Merge Like Joe Cool

Market Update: Setting the Stage for Ethereum's Merge

Lights are dimmed. The stage is set.

The onlooking crowd is alert like a mob of Meerkats surveying the scene for trouble.

In the weeks and days leading up to the main event, every analyst, social media influencer, and media outlet gave its take on what is about to be on stage.

I’m referring to the main event of crypto.

The question on nearly everyone’s mind is how will the days that follow play out.

If you are reading this essay just after it enters your e-mail inbox, you don’t need me to spell it out for you.

For others, we are referring to (what is likely now in the rearview mirror) Ethereum’s Merge. And if crypto had a schedule of big events for 2022, this is by far the biggest.

So understanding the nuances, the structure of the market, and the possible outcomes is at the top of nearly every trader, developer, and media outlet.

The fact is, do events of this size ever unfold as expected? FIFA World Cups, Super Bowls, Cricket World Cups, or heavy weight title boxing matches?

Rarely.

Why would we expect one of the largest events in Ethereum to be any different? We shouldn’t.

So instead of trying to fake it with the hopes of being right, I’d rather just be straight up and say I have zero clue how this is going to unfold. Which is why I’d like to take a different approach and hit on the main groups at play as we go into the Merge. And one possible way to play the Merge as the countdown to the event hits zero.

Let’s move quick here as I have about four hours left on the Merge countdown as I start.

The Cast of Characters

I’ve broken down the primary groups into four classes. While I know I’m missing a few, these entities provide us with a general and also diverse mix.

The groups are:

- The Cash ‘n’ Carry Cowboys

- Existential Crisis Miners

- Retail

- The Adults

To start off…

The Cash ‘n’ Carry Cowboys

In the month of July, a subset of crypto opened up a trade that gives them exposure to ETH without exposure to price movements.

This was done by going long on spot and shorting futures. Specifically the September, December, and March contracts. For those of us that have been following Espresso for a couple months now, you might remember this trade when we wrote, “Unknown Unknowns”.

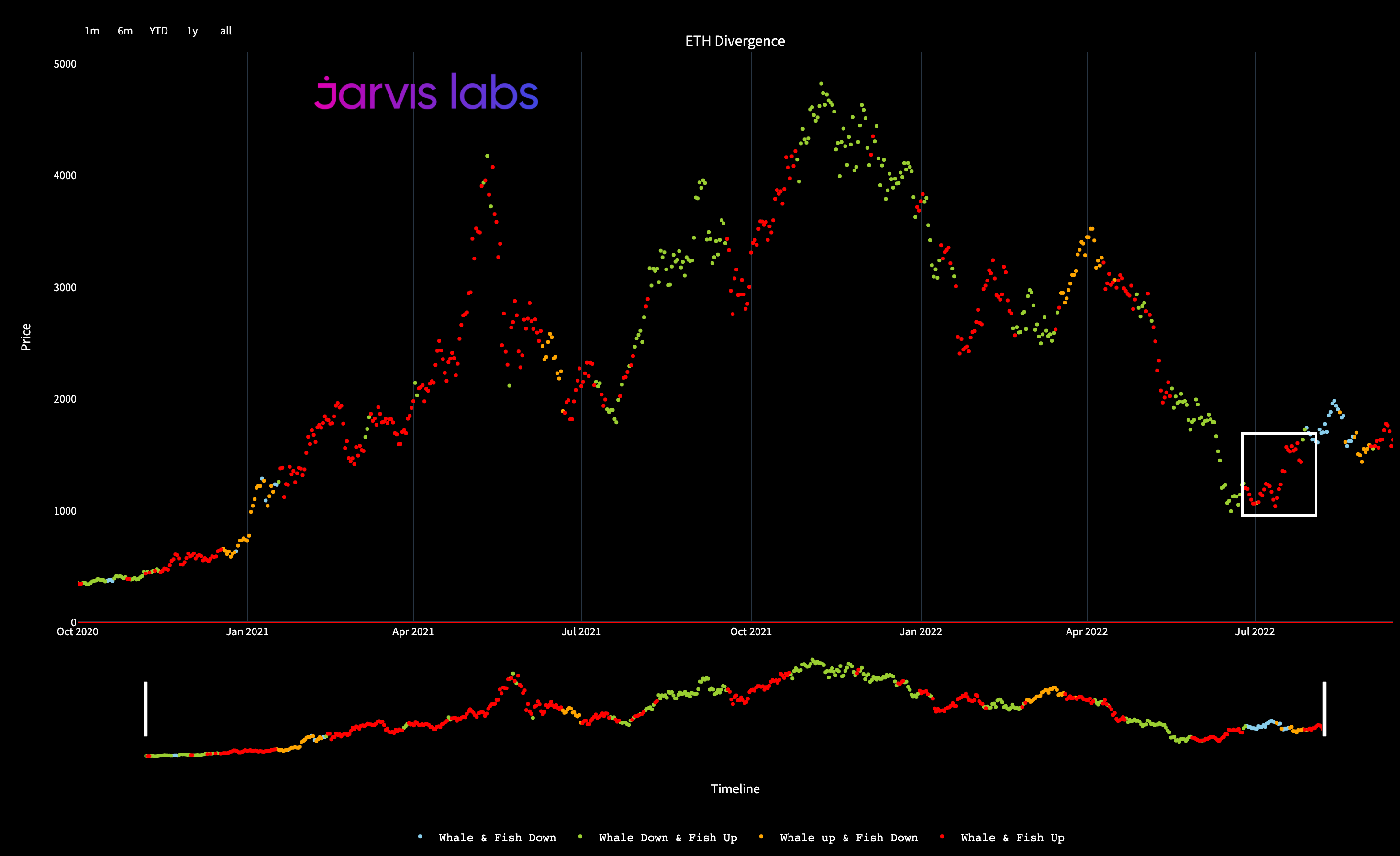

The trade took place for much of July and into August. The popularity of this trade created great demand on spot, which was picked up by our ETH Divergence chart - tracks whale and retail behavior.

In the chart below we can see the popularity of this trade reflect itself in the red dots below - highlighting whale buying.

The trade was so popular that September and December futures contracts went into backwardation in early August. This is where the futures contract price dips below the spot price, it’s not normal behavior.

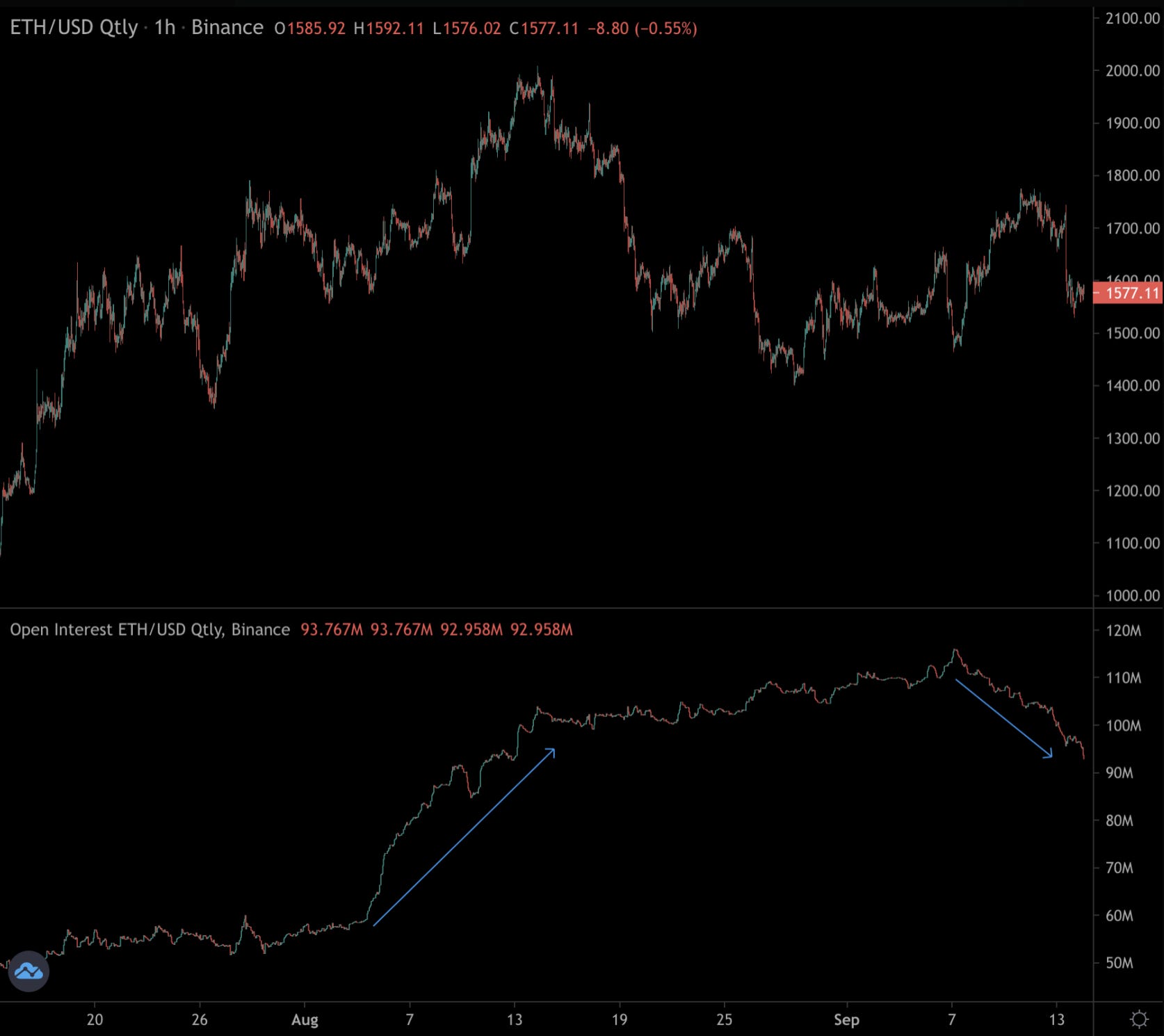

What’s more is that we know these Cash ‘n’ Carry Cowboys are trotting around onchain since we are still in backwardation and the Open Interest on these contracts have not let up.

The subplot in the chart below is Binance’s September Open Interest volume. As you can see, it’s still very high.

December shows the same.

This means there is a lot more pressure on the short side of these futures contracts than the long side. And as most of us know, as short positions close, they need to buy back… An action that can result in volatile price action.

This is one theory some believe will play out. And while many positions close out, it might not be what happens first. Instead spot can get sold to push price in a direction that helps closing out the short position.

In a way this behavior could cancel itself out. Meaning price does nothing but go sideways as the Cowboys close it down.

The real note here is to realize how these traders must act if price reacts aggressively in one direction versus the other.

For instance, since these traders are holding spot in bulk, as price drags lower there is no outsized risk taking place assuming this ETH is not being borrowed.

On the flip side, if price rips higher causing shorts to close out… we could realize more action to the upside.

Let’s keep that in mind as the days unfold.

Existential Crisis Miners

Here is what I view as the most interesting bunch.

Ethereum is moving to Proof-of-Stake. Miners are no longer a needed entity in the network like they were before.

They were once the security providers of an emerging success story. Now, they are orphans looking for a new home.

And as they exit their former home, they may not go peacefully.

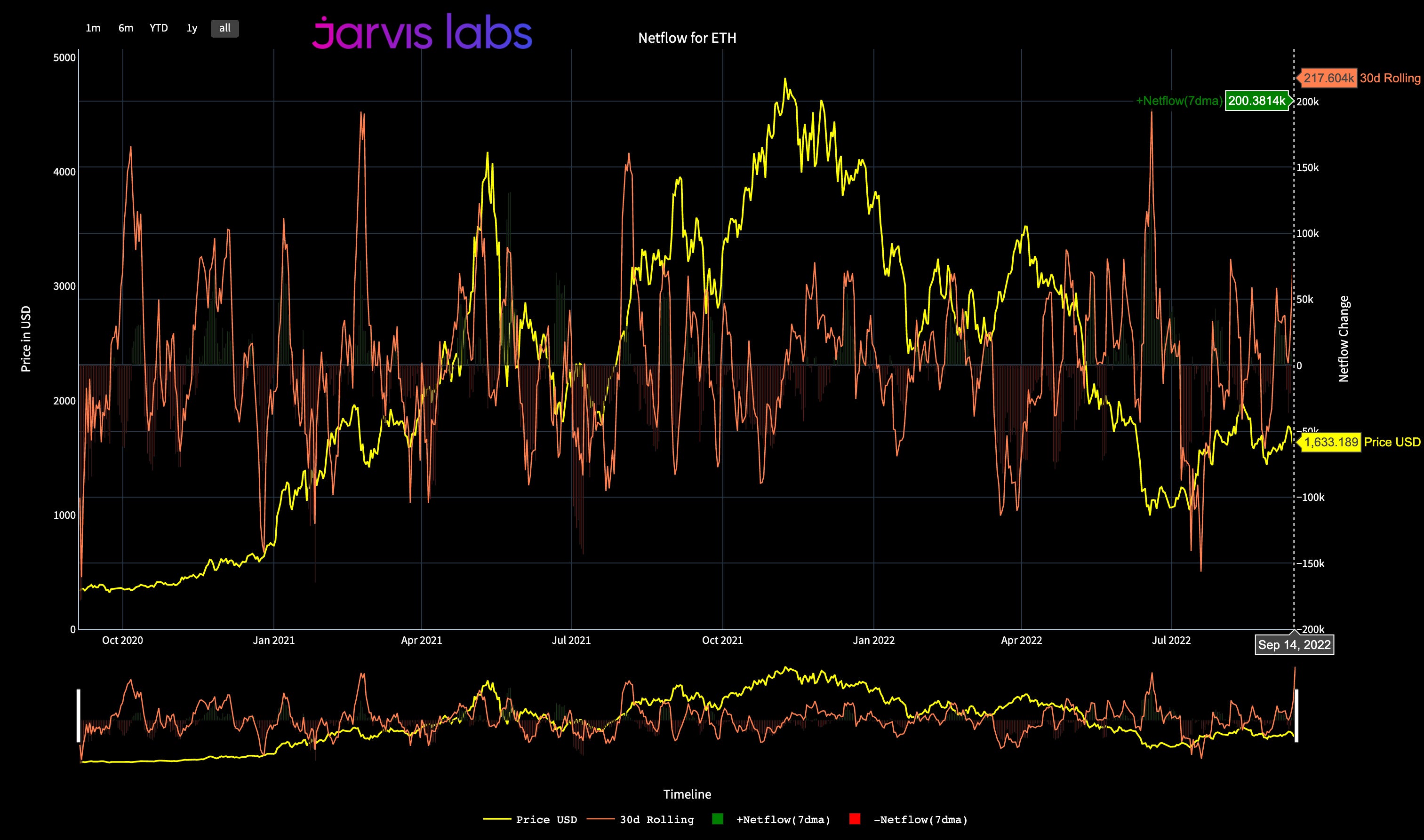

In fact, miner’s have begun to move substantial ETH to exchanges of late. Even as I write this the onchain activity is getting a bit wild.

In the chart below you can see the netflow of ETH to exchanges is north of 200,000. That’s about 60% more than any day during the June debacle of 3AC and Celsius.

It gives the impression that fireworks are coming. But in reality, miners are upset.

Acting aggressively tends to backfire, and if we see rumors spreading quickly that something negative is happening with the Merge and price drive lower at a truly impressive rate, we likely know who is behind it.

Which means this aggressive act may reverse equally as fast… No need to get caught up in it.

Now, what makes this possible revenge act even more interesting is the upgrade will likely cause some issues or delays with deposits and withdrawals with exchanges. We know this because FTX and Coinbase bug out when Jerome Powell opens his mouth. Why would something as big as Ethereum’s upgrade not cause a hiccup as well.

In turn, this means most price activity taking place on exchanges will take place with the capital already on exchanges. Keep in mind, most stablecoins sit on Ethereum. With Ethereum on pause and getting up to sync, we can’t expect these coins to easily transact.

This also implies that we need to be watching other chains to see when capital or buyers surface. This is likely to take place on Tron or some other low cost reliable network. This is something to remember in case rumors emerge and price drives lower.

What’s also interesting here is the possibility that these orphaned miners go ahead and fork Ethereum to preserve the value of their mining operation.

Many have said that they will go to Ethereum Classic. It seems a subset has as its hashrate has grown from about 45 TH/s to 75 TH/s.

Ravencoin has also witnessed a bit of a second life as its hashrate is up nearly 4x in the past month. It now sits at 9.5 TH/s.

But will they? I’m not so sure. The more attractive option seems to be a forked version of Ethereum.

It’s likely why Ethereum is only down about 100 TH/s. That’s substantially more than what we saw come online to ETC and RVN, but only a minor blip on Ethereum’s network.

With 100TH/s leaving Ethereum, about 30TH/s going to ETC and 6ish TH/s go to RVN, where did the rest go? Bitcoin? Perhaps. Or maybe they are waiting for the forked version of Ethereum to come about called ETHPoW.

Rumors from some experts are that the group around ETHPow, also known as ETHW, is having a hard time getting the chain ready.

If there is success, we shouldn’t be surprised to see it garner well above 100TH/s in the months to come. Which is why I wouldn’t be in such a rush to sell a second token if it happens. If the larger market believes miners provide better security, than I’m not entirely sure why a chain with substantial mining power would be worthless… Even if it takes time to come online.

Yes, ETHPoW likely is having issues… But mining power does equate to some value in crypto. So don’t completely discredit it even if many Ethereum proponents openly laugh about its struggles on Twitter and podcasts.

Only time will tell here.

Before getting to the next group there is one last thing I want to point out with miners.

In the hours and days that follow, if we see rumors saying the Merge is a failure or struggling… and price starts to tank… be sure to really do your homework. Triple check sources and try to find out the truth yourself. Don’t just react to what you read online.

Events like this have tend to have some turbulence on the network. Expect some minor wrinkles to need ironing out. Consider this nothing more than the network stretching its legs. Which means try not to get caught up on what might literally be miners acting out of anger.

Like I said, if we are going to have fireworks, I’d expect it from the Existential Crisis Miners group.

Retail

There is not much to say about this demographic. Where the wind blows, we tend to believe retail will follow.

This is the group that is most prone to getting sucked into a potential miner response or rumors that The Merge is having issues.

If price whips around expect retail to enter at the worst time.

They are stuck in the middle and more reactionary than anything.

And since I don’t give retail enough credit… there is one point I will make later, which is that this group is most likely to do what is probably the safest move. I’ll call it The Joe Cool move.

The Adults

We can thank IamNomad for this reference.

He’s definitely right here. Many businesses are likely hedging their customer holdings in the event the Merge fails or they can no longer access their clients’ tokens.

Recall that once the Merge happens, the tokens locked up for staking cannot be accessed yet. It will be another nine months or so before tokens can get unlocked.

That’s a lot of risk for a business to bear on behalf of its clients. It’s wise for this type of hedging.

It’s also in part why a lot of Open Interest in the futures market may not actually unwind after the Merge. This player is likely holding this hedge until expiry, and rolling it to a later date as the upgrade called Shanghai enables users to unlock their tokens.

This reduces the potential for all those short positions to unwind right after The Merge. If anything, it acts more like subtle buying pressure in the months that follow.

If any group here is likely to help keep the police from showing up to the party, it’s the adults.

The Joe Cool Move

Which leads me to the bigger picture of all this.

Assuming The Merge is not a failure…

Don’t get caught up in the days to come. The main player that is likely to do any sort of crazy activity is that of the miner. And that’s a one off event that is to be short lived.

The Joe Cool move is to sit there and buy any type of overly emotional movement. Then sit back and take it easy.

Watch the fireworks, and then get back to work tomorrow. Don’t let this event cause you to lose sight of something bigger. Which is the potential supply shock that is brewing.

Remember, when ETH gets staked, it’s locked up. Yes, there are derivative forms of ETH, but you don’t lock ETH up to sell the derivative.

If anything it signals the supply is behaviorally less liquid than ETH not locked up.

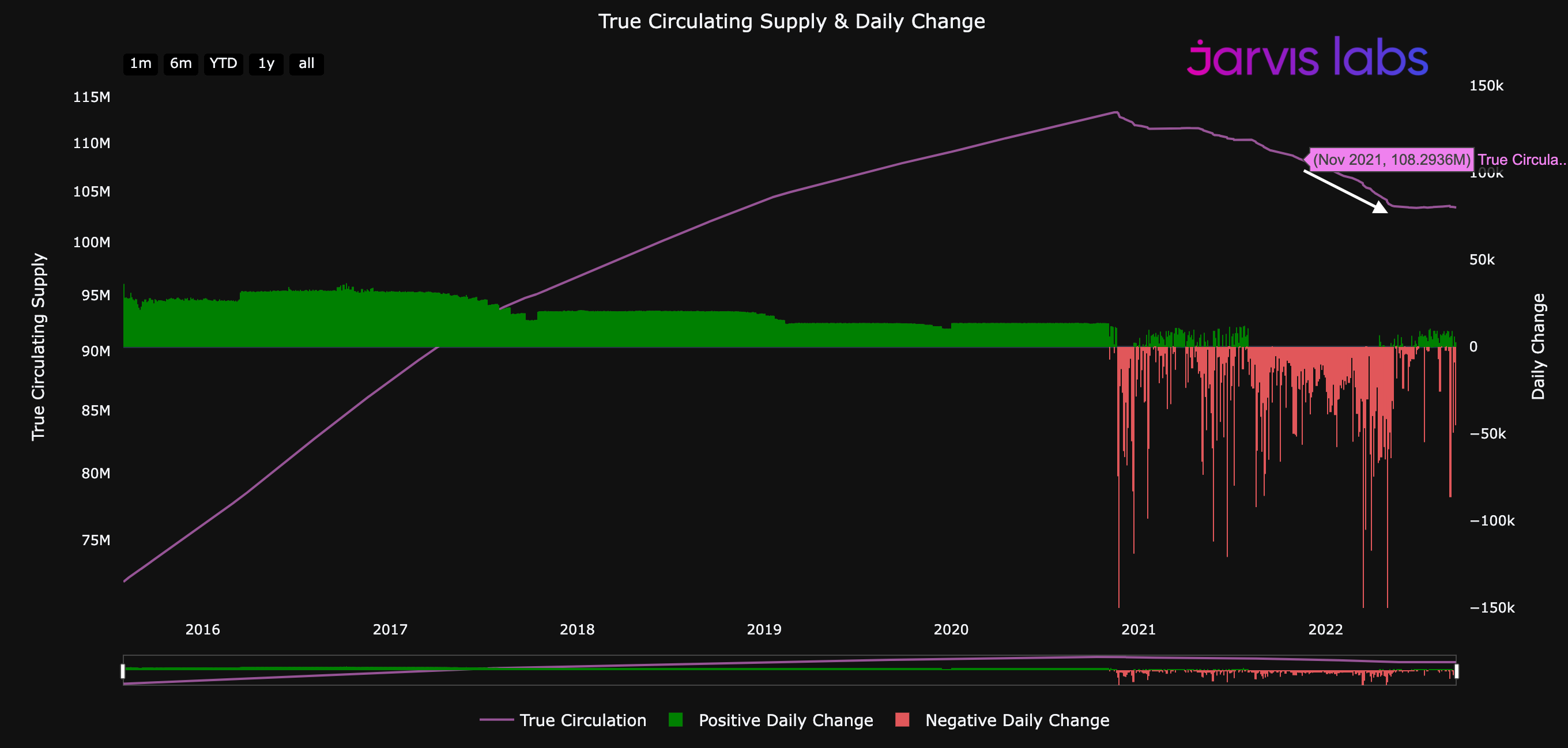

Also, there is the ETH getting burned from the EIP-1559 proposal. It’s adding up. In fact, when you add those variables that highlight the changing supply of ETH, it looks like the chart below.

The red bars highlight days when the tokens falling into either the EIP 1559 burn mechanism or the token getting locked up in ETH2 are greater than the new supply entering the market. As you can see, it’s a sea of red since December 2020.

More importantly, this measure is down nearly 5% since the market’s top in November 2021.

That’s important to note because since that market top, demand has been non-existent.

The impact this has in the market it known as price elasticity of demand. Meaning for every one dollar that enters ETH, it can create a more than one dollar impact on price. Said another way, once demand returns to the market, ETH can rise at a faster clip than normal.

What has that price elasticity looked liked historically?

In June 2020 we saw the summer of DeFi hit. The amount of ETH locked up went from about four million to 26 million in a matter of months.

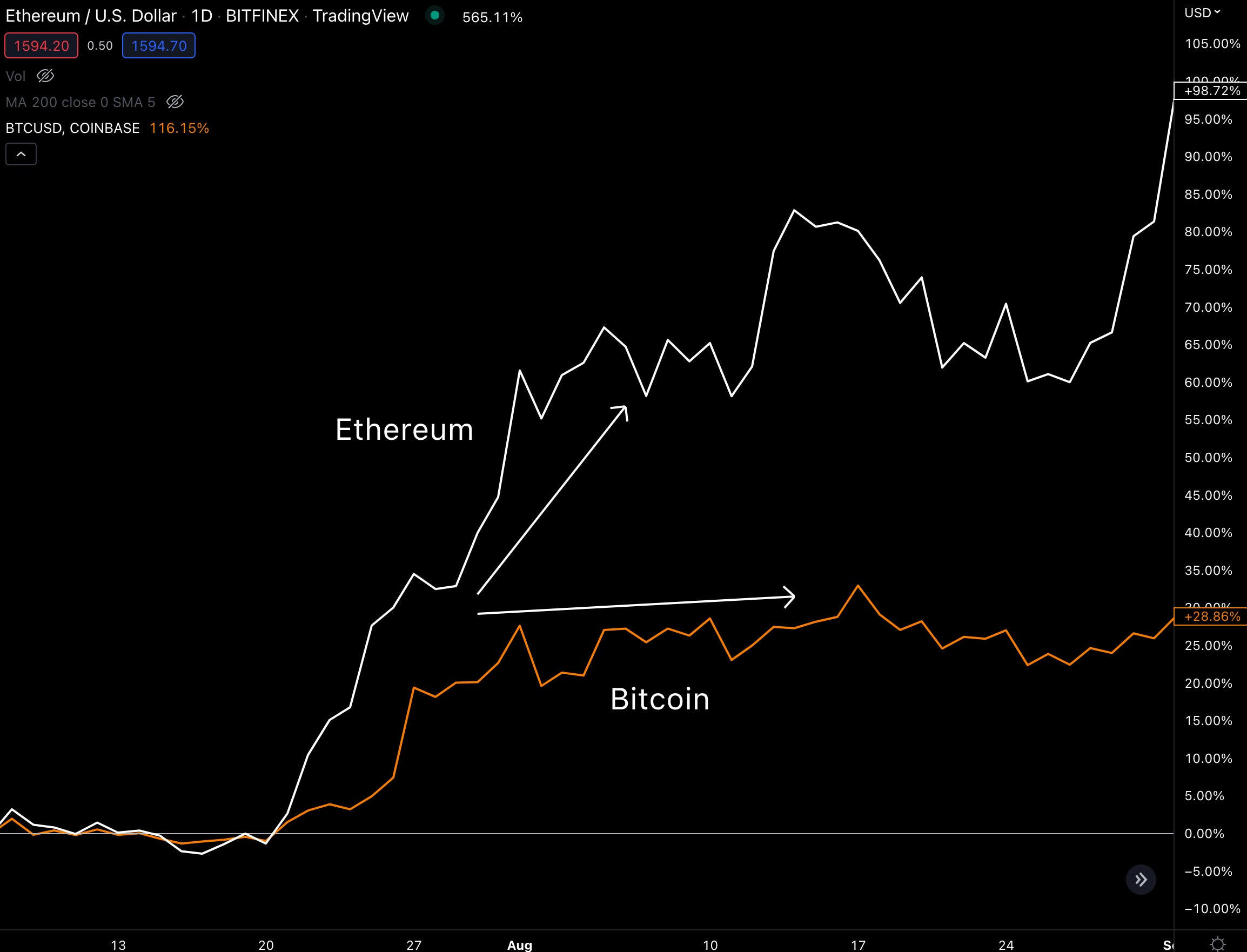

The ETH that was getting locked up created the effect on price outlined below. An effect where for each dollar entering resulted an outsized movements to the upside compared to Bitcoin.

Likely some of this was attributed to DeFi in general becoming popular and existing on Ethereum, while the other half being a result of a supply shock.

The difference here is that the lock up of ETH happened in concert of demand showing up.

Today, it’s different. The lock up of ETH is happening silently and in the background. It’s one of those situations where you brother might have take one coin out of your jar every time you left the room… And it wasn’t until months later you noticed half the coins were gone.

In this situation, once the market realizes the jar is half full, expect demand to surface as well.

We’ve witnessed this with Bitcoin several times now where its emissions rate cut in half every four years. Much of its cyclical behavior can be attributed to this. The difference being is the net liquidity is not as drastic as what we see unfolding here with Ethereum.

But what I want you all to take away here is that this supply dynamic takes a bit of time. And once you begin to see analysts showcase that ETH as an asset is having a liquidity crisis or massive drop in liquid supply, take note. That’s the fundamentals that Joe Cool is waiting for.

So play it safe, enjoy the show, and take advantage on any emotional reactions in the market.

Until next time…

Your Pulse on Crypto,

Ben Lilly