TradFi or DeFi? RWAs Offer the Best of Both Worlds

Filtered: July 24 – 28

You’d think they’d at least get the name right by now.

On Wednesday, U.S. Congressman Brad Sherman was criticizing crypto during a House Financial Services hearing on digital assets.

He made some confusing comments about how the government’s money-printing machine benefits the American people… and how the “billionaire bros in crypto” are trying to “appropriate” that machine for themselves.

But the real gem of the hearing came when he turned his attention to Bitcoin and blockchain’s creator...uh, what was his name again, Brad?

We are told that cryptocurrency is very innovative. Look at the incredible financial innovation of Enron and WorldCom, and reflect on the fact that I don’t believe that, uh, Saratoshi Nagamoto was very innovative.

I can forgive the congressman for getting Satoshi Nakamoto’s name wrong (perhaps he was thinking of a distant cousin of Satoshi’s). But if there was a theme this week in our content, it was showing how blockchain is being very innovative by opening up financial opportunities that were once closed off to most folks.

I’m referring to the trend of tokenizing real-world assets, or RWAs. RWAs cover everything from U.S. Treasurys and real estate to precious metals, art, or collectibles.

And by bringing them on-chain, it opens up access to people who might be cut off from investing in these assets and bridges the gap between TradFi and DeFi.

Our token expert, Kodi, was all over this trend this week, starting on Monday, with his Espresso piece on how tokenized bonds could be a good destination for stablecoin holders hungry for better yields:

There is a whopping $127 billion out there parked in stablecoins of various currencies. A large chunk is used for active trading, yes, but a significant amount is just sitting idle twiddling its thumbs.

With DeFi yields below those that tokenized bonds offer, this represents a tantalizing new pool of capital that traditional finance companies can tap into.

…

Tokenized bonds are a win-win for established asset managers, who can potentially reach a new breed of customers, and crypto users and protocols, who get access to new products that were not available to them before.

Kodi delved further into the benefits of bringing bonds onchain, and how they’re enticing Wall Street institutions like Franklin Templeton to experiment more with blockchain, in the full essay.

Then on Wednesday, he followed up on this storyline in this week’s special guest version of the Blend, where he talked about how crypto protocols themselves are already embracing tokenization of RWAs.

He highlighted Ondo Finance, which allows users to buy tokens that represent interest in funds tracking assets like U.S. Treasurys, corporate bonds, and money markets.

While these products require users to complete KYC and AML procedures, Ondo found a savvy way to offer similar yields to non-verified users as well, by forking a version of Compound.

Here was Kodi’s take on its solution:

The melding of TradFi and DeFi requires both financial acumen and deep blockchain expertise. Ondo Finance shows how projects fluent in crypto’s tech and culture and a willingness to color outside the lines and forge new paths in regulatory gray areas can outmaneuver the Franklin Templetons of the world.

You can find out how Ondo Finance offers TradFi yields to degens here (and be sure to check out the other guest essays on why inflation might not be going away anytime soon, and how the metaverse could be coming to Bitcoin.)

And finally, Kodi shared his knowledge with the Alpha Bites team on this week’s podcast, highlighting yet another tokenization opportunity called Tangible.

Tangible is a marketplace that offers trading of tokenized RWAs, including gold, wine, and watches. But it’s also built upon that model to offer new types of products.

For example, Tangible issues a stablecoin, Real USD (USDR), that’s partially backed by the tokenized real estate on its platform. And the rental income from those properties is paid back to USDR holders, offering them a source of yield.

Kodi said he thinks providing opportunities like these are a reason that Tangible could be a big winner in the next bull market (not financial advice). But he emphasized that these kinds of tokenization opportunities won’t be around forever:

…it's one of those things that you kind of want to be early [to], because part of the reason why they outperformed traditional markets is because it's really hard to get into these markets. It's same as the art market, same as any non-fungible market that only very wealthy people have access to. It's that same lack of access and lack of liquidity and obscurity that the market has that makes it outperform basically.

So the moment that becomes a market that pretty much anyone can access, fractionalized or not, it's likely that part of that outperformance declines, if not decreases or completely goes away.

You can find out more about Tangible at its website here, but Kodi also dived a bit more into it in the episode. And the rest of our team tackled a few crypto projects as well, including WorldCoin and GMX. You can listen to the podcast here, or on Apple Podcasts or Spotify.

As always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

Espresso:

Alpha Bites:

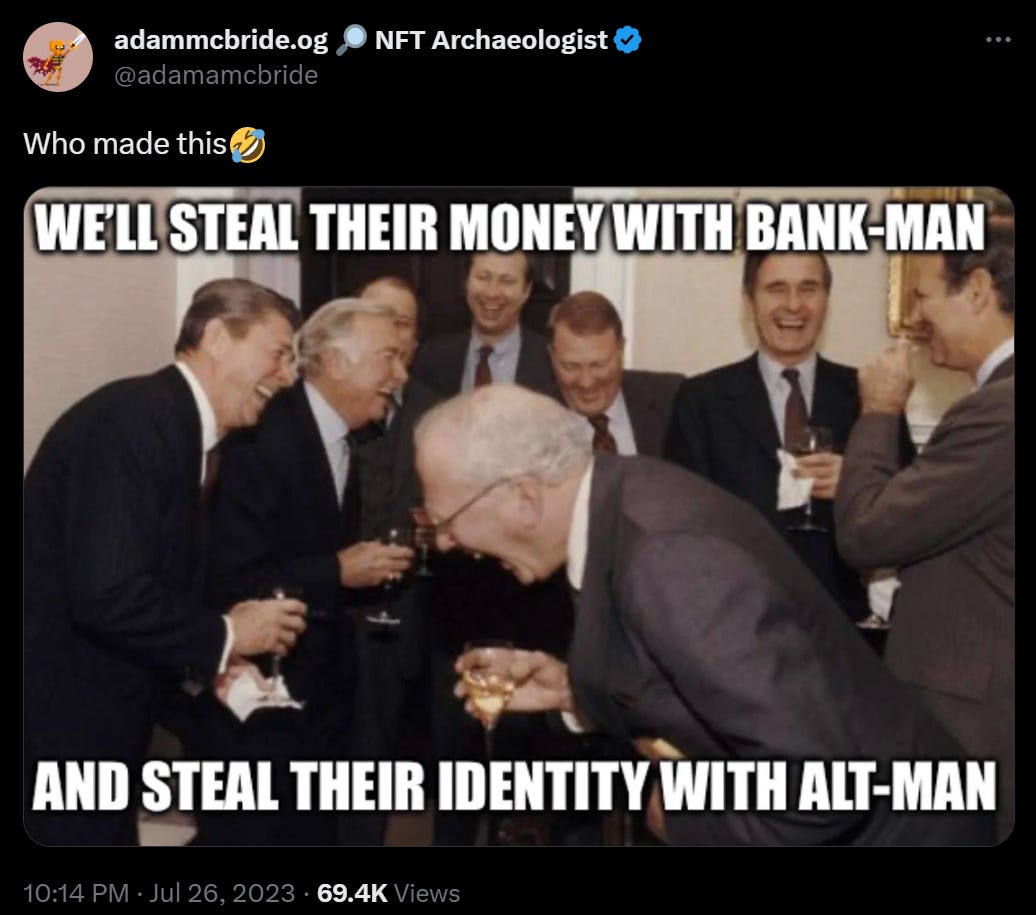

Tweet of the Week: