Preparing for the Bitcoin ETF

Using Gold as an example

Eight years since the first attempt... And still no ETF.

Yet for some reason many asset managers believe we are now on the cusp of having the first U.S. traded ETF.

The reason is Gensler’s speech last month at the Aspen Security Forum.

For those that don’t know the forum is held at the Aspen Institute, a place that regularly hosts world leaders, business executives, and leading thinkers. It’s the epicenter for discourse on shaping the world of tomorrow.

During Gensler’s speech in front of this highly esteemed audience he discussed crypto at length. One item of particular importance was a bitcoin ETF. The sentence that we can hone in on for the purpose of today’s discussion is this:

“Given these important protections, I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded bitcoin futures.”

He was signaling to Wall Street what he wants in a bitcoin ETF. A futures based ETF, not direct exposure via spot markets.

Whether it is the right or wrong way is outside the scope of today’s discussion. As far as we are concerned for now, this is the way it is for now.

And the reason I bring this topic up today is fund managers, investors, and traders alike are fully expecting an ETF. I’ve never witnessed confidence levels this high.

In fact, we’ve even heard from multiple sources in our network that individuals at the SEC are now buying bitcoin in anticipation an ETF is coming.

So it’s hard to ignore.

Which means as far as the current market conditions, people are buying the rumor that an ETF is near.

And as a market analyst this begs the question, is this ETF going to be a buy the rumor, sell the news event? Or will bitcoin just go parabolic in the weeks and months that follow?

Today we explore that very question.

The Case Study

To help us determine what might take place we can look at an asset similar to bitcoin. One that is both a commodity and had an established futures market before an ETF emerged… That asset is Gold.

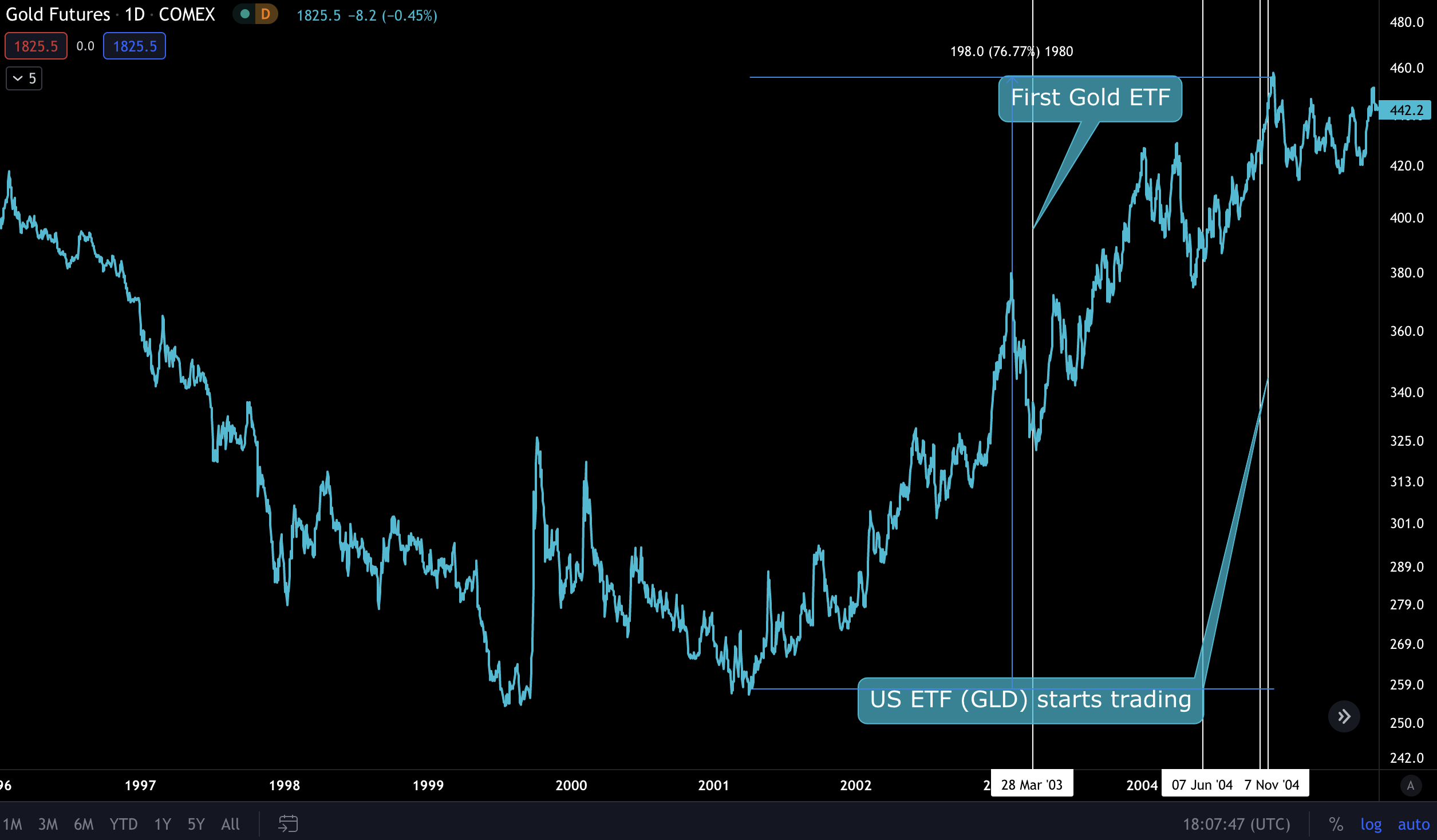

The chart below shows the history of Gold’s ETFs. In 2003 Australia opened up the first ETF in the world. Then the first ETF for the U.S. was GLD. It started trading in November 2004 after the SEC approved it in late October 2004.

Here’s what that history looks like on a gold chart.

The reason I bring this up is to help us anticipate if bitcoin might be a buy the rumor, sell the news event.

To determine what happened with gold, let’s zoom out.

Here is the price action prior to both ETFs being approved. From the low in 2001 until shortly after GLD began trading in late-2004, the price of gold rose about 76%.

This gives credence to buying the rumors or at least prior to a U.S. based ETF trading.

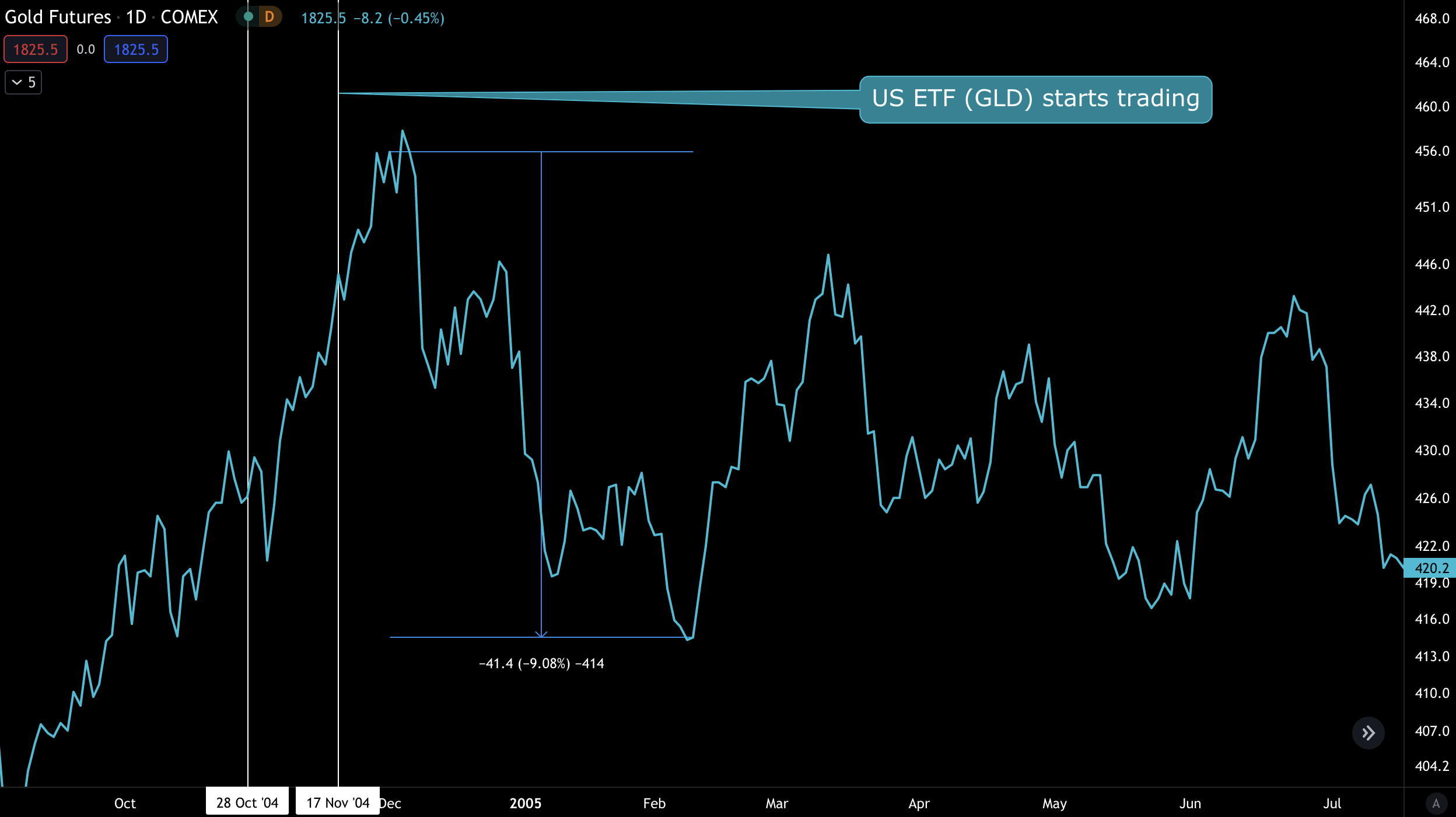

But what happened after? Was this a sell the news event?

Gold dropped over 9% during the next month. (Side note: I wrote it dropped 30% on Twitter, but this is incorrect. I have since deleted the post.)

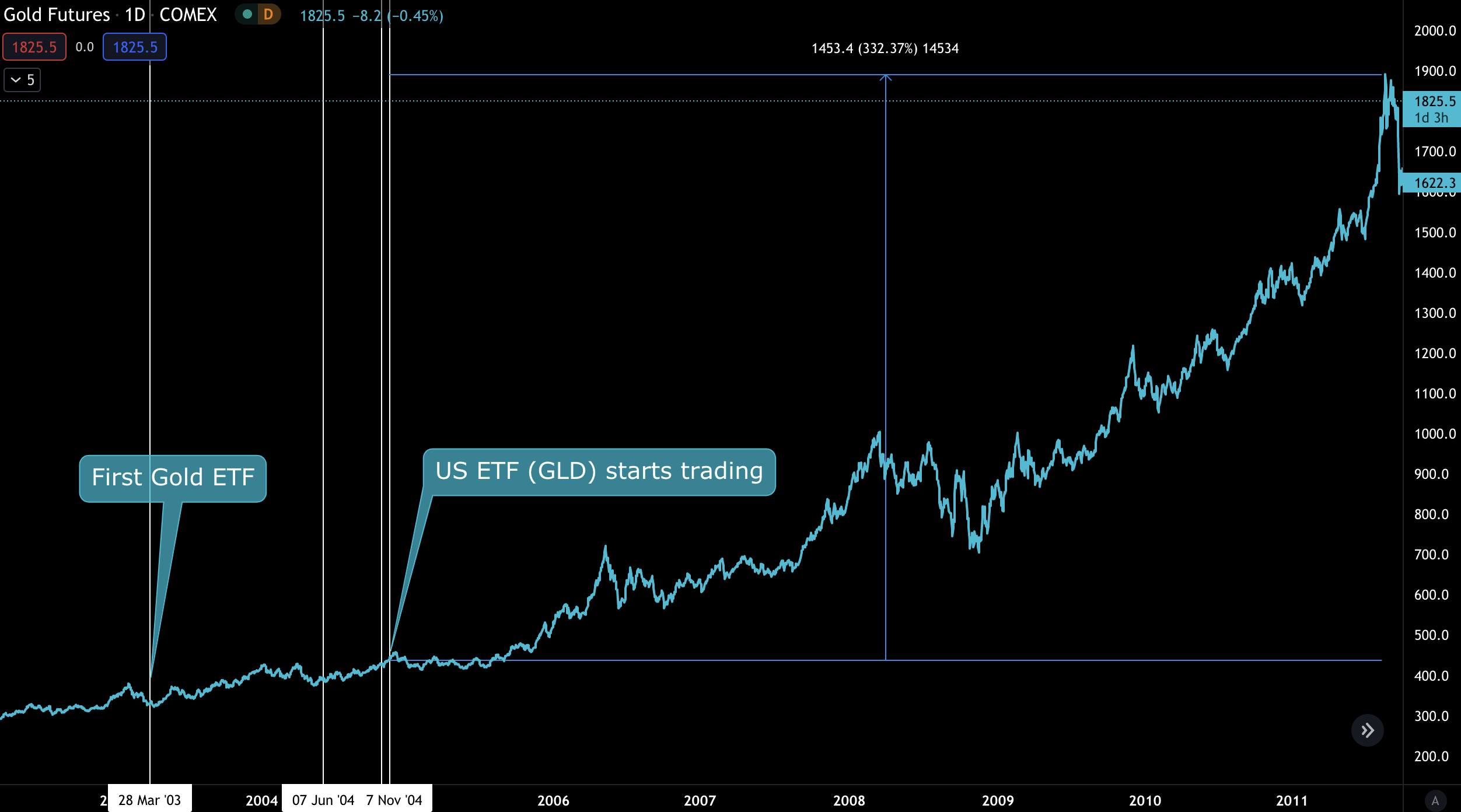

Then after trading sideways for the next year, the impact of the ETF unfolded.

More traders now had easier access to the precious metal. It also meant new entities could gain exposure to gold via the ETF without the need to take custody of the metal, hire auditors, hold it in a bank, etc - sound familiar?

And as new traders soaked up the easily accessible asset on the open market, here’s what happened…

Gold ripped from the $420-$440 range to $1900 over the next few years. 330% from when the ETF began trading.

This was arguably the best time to purchase gold. Since this epic bull run gold bugs have been left dreaming that another epic rally like this would unfold again.

But here we are, and gold has done little to nothing. My belief is that once the ETF made gold easily accessible, fresh money came into the asset… And since then no other event can compare.

It’s the fractionalization of an asset.

The only other way gold can have an mega rally like that is if a project tokenizes the coin and makes it purchasable for everybody with a mobile phone in the world - aka the actual global currency.

It’ll be the adoption of a tokenized form of gold. Which won’t happen until cryptocurrencies have their day.

But instead of dreaming about such possibilities, let’s look at where we stand on the bitcoin ETF.

Here’s the current breakdown of bitcoin’s history. In February 2021 the Purpose Bitcoin ETF began trading. Then in August we saw a fresh wave of Gensler friendly bitcoin ETFs get filed with the SEC.

Now we wait…

How long?

ETFs on average take 221 days to be approved. The maximum amount of time it takes to decide on an application is 240 days.

Based on these two figures this puts us in March or April of 2022. Many are calling for an ETF approval before the 2021 holidays, but based upon history this might not be the case.

But as far as buy the rumor sell the news…

Discussion

I think it’s safe to say the market will respond favorably to a bitcoin ETF. Simply put, more exposure to an asset with low inflation and an eventual max cap is an attractable setup.

Keep supply unchanged and increase demand, what do you get? Higher prices.

However, one concern is the mere fact it is a futures based ETF. This handicaps the amount of demand the asset will experience as opposed to an ETF which is spot based.

That’s because futures contracts like the CME can create excessive downside pressure.

Since the CME is not asset backed, but paper derivatives, traders can short more than 21 million bitcoin’s worth. I won’t get into all the details, but this will likely be the negative commentary you will read about on Crypto Twitter and various blogs after the ETF is approved.

However…

I see it as a positive.

My greatest fear with bitcoin is that it will become stale. Wall Street and various institutions will create sinkhole-like products similar to Grayscale where the physical asset never moves.

Meaning the transactions never take place on the bitcoin network. And if this progression were to continue and transactions take place off the network, then miners are the entities that get impacted.

Over a long enough period if a majority of BTC are not transacting will miners start to leave the network?

To be honest, I have no clue right now. But over the next 4-5 years this is not something to worry about. Instead, if an ETF gets approved in the coming year don’t get cute.

More entities, individuals, funds, corporations and others will have easier access to bitcoin. It will go higher over the span of years once this catalyst happens. Similar to what we saw with its analog version - gold.

After you ride that catalyst to new highs, then you can consider the philosophical debate of the network and if it spells trouble for the asset. But for now, an approval is uponly.

In Search of The Pulse,

Ben Lilly