Welcome Back, Sir

The best in the game are engineers.

We tend to think they are good at mind games… Calling it all psyops. It’s in part why the chart below is so popular with traders.

But if we take a step back from it all, it all comes down to engineering liquidity. Specifically, traders and market makers being the engineers.

Whoever does it best and can see what’s happening, controls the market.

The price action this week is case in point. The amount of messages we’ve received from some subscribers who have been inactive is high. Traders are ready to be active again. Money is coming off the sidelines.

Does this mean it’s dumb money?

No. Most of the individuals in our circles are anything but that. If anything, they see volatility and understand that means opportunity. They see their time spent in crypto markets as being productive once again.

When price is moving like a snail, productivity is low…

This is why I often view many who we work with as being wiser. They know when to take a few months and touch grass.

And with many former traders and investors coming back, it’s liquidity nonetheless. Engineers are doing their job.

This means we should get a bit more focused on the game now.

And while I’d like to give everybody who is coming off the sidelines a warm welcome back, I’d like to also give our old friend Pablo a friendly nod as he wakes from his long slumber.

Pablo

For those that have been with us for a while, you know the name Pablo well. It’s a name we gave some labeled wallets that we’ve been tracking since 2018. The activity associated with this label – Pablo – is associated with price action. We originally wrote about him back in 2020.

The thinking is pretty straightforward… tokens flow from the wallet(s) to exchange(s), the market can instantly be viewed as being softer. If tokens leave an exchange and enter the wallet(s), stronger.

Today, we saw tokens entering the exchange. I won’t mention amounts as subscribers pay good money to know those things, so I won’t dilute their alpha. But just knowing that tokens are moving is useful information.

And to be clear, this doesn’t mean we are going down tomorrow. There have been plenty of instances where his movements didn’t correlate with price movements.

However, we think he’s likely on to something here. Mostly because of where we are at in this rally.

Which brings us to our quick hit update…

Market Update

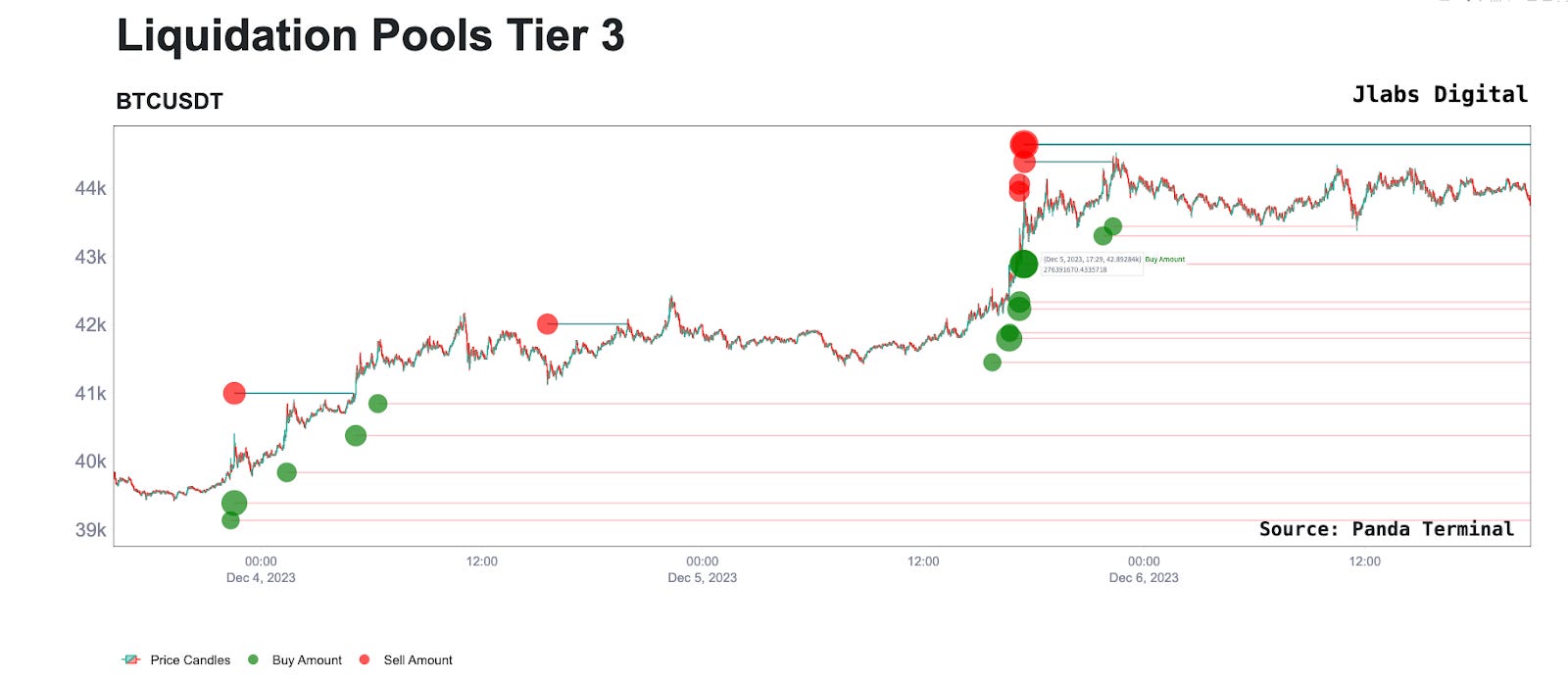

Liquidation levels that we mentioned in the last piece have been whacked, and new ones are opening up to the downside.

Let’s call this good engineering…

Reason being is much of the most recent push on open interest is derivative-fueled.

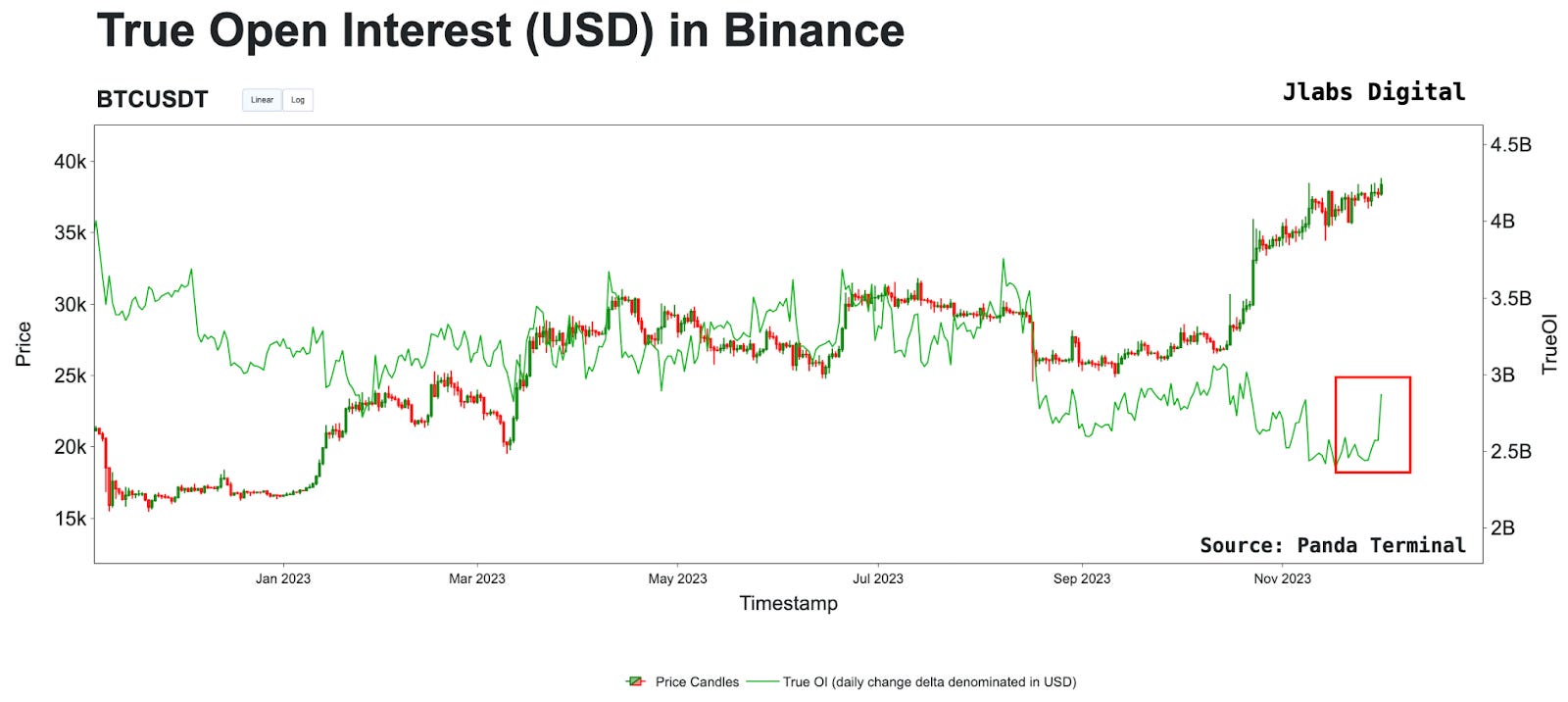

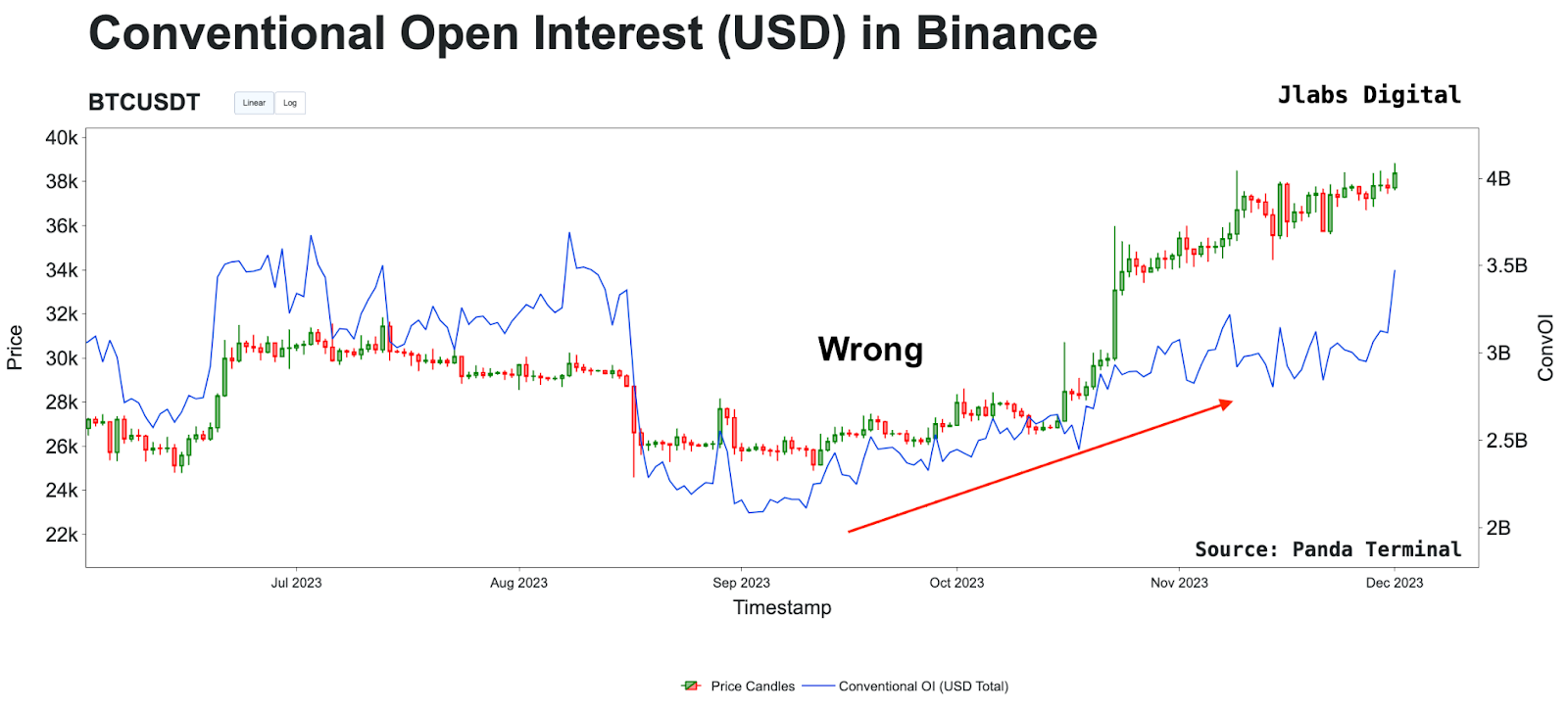

Believe it or not, but you’ve been reading open interest is wrong. To understand why that’s the case, we went ahead and finally took the time to explain how we look at open interest. We call it True OI.

Basically, the fact that some contracts are opened in dollars and some in BTC… And that the manner in which we calculate open interest gets skewed depending on how this calculation takes place on open positions… It creates misunderstandings in the market.

We detail it in this paper here. I recommend giving it a read if you’re into that sort of thing. But just note, OI is rising on this most recent push. Meaning market momentum and the engine driving this rally have started to shift from spot to derivatives.

You can see just before that red box below, OI was falling.

This is in contrast to the traditional way of measuring OI, something we call Conventional OI. This measure shows OI was fueling this rally of late. This is what 99% of the market is likely looking at.

Using True OI in this instance helps a trader better understand market structure and see the shift when it happens. Again, you can read more here if you want to understand the differences some more.

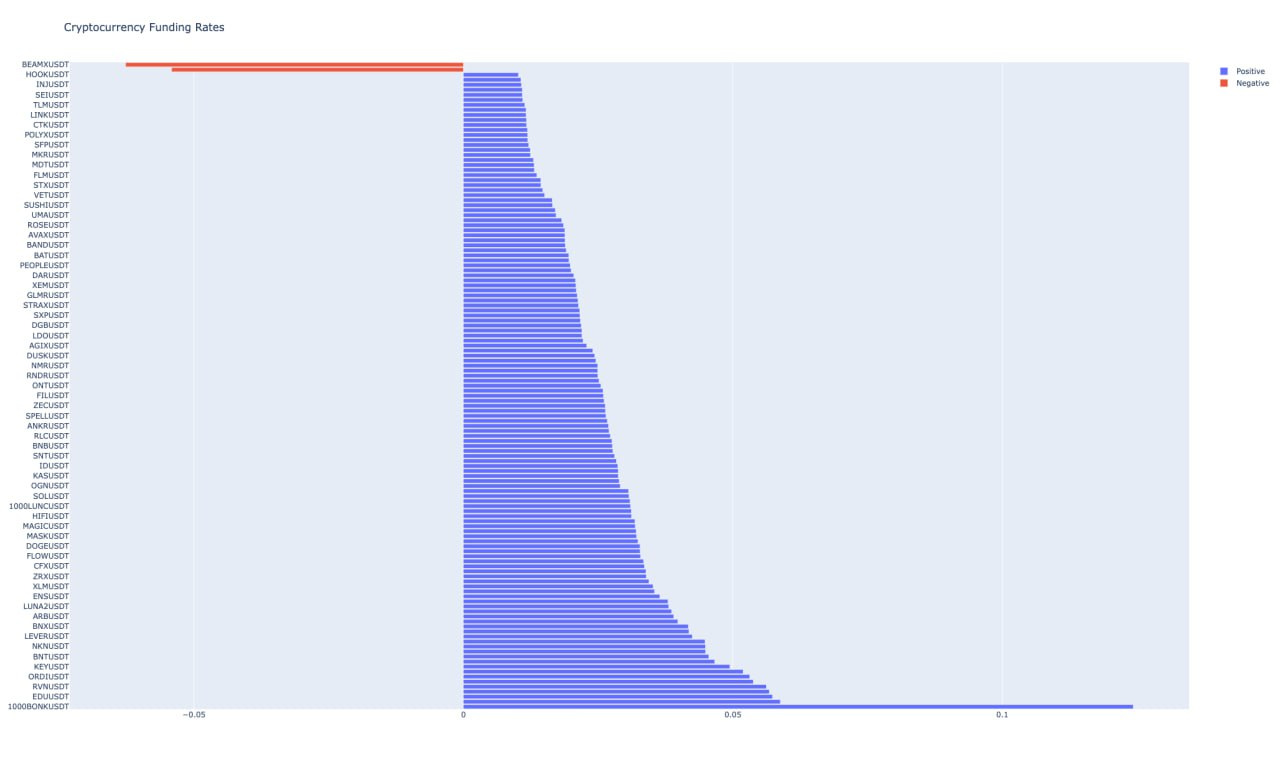

Anyways, what this alludes to is why funding rates have begun to rise yesterday and today. The chart below was from yesterday – it’s since risen a bit higher today.

This rally is now starting to get into the later innings. Derivatives are now pushing price, and the rate at which traders need to hold those positions are rising as well.

The incentive to push price higher and engineer liquidity is beginning to drop as well… That’s because the juice is starting to pool lower, not higher.

Traders have come in off the sidelines…Engineering at its finest.

Now, does this mean tomorrow we go to $30,000? No. I expect to see another run higher with a possible wick above $50,000. Whether we get it, only time will tell.

If you take anything from today’s essay, consider this a time to begin being more cautious. Don’t be afraid to book some profits. And perhaps let’s be mentally prepared if the market decides to cool off for the rest of 2023.

Your Pulse on Crypto,

Ben Lilly