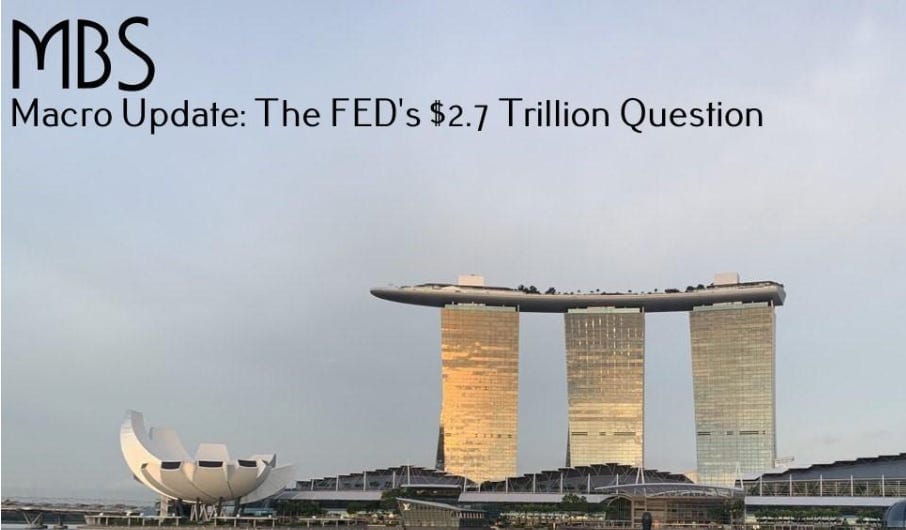

MBS

Macro Update: The FED's $2.7 Trillion Question

MBS.

Better known in this part of the world as Marina Bay Sands. One of the most famous casinos globally due to its unique architectural design and a few appearances in movies such as Crazy Rich Asians and Independence Day: Resurgence.

When I first came to Singapore, that piece of land which MBS sits on did not exist.

I can still vividly recall looking out the window from my office floor and seeing ships pumping sand out of their nozzles as part of the land reclamation effort.

To give you an idea, Rhode Island is almost five times the size of Singapore. Land is scarce.

With its land size limitations and its status as one of the top financial hubs in the world, it is not hard to imagine that real estate prices here in Singapore are sky high and real estate development is one of its top industries.

But today, we are going to take a look at a different MBS - It is also real estate-related and its growth is driven by financial markets.

The MBS we will be discussing is mortgage-backed securities.

$2.7 trillion worth of these securities is sitting on the Federal Reserve’s (FED) balance sheet.

FED chairman Jerome Powell’s recent hawkish speech last week telegraphed the intention to correct the US housing market. Placing this mammoth balance sheet item in the cross hares.

Currently, there are quite a bit of dissensions in the media regarding how the FED will reduce the MBS that are currently sitting on the FED’s balance sheet.

So let us explore the potential options the FED has for the MBS that are currently lounging in the FED’s book while sipping Singapore Sling.

The FED Backstop

The mention of the word “MBS” or phrase “mortgage-backed securities” usually elicits a cringe or a raised eyebrow amongst the public.

That is not surprising. After the subprime mortgage crisis back in 2008/2009 that almost brought down the entire banking system and the global economy, mortgage-backed securities are almost synonymous with disaster and garbage.

In an attempt to rescue the faltering economy and to make sure the housing market didn’t collapse, the FED started its MBS purchasing program in 2009. The FED acted as the backstop and bought MBS to guarantee flows and liquidity in the mortgage market because no one wanted anything to do with MBS.

Fast-forward to today, that is how and why the FED ended up with $2.7 trillion of MBS on its ledger.

Now, to set the table a bit, the FED wants to trim its balance sheet to the tune of $95 billion per month for the next two years: $60 billion of treasuries and $35 billion of MBS.

Said another way…$95 billion per month means that the FED will eliminate $2 million of liquidity from the market every single minute.

That was the goal. But Powell stated clearly and succinctly during his last speech that selling the MBS on the FED’s balance sheet is “not something that we are considering now”.

This statement provided a bit of relief for hedge funds, money managers, and real estate investment trusts (REIT) – for now.

What the FED is looking to do first, is to determine the reduction rate of the MBS balance per month via pass through. Once the reduction rate is determined, then the FED can decide how soon, how much, and how fast they want to start offloading the MBS.

Pass-through will be the critical performance indicator for the FED. Pass-through is how the MBS balance is brought down via the principal repayment of the mortgages and mortgage termination from refinancing or house upgrading/downsizing (sell the current house to move to a different house hence paying off the current mortgage).

But given the FED’s intention to slow down the housing market, the likelihood of achieving the balance reduction of $35 billion per month solely dependent on mortgage pass-through does not seem to be a feasible option.

Which means the FED will need to resort to selling MBS in the coming months.

The FED’s Candidates

Who will be the buyers? With the mortgage rate climbing, interest rate spiking, and the cooling of the real estate market, the MBS that FED has to offer are just not that attractive.

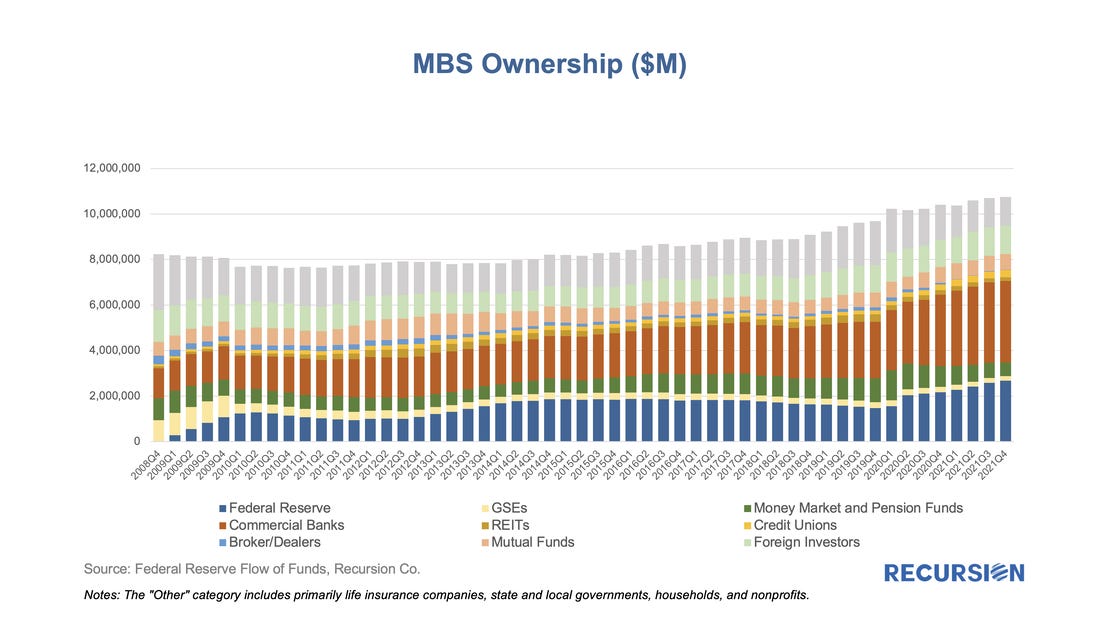

The chart below shows the MBS ownership breakdown from Q4 2008 to Q4 2021.

We can see a gradual rise in the FED’s holding of MBS since the blow up of the subprime mortgage debacle back in 2008. That is reflected in the blue bars in the chart below.

Source: Recursion

We also see an increase of holding from the commercial banks in the rust colored region of the chart. The commercial banks represent the largest portion of MBS holding. This gives us a nice overview of the MBS market.

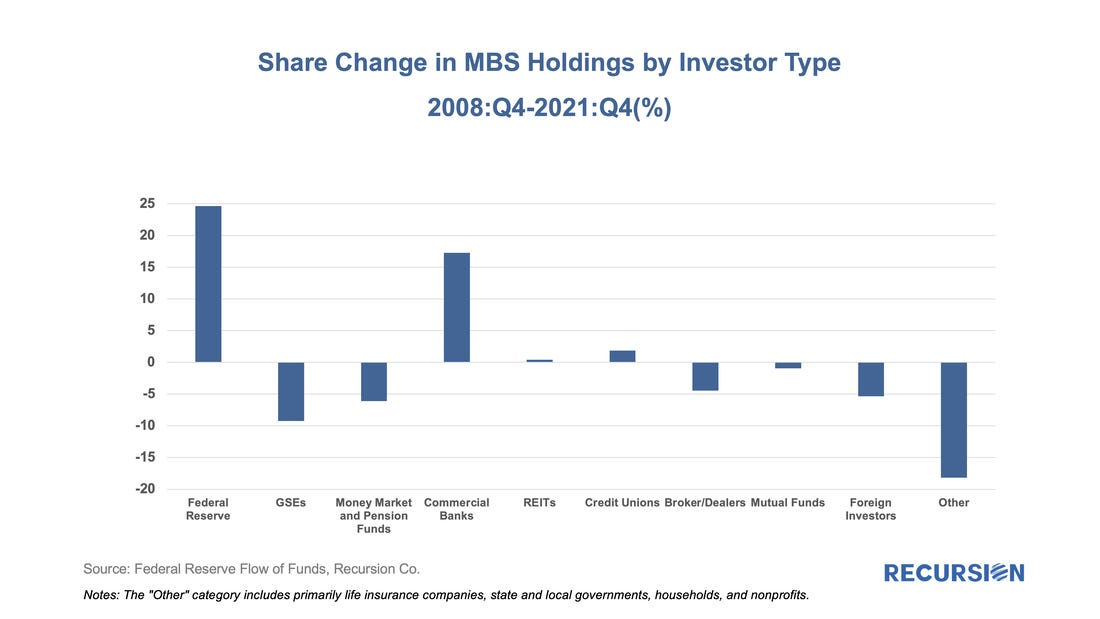

The next chart provides a glimpse of the change in percentage of MBS holding from different investor categories.

Source: Recursion

The commercial banks still own a tremendous amount of MBS. Coupled with the fact that bank deposits are starting to fall, chances are, the banks will be holding back on more bond purchases in the future.

So if the FED plans to jettison its MBS holding, it will have to look to other institutions as candidates.

And the most likely potential buyers for the FED’s MBS are: Money market (MM), pension funds, and foreign investors.

Foreign Investors

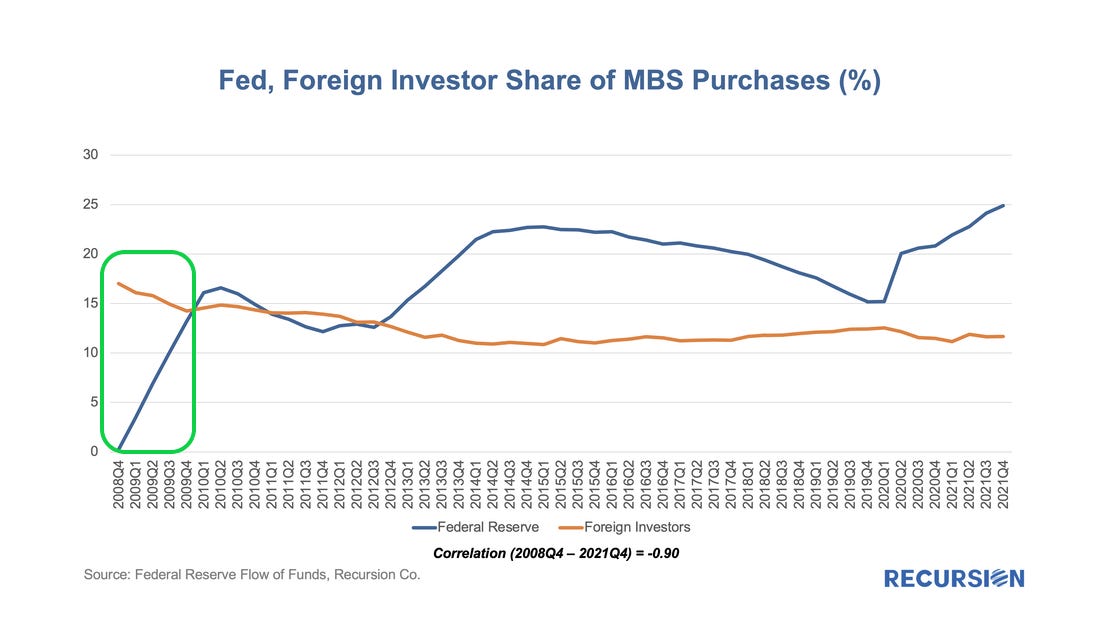

Foreign investors are the ideal buyers for the FED in the current economic climate. In the chart below, we can see that foreign investors had a higher percentage of MBS holdings than the FED before the subprime mortgage crisis as indicated by the green box.

Source: Recursion

The MBS holdings by foreign investors dropped and hovered about 10% for the past decade. This shows that there is still a certain level of demand for the mortgage-backed securities from the foreign investors.

With the strengthening of the US dollar, MBS would be ideal for foreign investors that want to earn interest on a relatively stable asset class that are also denominated in USD. The strong dollar is forcing investors to look at USD-denominated assets.

Pension Funds and Institutions

To make the MBS more attractive to the pension funds, there are tools that the FED can utilize. Duration matching would be one of the tools.

Duration matching, in simple terms, means that it is an interest rate hedging tool for pension funds or institutions that have cash outflow liabilities.

The FED can sell MBS that have certain interest rates and maturity profiles to these pension funds and institutions depending on their needs.

Let’s use a quick example that can both explain duration matching and illustrate the benefits for foreign investors.

In Singapore, there is a government social security scheme called Central Provident Fund (CPF). The participation is mandatory for every citizen and permanent resident residing in Singapore. The current interest rate for CPF’s retiree account is paying at 4%.

The Singapore government will have to find a stable financial instrument to help fund the 4% interest payment along with the principal payment for the retirees. To keep things simple, let’s assume the Singapore government is looking to fund the 4% liability for the next 5 years with a balance of $100 million USD.

What the FED can do then, is to offer the Singapore government $100 million USD of investment grade (IG) mortgage-backed securities that will mature in 5 years and that pays 4% from the FED’s balance sheet.

Again, this is a very simple explanation of duration matching.

The Federal Reserve has MBS with different maturity and interest rates that it can offer to funds and institutions to meet their needs and demands.

Also, in the last 12 months, USD/SGD went from the low of $1.38802 to today’s high of $1.43532.

This is an increase of 3.4%. Which means the US dollar has strengthened against the Singapore dollar.

So on top of getting a financial instrument to help fund the cash flow liability, because the MBS is denominated in USD, the Singapore government can also reap the windfall of the strengthening US dollar against its own currency.

Money Market Funds

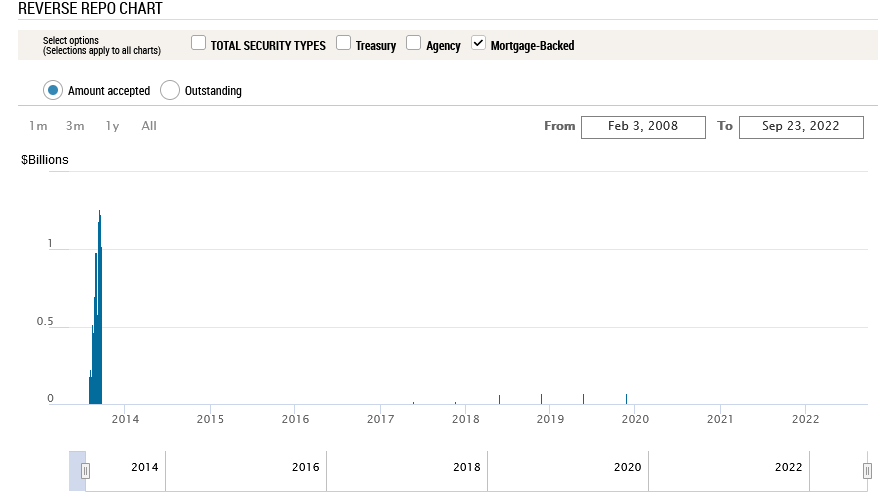

Another option for the FED when there is a lack of buyers for its MBS would be to allow Money Market Funds (MM), banks, or other institutions to use the MBS they buy from FED as a collateral for the FED’s repurchase (repo) or reverse repurchase (reverse repo/RRP) facility.

This discussion gets into some very nuanced discussions in the plumbing of the FED. But what we can takeaway here is the FED did allow banks and institutions to use MBS as collateral for repo and reverse repo back in 2013. This might happen again if current liquidity stresses continue.

Source: New York Federal Reserve

As we had mentioned in our update “Where to Plunge” on August 26th, 2022, one of the issues that the institutions are facing in the current environment is the lack of collateral to buy that will meet the FED’s requirements to participate in the FED’s overnight reverse repo facility.

This will solve the problem of a lack of buyers for the FED, and simultaneously, it solves the lack of repo/reverse repo collateral for the money market funds, banks, and other institutions.

Should the FED decide to allow the MBS purchased from them to be used as collateral for their repo or reverse repo facility, the institutions will be waiting in line with cash in hand just like teenage girls waiting to buy tickets for a BTS concert.

The End of an ERA

The FED finally stopped its MBS purchase on September 15th, 2022.

The settlement date for this last purchase will be on Thursday, October 20th, 2022.

Therefore, we can expect a possible slight uptick of the MBS balance on the FED’s book.

But this is it.

When will the FED start selling? How much will the FED sell? Will MBS be used as a future tool of the FED to help it meander down the mine field it has created?

These inquiries will be closely monitored by the finance professions. And one thing we can count on is there will be speculations and headlines popping up in the coming months.

We will monitor this arena closely just like the other financial professionals since these FED tools are likely not known by most in the cryptocurrency industry. And with the FED dictating global markets, BTC, ETH, and others follow along.

Thank you for reading.

If you enjoy this piece, please subscribe. Also, the past few weeks I have really enjoyed the comments. Please keep them coming.

Yours truly,

TD