Miners Continue to Hoard

ChainPulse update

We have a least a few more years.

The Federal Reserve made their comments yesterday. Many speculated there might be comments which allude to higher federal funds rates down the road. That was not the case. Powell signals zero rates through 2023.

In response, bitcoin jumped over $4,000 in the next six hours.

Normally we don’t put too much weight into such knee jerk reaction type of moves from the market. But I think we can draw two conclusions from it.

The first, markets react to bullish news when it’s in a bull market. This is more a confirmation of what we already know.

The second, Powell’s words immediately impact bitcoin’s price. This tells us bitcoin is influenced by macro news more than ever.

This is great as the macro environment couldn’t be more ripe for bitcoin. Debt is going parabolic, the rate of money printing is unprecedented, and governments around the world show no signs of reversing course.

And the fact bitcoin is more macro than before means yesterday was a win for bitcoin and crypto investors. Not just for a quick hit green candle that “up only” and “stonk” gamblers get excited for. But more in terms of reducing the headwinds that bitcoin faces in the coming months.

If the journey of a bitcoin investor was viewed as a driver crossing a desert on a two lane road with no gas station for fifty miles, I’d be fine punching it the gas pedal here.

The engine in terms of fundamentals looks good, the interest rate environment isn’t hurting, and the liquidity of Tether has my gas tank more than half full. We’re nearing what might be the last last leg and it’s almost time to see what she’s got.

And according to the Puell Multiple we highlighted a few days ago, whenever it goes above 4 price has done at least a 2x in less than three weeks each time.

I don’t believe this time will be much different, which is why I think that signal might create an ideal time for call option.

In saying that, for any of our lifetime clients, be sure to reach out to us in the coming days once you set up your options accounts. It’s time to get strapped in as Jarvis AI is ready.

Now, in terms of what’s changed since Monday’s ChainPulse Report, it’s mostly about Tether for two reasons, which we’ll get to in a moment. But first, a quick run down on some of our ChainPulse metrics…

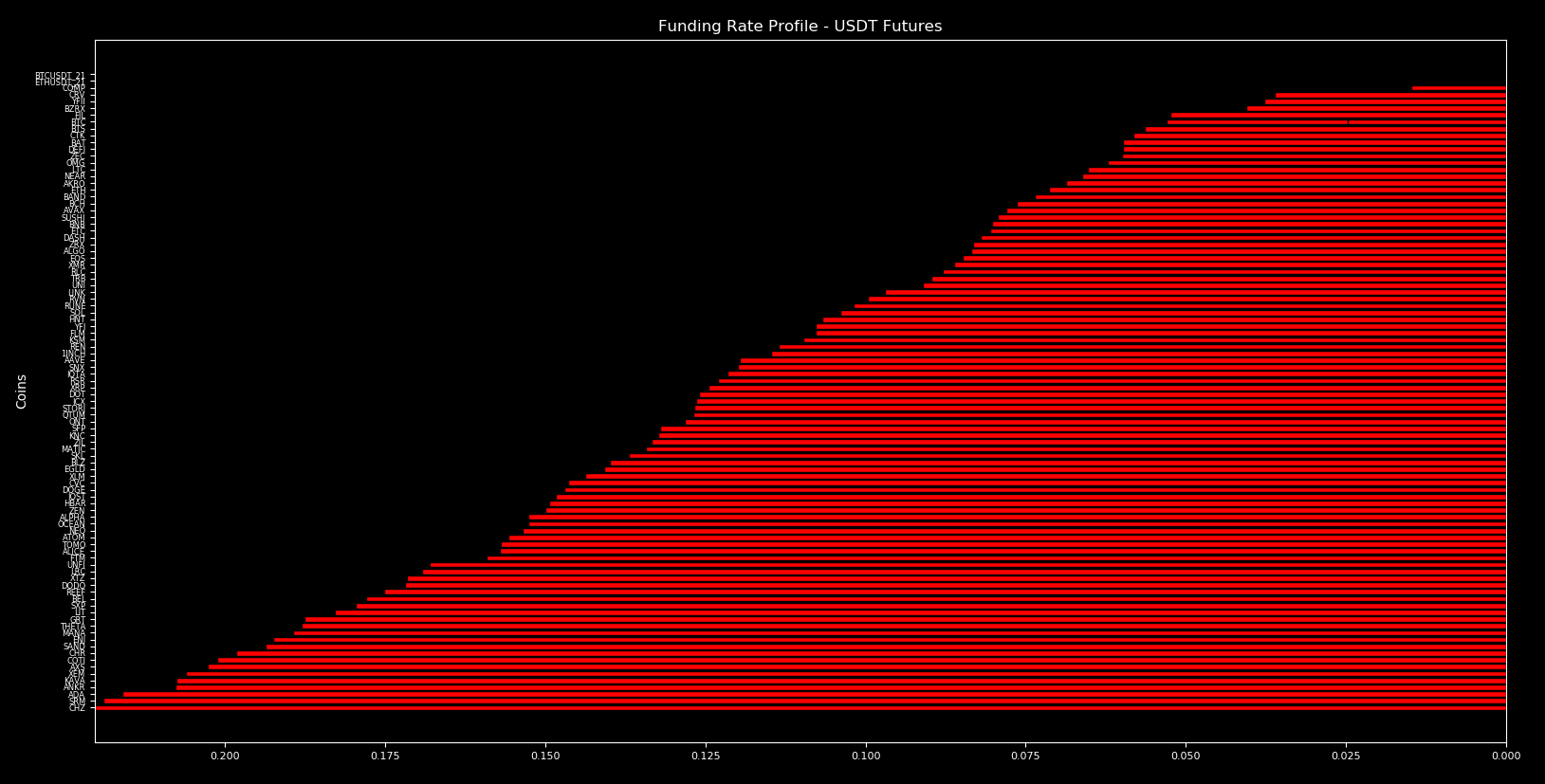

Funding rates are looking good.

The amount traders need to pay for keeping a long position open in the futures is continuing to drop. Low funding rates allow price to build momentum and potentially break to new highs.

Here’s what the funding rates look like now. Keep in mind a reading of 0.015 is considered neutral.

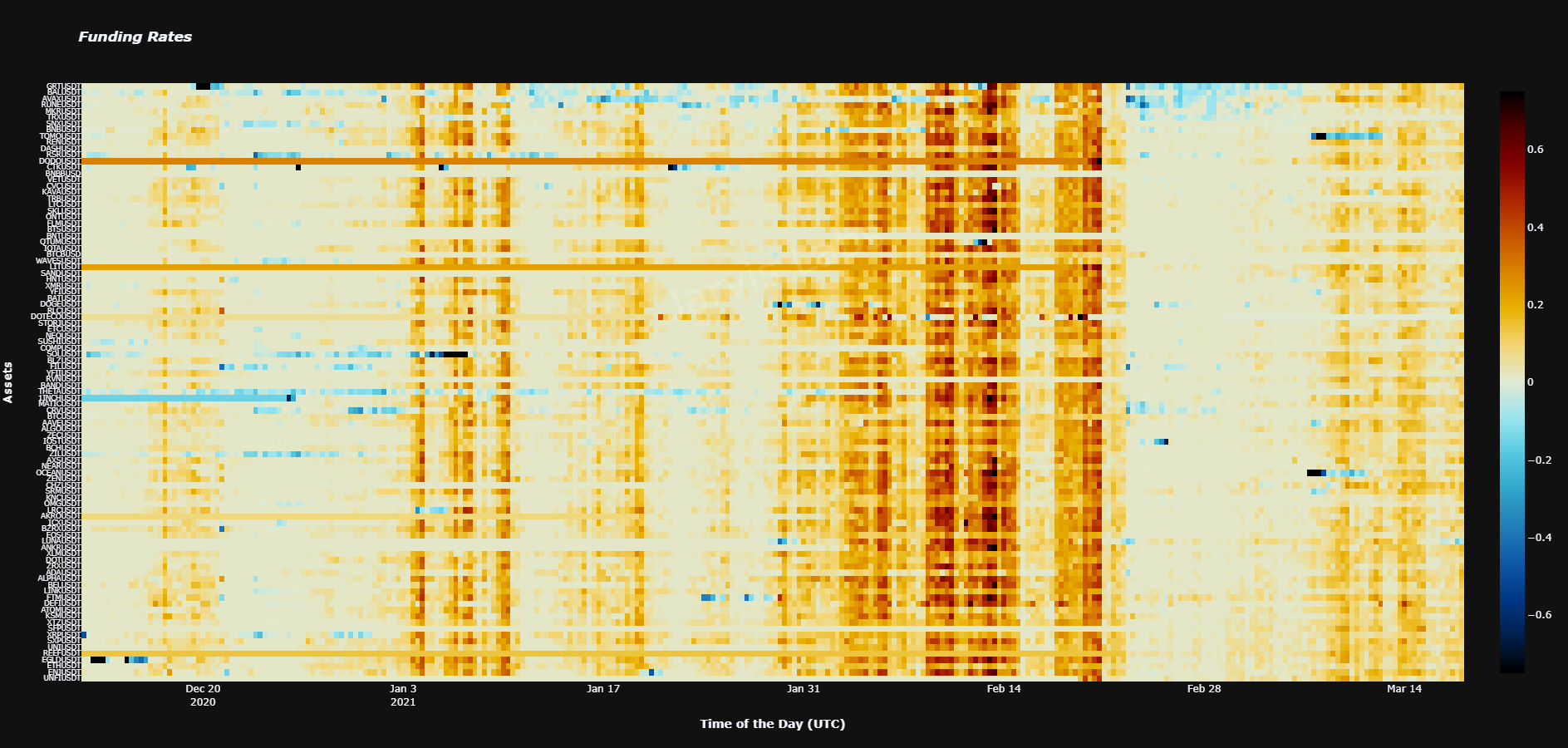

As far as our heat map, it’s still void of red on the right-hand side. This is good.

The white we see in its place means traders are becoming a bit disinterested in the market. It’s another way to view funding rates being low. We’ve even noticed every post in telegram gets about half as many views in 24hrs. This is another signal for us that the time to build positions is now when many traders have lost interest in the markets.

If you’re reading this, then you already have a leg up over half the market

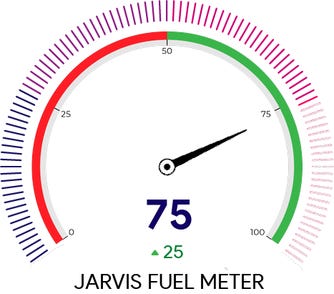

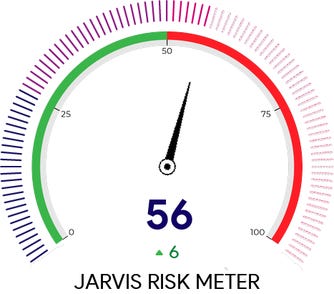

Risk meter is neutral, so nothing to scare people off right now. And with our bullish point of view, a fuel level above 50 is what we want to see in terms of our Fuel Meter. We’re at 75 thanks to more than 600 million USDt being printed lately.

Also, the second piece of Tether news is they’ve began printing on Solana. This in our opinion is signaling what’s to come.

Deep down in the news cycle there was a piece on Solana/Serum DeFi hackathon winners. The prize winners resemble what this area of crypto is looking like.

And for those that aren’t aware of what Solana is about, it’s about speed. And Serum is trying to be the exchange that exists on-chain that makes Uniswap look like the Department of Motor Vehicles - slow.

The two combined showcase some incredible potential for on-chain finance. Which makes the news about the hackathon interesting. Rewards were doled out to projects focusing on margin trading, derivatives, options, on-chain order books, yield bearing assets like AMM LP tokens, a Synthetix copy, and a asset management platform.

It’s a full suite of services. Needless to say, we have a few calls lined up over the next couple weeks.

Refocusing a bit… the fact Solana could be a destination for future speculation means USDt heading to that chain is a very bullish sign in our opinion.

As we look out over the coming ten days we expect more USDt to be printed as we get closer to Deribit options quarterly expiry on March 26th as we outlined yesterday. If we see this take place then our expectation for April remains. A month where we believe price begins to build momentum for the next major leg for bitcoin.

To build on the bullish case even more, miners continue to hoard. It seems they’ve paid their bills and only want to hodl. Here’s the latest chart for miner reserves. As you can see, it’s continuing to rise.

If the chart above seems a bit foreign to you, here’s a quick thread on what it means.

Miners are hoarding bitcoin. What does it mean? Read the thread below to learn more.

— Ben Lilly (@MrBenLilly) 4:10 PM ∙ Mar 2, 2021

Chart and analysis made possible by @cryptoquant_com

🧵👇

Wrapping up today’s issue it’s clear the FED is being accommodative for a rise in bitcoin. Pairing this up with low risk, lots of fuel, and a bunch of hoarding miners, we get he feeling that things are setting up nicely.

Summer is looking good.

Your pulse on crypto,

B

P.S. - Does anybody know if Bitclout is legit or not? I made a profile on it, but I’m still skeptical. Also, please DO NOT buy my coin if you’re reading this. I’m only asking for perspective and figuring out if there’s a way to create real value from it.