It’s Too Soon to Declare Victory Over Inflation

The Blend: How to Become a Bitcoin Landlord; Crypto Protocols Are Already Experimenting With RWAs

Ben Lilly here.

We’re going to do this week’s version of the Blend a little differently. Just for today, I’m handing the reins over to three associates of mine who will each provide an insight of their own.

Regular readers will likely recognize Tyler, our macro analyst, who breaks down why it may be premature to declare victory over inflation.

Our token design expert, Kodi, has a fascinating follow-up to his Monday piece, on how crypto protocols are already innovating as real-world assets come onchain.

And we’ll also hear from independent analyst Nivesh, who explains how a new project could enable the metaverse to come to Bitcoin.

We hope you enjoy today’s issue.

Your Pulse on Crypto,

Ben Lilly

When Seeing the Trees Matters More Than Seeing the Forest

By TD

At today’s FOMC meeting, Federal Reserve Chair Jerome Powell is expected to raise rates again as part of the battle against inflation. But there’s a sense from the media that the battle is already over.

The latest inflation measurements do show that it’s slowing down. In June, the Consumer Price Index (CPI) increased 3% from a year ago. That number was 4.8% back in June 2022.

And in May, the Personal Consumption Expenditures (PCE) price index, the Fed’s go-to benchmark for measuring inflation, climbed 3.8% from a year ago. That reading was 7.3% in May 2022.

The financial market jumped into euphoria. They latched onto the notion that inflation is tamed, the economy avoided a hard landing, and the Fed will stop raising its federal funds rate (FFR), if not prepare to pivot.

But is inflation really tamed?

Is there a discernible difference in the monthly household bills?

Is there a sense of relief when one glances at the price tags in grocery stores?

My guess is: Probably not.

While everyone’s eyes are on the big picture and overlooking the details, let’s bring focus a bit closer to where we stand and see the trees instead of the forest.

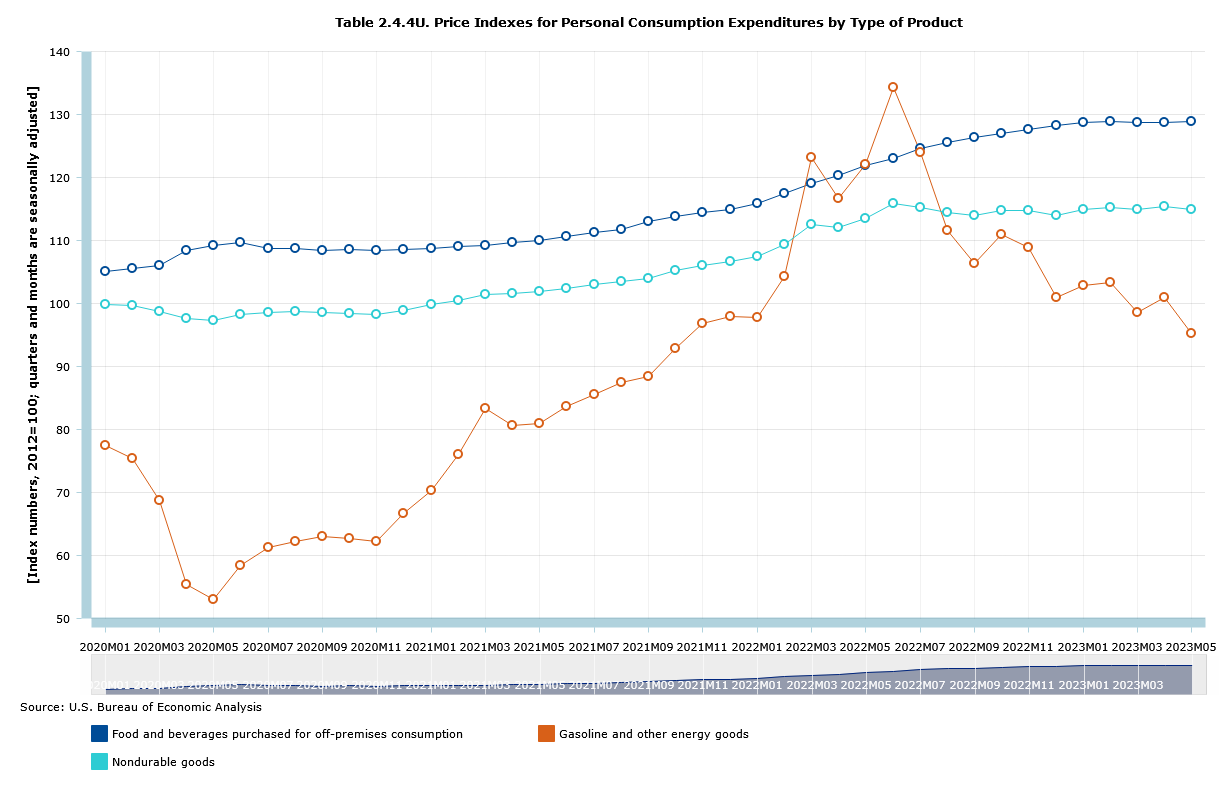

To start off, let’s use a chart to provide a visual. We will use PCE since this is Chairman Powell’s favorite barometer.

This is a chart of monthly price changes in nondurable goods since 2020, as measured by index levels. The dark blue line shows prices for food and beverages, and the orange line is gasoline and other energy prices. The turquoise line is the overall average.

Year-over-year, food prices have jumped 5.76%. But the big change in the last 12 months is energy, which is down by 21%. We suspect that’s behind the drop in the overall headline inflation figure.

The Biden administration is still depleting the strategic petroleum reserve in the U.S. to battle energy prices. Meanwhile, oil has dropped to a range of between $60-80 per barrel courtesy of the global economic slowdown and recession worries.

This, however, has not really translated to easing the plight of daily commuters.

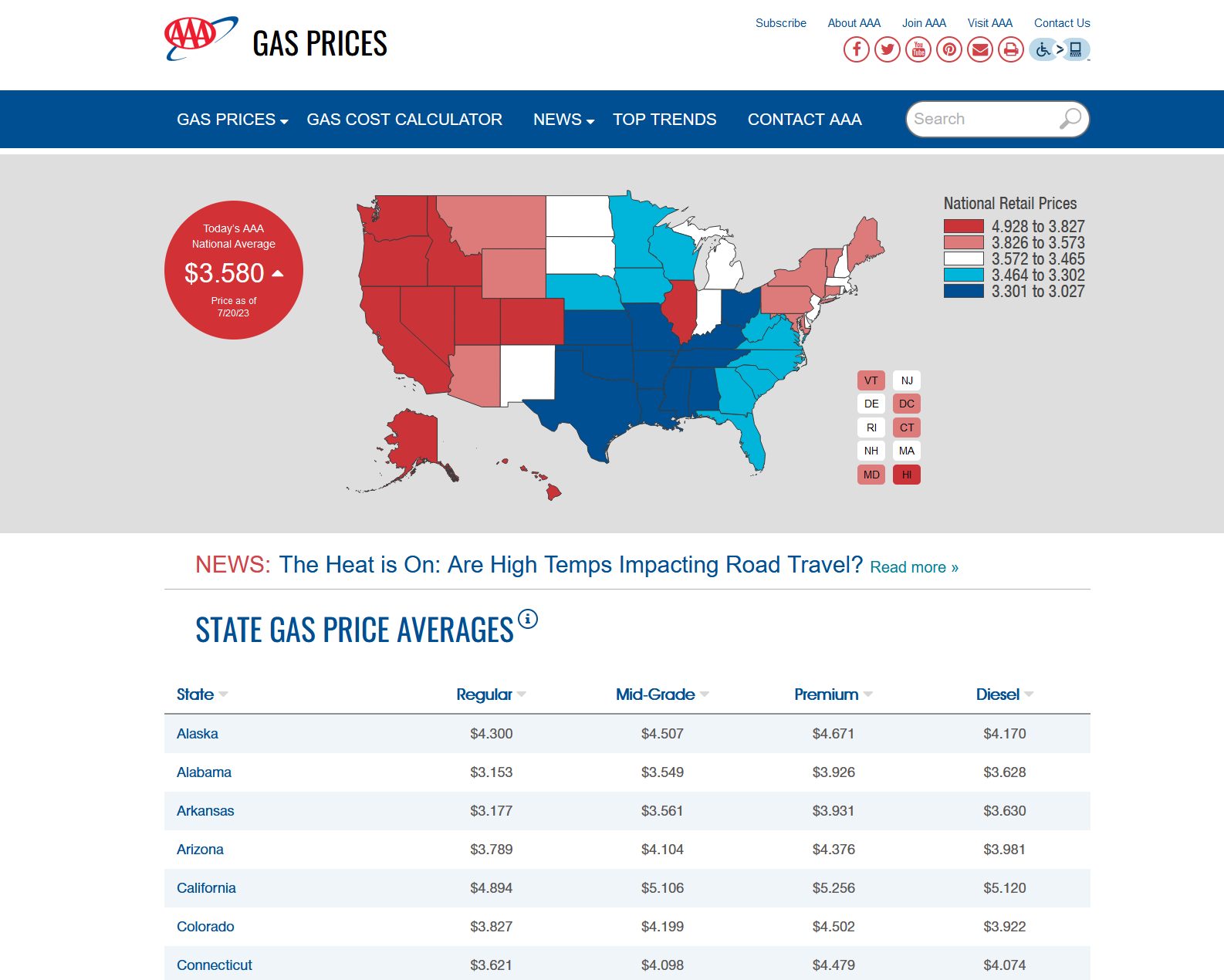

The national average price of gasoline is still hovering around $3.50 per gallon. And Western states are paying the highest prices in the nation. Washington is highest at $4.928 a gallon, followed by California at $4.894 a gallon.

As we had suggested in our article last year, the high prices at the gas pump will continue to be a sticky issue for years due to the lack of upgrades for existing refinery infrastructures, no development of new refinery facilities, and an old, antiquated transportation law.

Meanwhile, in the world of grocery, 5.76% year-over-year inflation is still higher than the Fed’s funding rate. The most noticeable offenders are cereal and bakery products at 10.73%, fats and oils at 12.24%, and sugar and sweets at 10.24%.

Despite these categories already suffering from high inflation, we can expect them to go even higher when Russia cuts off the export of Ukrainian grains starting August 1.

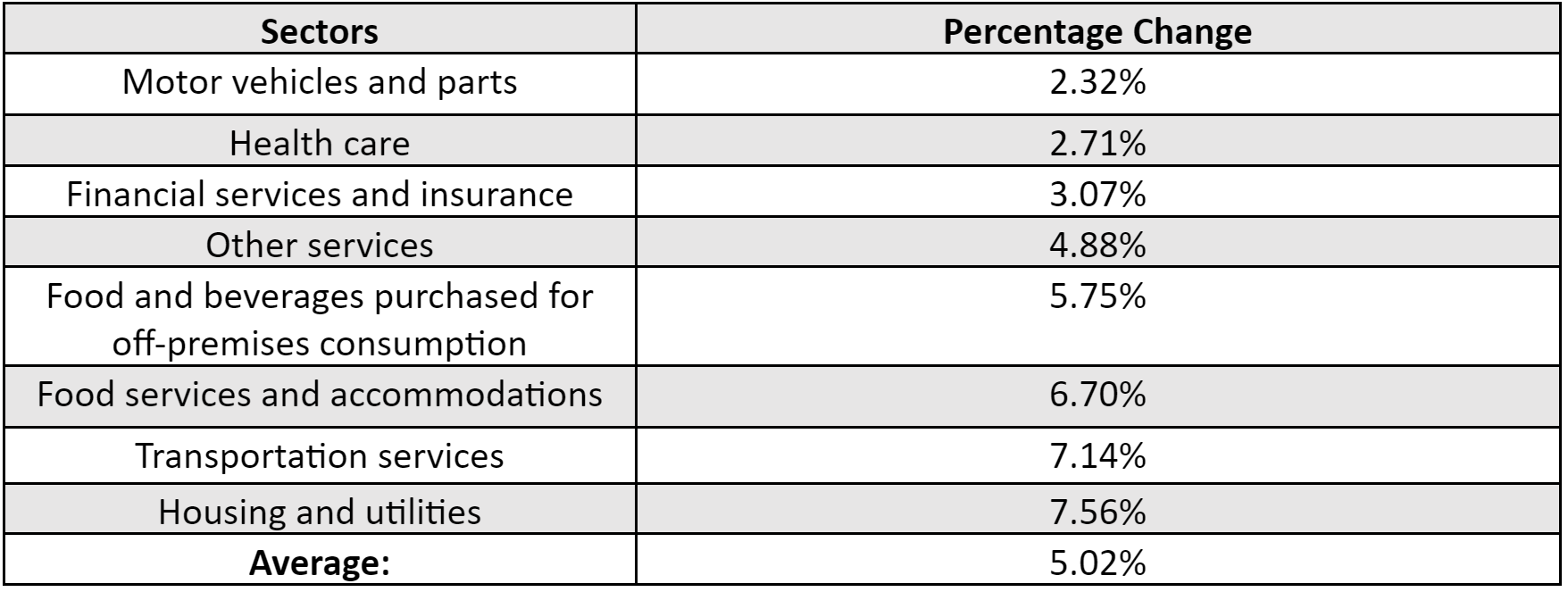

To get a better overall idea of what sectors inflation is hitting hardest, we can look at the following eight sectors that are important to household expenditures, and how prices have changed over the between May 2022 and May 2023. (For clarification, the category of “Other services” includes: communication, education, professional services, social services, and household maintenance.)

The eight sectors’ average is a 5.02% inflation rate, which is right at the FFR, while the media and the talking heads are heralding that inflation is tamed and we are heading into a deflationary environment.

In other words, the Fed has only raised the rate enough to offset inflation, not curb it. For the Fed to win the inflation battle, a higher FFR will be required – even under the current conditions.

Not to mention that a less-than-forgiving winter in the Northern Hemisphere could affect food production and energy demand and cause inflation to come back with a vengeance. In which case the Fed will be forced to resume rate hikes in a more aggressive manner.

It is important to see the forest and not just the trees. But seeing the trees can be just as important, because the devil is in the details.

Yours truly,

TD

How Ondo Finance Fuses Traditional and Decentralized Finance

By Kodi

On Monday, I wrote about how big old Wall Street is creeping onto the blockchain, with giants like Franklin Templeton and Wisdom Tree launching an array of tokenized products tied to Real-World Assets (RWAs), like U.S. bonds.

But the degens aren’t just gonna let the suits take over.

Crypto-native projects like Ondo Finance are throwing their hat into the fray, and their ingenuity and crypto know-how might win them the day against the TradFi titans.

Let’s take a look now at Ondo, how it managed to become the second-biggest project by total value locked (TVL) in the tokenized bond space (only behind Franklin Templeton), and what other projects can learn from it.

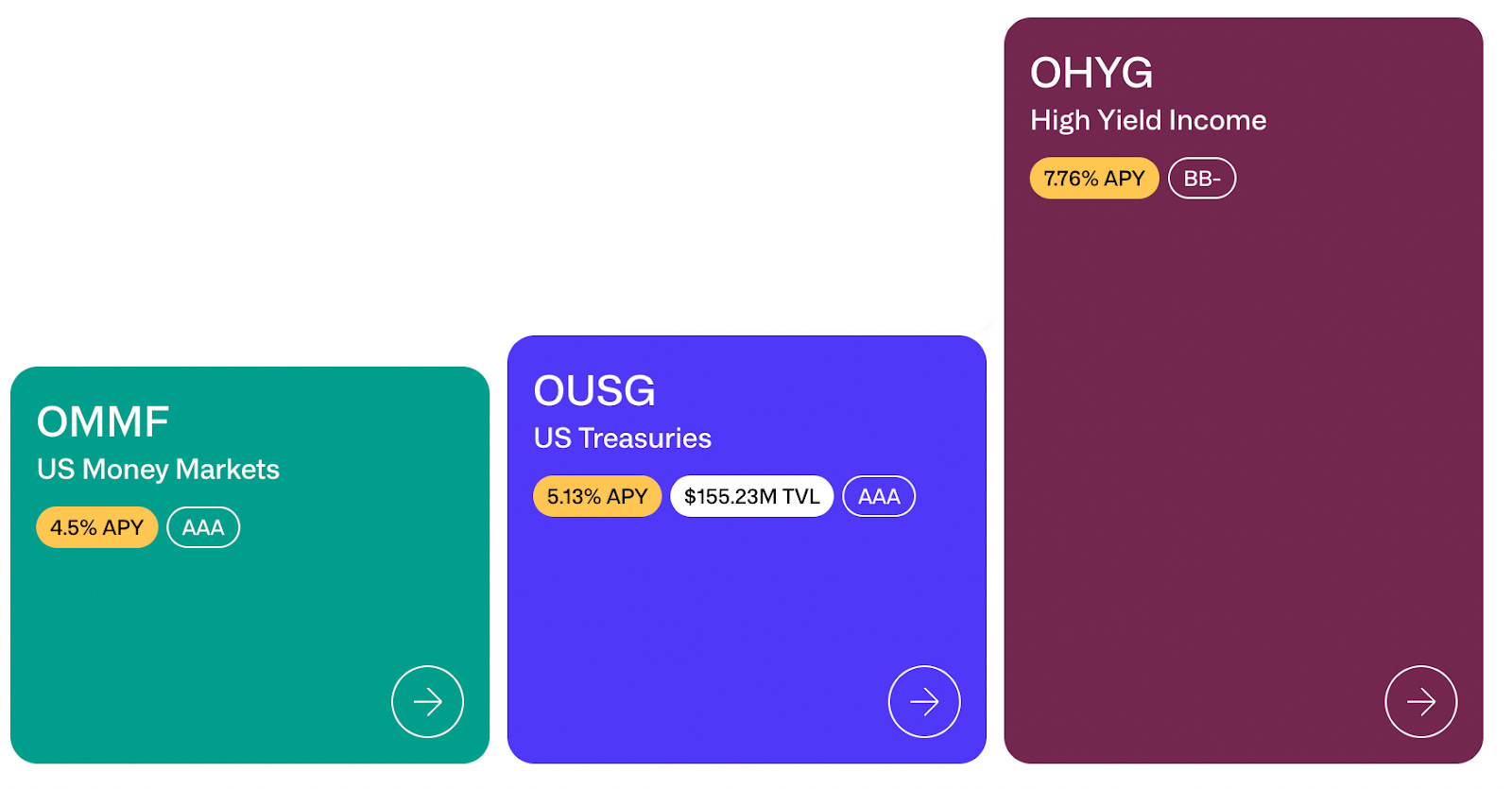

At its core, Ondo provides tokenized funds tracking assets like U.S. Treasurys (OUSG), corporate bonds (OHYG), and money markets (OMMF).

When you buy an OUSG, OHYG, or OMMF token, what you’re buying is interest in a fund that invests in an exchange-traded fund (ETF) that tracks the performance of the underlying securities.

To invest, you must complete KYC and AML procedures, just like with any traditional finance company, as well as be an accredited (read: loaded) investor.

In exchange for confirming you are human, and giving up a bit of your privacy, you get access to TradFi yields, which if you have not been paying attention are much higher than DeFi yields lately, crazy as that sounds.

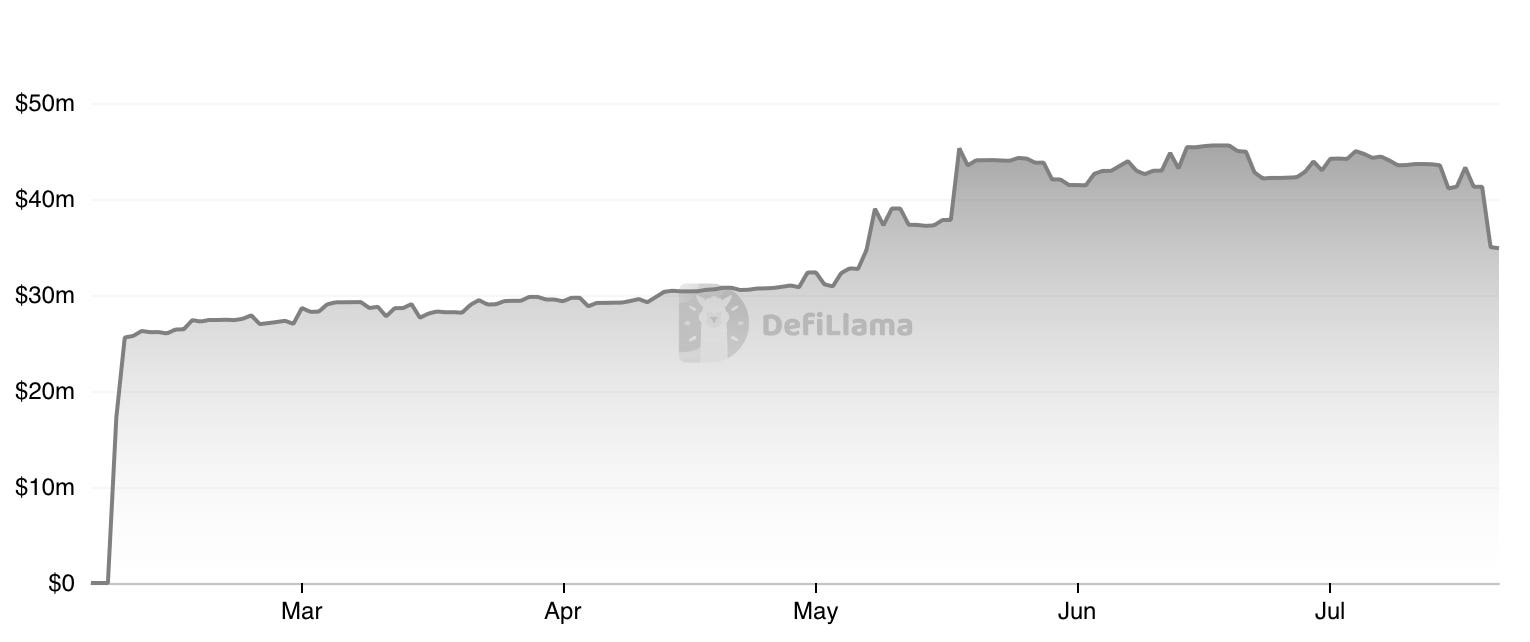

Ondo’s TVL has been creeping up since it launched on mainnet back in February, standing now at $150 million and representing almost a quarter of all TVL for tokenized bonds across DeFi.

If that was all Ondo had done, it could be considered a success already.

But the team was not content. Remember how we said before that you must go through KYC/AML procedures and be accredited to invest in their products and get that sweet TradFi yield?

Well, the guys at Ondo found a way to offer those yields (well, very close to them) to any crypto degen out there, whether they are accredited investors or not.

To do so, they forked Compound V2, the OG DeFi lending protocol. Compound allows users to lend and borrow via liquidity pools. Interest rates are set algorithmically by supply and demand.

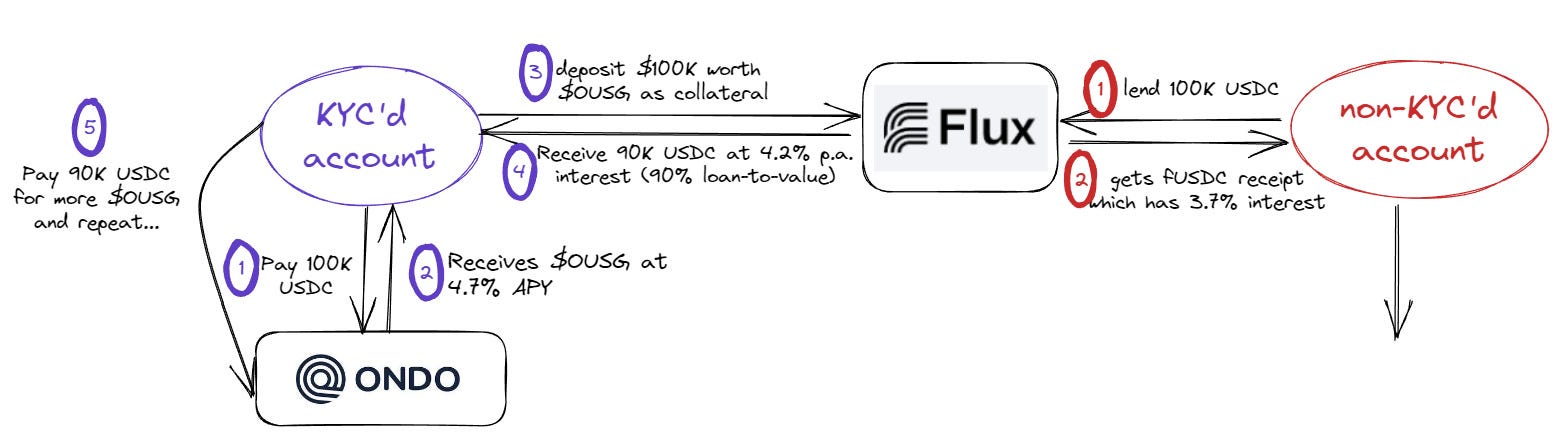

Ondo’s forked product, Flux Finance, allows Ondo users to deposit their OUSG tokens and use them as collateral to borrow stables, maybe to go levered OUSG, as U.S. bonds are one of the safest financial instruments out there.

On the flip side, any user, KYC’d or not, can lend their stables to the holders of OUSG that deposit on Flux and earn a yield close to the one that the original bond is giving out.

Maybe a diagram will help:

So, KYC’d Ondo users get access to leverage and non-KYC’d crypto natives get access to TradFi yields — the best of both worlds.

Since Flux launched, it’s attracted $35 million in deposits. And that number will likely grow in months to come, as the base annual percentage yield (APY) for stables in Flux sits at around 4% compared to the 2.5% that you can get on Compound or Aave.

The melding of TradFi and DeFi requires both financial acumen and deep blockchain expertise. Ondo Finance shows how projects fluent in crypto’s tech and culture and a willingness to color outside the lines and forge new paths in regulatory gray areas can outmaneuver the Franklin Templetons of the world.

But it’s not just Ondo showing the way. Other solutions, like OpenEden’s TBILL tokens or Maple Finance’s cash management pool (MPLcashUSDC), also enable users to gain access to U.S. bond yields. These two are actively managed and invest directly into bonds and dollars/stables, as opposed to Ondo which invests in an ETF.

In any case, bringing RWAs on-chain will open new avenues for users to get exposure to existing financial instruments. And it will enable blockchain technology and smart contracts to be used in novel and interesting ways, and will likely result in new kinds of financial instruments being invented.

Keep it fun,

Kodi

The Metaverse Could Be Coming to Bitcoin

By Nivesh

After the hype surrounding non-fungible tokens (NFTs) on Ethereum and other chains, a metaverse on Bitcoin was inevitable. And now, you can become early landlords for less than $10 apiece.

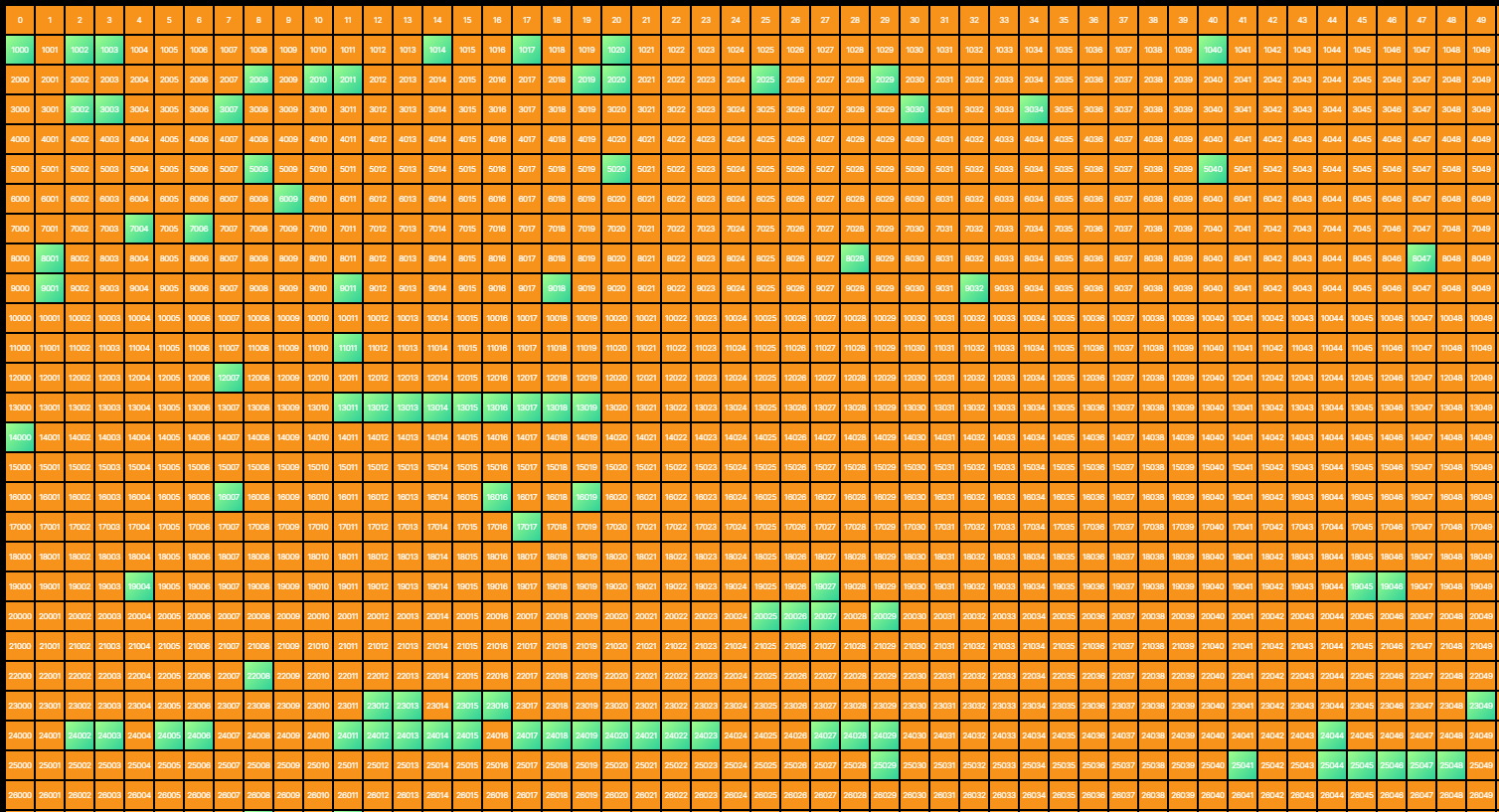

Launched on June 1, Bitmap is a new standard developed by @blockamoto, a pseudonymous developer, that allows users to claim proxy ownership of Bitcoin blocks using Bitcoin Ordinals. These blocks correspond to a land unit in the proposed Bitcoin metaverse.

To recap, Bitcoin Ordinals are a numbering scheme for individual Bitcoin satoshis (sats), giving them a distinct identity. Sats are the smallest unit of Bitcoin. You can also attach other media to them, such as images or videos, making them similar to NFTs.

Bitmap uses Ordinals to inscribe a sat on Bitcoin blocks following the same .bitmap naming standard. For example, a sat carrying the inscription of “103447.bitmap” refers to the 103,447th Bitcoin block.

The result is a map of 796,239 “land units” that can be owned.

Some teams like OrdzGames are already developing ways to inscribe a child Ordinal, which can be used to attach media or game files to a Bitmap.

These land units could be traded just like the ones in other metaverse projects like The Sandbox and Decentraland.

The inscription cost for each land unit was around $2. Currently, these are changing hands for 0.00021 BTC, or about $6.

In the last 30 days, Bitmaps have seen about 19.8 BTC (~$576,000) worth of volume on NFT marketplace MagicEden, and 15.5 BTC (~$450,000) on ordinalswallet.com in the same period – about 35.3 BTC worth (~$1.02 million) total.

In comparison to other metaverse projects, the supply of Bitmaps is significantly higher, boasting 796,239 units, which is five times more than The Sandbox’s total supply of 166,464 lands, and eighth times more than Decentraland’s 90,601 lands.

Of course, there’s still a lot up in the air. For now, a metaverse world tied to the Bitmaps blocks is just theoretical and has yet to be created. And the development of metaverse-related applications, such as games and virtual worlds, are ambitious ideas that require substantial technical development, investment, and time.

But it’s thrilling to see this type of continued development and innovation with Bitcoin and Ordinals. It opens up many more potential use cases for Bitcoin, which could drive more demand for block space. As Ben Lilly said when he wrote about Ordinals in June:

Yes, there are still plenty of kinks to work out with ordinals…. But it’s early. We can’t ignore this trend.

For one thing, Bitcoin is becoming more about builders than it has been for many years.

It’s becoming less about preaching the greatness of sound money, emission rates that can’t change, and its lindy-ness (the idea that because it’s the longest-lasting cryptocurrency it’s more valuable). And more about what is coming next. Innovation is coming to Bitcoin.

If you want to explore Bitmaps more, you can check out the map on Ordinals Wallets.

Alternatively, you can also buy individual pieces from Magic Eden.

Best,

Nivesh