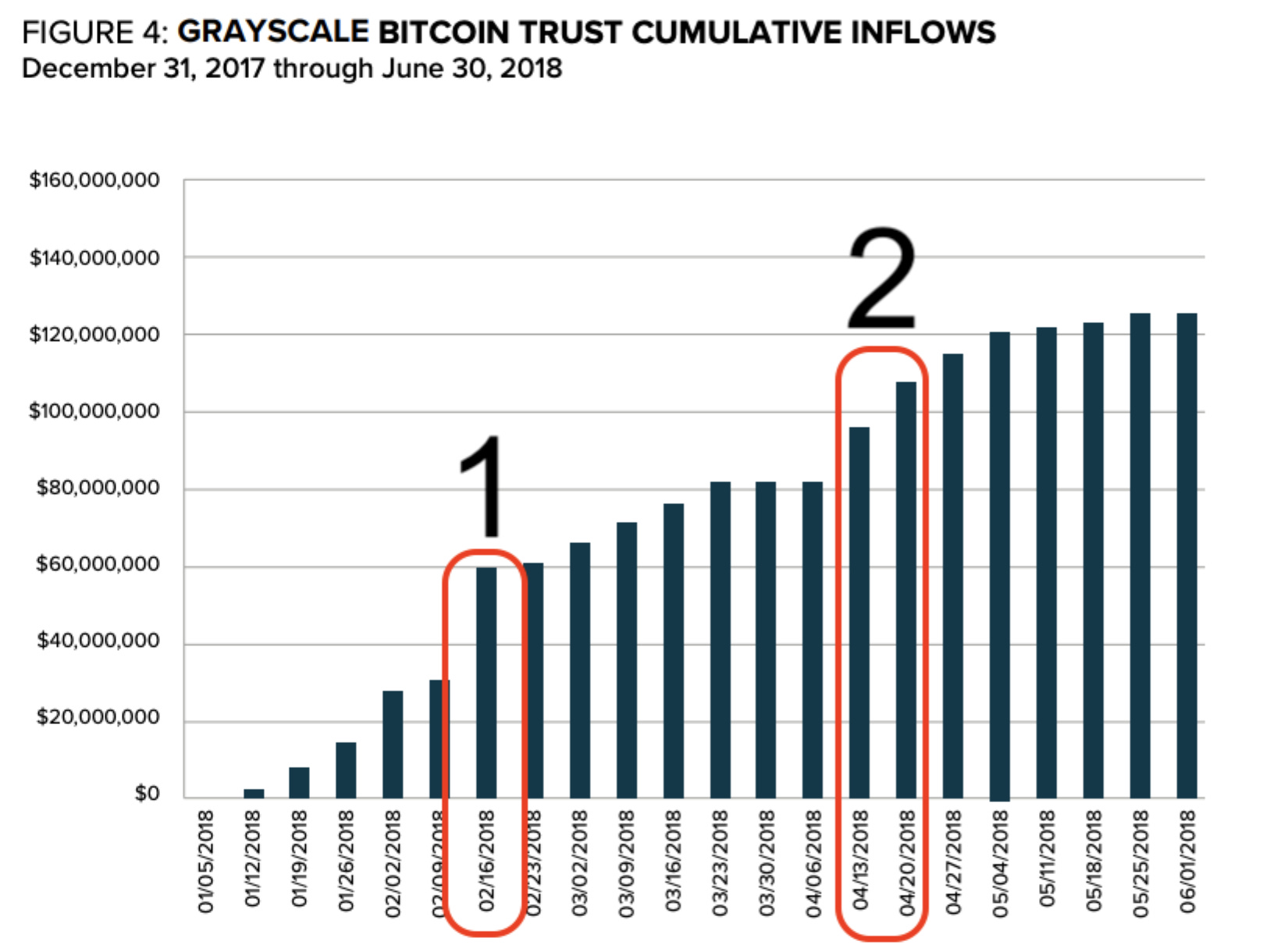

So first up is tranche 1 and 2.

The chart below shows two periods where the fund witnessed a large jump of inflows. Tranche 2 appears to happen after a brief period where no inflows were happening. Consider these ‘flat’ periods as moments when Grayscale did not accept new investors.

These two tranches were set to unlock twelve months later around February 16, 2019 and April 13, 2019. Yes, twelve months. The six month lock up didn’t come around until January of 2020.

Now two weeks before each unlocking period the average net asset value was 18.8% and 23.9%. These figures represent the premium GBTC is trading at in terms of the total amount of BTC held by the trust. If there were $100 million in assets in the trust, it means shares are trading as if the trust is worth $118.8 million or $123.9 million.

When the premium is 0% GBTC buyers are getting fair value for the assets held by the trust and the incentive to ‘rinse and repeat’ is gone. So as long as this premium exists, expect The Effect to be in play.

Now where things get interesting is after each unlocking event. As you’ll see, BTC has noticeable moves every single time. Here’s the price shortly after the first two tranches.

Now, after two instances it can be considered a fluke. And it can also be considered a great coincidence that the first major unlocking occurred as Bitcoin bottomed out from its December 2017 high. (Note: That wasn’t the first unlocking, just the most significant to that point)

So to find out if this was a fluke, let’s keep going.

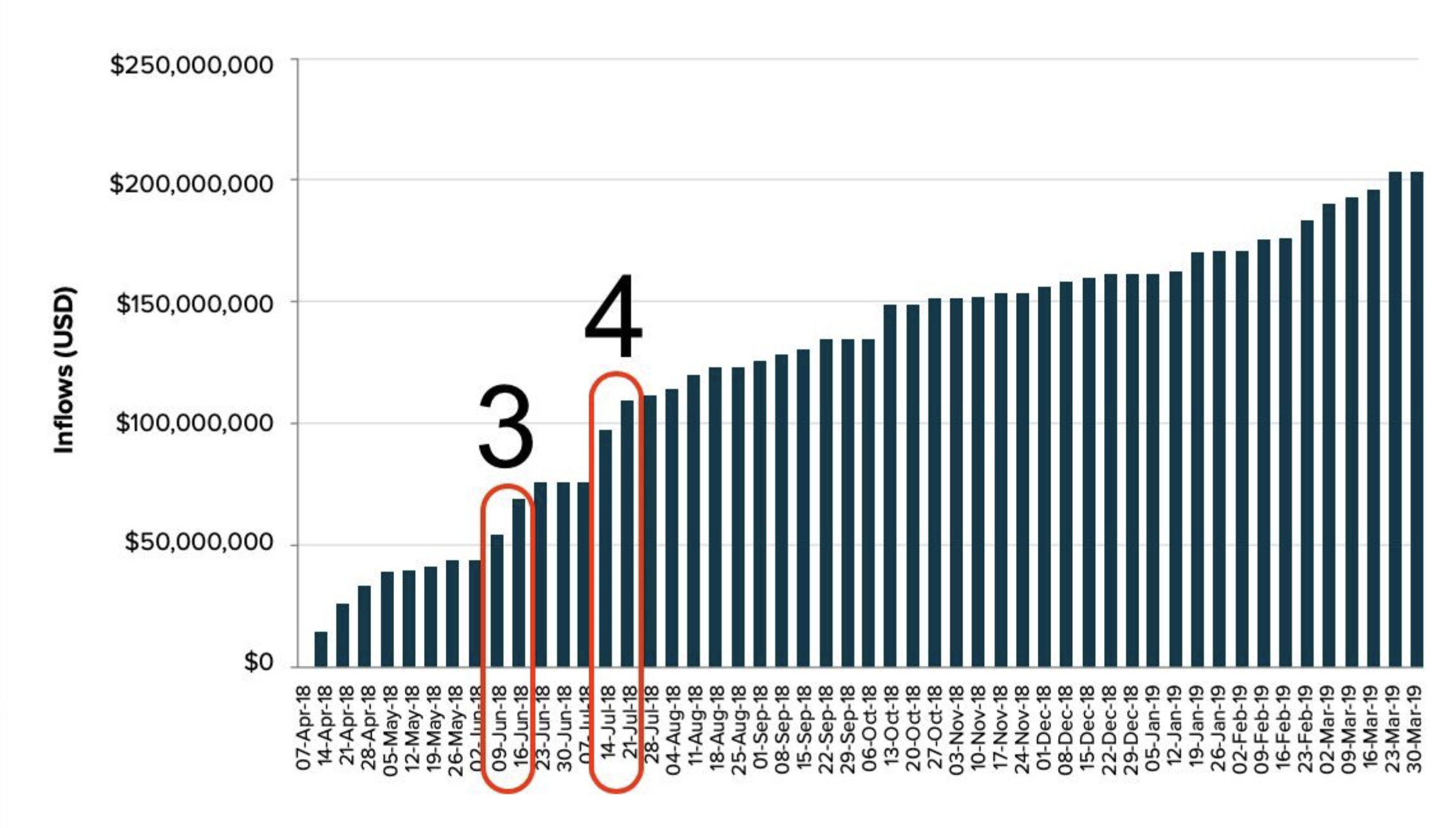

Moving on to tranche 3 and 4.

Tranche 3 unlocked on June 9 and June 16, 2019. Remember, the 6 month lock up didn’t changed until 2020. The week prior to tranche 3’s unlocking, the premium on GBTC shares averaged 26.4%.

Therefore the incentive for the next lockup still exists.

Here is the spot market during that period.

Remember, bitcoin can be $5,000 or $50,0000 and the return in terms of BTC does not change. The focus is on growing a portfolio in terms of the number of bitcoin. As long as the premium exists, investors increase their stack.

Now back to the doldrums of the tranches…

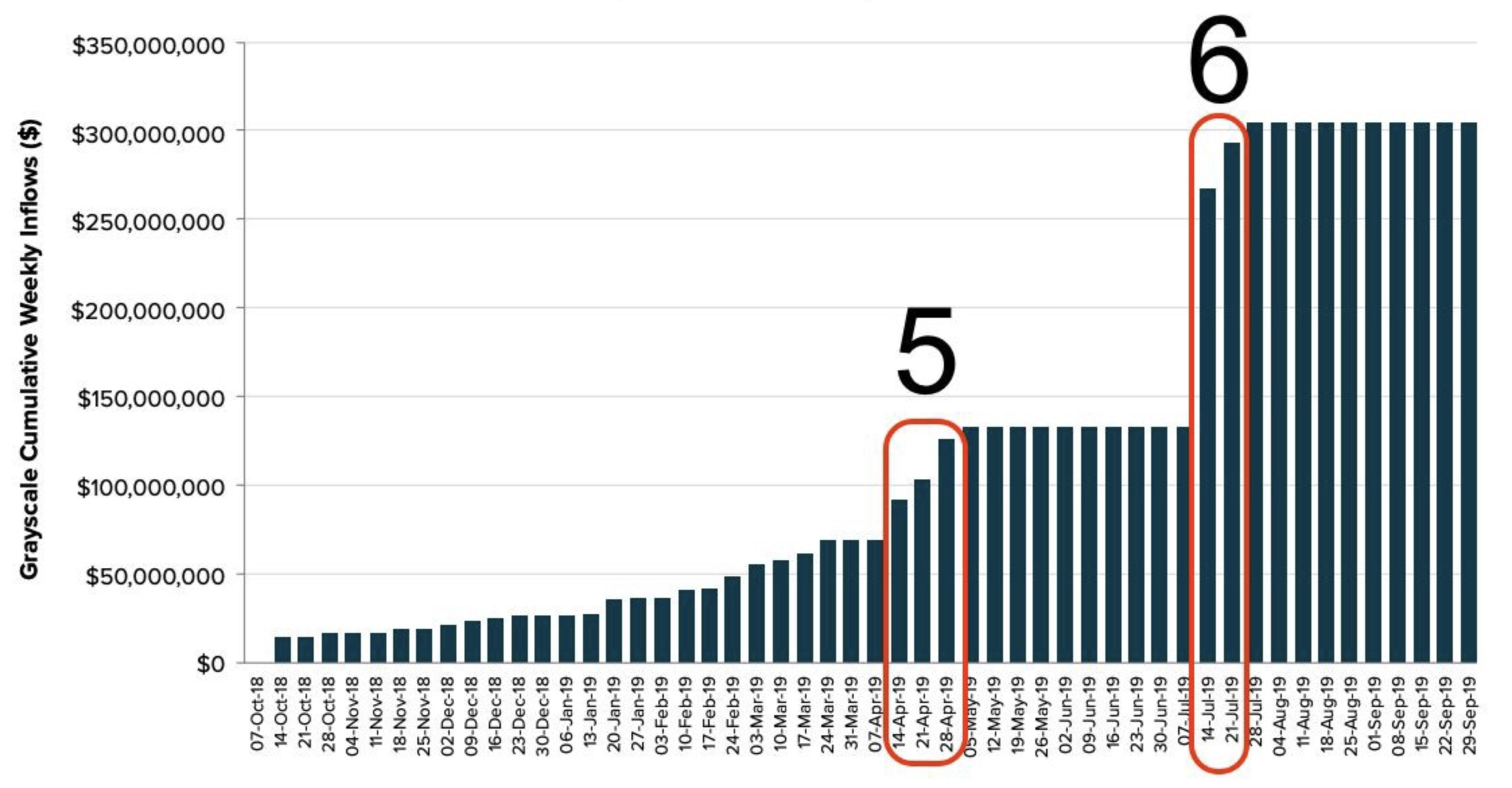

Tranche 5 and 6 These two are unique in that the unlocking happened as the Trust moved from a 12 month lockup to only a 6 month lockup.

The rule changed happened on January 21, 2020 and takes 90 days to go into effect. I was uncertain whether this applies to shares already under the unlocking timer or it only applies to new offerings. As I’ll show you in a moment, my intuition says it didn’t apply to shares already pending.

Here is tranche 5 and 6. As you can see tranche 6 more than doubled the Trust’s inflows.

For tranche 5 the 12 month period ends on April 14–28, 2020. For tranche 5 it’s most likely July 14, 2020. But again, this might be a bit different because of the rule change. However, the chart seems to hint that it was 12 months.

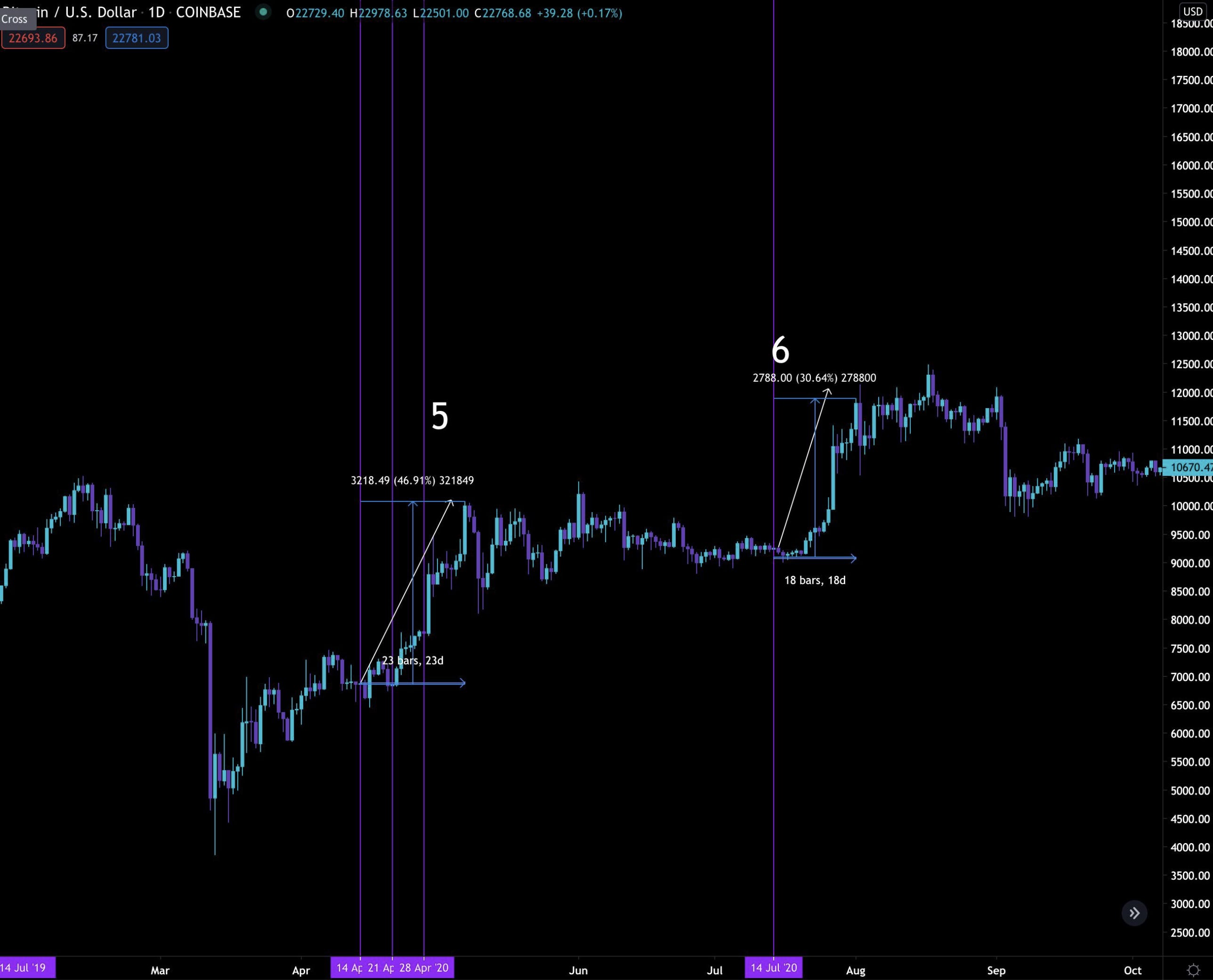

Here’s the chart so you know what I mean.

As you can see, this is a repeatable pattern forming. But it gets better.

The rule change occurred on January 21st, so the rest of the tranches are 6 month lockups.

Tranche 7 ends up falling on July 20th and July 27th. This overlaps with tranche six in terms of the premium. No need to cover this again.

Tranche eight was an absolute moon shot. It was a sustained period of inflows from April 27, 2020 through June 29, 2020.

The various unlocking events started on October 27, 2020 and runs for 9 weeks to December 29th.

In terms of what the premium was before, I chose to look at the first half of October. That’s a period well enough before the gauntlet of unlocking events. The average for the first half is 11.2%. Therefore, rinse and repeat is in place… Initiate spot buying.

You likely know what happened. The market erupted.

What’s clear is these unlocking events coincide with significant price moves higher.

Now for those that are wondering what this means for GBTC premiums and what it looks like when new shares are unloaded in that market. Here’s quick chart to summarize the unloading of GBTC shares.

Note the indicator on the bottom third of the chart, that’s the premium. It drops after every unlocking. So if you’re playing this with GBTC, buy a week before, sell on the unlocking. You can read more on my tradingview account: https://www.tradingview.com/chart/BTCUSD/8jUw2lLi-Grayscale-Premium-AFTER-Unlockings/

Now, what’s important to know is once these higher prices and premiums are realized after an unlocking, price goes on to consolidate. This lets the premium shrink again before its next unlocking event.

We most recently saw the biggest buyer in the market step away the week of December 29th.

The Effect tends to last for about a week or two after the unlockings, which supports the January 11th date.

When we combine this information with Jarvis and its data on spot purchases and labeled wallets, it’s clear Grayscale is driving the market. There is nothing more important for you to focus on. Even 3 Arrows Capital is getting in on the game as they announced twice they are taking part in the rinse and repeat game.

But don’t get upset, that’s the last thing you need to do. There is so much to be had taking part in this, just ride the coattails.

Discussion

The next major unlocking is set to happen around February 3, 2021. Meaning the time period beforehand will be void of unlockings.

This void enables the market to cool down. That’s what we’re currently witnessing the week of January 11th.

After February 3rd we can expect some more spot buying. But honestly, I’m looking forward to the next round of massive inflows like we saw in October.

If you want to stay in the loop on Grayscale’s Effect and when wallets start to light up associated with Grayscale, be sure to enter your email below and subscribe to our free daily newsletter, Espresso.

Stay tuned until next time.

Your pulse on crypto,

Ben Lilly

(This story was originally published in Hackernoon on December 25, 2020 and in Medium on January 14, 2021.)

Jarvis Labs: We provide actionable on-chain data via ChainPulse, build software solutions, and produce research that leans on our autonomous ai/ml trading software, Jarvis AI. Our customers are hedge funds, family offices, and retail customers.

If you want to learn more about Jarvis Labs, Jarvis AI or ChainPulse message us on our webpage at www.jarvis-labs.xyz or send us an e-mail: askus@jarvis-labs.xyz. You can also message me on Telegram @Ben_Lilly or by e-mail at ben.lilly@jarvis-labs.xyz.