Weekend Chainpulse

Quick metrics update and some tips

The grind is upon us.

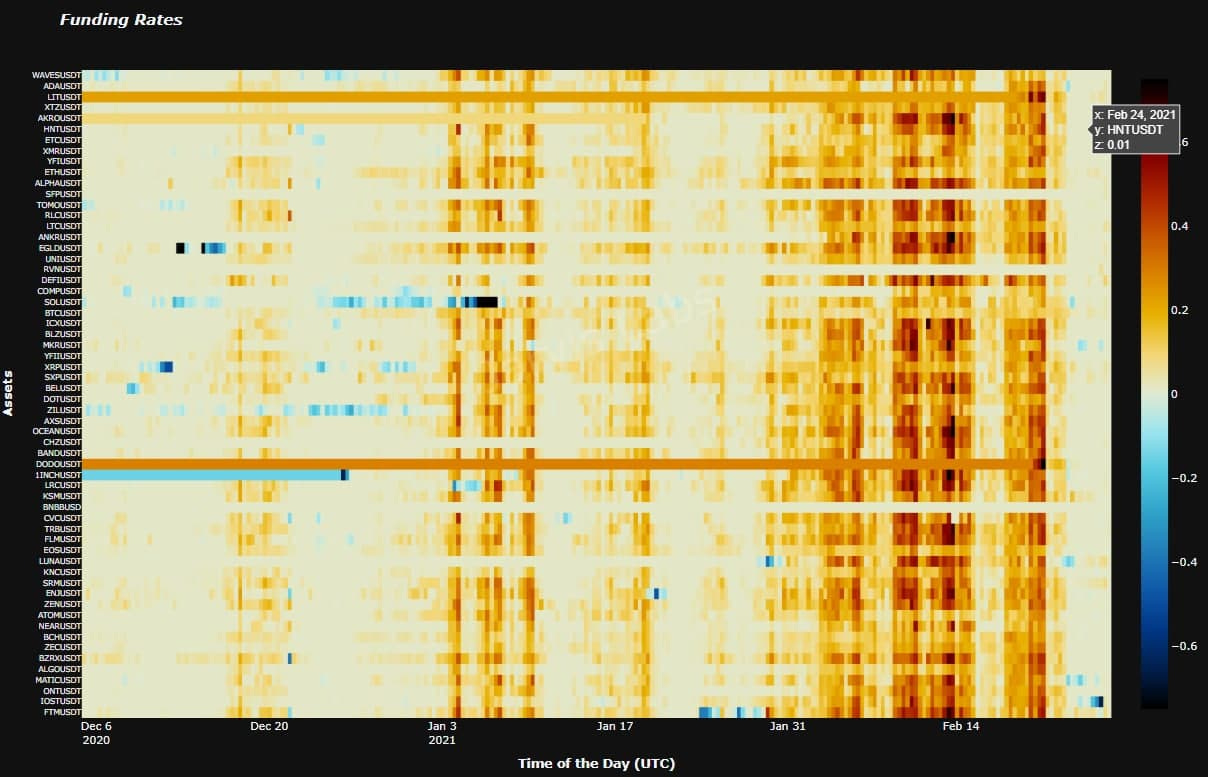

Earlier this week we witnessed the first full reset of funding rates in the market since this bull market went full bore. You can see that in our heatmap below.

The heatmap can be looked at rather intuitively with red (hotter) colors being high rates for traders holding a long position. The blue (colder) colors represent the opposite. White is neutral funding rates.

The market is mostly white right now which is a good sign that price can build momentum when it decides to go higher.

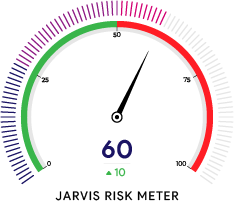

The risk meter and fuel meter are both pretty neutral rate now, which lines up with the earlier point that momentum can progress uninhabited.

Meanwhile the price is grinding and bears have come out of hiding.

Few hours ago we received cautionary alerts from Jarvis wallet tracking system. 3 of them.

One was a 15k BTC outflow from a market-mover wallet that was instrumental in dropping prices in the Black Thursday sale of March 2020.

Second was a 14k BTC outflow from F2 miner pools, third was 30 million USDT moved back into market-mover wallets (profit taking or selloff).

These alerts were received between 46-47k price BTC price range. This is a caution alert and not an invitation to short. Traders could simply move stops to profit, take profit, deleverage their longs and wait for the heat to cool down. Effect of these movements could be instant or could take a few days, but the probability remains high to impact prices ( I could see it impacting as I write).

That’s because it might take a bit of time for this pattern to unfold. The longer it grinds sideways the more potential there is for a stronger breakout to the upside.

One thing we’re looking out for in particular is the fuel meter. We’re expecting Tether to mint new USDT at some point soon. When it happens this is a good indicator that buying pressure is imminent. Consider it a cue to drop your cross-stitching project and get ready to put some trades on but with some caution.

Now get out there and enjoy the weekend.

Your pulse on crypto,

Ben Lilly & Benjamin