Ending Boredom

Market Update: The slingshot is pulled back

The blood rushes to your head as you sit in the chair upside down again.

Agitation burns through your body like an intravenous injection gone wrong at the hospital. So you start to gaze around the room with an uncomfortable alertness looking for an antidote.

You think to yourself, I’ll do anything to make this feeling go away…

Boredom is a bitch.

And similar to those dog days of summer as a kid where you watched TV upside down, boredom is alive and well in the crypto world.

Then there is the fact that while you redraw Bitcoin’s support line for the fourteenth time, the social feed of the world is piling up with activity…

Geopolitics has been anything but still. We have the proxy U.S. / Russia war nearing full tilt with sabatoge at play. Oil dealings among OPEC and the United States’ oil reserves in the media limelight. Winter coming to Europe as energy continues to play a front and center role for millions as they look at their monthly expenses. And inflation continues to make everyday purchases feel like quick sand as it pulls households under.

Not to mention central banks are doing their part to fill their timelines with recent stories. The commonality here is across the globe monetary authorities look to be grabbing an order ticket to reload on more QE.

The Bank of England (BOE) was one of the most recent as government issued debt started to buckle the financial system. While the quantity of QE did not tip the scales, the mere fact we saw it was enough to excite global finance. And now the BOE looks to back itself out again. This turbulence is causing concerns elsewhere to percolate.

Our colleague TD went over the hairpin turn the Bank of Japan is navigating as the race to push interest rates continues on with the U.S. Federal Reserve (FED).

And even in the United States the FED is trying to unwind its balance sheet. One such asset is Mortgage Back Securities (MBS), and that was another topic TD hit on a couple weeks ago as the FED starts to assess their options.

In the essay, TD hit on an option where various parties take MBS off the FED’s back. This seems to be a more realistic option… Main reason has to do with financial plumbing becoming more intertwined with collateral than ever before.

And funny enough, banks are sure to turn around and pledge those same MBS as collateral to borrow the liquidity they just bought the MBS with… Especially as the financial system meanders further into this minefield, one populated with squawking black swans.

I say all of this not to dive into these topics today. But instead show this boredom in crypto is somewhat surprising. Things outside of crypto are very volatile.

So while we have likely grown tired of the boredom, I’m here to say this is likely coming to an end.

Which is why I’m writing to you today. We got an alert over the weekend that upcoming volatility is likely. You can see the tweet below for reference:

#btc Highly explosive volatile move is incoming for BTC that is bound to get traders on offsides from their sideways positioning. Whichever direction it explodes, we stay in that for the coming term. Arrows indicate historicals when this alert was generated.

— JarvisLabs (@Jarvis_Labs_LLC) 4:48 AM ∙ Oct 9, 2022

In response, today let’s go over what the data says in order to be better prepared in the event this plays out. Additionally, let’s revisit what we wrote about the Ethereum Merge event last month to see how that is panning out in case there is a takeaway to be had there.

So splash some cold water in your face, grab a coffee, do a few dozen jumping jacks, and let’s get to it. Boredom is over.

The Popular Trade

An unbiased approach to data is typically how Benjamin and I lay the cards out on the table.

We essentially divide things into bullish or bearish for BTC and ETH. This helps to see if anything is tipping the scales in one direction or another. And if we can get the same sentiments to line up for BTC and ETH, then we are likely on to something.

We also would look at USD and equities since we started this letter over two years ago. Main difference now is the USD and equity talk has evolved into way more FED discussion.

One such point we weighed recently was simply how crowded things feel when it comes to macro, equity, and dollars.

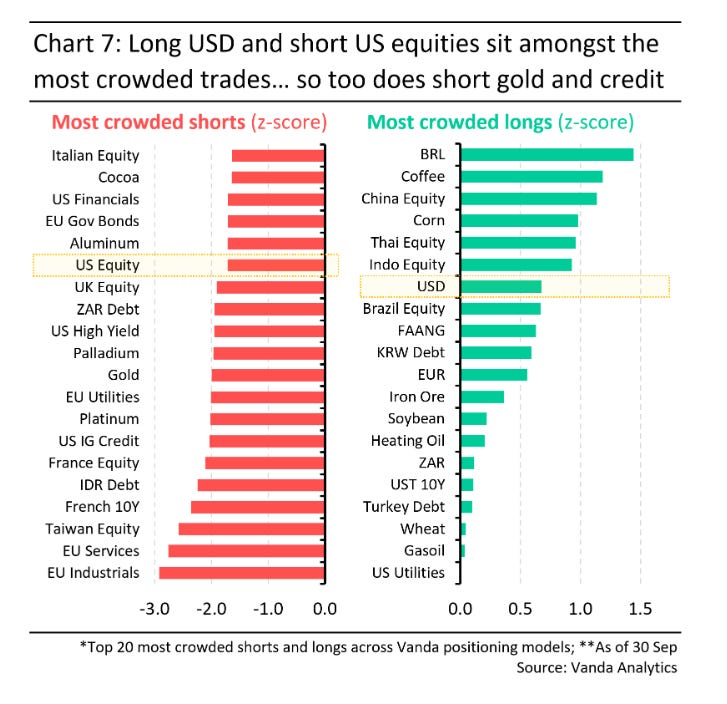

A chart that sums up this outlook best was one I found in Fidenza’s recent note. You can see it below. Geo Chen used it to showcase the momentum trades of shorting U.S. equities and going long the USD was getting a bit long in the tooth. This tidbit on the trades nearing exhaustion is one I agree with.

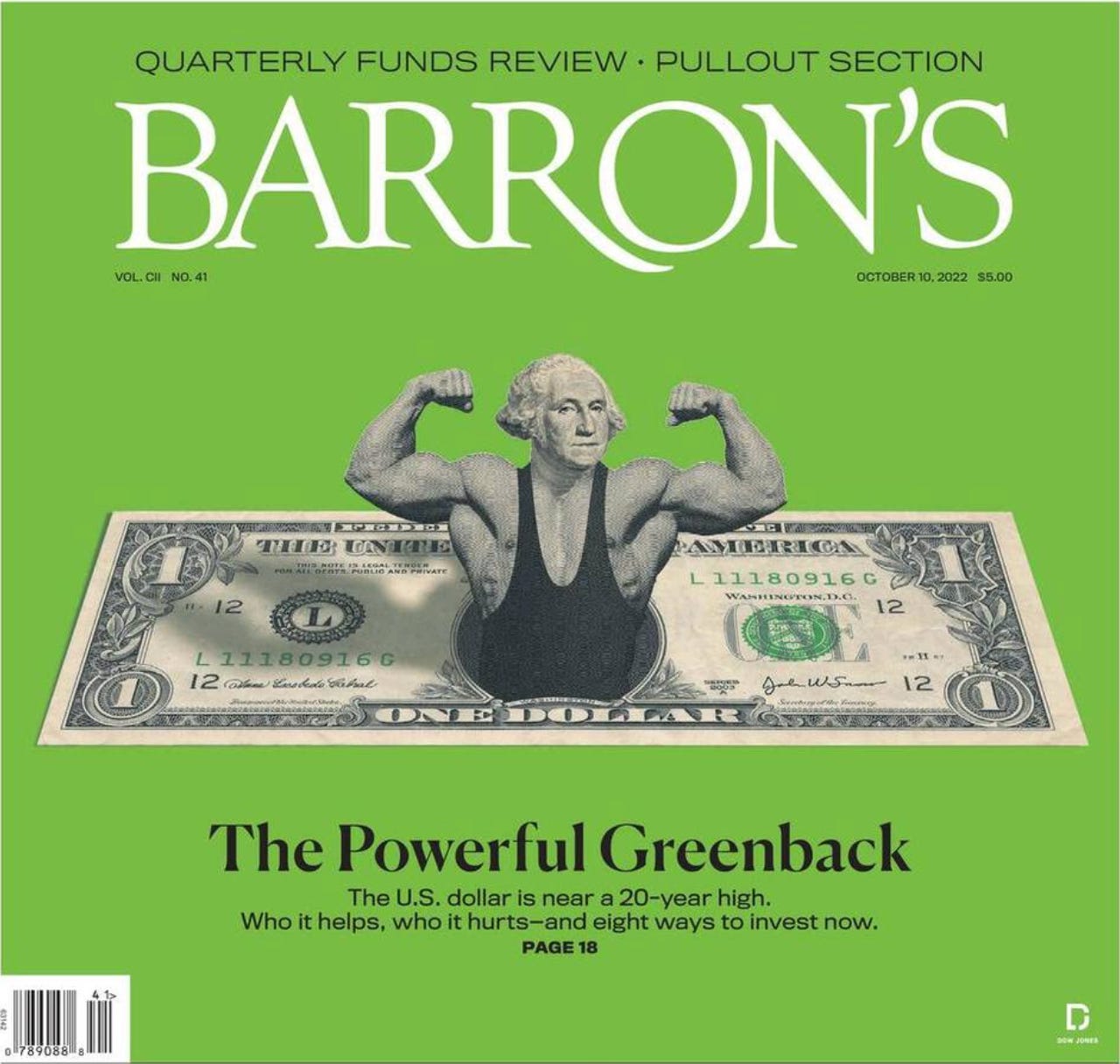

To double down on the point, media outlets are beginning to tout the strength of the USD. Here is Barron’s most recent cover that does exactly that.

This is the same magazine that had a December 2021 cover stating the housing market will realize a boom for the next decade. Housing indexes have been chopped nearly in half since then.

I wouldn’t go as far as to say Barron’s is contrarian indicator, it’s more to exemplify the popularity of this long USD trade.

Which begs the question for me… If these two trades were rubber bands, how much more stretch is there.

Armed with that thought, most crypto investors and traders know any softening in the dollar or strength in equities will translate to strength in crypto.

Which made Benjamin and myself wonder if crypto was showing hints that the rubber band was preparing to snap back.

And instead of boring you with doing our exercise here, I’ll try to provide the summarized cliff note variety in expedited fashion.

Indecision

As I rifled through the usual charts such as accumulation, whale holdings, divergence charts, and even trends broken down by timezones…

There was no indication of an overarching trend. It was indecision.

I could go chart by chart, but that’s the one sentence cliff notes.

Bitcoin is showing minimal accumulation taking place with a lack of whale interest. Ethereum differed in some manner as it showed whale buying taking place with decent consistency. But overall whale holding balances are not trending. This makes the bullishness seen from whale buying not as clear since balances are not moving in unison.

This lack of substance forced us to dig a bit more to see if there was anything unique going on that we can track in the coming weeks.

Two things stood out.

The first was that the Merge’s popular Cash n’ Carry trade from July and early August was successfully unwound. Here is the open interest on December contracts for ETH on Binance. The September contract showed something similar before it expired.

This acts as a reset on ETH. And this resent means Ethereum’s economics from The Merge can start to shine through to price.

Based upon the economics of Ethereum pre-Merge, the supply of ETH would likely be more than 4.5 million ETH. This is done using the ultra sound money website.

Currently, Ethereum is on track to realize a 97.6% reduction in new supply at a little more than 100,000 new ETH tokens for a year. That is drastic, and comparing Bitcoin’s halving events, this change for Ethereum seems very significant.

These supply changes tend to take a bit of time to unfold. I wouldn’t expect Ethereum to be any different here. Once it does, it’ll be a price discovery event since ETH will adjust to its new supply/demand equilibrium.

We can watch this catalyst unfold via the ETH dominance chart. The token is commanding nearly 18% of the market. It has tested the 20-21% region several times, and would expect the next attempt to make a break as the price discovery generates more attention and likely higher market cap.

The second thing that stood out was Bitcoin’s supply.

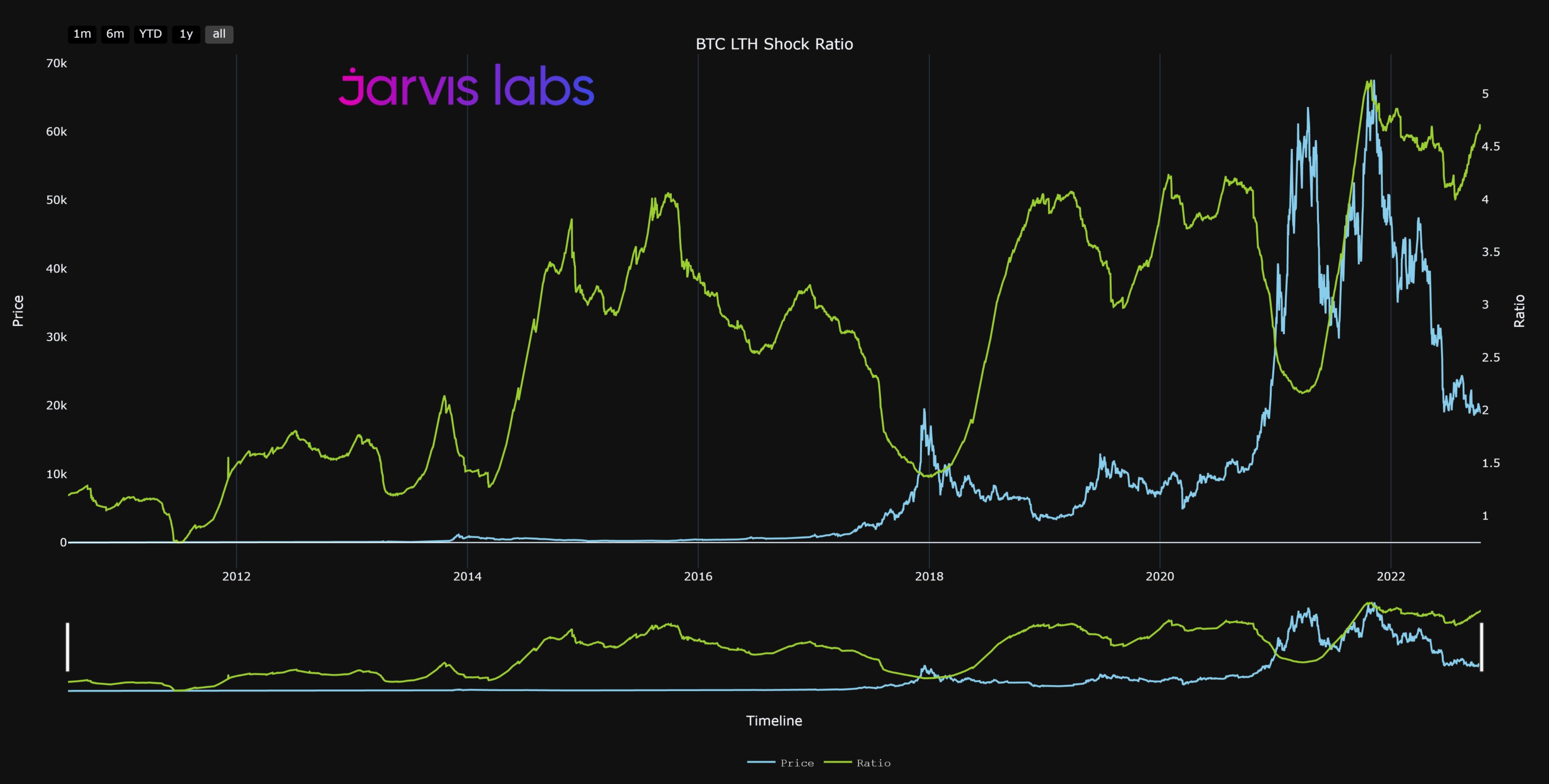

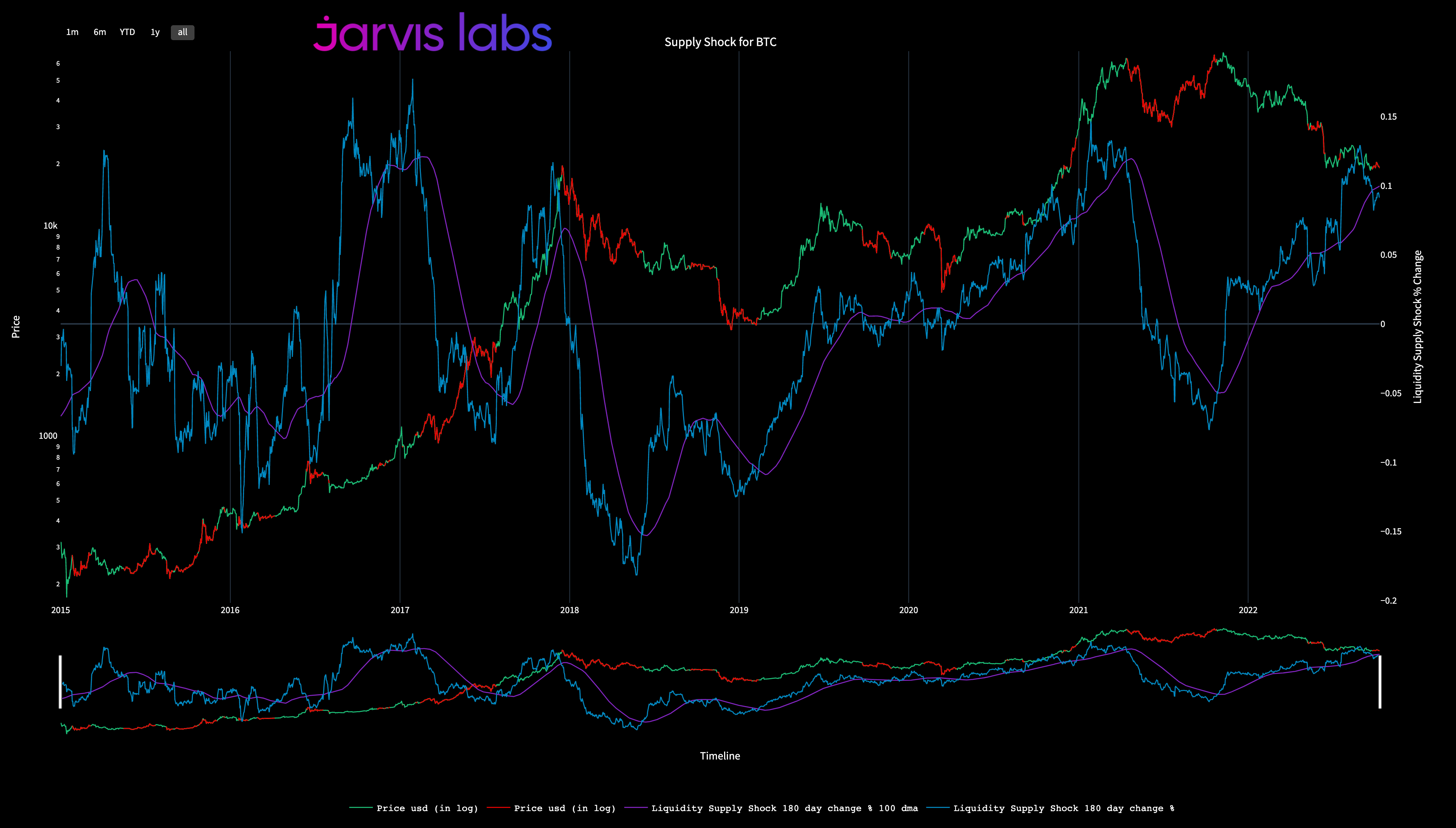

We can best view this through supply shock ratio, which is basically a measure of coins that are not moving on the network. Analysts tend to categorize this as illiquid. I like to think of it as a behavior trait on a subset of tokens - a trait of not transacting the token.

As you can see, a higher reading (more illiquid) can proceed rallies once the measure moves sideways for a period of time. Exception here is the March 2020 Covid crash. About a year ago it was very high. And now we are approaching those highs once again.

Here is the same chart, but manipulated. As you can see, we are trending up near similar levels once again.

And the fact we have such a large portion of supply acting in this manner paired up with the incredibly high open interest in bitcoin futures makes one wonder is this a similar rubber band setup as mentioned earlier?

As you can see below, the open interest is very elevated.

And with the open positions rising as price declined in 2022, we can assume much of this is on the short side.

Pairing this up with low movement of supply onchain for bitcoin, it seems the unwind of open interest with low liquidity from current BTC holders is a recipe for a snapback.

The main issue with this snapback way of thinking is we don’t see trending whale behavior for BTC in terms of accumulation or buying. So why would this rubber band effect happen now?

The Market Needs You to Be Wrong

Nothing is pointing to the effect unfolding now. It is indecision happening when looking onchain.

But when it comes to USD and equities, the catalyst looks to be sitting there. Any sign of a change in momentum in traditional markets will create outsized movements for crypto.

The reason being is the market is acting like a powderkeg. It has nearly 15% of the entire market cap in stablecoins - easy to move into network tokens. Ethereum is experiencing a major drawdown in new supply, Bitcoin sits with a snapback type of open interest that is magnified with onchain liquidity. And traditional markets are becoming a bit overextended.

Understanding the market structure sits as it does, while much of the macro volatility sets the softwood forest ablaze, this makes decision making nearly impossible.

But in the event we do get the volatility in crypto, it’s important to know:

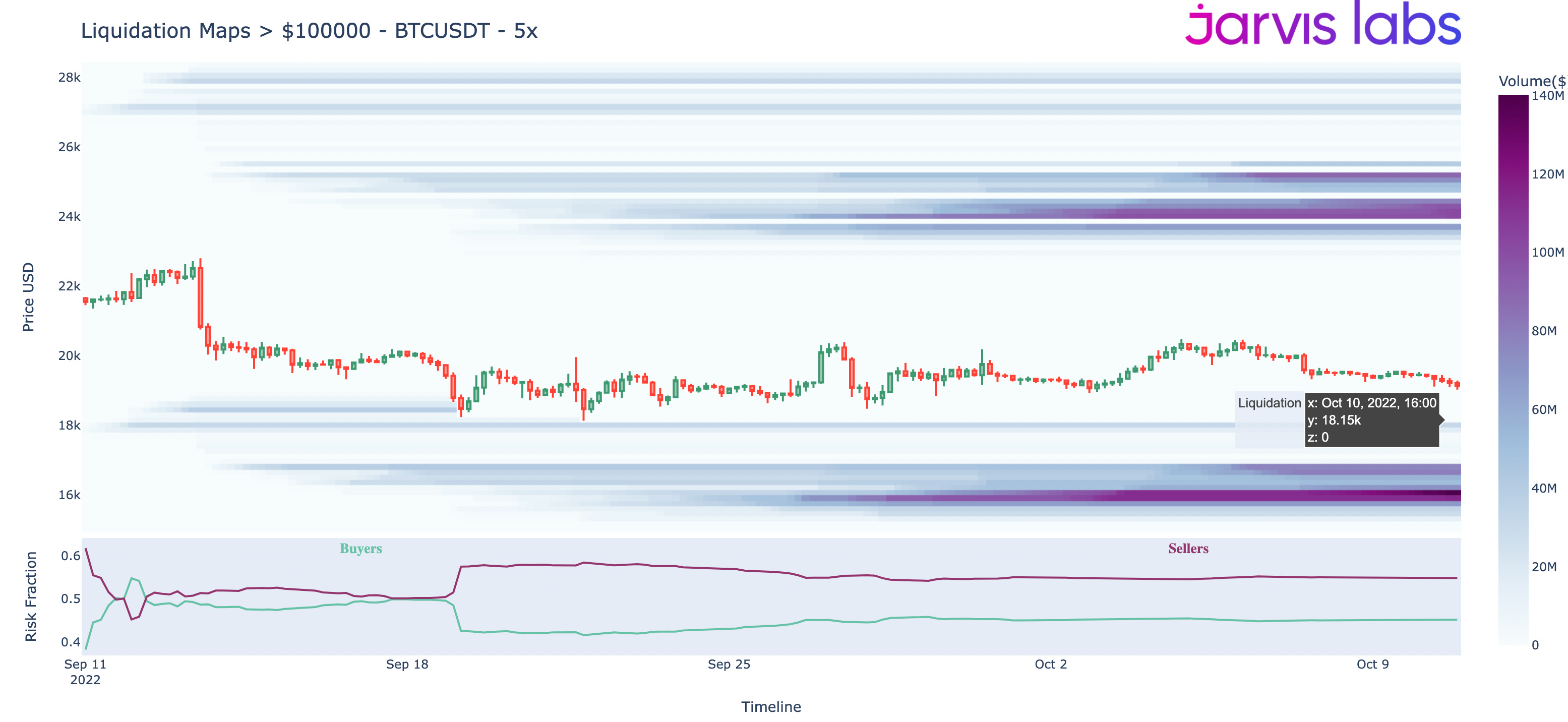

1) there is no trend at the moment. And this can mean further testing to the downside. Currently liquidity for Bitcoin sites around $18k with much larger pools starting at $16.9k.

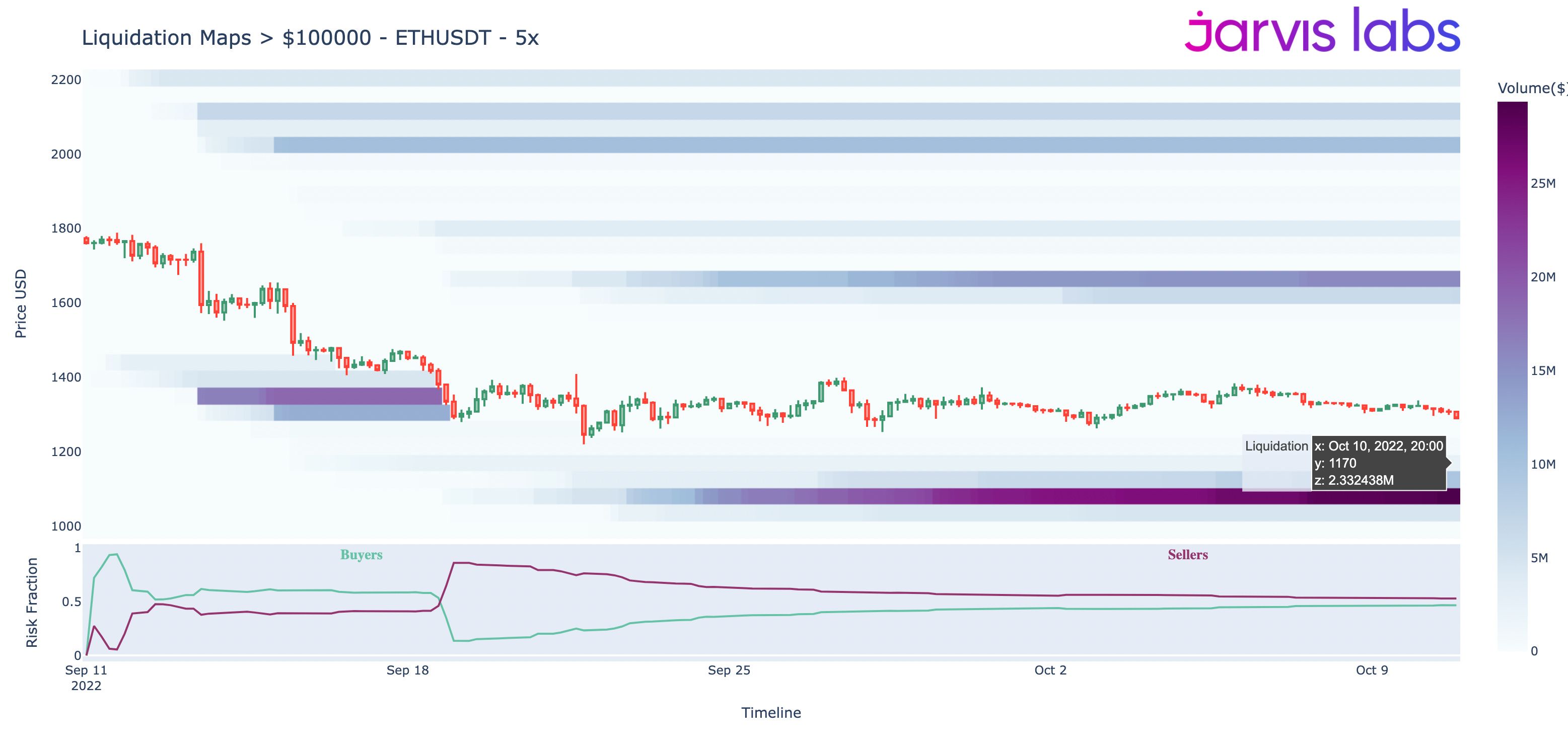

Ethereum shows pools starting around $1,150. The largest band sits around $1,075.

If we do get a sweep to the downside… then we need to realize 2) the market can reverse with speed. And you don’t want to get caught offside. It might simply be a move that generates renewed interest in the market… Which brings with it fresh liquidity.

Now, in terms of a sweep being enough to create a new trend… We have saying - the market won’t shift until many traders are very wrong. The current structure is getting closer to this moment where the remaining actors are getting offsides.

In times like these all I can really say is, trade safe. Hope you enjoyed today’s piece. Please leave your thoughts on what you see in the market as I’m interested in what each of you believes will happen. I can’t remember a time period as uncertain and exciting as we have now.

Your Pulse on Crypto,

Ben Lilly