The Nigerian Nightmare Before Christmas

Macro Update: Why CBDCs May Be Coming to a Bank Near You, Part 2

It is that time of the year again.

Jingles bells and Santa Claus.

Yes, we’re talking about Christmas – the season of giving.

Nothing brings me more joy than spending quality time with family and friends and seeing their faces when they rip apart the wrapping paper to see what’s inside the gifts I gave them.

But while holiday shopping is well underway in most countries… in Nigeria, the season has turned into a nightmare.

On December 6, the Nigerian government announced it will carry out domestic capital controls on its citizens – limiting the amount of cash they can withdraw from their bank.

This all started because of the paltry adoption rate of the eNaira, Nigeria’s central bank digital currency (CBDC).

Despite the eNaira launching back in October of 2021, only a meager 0.5% of the 211 million people in Nigeria are using it.

Therefore, to expedite its adoption, the Nigerian government decided its citizens can only withdraw $225 USD worth of Naira per week over the counter. ATM withdrawals are capped at $45 USD worth of Naira per day.

Larger sums can still be taken out, but they come with a hefty 5-10% processing fee.

Basically, buying gifts and paying for holiday meals with large sums of cash just got a bit trickier for Nigerians.

These are draconian measures put in place to enforce the usage and adoption of the eNaira. And it makes one wonder why its mainstream adoption and participation rate is so low.

The answers possibly lie in the characteristics of a CBDC.

It serves as a perfect continuation of our discussion of capital control from two weeks ago. And it’ll lead us into part two of our discussion on CBDCs today.

Last week, we examined CBDCs at the wholesale level. In the last macro update of 2022, we’ll examine the characteristics of a CBDC at the retail level and its impact.

First, we’ll talk about some ways CBDCs can improve our existing system… before diving into some of the potential pitfalls.

Why Use a CBDC?

The main characteristics of a CBDC that matter at the retail level are efficiency, traceability, and programmability.

In terms of efficiency, a digital currency reduces the cost of transaction by removing the escrow layer (or the middle layer) needed in the traditional finance system to verify transactions.

With CBDCs, retail customers can interact with central banks directly instead of going through local retail banks or credit unions. Since a person’s wallet would be directly linked to a central bank, any funds could be directly issued and deducted.

The horror stories of banks going insolvent and triggering a run on deposits from people trying to get their money out (like what we just witnessed with FTX) will be a thing of the past.

Meanwhile, thanks to blockchain’s traceability, a CBDC would theoretically promote greater transparency of transactions. This would make it easier to monitor budgets in both the private and public sector.

Remember Bernie Madoff back in 2011?

His Ponzi scheme would not have lifted off the ground if a CBDC were in place. The money in the fund would’ve been traced to identify how it was being allocated or used.

As for the public sector, it’s all too common to see headlines such as the Pentagon failing to keep track of $800 million worth of construction projects or the city of Los Angeles spending 10 times more than other cities on homeless shelters.

CBDCs can resolve these issues and save taxpayers a tremendous amount of money with their traceability. Every piece of the data from every transaction would be logged and retrievable on the blockchain. And the data is immutable.

This promotes accountability and culpability from government officials. Issues such as misappropriation of funds and illicit budget overspending will be greatly reduced.

Another key component in a CBDC is its programmability. This allows the government more latitude to make its monetary policies more effective.

One of the big headlines in 2021 was that Americans weren’t spending the COVID stimulus money they received from the government. Instead, people decided to save the money.

This took the government by surprise. And it completely defeated the original intent of issuing the stimulus checks to the public, which was to promote spending to give the faltering economy a boost.

A CBDC can resolve this ineffectiveness by programming an expiration date into any stimulus currency the government hands out. This will create a “use it or lose it” scenario to prevent the stimulus money from being stashed away.

And it doesn’t stop there.

Should a certain industry in the economy start underperforming and need a boost, the government could issue a stimulus CBDC that’s programmed so it can be spent only on a particular sector of business (food and beverage, tourism, household electronics, etc.).

It Cuts Both Ways

While a CBDC provides myriad benefits, it does have its critics.

They claim the same technical bells and whistles that a CBDC provides can also work against the populace. A CBDC can aid in the creation of a dystopian society and usher in populace control.

For one, the traceability of CBDCs allows governments to monitor individual spending. There would be no privacy in financial transactions. While this will greatly reduce transactions for criminal activities, this transparency will also reveal the financial records and money movement of innocent individuals to authorities.

To add another layer of complexity to this issue, if this data isn’t secured properly, hackers could obtain it. A person’s spending record and other financial data could be sold to anyone and used for malice.

Another major concern is the programmability of CBDCs that we noted earlier. It enables the government to wield greater control over its people – in an insidious manner.

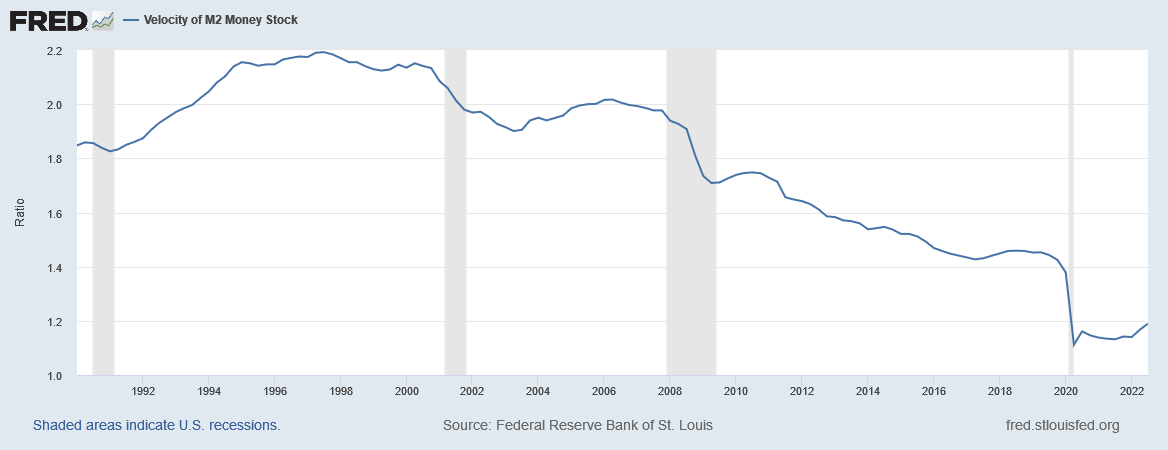

In “Hit 'Em Where it Hurts,” we mentioned that the higher the velocity of the M2 money supply (the total money supply in the system), the hotter the economy is. Below is the M2 velocity chart from 1990 to the present day.

The velocity of M2 has been steadily falling since 2000. All the liquidity provided by quantitative easing and zero interest rate policy did nothing to churn up the velocity of M2 and improve economic activity. Instead, people put their money into assets such as equities and real estate.

This can be prevented with a programmable CBDC.

By issuing a CBDC programmed with an expiration date and a tailored list of qualified purchases for its use, the government can force its people to spend their money, generating a higher M2 velocity instead of letting citizens put money aside. The government can determine how much money one can spend, where to spend it, how to spend it, when to spend it, and what to spend it on.

There are also concerns that a CBDC could be combined with a social credit system like what we’re seeing in China. A CBDC would enable the government to further control money movement and force its citizens to ration goods or services.

In other words, this is absolute capital control.

Maybe it ‘s not hard to understand why the eNaira’s adoption rate is still at a basement low after its launch over a year ago.

Uncanny Irony

The irony of Nigeria’s situation is the government is deploying capital control measures to get Nigerians to start using a digital currency platform – one that will make it easier for the government to exercise capital control in the future.

And Nigeria’s not alone. Governments around the world are starting to test CBDCs and roll out pilot programs. It’s probably a foregone conclusion that we will be entering a new era soon, in which traditional fiat money will be replaced by digital currency.

And with the distinctive properties of CBDCs that allow governments to trace money flow, monitor transaction activities, and deploy capital controls with greater ease, there’s a high probability we might see a parallel economy develop once CBDCs are officially adopted as the sole legal monetary system.

This parallel economy will fulfill the needs of individuals who aren’t able to participate in the CBDC economy or purposely want to avoid using it. And it’ll create a vacuum for a different form of barter medium to emerge.

A medium that is fast and easy to use.

A medium that has a low transaction cost.

A medium that is decentralized and trustless, without the need of an escrow or third party for transaction verification.

Does that sound familiar?

As we noted two weeks ago, Lebanon has demonstrated that a fully functional, parallel economy is feasible with cryptocurrencies such as Bitcoin and Ethereum.

Once CBDCs become the de facto fiat system, we might see the mass adoption of cryptocurrency – fulfilling the vision of Satoshi Nakamoto and other cryptocurrency pioneers.

Instead of the shortcomings and the faults of traditional fiat systems pushing for the adoption of the cryptocurrency, this mass adoption would be the result of the official deployment of CBDCs.

The irony is uncanny.

And it means that the best days of cryptocurrencies are still ahead.

Happy Holidays

As we are wrapping up for 2022, I want to send a big thank you for your support.

Time is a precious asset for everyone.

I sincerely appreciate you taking your time to read the updates.

Last but not least, I would like to wish everyone a fabulous holiday season and a Happy New Year!

See you next year!

Sincerely,

TD