The Trojan Horse of Real-World Assets

Single Origin: How Tokenized Bonds Could Bring TradFi Onchain

It’s a tough time to be a yield hunter in crypto right now.

Go back to the summer of 2021. The sun was shining, the birds were singing, and double-digit yields were easy to find no matter where you looked.

Maybe you put some tokens into Terra’s Anchor Protocol to earn 19.5%. Or maybe you weren’t as savvy with DeFi yet, and used BlockFi and Celsius to earn up to 17% on your altcoins.

Or maybe you parked your money on OHM or one of its endless forks, that promised a new "reserve currency" with yields in the hundreds of thousands. We did not know how good we had it.

Fast forward two years later, and those yield opportunities either got exposed as outright scams, or they were forced to drop rates as the bear market took hold.

To be clear, that kind of environment, in which everyone and your grandmother was offering double-digit interest, was unsustainable. It’s good that the ones that were scams got exposed, and hopefully, crypto learned a few lessons.

But it’s hard not to feel a bit nostalgic for when you could earn at least a decent rate on-chain from your stablecoins. Now, not so much.

The base annual percentage yield (APY) for stablecoins on Aave and Compound is between 2.5—3% over the last 30 days. Over 2022, yields stayed below 2% most of the time, even under 1% for rather long periods.

It hurts even more when you factor in what’s going on in macro. Many of you have probably been feeling an acute case of “Shrinking Purchasing Power Syndrome” thanks to inflation. That’s right, $100 before the Covid-19 pandemic was worth as much as $118.27 today. That’s a loss of over 18% in purchasing power in just over three years.

What’s a crypto investor to do with their stables in this market?

The answer may come from where you least expect it: TradFi.

And it may finally be the backdoor for institutions to dive into decentralized finance.

TradFi Goes Degen

While rates in crypto are abysmal, in TradFi, they’re becoming more enticing by the day.

The 1-year U.S. Treasury started yielding above 2% in May 2022 and never looked back. By October, it was above 4%, and it now oscillates around 5.3%. That’s not only outpacing inflation (which was last measured around 3% annually), but it’s better than what you can find in the average, safe DeFi play these days. Not bad for a bunch of normies, don’t you think?

Wouldn’t it be nice if us degens could get these yields for our stables?

Turns out, we actually kinda can. TradFi is already embracing the idea of launching tokenized bonds on-chain, as I’ll show you below. It’s one of the more compelling examples of real-world assets (RWA) coming to the blockchain.

Many traditional finance companies have been dipping their toes into the sector for some time. JPMorgan, for instance, has developed a private blockchain (Onyx) and payments system, JPM Coin. Yet, these products have largely remained beyond public reach, mostly due to the unclear regulatory environment.

That's where tokenized bonds come into play. Institutions are starting to realize the benefits of offering bonds on-chain. Let’s delve into some of them below.

Regulatory Compliance

The most obvious benefit of tokenized bonds is they have a stronger case for meeting compliance than, say, trading of cryptocurrencies.

These products are mainly either (a) composed of on-chain money market funds (MMF) or (b) represent an interest in a fund that invests in an exchange-traded fund (ETF) that tracks the performance of, say, U.S. Treasurys. Since the underlying securities and the financial instruments used (ETFs, MMFs) are strictly regulated, the path to achieving regulatory compliance seems pretty clear.

This might be bad news for small-time crypto degens, however, since in order to access most of these tokenized bond products, you need to be (i) a U.S. citizen or resident and (ii) an accredited investor (read: loaded).

Access to Capital

There is a whopping $127 billion out there parked in stablecoins of various currencies. A large chunk is used for active trading, yes, but a significant amount is just sitting idle twiddling its thumbs.

With DeFi yields below those that tokenized bonds offer, this represents a tantalizing new pool of capital that traditional finance companies can tap into.

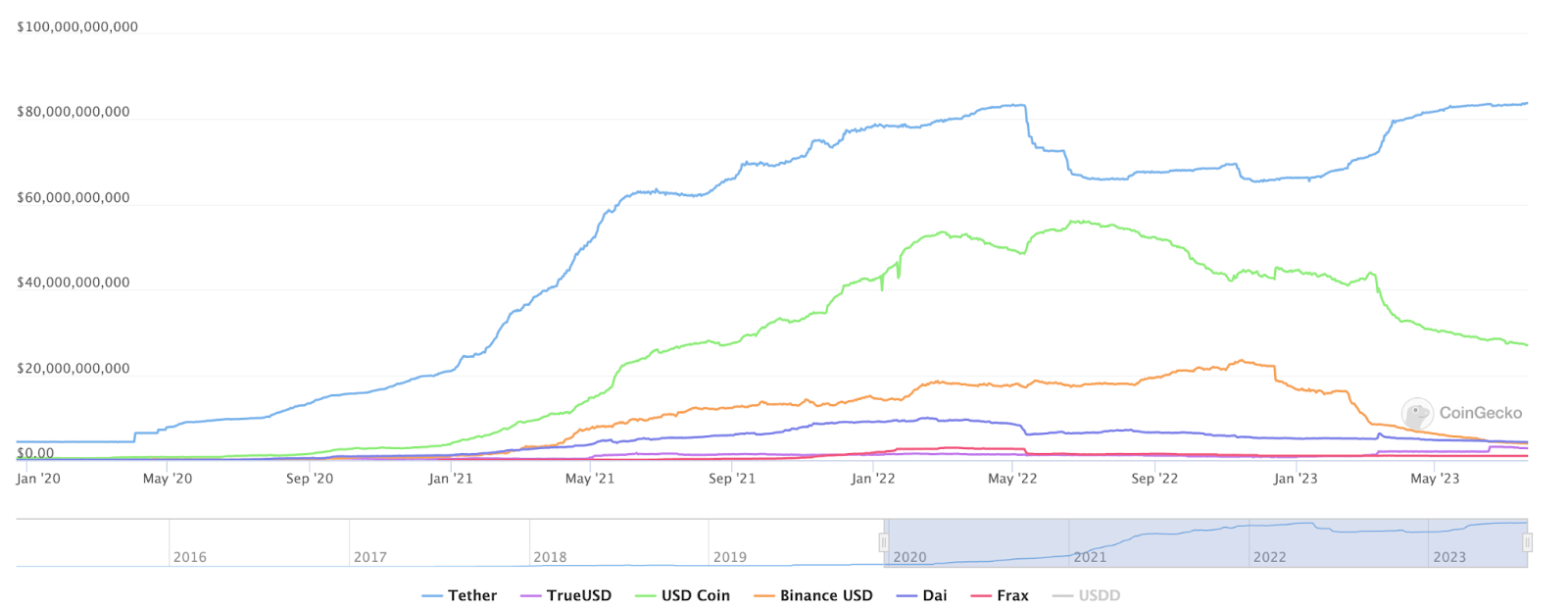

And it’s not like that $127 billion ain’t gonna grow. At the start of 2020, the total market cap of stablecoins was just $5 billion and represented less than 3% of the total crypto market cap. At its peak, all stables combined had a market cap of over $150 billion, representing 18% of the total.

And while some stables lost a significant share of their market caps in 2022, and others downright imploded, Tether (USDT) circulation is already at all-time highs, with a market cap of over $83 billion (blue line in the chart below). Meanwhile, new stablecoin protocols are being funded left and right.

Tokenized bonds are a win-win for established asset managers, who can potentially reach a new breed of customers, and crypto users and protocols, who get access to new products that were not available to them before.

Faster Settlements on a 24/7 market

It's hard to fathom that in our "always-on" world, public markets and cross-border remittances still follow a 9-5, Monday-to-Friday schedule. This is mostly because the systems we use today were created decades ago, in a world before the internet, email, and instant messaging apps.

The SWIFT system, the interbank messaging system that was established in the 1970s, appears increasingly antiquated. The credit card system dates back even further to the late 1950s with the creation of Visa and Mastercard.

But blockchain doesn’t care about business days or bank holidays or any other delays in completing transactions. It operates 24/7/365.

Moreover, it’s evolved over time to significantly improve transaction speeds and costs, with chains like Solana leading the way. Solana boasts between 1,250-1,350 transactions per second. Visa, 1700. Still not quite there, but getting close. And L2s like Arbitrum, zkSync, or Starknet are set to scale Ethereum’s TPS close to those numbers in coming years.

It’s another reason for institutions to take the first step and offer bonds on-chain. This progress signals a future of finance that's not just 24/7, but also more rapid and economical.

Thank you for reading Espresso. This post is public so feel free to share it.

The Trojan Horse of Tokenization

Imagine traditional finance as the Monopoly Man taking a big, juicy bite out of the crypto apple. That's bond tokenization for you – the first nibble at a whole new world. And some financial institutions have started nibbling already.

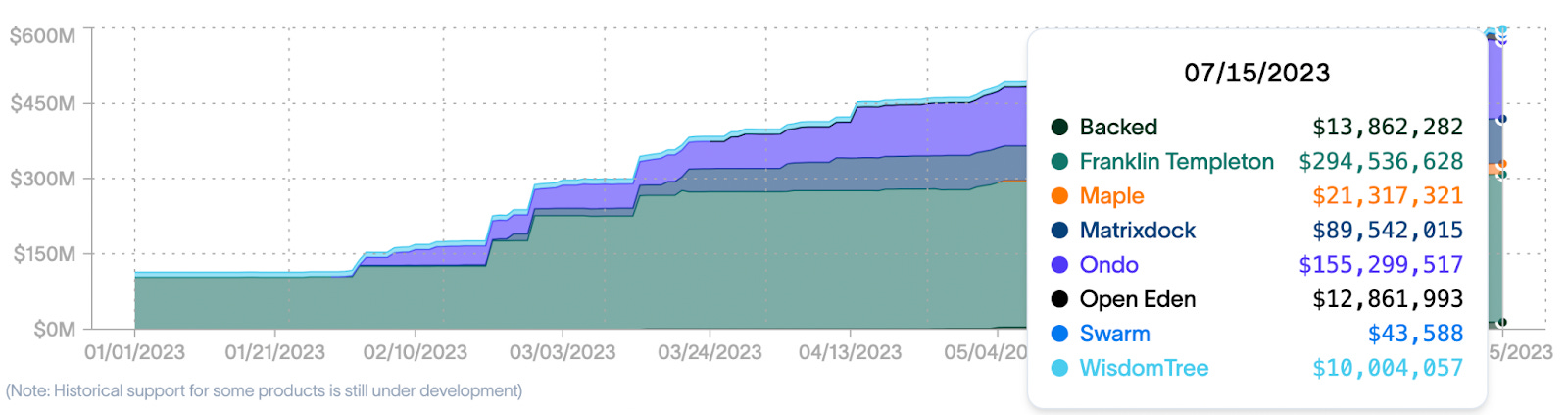

Since the start of 2023, the number of protocols offering access to tokenized bonds has exploded in DeFi, from a total value locked (TVL) of $100 million (most of it sitting in just one product) to a TVL of over $600 million distributed among different protocols. And a few TradFi companies are in the mix.

Franklin Templeton launched its own on-chain money market fund called the Franklin OnChain U.S. Government Money Fund (FOBXX). Since the start of the year, it’s grown from around $100 million in TVL to $300 million and accounts for half of all tokenized bond TVL.

If you're unfamiliar with the name (like I was until a quick Wikipedia search), it’s a global asset manager with $1.5 trillion in assets under management with roots dating back to the aftermath of World War II.

It’s as Wall Street as it gets. Which also suggests it’s not exactly bred in the crypto world, as seen in its decision to first launch on Stellar Lumens. Now that is a name I haven’t heard in a long time. It has since expanded to Polygon, though, so it seems the company is learning quickly.

Another established TradFi company trying to break into the tokenized bond scene is WisdomTree, an exchange-traded fund (ETF) provider. It surely won’t be the last one.

Now, if these tokenized products find their foothold, they could motivate traditional finance companies to venture further into the crypto sphere. Success has a way of whetting the appetite for more, after all.

And if so, then bond tokenization wouldn’t just be a boon to stablecoin holders looking to earn decent yields. It could act as a crypto Trojan Horse, its success spurring these companies to rethink their technology stacks in a long-anticipated (and arguably needed) overhaul in finance.

Keep it fun,

Kodi