You Are The Problem

Market Update: What Actually Happened at Jackson Hole and Whales Return

Inattention is rational.

This was how I summed up Jackson Hole to clients after U.S. Federal Reserve Chairman Jerome Powell quickly packed up his written speech and exited stage left.

His speech was short and message direct.

Inflation is our enemy, we are fighting it, and we won’t stop until we win.

There was no room for misinterpretation. No room for second takes. The speech was direct and to the point.

Which is why it was underwhelming. And I was personally left wanting more.

Luckily his remarks were released online shortly after JPow was getting patted on the back and other Federal Reserve members began relaying their hawkish takes to the media.

It was all too rehearsed. Timed… Planned.

As I pressed forward to uncover clues of what the FED was really thinking, I was fixated on the portion where Jerome seemingly blamed citizens for inflation. He wrote, “If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will.”

This seemed odd as he hinted at inflation being psychological.

He went on to say… “Unfortunately, the same is true of expectations of high and volatile inflation.”

To sum it up, if you think there will be high inflation, there will be. If you, the public, think inflation will remain low, it will.

Put it plainly, it is up to the public to make things better.

While it sounds silly, it actually makes sense. As thoughts of inflation take root in the mind, your daily decisions are influenced with the understanding that next month prices might be different.

This type of thinking is incredibly dangerous. And in fact, acts like jet fuel to what looks like a dumpster fire at this point.

That’s because if the public starts to act with inflation at the forefront of their mind, they spend dollars faster ( uptick in Velocity → P = (MV)/Q. V goes up, inflation arises all else equal ). They do this as they want to maximize the goods they can buy with the dollars they have at the present.

To compound the issue… They will also sell dollars for items for alternative stores of value. Which goes back to maximizing a household or businesses ability to buy things.

Both of these factors accelerate inflationary pressures. So it makes sense to try to stamp out this line of thinking before it becomes group think.

Focusing in on this psychological tooling by the FED, there was a footnote that caught my attention. It was footnote “3” in his remarks for the curious among us…

Opening it up it was linked to a discussion on Rational Inattention Theory. Digging into it a bit more I saw the European Central Bank wrote up a 76-page document on this exact theory in 2021. You can access it here if you are having trouble sleeping.

For those that don’t have trouble sleeping, the quick take is simple. The world is busy. Reading 180 characters on Twitter is how we digest information. It is irrational to think the public at large is paying attention to monetary policy.

Which means to effectively push a message to the public at large, and break this veil of inattention, the message needs to be extremely direct. No room for misinterpretation.

The media was able to relay this message without any problem at all. The next day headlines were telling the public the FED is walking the walk. They are serious in beating inflation. Brace for more pain.

Even well respected pundits relayed the message. Joe Weisenthal from Bloomberg even megaphoned this message to FinTwitter and echoed it further with his’ and Tracy Alloway’s Odd Lots podcast (I recommend subscribing) that brought a FED President on the show.

In the days that followed, it was clear - message received JPow.

But here’s the kicker…

As Jackson Hole began to fade from the limelight and everybody was done giving their hot take, something a bit unnoticed happened. Academic articles and speaker remarks that were held back from release became available in the days that followed. It is great material for anybody paying attention to what was actually discussed at Jackson Hole.

And this is what I’d like to go over today as it paints a much different story than what we saw from Powell. And gives us clues to what is about to unfold in the months to come.

As we get started, substitute that espresso for a large cup of coffee... And also, be sure to subscribe before you forget.

The Blame Game

In the papers that emerged in the days that followed, there were two main takeaways from the Jackson Hole conference titled, “Reassessing Constraints on the Economy and Policy”…

P.S. - You can find links to all the papers here on Kansas City’s Website.

The first was that inflation was not the FED’s fault. It is fiscal policy aka the government that is to blame.

The second, creating items in countries where labor is significantly cheaper is becoming less cheap. And it’s causing inflation. The FED has been calling this supply chain issues…

Let’s first dive into the first takeaway and describe what is the start of a finger pointing match by brings up some quotes.

To start off, this quote touches on the papers of Fancesco Bianchi of John Hopkins University and Leonardo Melosi of the Chicago Fed…

“The fact that approximately half of the recent increase in inflation has fiscal roots poses some specific challenges for policy makers today. Not only fiscal inflation tends to be highly persistent but it also requires a different policy response,”

Even more juicy is the actual paper itself, where it states,

“The increase in rates would have resulted in only a modest reduction in inflation, at the cost of a large reduction in output. This large sacrifice ratio arises because when inflation has a fiscal nature, the central bank is not uniquely responsible for its reduction.”

Bianchi and Melosi again,

“…our model conforms to the notion that ‘persistent high inflation is always and everywhere a fiscal phenomenon’”.

Another snip, this time from Gita Gopinath from the IMF in her presentation wrote,

Near-term fiscal support should be targeted and not provide macro-stimulus”

After reading this, I’ve never been more excited to see the FED poke the U.S. government in the hopes of the two engaging in an outwardly visible schoolyard brawl.

Poking Biden and the administration again, here is essentially top dog Augstín Carstens from the Bank of International Settlements,

“We may be approaching what in aviation is called a “coffin corner”, the delicate spot when an aircraft slows to below its stall speed and cannot generate enough lift to maintain its altitude. It takes skilled piloting to get the aircraft back to a safer, stable place. Continuing to rely primarily on aggregate demand tools to boost growth in this environment could increase the danger, as higher and harder-to-control inflation could result.”

To connect the dot between what he refers to with “aggregate demand tools to boost growth” and fiscal policies aka government spending he later states,

“In a world of unforgiving supply, what fiscal stimulus adds to demand may need to be taken away by monetary policy tightening. Scarce fiscal resources should instead be used…”

He’s giving the warning that if fiscal spending begins to ramp up, central banks will tighten in response.

Central bankers at Jackson Hole are drawing a line between government spending. And the way they look to drive home their point is telling the world how hard they are fighting inflation today.

This positioning and vocal narrative by the FED is them saying they are doing all they can to fight it. And with such a direct message, they hope this gets into the minds of all the rationally inattentive population.

Which means if inflation proves to linger around, the finger will publicly be pointed at government spending.

You might be saying to yourself that the FED is a tool of the government.

Let me toss in a quote from a 1981 FOMC meeting transcript…

“I think we have an opportunity this time to carry forward what we should have done before because for the first time ever we do have, for whatever length of time, the support of the administration at least. So, we ought to take advantage of that opportunity.”

They likely help one another out. But what I’m sensing here is that this terse speech from Powell was

White pawn to e4…

Said another way, the game of chess has begun. The government is now on the clock.

But here’s the hilarity of it all, the second takeaway is pinning the lawmakers between a rock and hard place.

That’s because fiscal policy and spending is typically done to boost productivity. For those who took the time to read our two month old July 7th issue “Restoring Trust” you will recall exactly what we are referencing…

Productivity growth is trending down… And the current macro environment boils down to this.

If governments cannot boost economic productivity, then inflation will persist. This line of thinking was seen in what I would say is about 50% of the papers from Jackson Hole.

Due to the drop in productivity, the fight against inflation is made harder. Referencing back to that old essay, this is the “Q” portion of the equation:

If economic output cannot outpace the growth in the money supply, this spells trouble. AKA if Q cannot rise more than the top half where M sits, then P (inflation) rises.

Said differently, if governments cannot boost productivity while not spending, inflation will persist.

Rock and a hard place… Amongst a gaggle of black swans waddling through a minefield meadow. Does it get any more dramatic?

See why the FED is now relaying its message so clearly today? This issue seems to be coming to a head soon.

And to further drive home this point I’ll quickly pull out some quotes hitting on this productivity issue before getting to what I think is about to unfold…

Bick, Blandin, Fuchs-Schundeln

“Our findings point to several open issues for future research… government policies contribute to this differential response would be helpful for projecting the impact of further decreases in the fixed costs of working.”

The paper talks about productivity decreases, but goes on to say there needs to be more research on how the government is basically failing and what it needs to do to combat this problem.

Augstín Carstens from the Bank of Int’l Settlements with an encore,

“Global supply and low inflation concealed the costs of low productivity. In consequence, governments lost the appetite for technically difficult - and often politically unpopular - structural reforms. The can was kicked down the road…Efforts to make the financial system more balanced yet more innovative go hand in hand with reforms on the real side.”

There were other mentions, and frankly I am running out of time to get this to you, so I need to make my point quickly now…

Wrapping it Up

The drop in productivity is being blamed on fiscal policy and de-globalization.

Focusing on de-globalization for a moment - cheaper goods and services that were being imported from overseas for the U.S. were hiding the inefficiencies of fiscal policy.

And monetary policy can no longer conceal it.

How much truth there is to this we could probably debate for a while… After all, if this were true why was an annual inflation rate 2% the goal, and not a lower figure?

Regardless, this is the FED’s stance. Understanding their positioning that productivity growth needs to happen… Higher costs from de-globalization aka supply chain issues are making inflation worse… And they will do what they need to do to fight inflation leads us back to something we brought up last week going into Jackson Hole…

The U.S. does not want to devalue the dollar relative to other currencies and commodities.

Sticking to this thought, a higher dollar helps some of the items we mentioned above.

It will reduce cost of goods and services abroad…

But at what cost?

Likely foreign nations will begin having trouble with their own currencies as various pegs get broken, debts become too expensive to pay, and the impending run up of the dollar causes a rush to buy dollars or Treasuries as collateral.

Which might be just what the FED is trying to do. Whether or not this is the intention is yet to be seen. But one thing seems certain, the FED is preparing to point the finger openly at the lawmakers in the U.S.

This means the next two months in the run up to elections (not a Presidential election) in the U.S. will make for an interesting time.

In the meantime… Let’s see what the crypto markets have in store for us.

Market Update

This will be brief as I was a bit long winded again on the macro topics in light of Jackson Hole. Hopefully next week we can spend a bit more time focusing on crypto as we approach Ethereum’s big upgrade - Phase I actually begins next week.

For a quick recap on what we said last week…

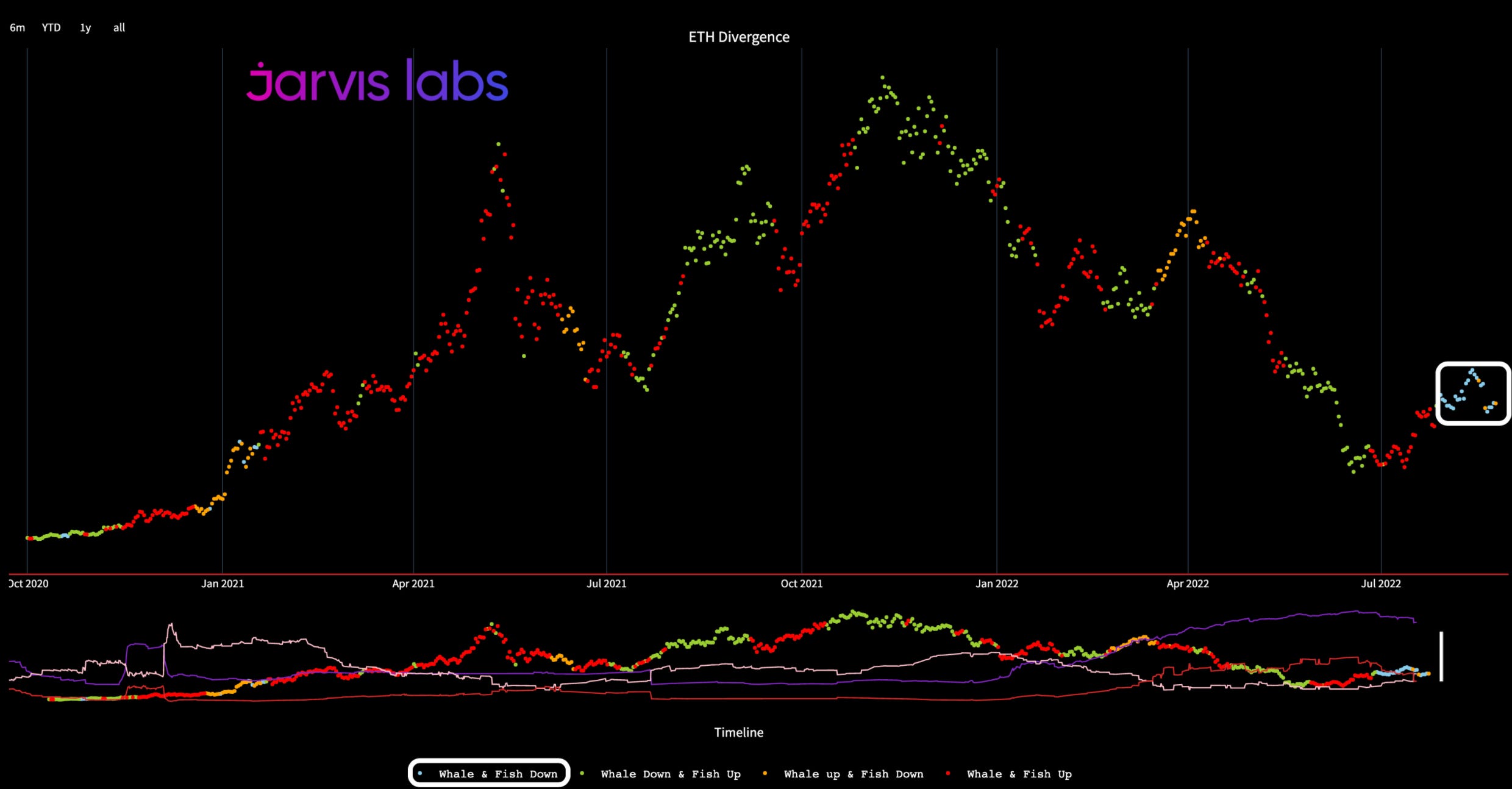

Whales nor smaller wallets were taking part in the market.

This, combined with a few others items forced us to look to the downside. This is where we drew attention to the $1400 price in the chart below - also from last issue here. We got a low of $1420, which was $20 from the deepest pool of liquidity - darkest purple band below.

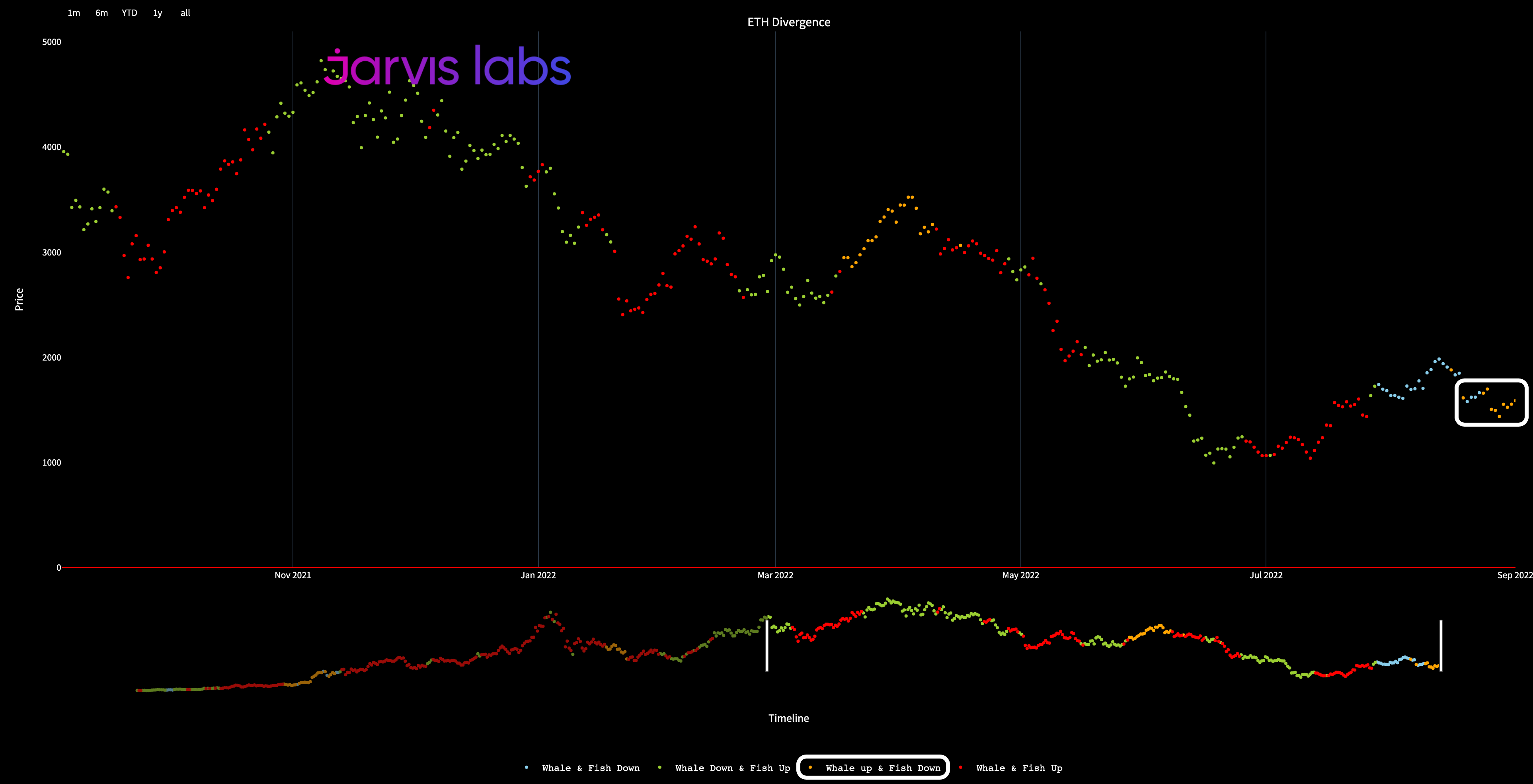

This weeks things are in fact changing…

In the ETH Divergence chart we see larger wallets are buying once again while smaller wallets are on the sidelines - orange dots. This is positive to see after we got such a strong drive to downside liquidity.

It also makes everything a bit more compelling as we near a more fundamental catalyst with Ethereum’s Merge.

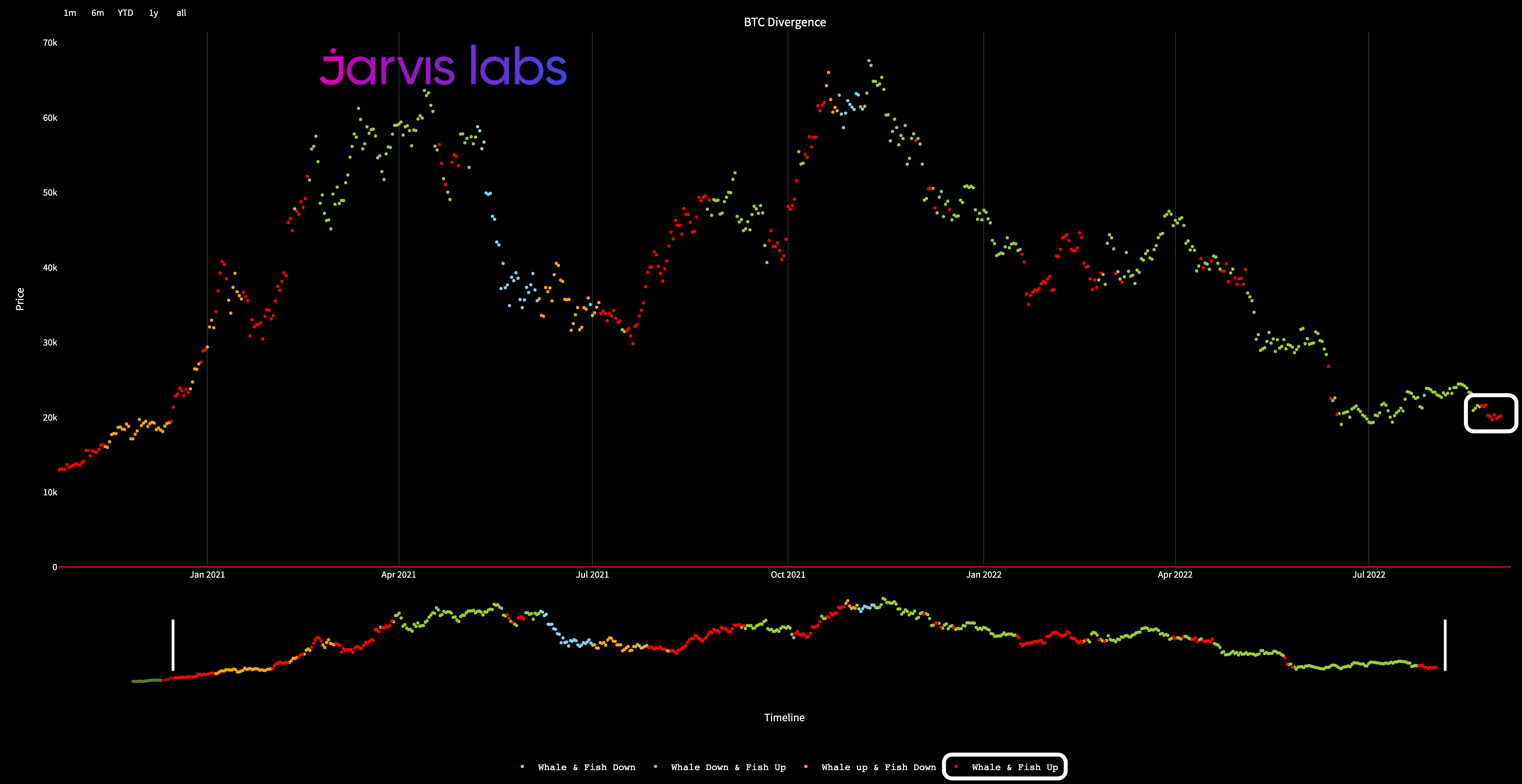

But more importantly, last week we said there were only a couple red dots that indicate both larger wallets and smaller wallets buying Bitcoin. And it’s really only a trend if we continue to see all week.

Well, we now have 10 straight days.

That’s the most consistent trend there has been for this metric since prior to the March - April bear rally.

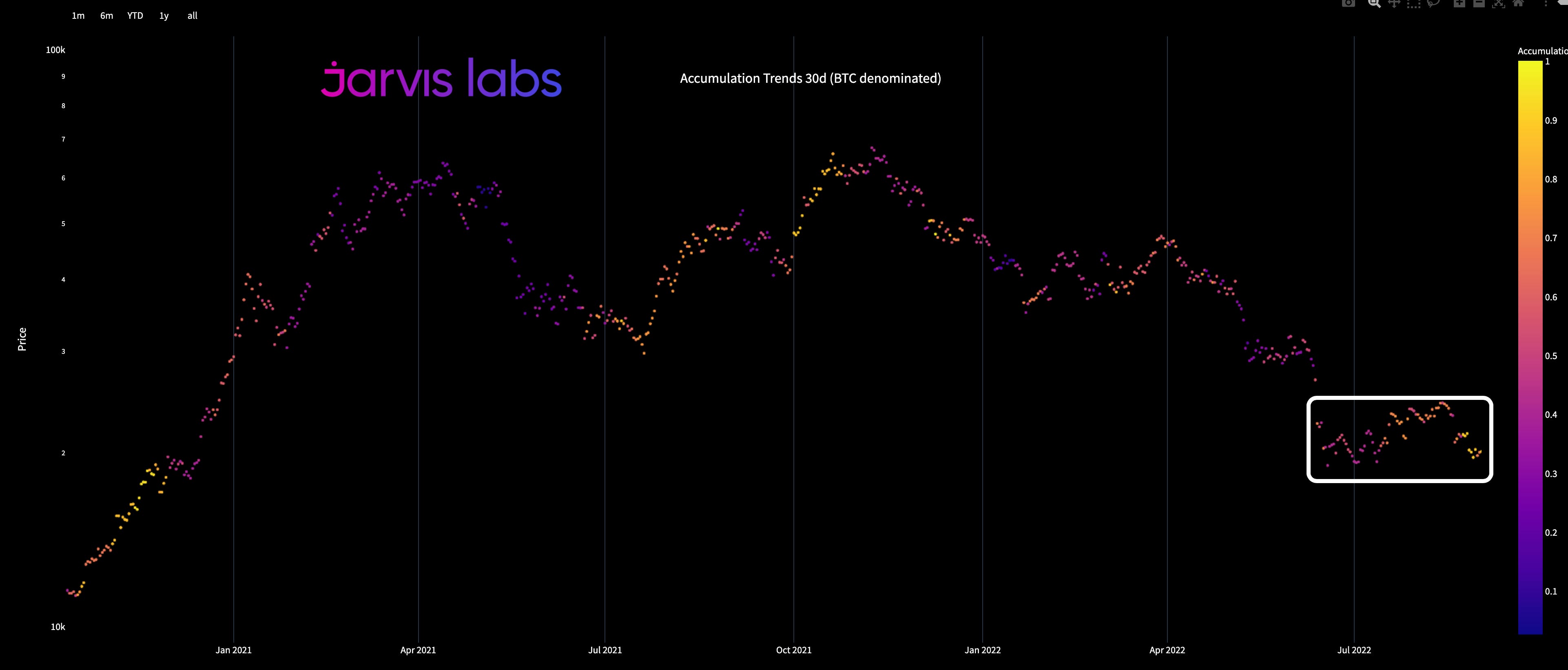

To add to this finding, the Accumulation Trends (30d) reading is showing a good progression.

What I mean by that is there was little to no accumulation after the 3AC/Luna/Celsius debacle. But we’ve since witnessed accumulation go from a very low score, to now a much higher score.

This pattern is more indicative of a bottom. Whether it’s a multi-week local bottom, multi-month, etc… Too early to tell. Yellow dots is what we want to see…

The above data does let us know that large wallets are beginning to get active again. And we should be looking to the upside more so than the downside.

So where does the liquidity sit at now?

Recall, liquidity maps tend to help us know where price is attracted to. It is helpful in determining where to take profit or open positions.

I’ll follow up with this chart on Twitter as soon as I get the updated maps. Should be later today. My Twitter handle is @MrBenLilly if you don’t follow me already.

In the meantime, thanks so much for taking the time to read this update. Enjoy your weekend.

Your Pulse on Crypto,

Ben Lilly

P.S. - Arthur Hayes discussed Standing Repo Facilities. This was going to be a topic, but after diving into it some more, I was not sold that this really represents liquidity in the same way as RRP does. I see it as more of stress indicator. If SRF begins to get active, that’s a sign that bank deposits are being drawn upon (demand deposits, like your savings account)… and banks are tight on liquidity to meet these liabilities. This is a function of what happens when the FED goes from QE to QT… Banks don’t scale down demand deposits as they should - this was another Jackson Hole piece called “Liquidity Dependence”.