Prepare Now to Perform Later

A major run this summer is still intact

Self fulfilling prophecies matter in crypto.

The next one on our radar is in the options market.

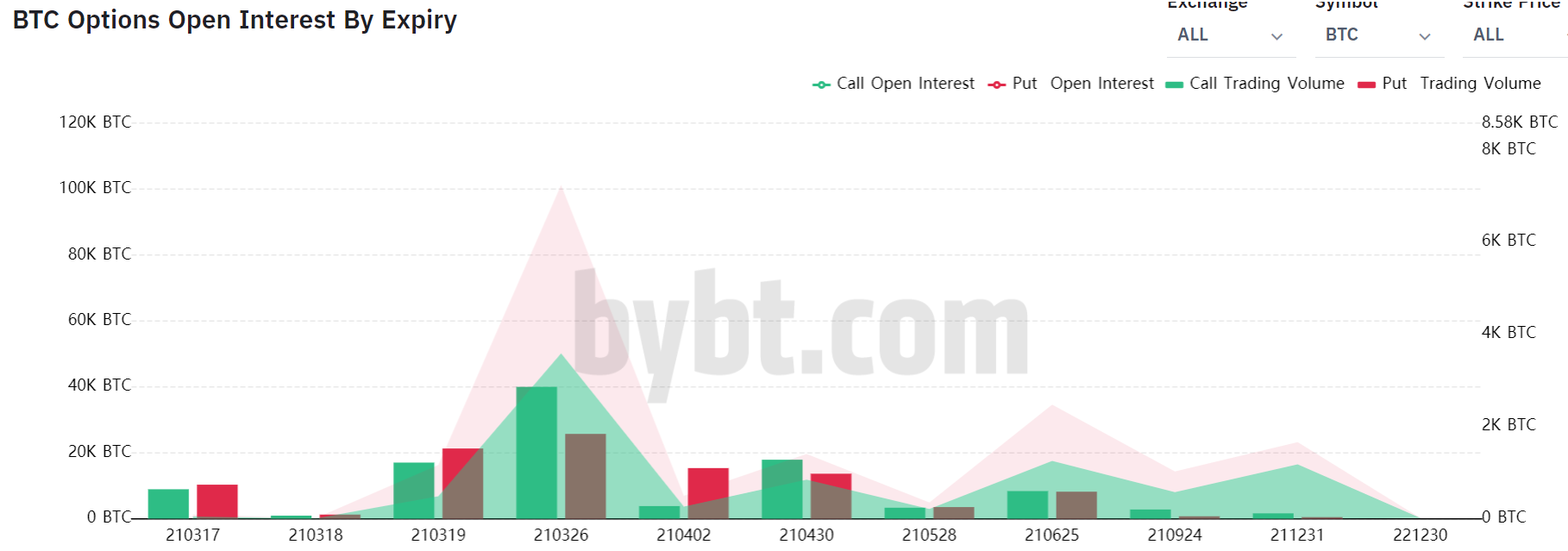

Open interest in the options market means the amount of contracts that exist. It’s a good way to determine the amount of liquidity attacked to certain expirations and strike prices.

When it comes to which options tend to witness the most liquidity, it comes down to those expiration dates that are listed for the longest period of time. These tend to be quarterly expiration date.

In fact, if you go on Deribit right now you can buy June, September and December expiration dated options. And these dates get closer, Deribit adds more expiration dates in a particular way.

Because of this, when trading options and looking for the best liquidity, many traders seek these quarterly dated options. It’s another reason why these dates ultimately attract the highest levels of liquidity.

March 26th is the next major expiry for options.

This is the first quarterly expiry for the year. You can see it commands the most open interest (OI) at the moment. In fact, it’s more than 10x the OI for the week prior, and for weeks following that date its OI stands tall like a skyscraper in a cornfield.

What does that mean? It means price might not move a whole lot until after this expiration passes.

The last two quarterly expiry dates for options can be seen in the chart below. As you can see there was consolidation in price in the weeks that led up to it.

September 2020 is a bit hard to read on that scale, so unless you look for yourself, you’ll need to take me at my word.

Now, in terms of these expiration dates happening, commanding an outsized amount of OI relative to other expirations, and price going on a 85% and 77% tear afterwards… It feels a bit like fitting a chart to a narrative.

That narrative is the bullish one.

What I’m saying is sometimes just knowing what the next narrative in the market can help you prepare, regardless of how much truth is in it.

So as you read other commentary in the coming days to weeks in regards to the expiration date being a thing, realize that’s one of those self fulfilling things.

That’s mostly because the crypto options market is still pretty small.

Regardless, we bring this up because the on-chain data remains bullish, which can allow the price rise to take place after we get past this narrative.

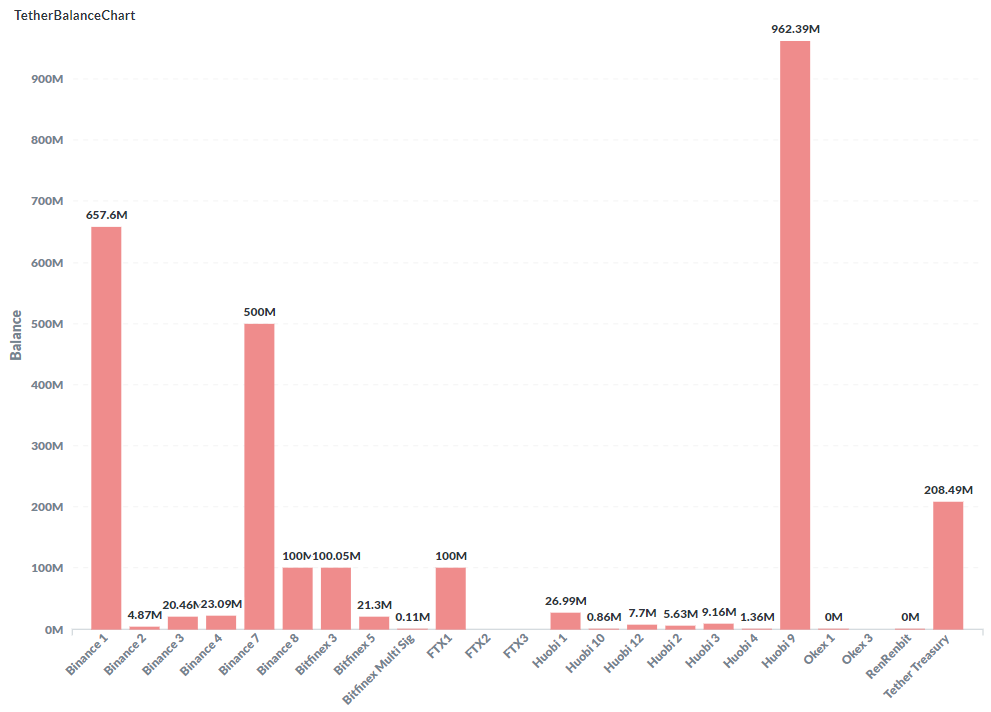

Over the last three days we’ve seen nearly 600 million USDt.ERC20 hit the blockchain with more than half already moving onto exchanges. This is a sign of growing accumulation and dip buying.

In fact, here’s the amount of USDt.ERC20 sitting on exchanges… One glance at the chart below and you can see traders are “locked and loaded”.

Now, the past patterns of such behavior statistically indicate accumulation taking place and dip buying. If that’s the case, then our view of a massive rally ahead of us continues to remain intact.

As for now, risk meter and fuel remain relatively unchanged since Monday… Funding rates are calming a bit and normalizing… And the passing of a large OI in the options market is approaching.

Combine this with bullish on-chain activity and our view that the summer months (May-July) will bring some incredible price action.

Keep reading these issues as we’ll bring to light more metrics to help you navigate the upcoming run.

You prepare now to perform your best later.

Your Pulse on Crypto,

B

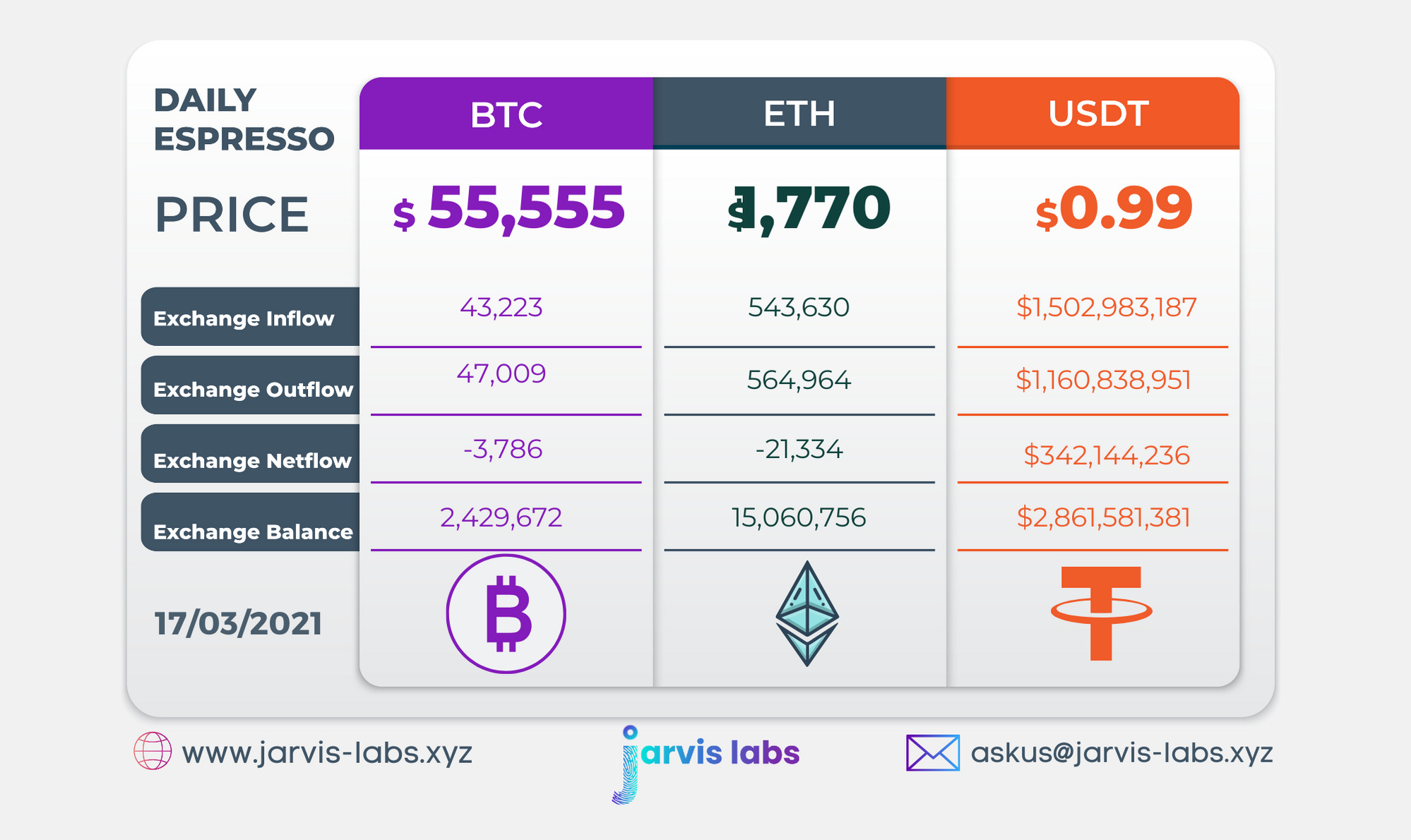

Below is our daily exchange flow data. This is a great gauge for understanding if BTC, ETH and USDT are flowing into exchange or leaving. If BTC and ETH are entering exchanges it can generally be viewed as bearish. The opposite scenario is bullish.

When USDT is flowing into exchanges it’s typically viewed as bullish. The opposite scenario is bearish.

This should only be used as a general gauge. Tagging the exact wallets these flows move into or out of helps improve the reliability of this data, which is what we do at Jarvis Labs. To date we have over 800 market mover wallets and 16 million wallets tagged all together. Consider us your on-chain trackers.