Happy Expiry

End of Week ChainPulse

You won’t be halfway through your coffee by the time you finish this update.

It’s the End of the Week ChainPulse update. Before we get to it, it’ll help to know what unfolded over the week.

On Monday we wrote the Weekly ChainPulse issue titled, “It’s All Lining up for Bitcoin”.

In it we painted some broad strokes regrading the global financial system and how bitcoin fits in. (To be honest, I haven’t had enough time to dig into all the PR events this week to see if anything was said outside of the quote from Powell earlier in the week. My hunch is this PR frenzy was a non-event for the coiners.)

We then honed in on the state of crypto with a monthly outlook. This 10,000ft view on bitcoin was littered with some bullish talking points.

Finally, we narrowed in on what this week was setting up to be. This is the part that matters as we primarily focused on two things.

The first was the massive expiration date happening today. It’s massive in the sense that a lot of money is tied up in these positions. What we mentioned to you on Monday was once this expiration passes, the capital will be freed up to make new positions. It’s the type of thing that can let price get back on its long-term trend.

On Wednesday we sent you an update to this first item as we were forced to paint the expiration date in a new light. That’s because of a wallet we nicknamed as Pablo, was active again - which was a near term bearish event.

This made us consider the max pain point in the massive options expiration date, which sat at $44k. Max pain is where the least amount of money is transferred from option sellers to option buyers.

Later that day as the expiration day drew near, price was pushed to a new local low around $50,000.

Today we’re free from that narrative… And we can happily move on. Which brings us to the second point we raised on Wednesday.

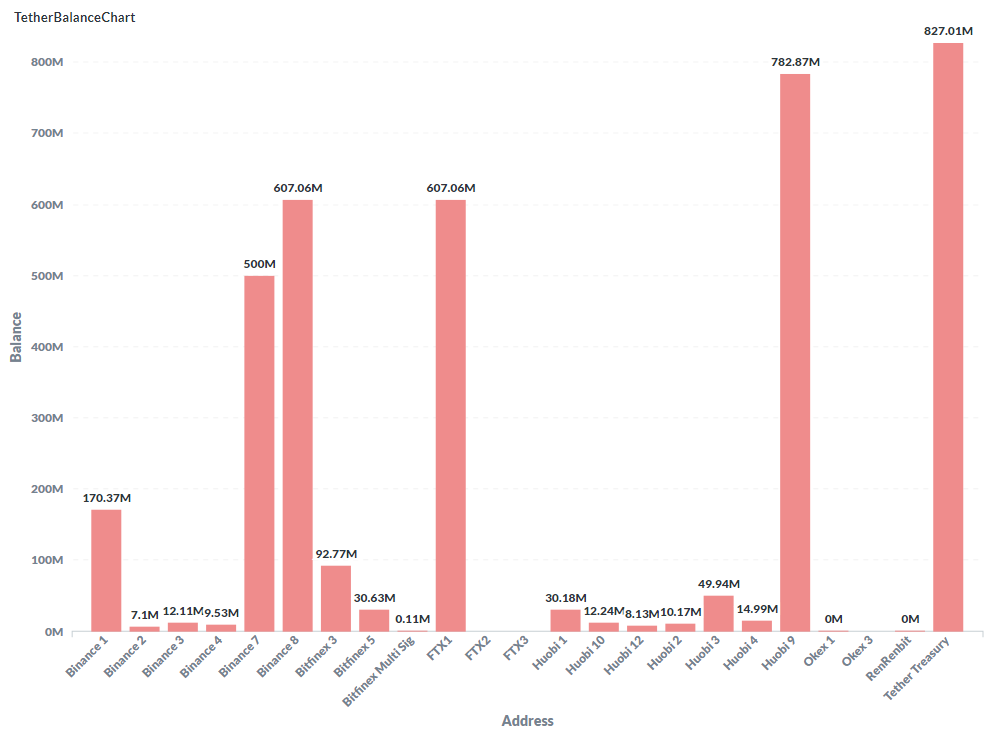

The market is still sitting on a mountain of dry powder. Here’s what I’m talking about.

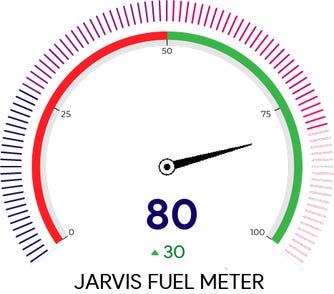

And when we combine this information with our risk and fuel meters, which sit at 25 and 80, we start to get the feeling that any sustained bullishness will evolve into new highs.

Here’s what we mean when we say bullishness.

Yea, it’s pretty bullish.

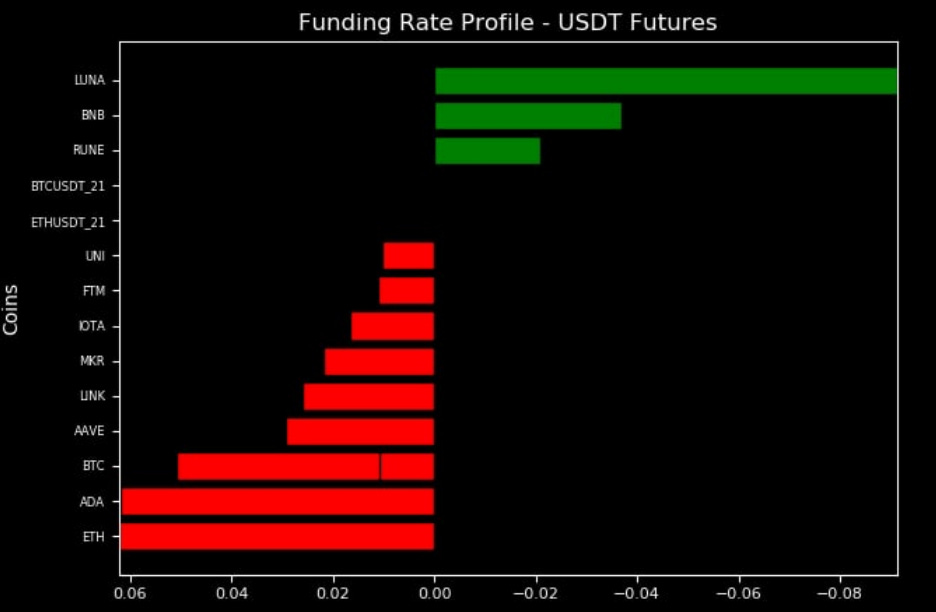

Dry powder, upcoming Grayscale unlockings, massive options expiration date in the rear view mirror, and a neutral market in terms of funding (see the P.S. below) are setting the table up nicely.

Now, before we get ahead of ourselves and start considering new highs, $100k price points, and potential May or June Gamma squeezes, it’s important for bitcoin and crypto to build some momentum right here.

At the time of this writing, Jarvis AI has yet to alert us of any buyers stepping up to lead the charge. Which means spot buying is good. As for derivatives, not yet.

Why? Because there’s a sensitivity to time that requires confirmation of a new uptrend before entering a derivative position.

If we don’t see whale buyers step up in the next couple days then perhaps we get a double bottom or a slight lower low over the weekend before the momentum presents itself. This type of price action can be a drag on a derivative position.

As you can expect, if we see momentum beginning to form we’ll update you.

For now, enjoy the weekend and start preparing.

Your Pulse on Crypto,

B

P.S. - This Funding Rate Profile looks as good as it’s been since before October. Any coin not shown in this picture is at a neutral funding rate. It’s as clean of a slate as we’re going to get in this bull cycle.

P.P.S - An old chart about ETH/BTC… This looks very bullish if it starts to gain momentum… And as an aside… if ETH/BTC hits 0.9 and bitcoin is slightly above $100k… the $10k ETH army will be right.