What Keeps Me Up at Night

Macro Update: The Biggest Flashpoints for 2023

Tick. Tock. Tick. Tock.

Toss to the left. Kick the comforter to the side. Too warm.

Flip to the right. Pull the comforter back. It’s a bit chilly.

We’ve all done this before.

Insomnia is not fun.

Given how 2022 turned out, my nights of tossing and turning vastly outnumbered nights of sound sleep last year.

We had to deal with an outbreak of war after Russia invaded Ukraine…inflation running sky-high…and markets, especially crypto, taking us on a roller-coaster.

It’s hard not to wonder what will be in store for 2023.

Unfortunately, I think there’ll be plenty of things that will keep us up at night this year, too.

I’m not saying that to scare you. But in order to succeed in the markets, it’s important to be aware of the biggest risks the world faces today, so you can prepare and start identifying the next opportunity.

So if you can’t sleep, then grab a cup of joe and let’s do a fireside chat.

These are the potential flashpoints of 2023…and how they could affect the one indicator you need to keep an eye on this year.

The New Cold War

The most prominent hotspot for 2023 will once again be Ukraine.

Thanks to winter, the ground warfare has ceased in the region. But Russia and Ukraine are still exchanging ballistic projectiles. The next round of major personnel and weapon deployment will most likely be in spring of 2023 after the snow thaw.

Whether the Russians achieve their goal or the Ukrainians succeed in driving them out of their country is up for debate. How long the war might persist and who will win are questions best reserved for geopolitical experts.

But no matter what happens, the result will have lasting effects.

If the Russians win and dictate their terms with Ukraine, this could accelerate the pace of the U.S. dollar losing its dominance. The bloc of countries known as BRIC (Brazil, Russia, India, and China) will be stronger than ever, and they could begin to weaken the dollar with a strategy tied to commodities.

Russia and Brazil will continue to provide commodities to the world, but expect the BRIC bloc to start moving away from settling transactions in USD – and possibly switching to gold or a basket of currencies. Once a system is in place, the bloc will most likely reach out to the other commodities and energy producers in the Middle East, Africa, and Asia to invite them to the new platform.

For instance, Africa’s export amount in 2021 was $513 billion USD. Middle East exports in 2021 totaled $1.215 trillion USD. Most of those exports were commodities. Once commodity-producing countries shift away from USD for settlement, the dollar will certainly lose its reserve status.

As this unfolds, we might see a more pronounced rivalry between East and West.

But if the Ukrainians come out victorious, then it will be a bit more complicated.

Will a defeated, tattered Putin regime still have enough power and resources to maintain a tight grip on Russia?

Or will there be other factions ready to move in and take the reins from Vladimir and his men?

A Ukrainian victory will very likely throw Russia into political disarray and societal dissonance, diluting the power of the BRIC bloc, especially if there’s instability in the commodities market.

A coup might take place, put Russia through a period of civil unrest, and disrupt the production of oil and other commodities. Or a hard-line, anti-Western government might replace Putin and take a harder stance against the U.S. and NATO alliance. This might result in stricter sanctions against Russia.

And if the West is able to prop up a government in Russia that’s friendly, then it most likely will change the dynamic of the BRIC bloc and potentially shift the distribution priorities for commodities.

While the U.S. dollar retains its dominance status, we might see the bonds between the BRIC bloc weaken.

More worrisome, China and nations that aren’t on good terms with NATO might start getting fewer supplies from Russia.

Maybe that’s why Xi Jinping wasted no time visiting Saudi Arabia in December.

After all, China relies heavily on Russian crude. While Saudi Arabia is still the No. 1 crude exporter for China, Russia is a very close second.

There are quite a few scenarios that could result depending on what happens in the spring.

But one thing we know for certain is that the longer the war goes on, the more volatile commodities will be. And that has even more dire implications.

Food Shortages Are Coming

We might be staring down the barrel of an upcoming food shortage.

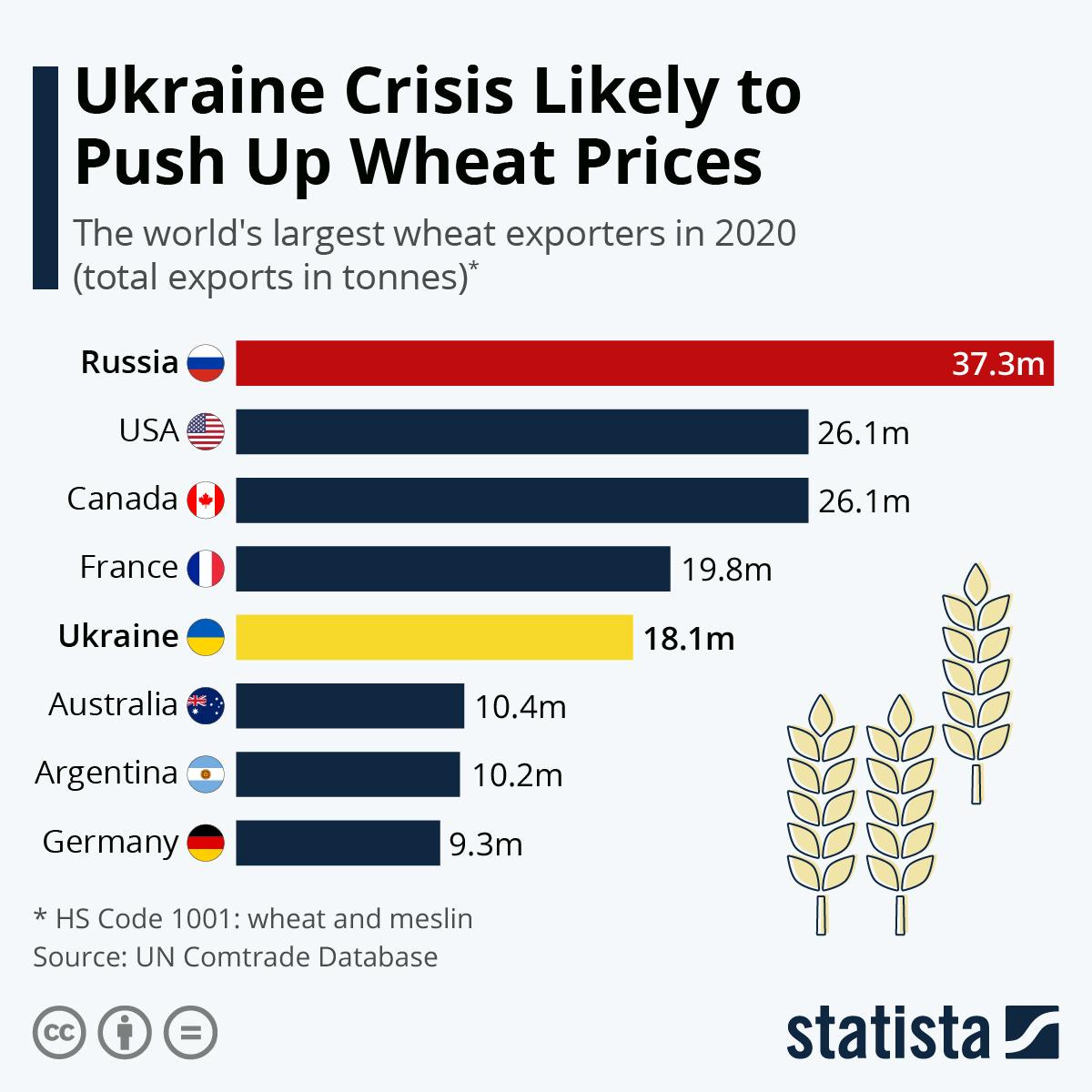

The chart below pretty much sums it up.

Russia and Ukraine combined are responsible for 25.4% of the world’s total wheat exports (Russia 18% and Ukraine 7.4%).

Since countries around the world are still relying on their inventory of wheat they purchased in 2020 and 2021, we might be in for a surprise in 2023 when food and feed producers try to fill up the silo at a much higher price and much lower volume.

But wait, there’s more.

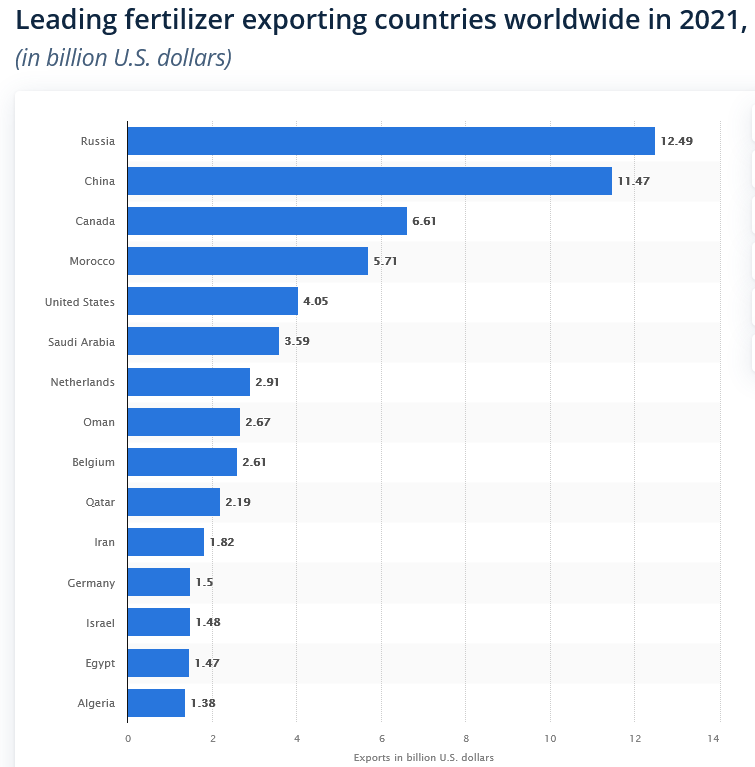

Russia leads the rest of the world in dollar value ($12.5 billion) and the share (15.1%) of fertilizers exported globally. But with sanctions in place because of the war in Ukraine, the world cannot import fertilizers from Russia.

So now, a fertilizer shortage is beginning to rear its ugly head.

This is a very pertinent structural issue because fertilizers enable farmers around the globe to increase the yield of their crops.

The fertilizer shortage, however, is not solely caused by the war.

High energy prices and the Environmental, Social, and Governance (ESG) movement are also contributing factors.

Since nitrogen-based fertilizer is a byproduct of oil, it requires a tremendous amount of energy for its production and transport. The elevated energy prices in 2022 made it quite cost-prohibitive for fertilizer companies to achieve the same amount of output similar to previous years.

And because of the amount of energy required to produce it, ESG mandates prohibit the use of nitrogen-based fertilizers because of their massive carbon footprint.

But ESG advocates grossly underestimated the impact that would have on harvest yield. This in turn results in food shortages.

And remember, food shortages equal higher food prices. And that translates to higher inflation...which leads us to my final flashpoint.

The FED’s Next Move

Once again, the Federal Reserve (FED) will be under the limelight this year as investors debate whether it will pivot from continuing its interest rate hikes.

The fear of a deepening recession combined with faltering economic conditions have prompted pundits and Wall Street experts to clamor for the FED to stop its rate hikes and quantitative tightening.

They’re suggesting that the FED should instead start lowering interest rates again and restart quantitative easing to prevent economic conditions from worsening. In November, the U.S. Leading Economic Index (a gauge of 10 indicators that show whether the economy is getting better or worse) fell by 1%, its biggest drop since the Lehman Crisis.

But since inflation could potentially run higher due to the causes we talked about above, more than likely the FED and other central banks around the world will have to continue to raise interest rates to combat inflation.

That will lead to rising yields and a stronger U.S. dollar.

These conditions do not bode well for the bond market.

Higher yields mean lower bond prices. A stronger dollar from the FED rate hike represents lack of liquidity in the international bond market because international investors are buying USD to buy U.S. bonds. Domestically, the high-duration bonds will be pushed aside because of the interest rate risk (the new issues will have a higher interest rate).

Not to mention that higher interest rates represent possible refinancing challenges for a lot of companies in the private sector.

Despite the aggressive rate hikes from the FED, the corporate bond market is still functioning like a well-oiled machine.

But as interest rates continue to soar, that will certainly make it harder for a lot of corporations to roll over their debts to finance operation costs in the near future.

A recession would also reduce corporate earnings and make it tougher for companies to service their outstanding debts.

So we might start seeing more and more corporations default on their debts in 2023.

And that doesn’t even cover the risks this situation poses to sovereign debts.

We have a bit of a buffer now, since the FED and other central banks have been hiking rates so aggressively that it prevented countries from over-leveraging and taking on more debt.

But no matter what, governments around the world will have to continue borrowing at high costs to meet their obligations.

What we witnessed in the U.K. with its Gilt crisis earlier this year could be just a precursor.

While sovereign defaults remain a concern, the more pressing matter is that governments will have to stop their citizens from moving their capital beyond their borders to locations that offer safe havens or higher yields.

As a result, we might see more capital control measures being deployed next year, like what we’re seeing in Nigeria now.

Regardless of which level of debt, private or public, credit default events deserve to be monitored in 2023. They might be the first domino to kick off a contagion effect that could lead to a crisis.

The Most Important Indicator for 2023

With today’s trying conditions and the gloomy economic outlook, 2023 is shaping up to be a challenging year.

The conflict in Ukraine and other potential geopolitical risks will most likely have an impact on the dollar’s dominance. But there are plenty of tailwinds that could enable it to continue strengthening.

Inflation caused by shortages of commodities, energy, and food will likely lead to more rate hikes from the FED and other central banks.

That means more and more investors will be looking to invest in U.S. Treasurys or dollar-denominated assets. More demand for the dollar means it gets stronger.

As a result, other sovereign debt issuers might have difficulties finding bidders for their debts. They will be forced to either raise the rate to entice investors or find other ways to fund their liabilities.

For countries with their currency pegged to the dollar, the peg will become more problematic to maintain. Countries without many natural resources that rely heavily on imports for food, energy, and other staples will spend more to convert their local currency to USD to purchase the goods.

It is a negative feedback loop.

This might also create chaos in the bond market as countries liquidate assets such as U.S. Treasurys to fund the USD peg or the imports of goods.

The common denominator here is the U.S. dollar.

Hence the most important economic indicator to keep an eye on in 2023 will be the U.S. Dollar Index (DXY).

Especially for investors looking at risk-on assets such as equities and cryptocurrency.

Should DXY start to soar again, expect the equity and crypto markets to descend into a deeper abyss.

Diligent risk management will be a top priority for investors in 2023. The markets will remain volatile.

The Chinese Zodiac sign for 2023 is the Year of the Rabbit.

For the financial markets, 2023 will be the Year of the Dollar.

Yours truly,

TD