We're Back... Right?

Filtered: June 19 - June 23

Welcome to a new weekly issue we call, Filtered.

If you’ve been following Espresso regularly, you’ve likely noticed that we’re starting to ramp up our content on other platforms. So we thought we’d help our readers out by giving you some of the highlights.

You can consider this your weekly round-up of top insights from our analysts, filtered down to serve you better.

And if you’ve missed any of our content this week, whether it’s in essay, podcast, or video form, you can find links to it at the bottom.

Without further adieu, let’s get into today’s Filtered.

It was July 1969. Elvis hadn’t performed live in more than eight years.

His career was in disrepair… treading water.

But that night at the International Hotel in Las Vegas, the star was reborn. He proved not only is he still able to rock ‘n’ roll, but can do so better than ever.

Much like Bitcoin (BTC) this week.

https://twitter.com/MrBenLilly/status/1671316524890574849?s=20

This rebirth was thanks to Bitcoin pumping above $30,000 for the first time since April.

Ethereum (ETH) wasn’t left behind either, gaining more than 11% at one point this week.

The market seems to be running off the high of BlackRock’s announcement last week that it’s filed for a Bitcoin ETF. And it’s not alone...a handful of other companies have followed the $10 trillion asset manager’s lead.

So is it time to degen into crypto once again, or is this a sucker’s rally?

That was a big focus of this week’s xChanging Good episode of Alpha Bites. And the answers we got from our analysts were a little more mixed than you might expect.

While taking a brief break from cleaning the halls of Jarvis Labs, our resident janitor J.J. weighed in and cautioned us not to overthink things:

I do think even if we break out from here, it's highly likely within the next 12-18 months, we come down and retest this range, whether that's a flash crash or we move down slowly.

But in terms of this summer, if we get a monthly close say, above that $27,500 range for Bitcoin, and obviously if that's paired with DXY falling below the 100 mark, that's a bullish setup. You can't really slice it any other way. Sometimes, things are just as obvious as they seem. And when you have a $10 trillion asset manager entering the space, it's bullish.

Not everything is a trap. I think we all have so much PTSD from the past year that we're always looking for reasons why things are more bearish than we expect. And sometimes, it's just as simple as it seems. And that seems to be what the market's saying today.

J.J.’s point is well-taken. It’s easy for us crypto folks to give in to paranoia too often, considering what we’ve been through over the past year and a half.

That said, it’s always important to look for “confluence,” as J.J. says – other data points that align to support whatever your current bias is.

And that’s where Mr. Benjamin, the other Ben at Jarvis Labs, layered in some important nuance regarding this rally. Here’s Benjamin:

People are buying as a result of the announcement rather than any improvement in liquidity. We're not seeing much of an improvement in liquidity across the order books across the exchanges. The money that left over the past couple of weeks as a result of the SEC lawsuits has not returned yet. So I do feel that people are getting a little ahead of themselves.

But the key point is $32,000. If we are able to consistently close and retest $32,000 as support, then I think we have another 30% rally at the very least to look at. So I think it's not required that you have to start buying here. I think there is still time for confirmation. I think people are still rushing in over here.

Meanwhile, the BlackRock news had the team looking back at an Espresso piece from way back in September 2021 analyzing how gold took off after it got its first ETF.

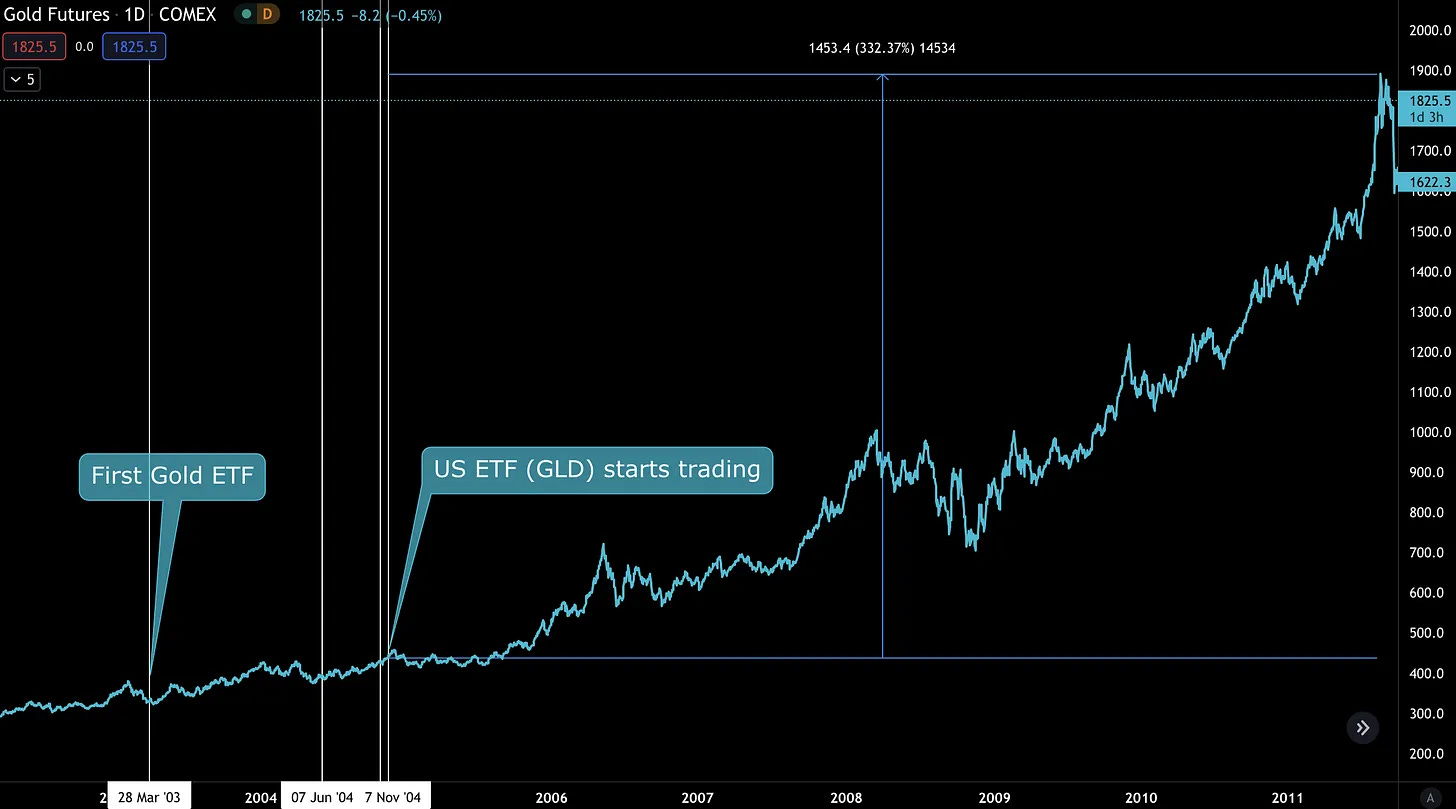

You can see gold’s run in the chart below.

By taking a look back at what happened with the gold ETF, we can see what happens when an asset has greater accessibility.

Australia had the first gold ETF in the world in 2003. And then about a year later in November 2004, we got GLD, which was the U.S.'s first gold ETF.

It’s important to note that the price action for gold didn't really respond right away. If you go ahead and zoom out, you can kind of see a steady march higher over seven years, reaching a high in 2011. It really speaks to the gold market having several things happen right away.

The first is that more market participants could buy since they didn’t need to source physical gold or meet gold futures contracts requirements. It was merely a click of the button. And people could get fractionalized shares of gold, which should sound familiar to anybody in crypto.

All of this alludes to the fact that with a Bitcoin ETF, we should have greater accessibility into this asset. And it will be a slow march higher, a subtle and constant demand shift over time for the market.

Now, the BlackRock ETF wasn’t the only big news last week. Uniswap released a whitepaper describing its upcoming V4, and while that had the DeFi community buzzing (for good reason), another announcement may have flown under your radar.

A project called Ambient Finance (formerly CrocSwap) officially launched last week. And according to our token design expert Kodi, it has some interesting features that could allow it to go toe-to-toe with Uniswap:

They introduced some really interesting innovations. The main one being that the [liquidity] pools for trading are not going to be separated. All the pools are going to be in the same contract. Gas is going to be much less, both for liquidity providers and users that transact within Ambient or Uniswap. There's going to be limit orders enabled. There's going to be different kinds of pools, like concentrated liquidity.

If they can get a bit of a head start here, if people start using Ambient Finance and they attract a significant chunk of liquidity, I think they could be a true rival to Uniswap. If not, Uniswap will just run with it. Their position is just too dominant right now, as you say. I’m rooting for Ambient, but they are definitely the underdog right now.

If you’re interested in learning more about Ambient and what they offer, it was one of the three topics I briefly covered in the latest Blend here.

Finally, for the folks who are looking to brush up on their crypto knowledge, our analyst Rishi gave a crash course on flash loans – and how they enabled a trader to make over $16,000 in seconds.

You can watch that video below, and subscribe to the xChanging Good YouTube channel for more videos here.

That’s it for me today. You can find links to all the content we published this week below.

Until next time...

Your Pulse on Crypto,

Ben Lilly

P.S. Sorry for all the coffee-themed issues… It sort of keeps things straight in my mind. The Blend is three stories into one essay. We have Filtered today. And soon, each analyst will roll out one longform piece each month. Meaning our four contributors here will have a Single Origin piece coming out starting in two weeks.

Espresso

Alpha Bites

Educational Series

Tweet of the Week

https://twitter.com/JLabsJanitor/status/1670869954252374045?s=20