The Fed’s Rate Hike Regime Is Getting Out of Control

Macro Update: The Treasury Tries to Come to the Rescue

No other sport in the world has a greater variety of traditions than college football in the United States.

There are 129 Division I college football teams in the FBS (the highest tier of college football), and each school has its own mascot and football tradition, either on or off the field.

From the blue blood programs such as USC, Michigan, Alabama, and a few other elites, to the smaller schools such as Appalachian State, each college’s fans and alumni hold these traditions near and dear.

But they don’t always work as intended.

Sooner Schooner is a covered wagon that is the mascot of the University of Oklahoma (OU). It’s pulled by two horses named Boomer and Sooner. The tradition at OU involves a handful of students driving the wagon onto the field every time OU scores.

It is one of the most storied traditions in college football. Watching the speedy stallions galloping and scootering the wagon around the field is quite a spectacle and elicits feverous roars from the fans in the stadium.

Until something goes awry.

On October 19, 2019, after an OU touchdown against West Virginia, the Sooner Schooner was headed into the middle of the field when the unthinkable happened: The wagon tipped over and threw the students onboard to the ground.

The good news was neither the horses nor the students were seriously injured.

If you watch that video again, it sure looks like the wagon took that turn too fast and lost control, causing the accident.

It’s not too different from the Federal Reserve’s trajectory the past few months as it’s hiked rates…and we’re starting to get signs that its own wheels are falling off.

In fact, the Treasury Department recently made an announcement that it’s going to relaunch a program not seen in over 20 years.

It could be another sign that things are shakier than they seem, even with all the talk of bank failures and the debt ceiling fight.

But first, let’s examine how the Fed got itself into this position. So sit down and grab onto something as we take the Fed schooner out for a spin.

The Liquidity Crunch

The Fed’s rate hike regime the past 12 months is the most aggressive in the past 30 years. Since March 2022, it’s raised rates 500 basis points from 0.25% to 5.25%.

Its goal was to curb inflation. And while inflation has cooled recently, it also had the side effect of making the long-term bond market illiquid.

The key words here are interest rate risks.

Now that rates have risen, long-term bonds have fallen out of favor. Why buy Treasurys that have already been issued (called off-the-run Treasurys) with low interest rates, when the newly issued ones (called on-the-run Treasurys) offer a higher interest rate?

Furthermore, why buy the newly issued long-dated bonds if I expect the Fed is going to keep raising rates? It is better to buy a short-dated bond and roll over the proceeds to a new bond once the older one expires.

The demand for long-term bonds is simply not there.

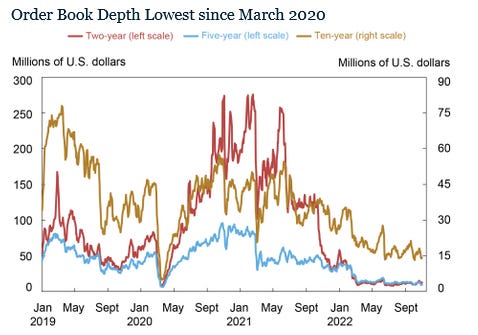

Below is a chart with order book data through the third quarter of 2022 for the 2-year (red line), 5-year (blue line), and 10-year Treasurys (yellow line). The market depth has been decreasing and getting shallower by the month since the Fed started to hike rates back in March 2022.

In other words, the market is illiquid. And the situation is getting worse.

After the Great Financial Crisis, the government instituted the supplementary-leverage-ratio (SLR) requirement. In order to keep banks’ balance sheets healthy in the wake of the crisis, SLR requires that banks set aside a certain amount of their liquid capital as a cushion.

This drastically reduced the big banks’ ability and interest to serve as the market maker for the long-dated Treasury market.

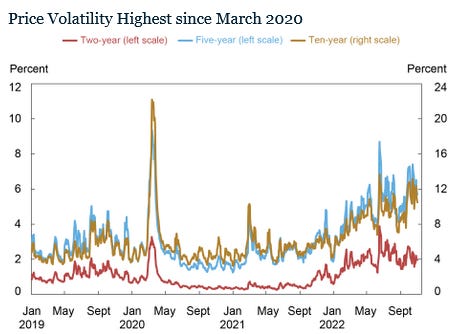

Without a market maker, liquidity dries up, and that spikes volatility – as you can see in the chart below – making it more difficult for long-dated Treasurys to change hands.

Per the chart, volatility for the 2-year, 5-year, and 10-year Treasurys has been the highest since 2020, which coincided with the shallowest order book depth since 2020.

And if that is not enough, the quantitative tightening (QT) that the FED is conducting is increasing the supply of long-dated Treasurys, since the FED is unloading its holdings onto the secondary marketplace.

Reduced demand, increased supply, and increased volatility due to lack of market makers made the U.S. Treasury decide to step in.

What is a Treasury Buyback?

Recently, the Treasury Department announced plans to initiate a buyback program for government debt.

Just as the term implies, a Treasury buyback is when the Treasury Department buys the already issued, older Treasury bills back from the secondary marketplace.

It will take place in 2024, although details like how it will be done, how big the amount will be, and which vintage of the issuance will be affected are yet to be shared.

Some might misconstrue this as a covert action to inject liquidity into the financial market. But this is not to be confused with the Fed buying Treasurys during quantitative easing (QE).

For this operation, the Treasury buys back off-the-run Treasurys and swaps them out with on-the-run Treasurys.

It’s basically eliminating the older bonds for the newer bonds. The newly issued bonds will raise money for the Treasury to buy the older bonds back.

This isn’t the first time the Treasury has done such a program. It bought back bonds in 2000–2002, when the U.S. was running a budget surplus in order to take advantage of lower interest rates.

But it’s instituting this latest buyback program because of the liquidity problems in the long-dated Treasury market.

Thank you for reading Espresso. This post is public so feel free to share it.

Wheels Coming Off?

On the surface, the Treasury announced this program in advance to mute and remove market volatility when the time comes to issue new debt, as well as smooth out its cash management function.

But the bigger picture here is perhaps the Treasury sees something brewing – as a result of the Fed’s aggressive rate hikes – that might result in potential havoc.

And this has prompted it to to roll out pre-emptive measures.

Recent events, such as the on-going banking crisis, and now the illiquidity in the long-dated Treasury market, are signs that the Fed’s uber-ambitious rate hike scheme is beginning to take a toll.

The Fed hiked the rate so high and so fast, markets did not have the time or the bandwidth to digest the effects and let them reverberate throughout its system, react to the new changes, and work itself out before another rate hike kicked in.

It is like drinking directly from the fire hose.

Now, the effects of the rate hikes are beginning to catch up.

This latency impact will start to show up in areas such as corporate bonds and real estate as we had mentioned already. But it could also affect other sectors such as auto loans, student loans, consumer credit, etc.

Whether the market has priced it in or not (my belief is the latter), it has not seen the full effect of the Fed’s rate hikes on the economy and its many different facets.

As the Fed wagon rolls along, its wheels are beginning to fall off – one by one.

Until the day that it tips over, brace for the impact, just like the drivers on the Sooner Schooner.

Yours truly,

TD