Unknown Unknowns

Market Update: Ethereum's Merge trade playing out onchain and offchain

Pigs get fat, hogs get slaughtered.

After making bank early in my career I was Ivan Drago the USSR boxer from Rocky III and Rocky IV, unbeatable. This elated confidence was not a quick hit of euphoria…

No, it spilled into the weeks that followed… Resulting in a string of massive wins.

During this streak my mentor and boss poked his head into my office. He knew what was happening and casually said, “Take what is given, not what you want”.

I thought about this for two seconds and short sightedly thought, sounds good. Will do… You likely know what happened next.

I went for another home run. The streak became full on greed, and blew up in my face.

My mentor knew it would happen. And instead of stepping in and stopping me from making the mistake, he viewed it as a prime opportunity to let things run their course. The collateral damage was manageable.

His foresight was spot on.

Which luckily for me, meant I lived another day. Hardly any consequence for this naive behavior. It also meant I got to hear where he learned about taking what is given.

He attributed his success and more importantly his survival of being in the business for several decades by using the philosophy: never be the fattest pig at the trough.

If you start to stand out more than everybody else, you’re done, because that’s when greed gets you in trouble.

To this day I try to remember those words… Take what is given, not what you want.

And looking at the Ethereum event that is on everybody’s radar, we can see this type of mentality needs to be practiced.

To see what I mean, let’s break down what is happening with Ethereum, how the industry is playing it, and how you can track if over the next 39 days.

The Merge

If you looked at Crypto Twitter over the last week, you’ve likely read something related to the big Merge event coming.

In fact as I write, Ethereum’s testnet will conduct a Merge event itself in a few minutes. I’d expect to see a bit of a pump on the news if all goes well. But for long-term price action the testnet event does not impact what has unfolded over the last month.

To see what I mean, let’s bring up a chart we’ve showcased for several weeks now. It will prove to be a starting off point for us to view what the market is giving us.

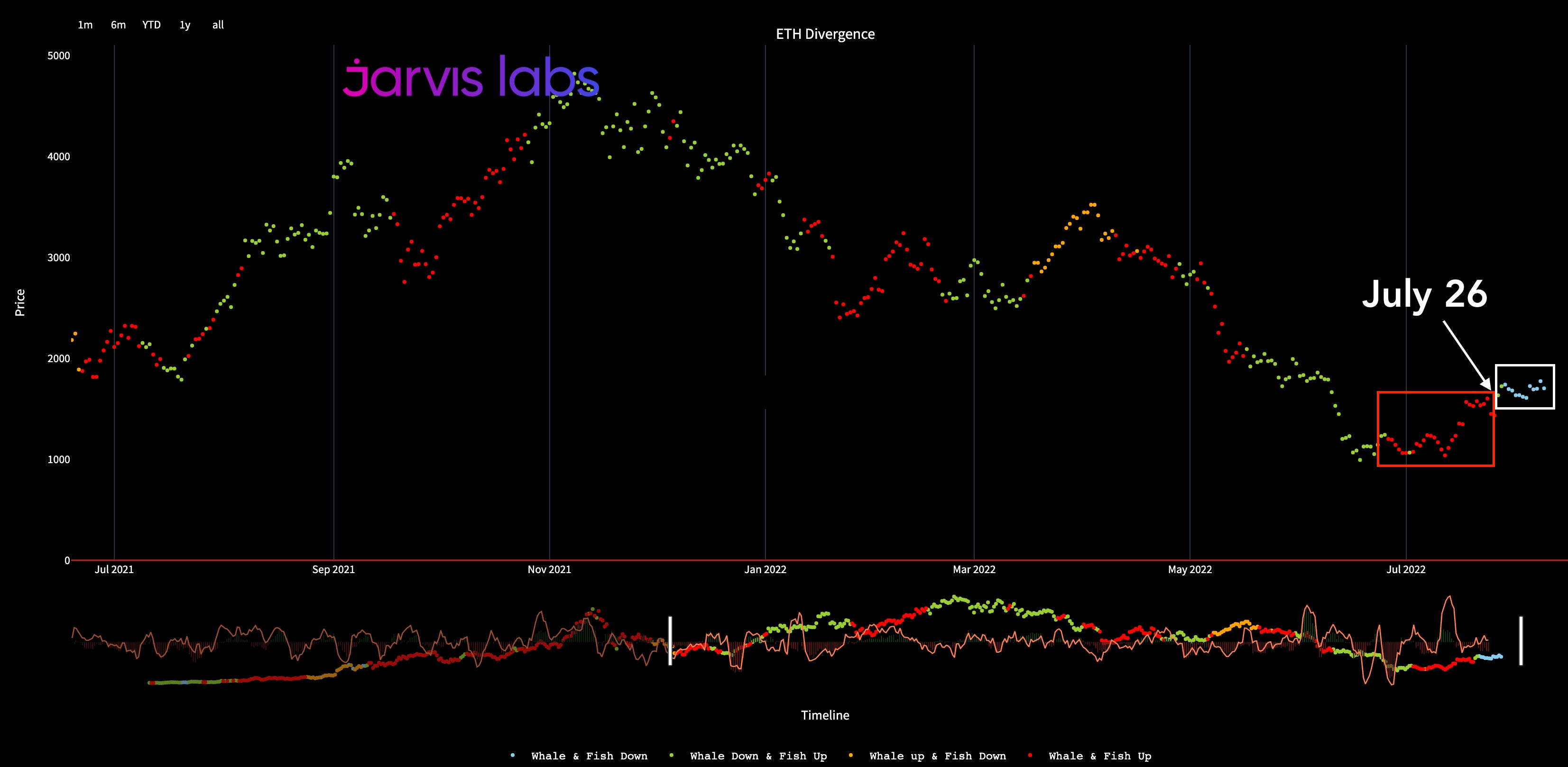

The chart I’m referring to is the ETH Divergence chart. It shows when whales and small wallets (fish) are buying or selling. When it’s red, both whales and fish are buying. This started when ETH and the crypto market carved out a local bottom and started to trend higher. That’s reflected in the red box below.

On July 26th, this changed as Whales stopped buying as seen in the white box below.

This subtle change in the market is interesting as it led us to explore a few other parts of the market to find more clues of what is making the market move…

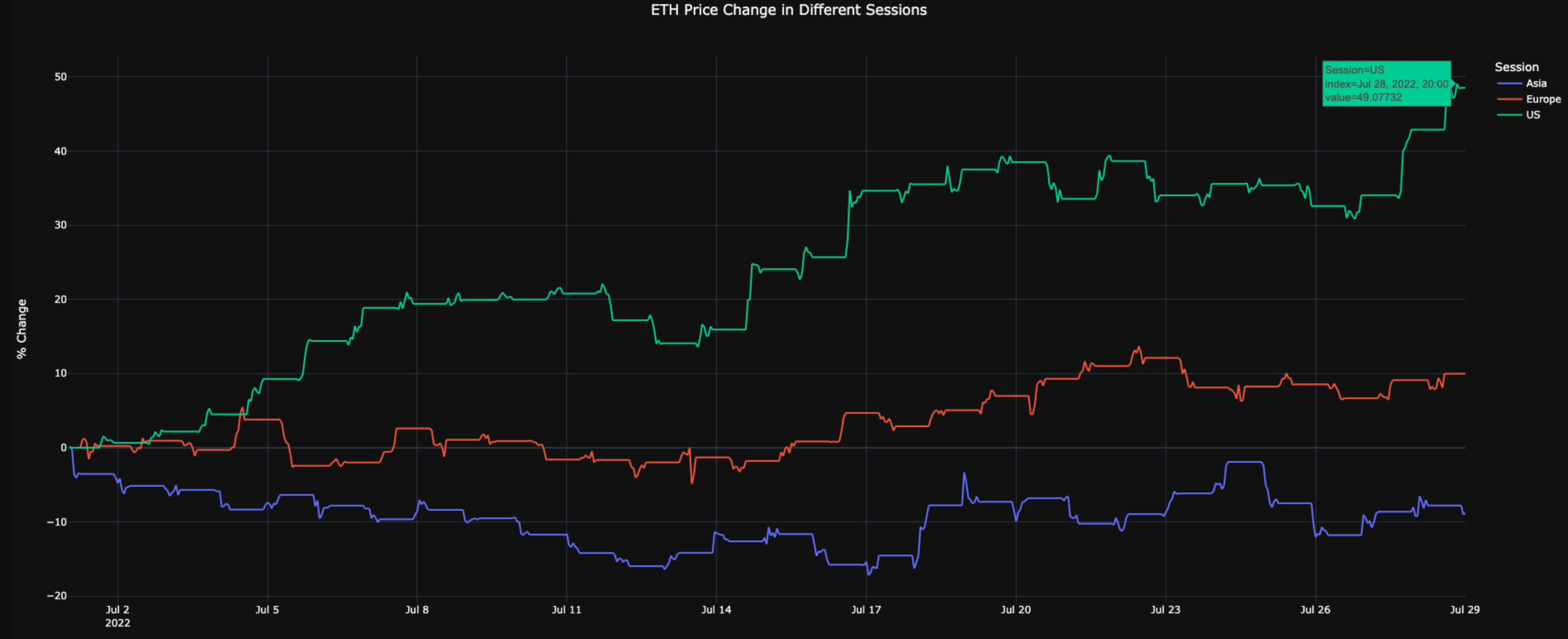

If you tuned in last week and read “The Rising Trend: Pay Attention to New York” the chart below will look familiar. It highlighted that almost all of the recent gains were taking place during the New York trading hours.

This week we promised that we would dive a bit deeper to see if this activity took place in terms of onchain activity as well.

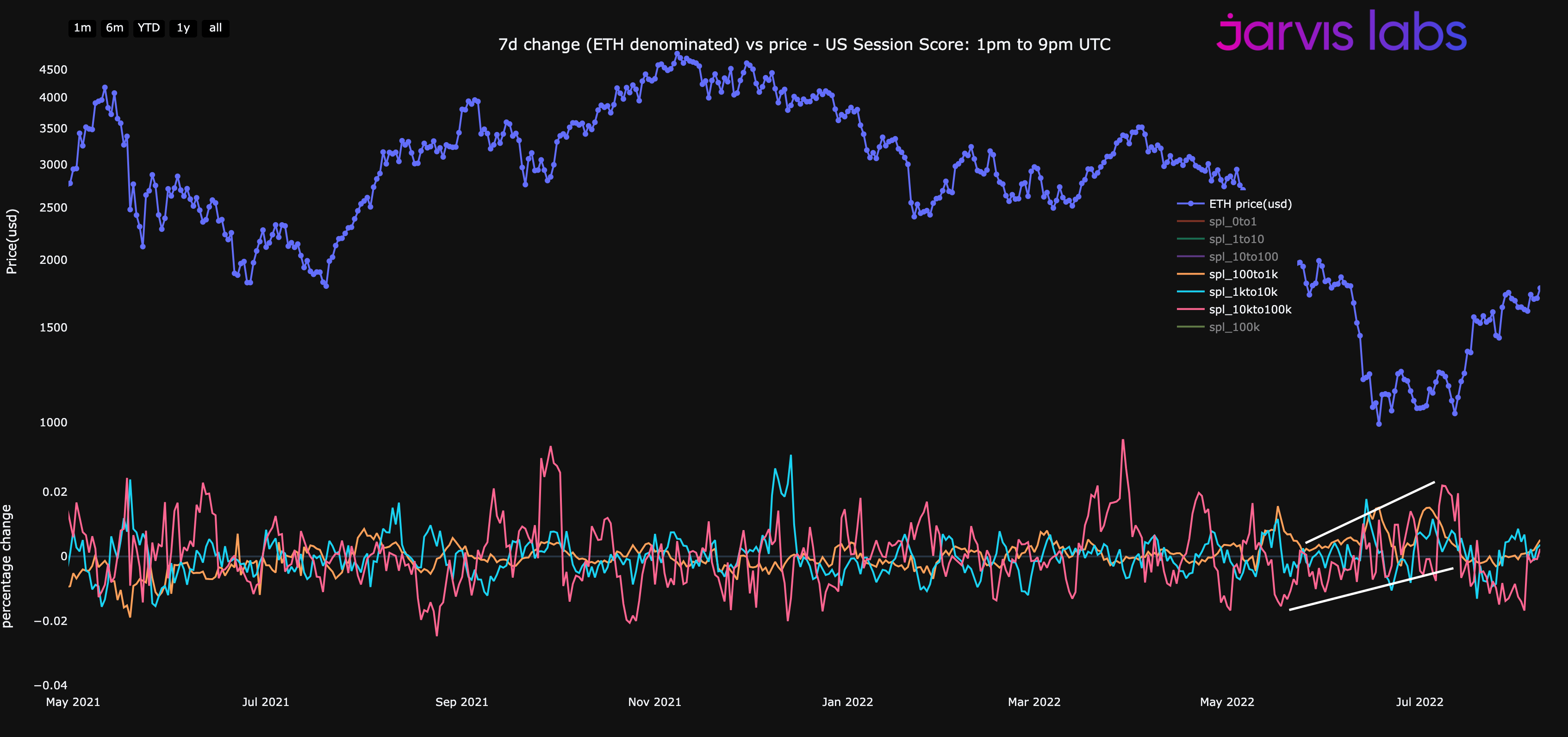

We went ahead and broke down various wallet entities by balance. Then looked at netflow of those wallets based upon the various timezone in which the onchain activity took place.

In the chart below you can see that larger wallets during New York hours were active in accumulating ETH before this recent run.

Further, this also implies that as this accumulation waned in terms of the onchain data for whales acting during New York hours, the ETH Divergence chart from earlier also witnessed whale wallets turn off.

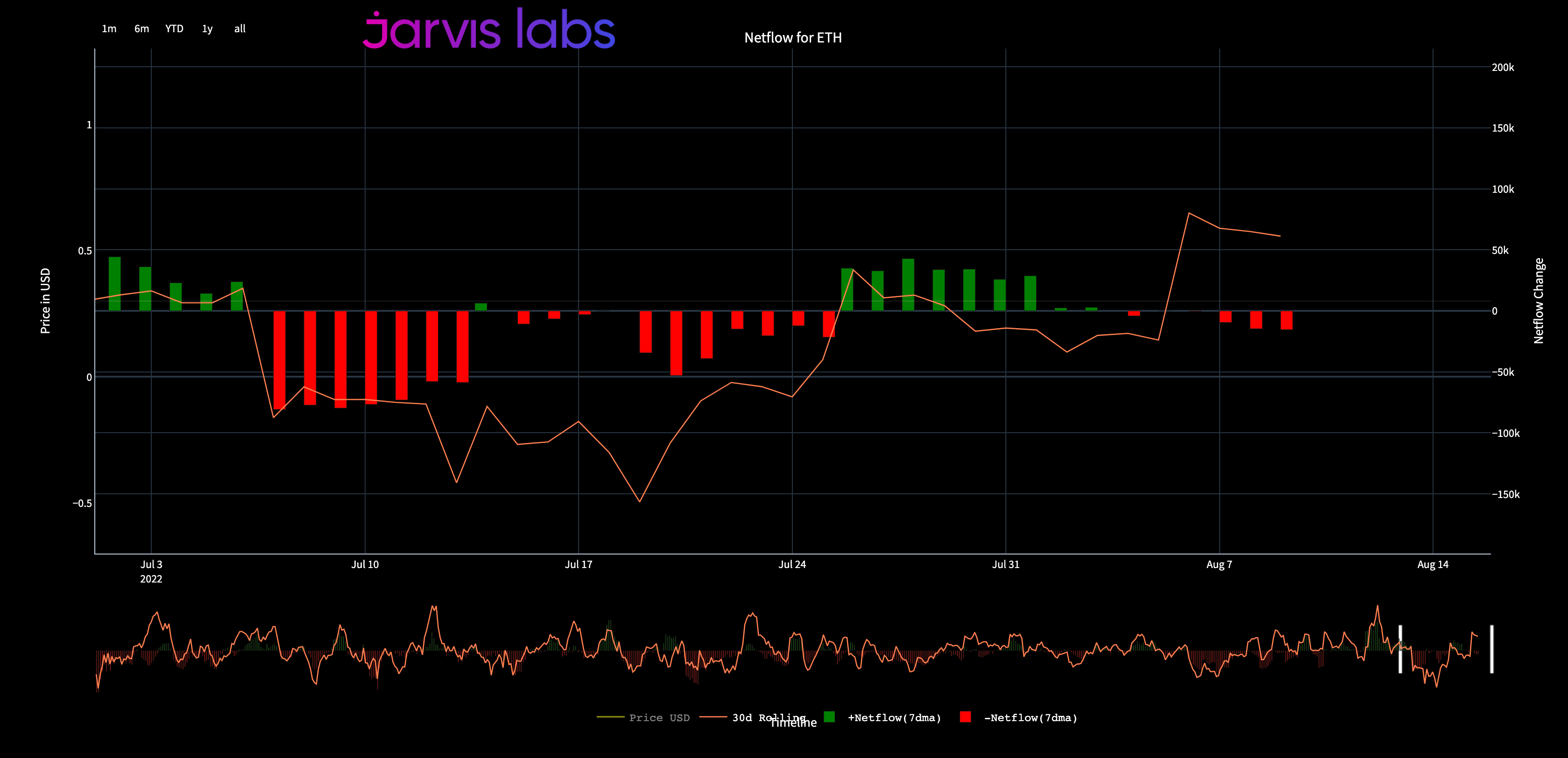

And looking at things more broadly, here is the netflow for ETH from exchanges. It is very negative implying significant ETH leaving exchanges.

Which begs the question, why did the spot accumulation wane as price rose? This is where we begin to dive into the recent trade that acted as the trough for pigs to chow down on…

Dreaming About the Unknown

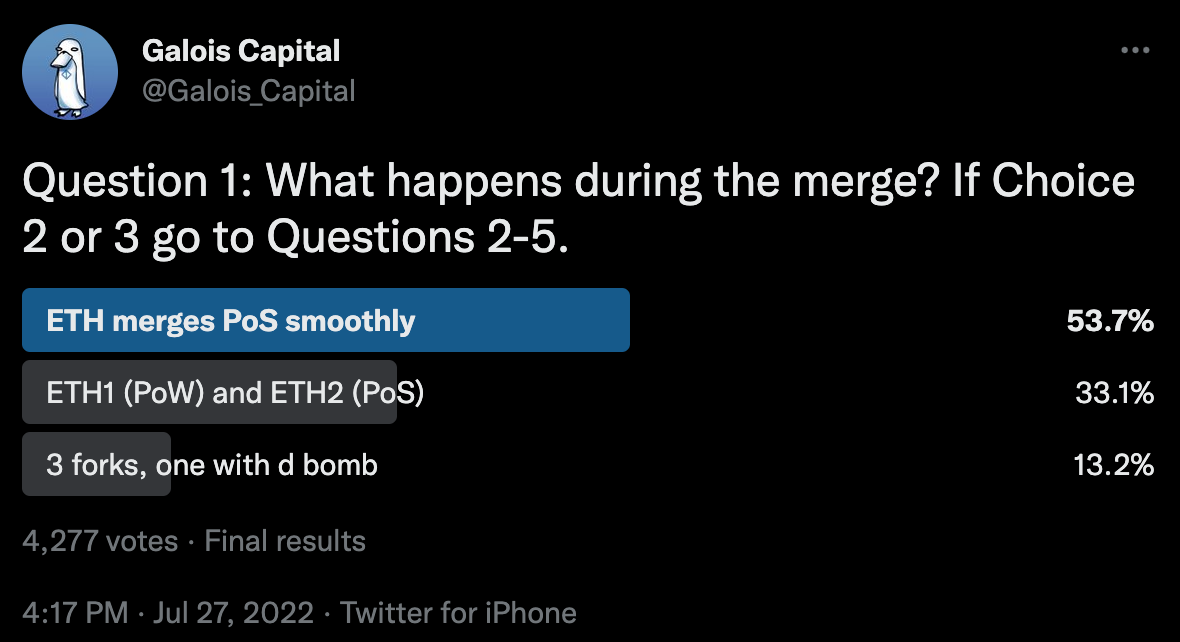

For those that like to digest various podcasts, Kevin Zhou from Galois Capital went on the Unchained Podcast with Laura Shin last week. Good episode if you can spare the time.

On it, Kevin asked listeners to consider the unknowns of Ethereum’s Merge. Which was a follow up to an earlier tweet on July 27th where he posed the question about what might happen during The Merge.

While his intentions were likely good and his insights were great, what ended up happening is that he was talking his book - whether he meant to or not .

He mentioned his firm tends to do price neutral strategies. Meaning the firm tends to make money not from directional price movements. Traditionally this implies a trader is long Volatility, meaning as price starts to whipsaw around, the trader makes money.

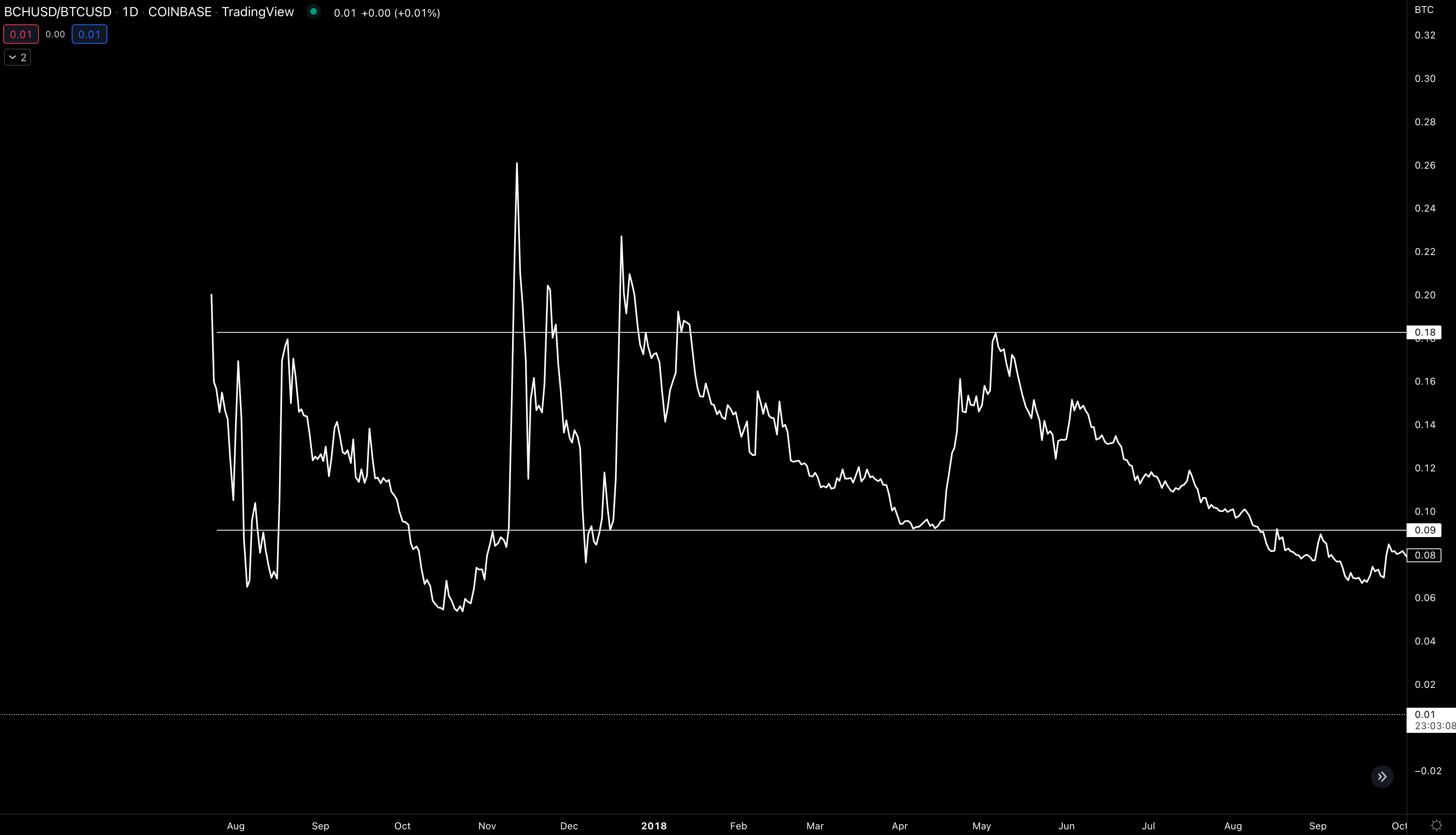

But in this instance things are a bit different. For those that weren’t around in August of 2017, Bitcoin had a hardfork event that is in a lot of ways similar to what is about to unfold for Ethereum.

As somebody expressed to me regarding the 2017 event: the market took a rib from Adam and made Eve in terms of value and liquidity… This was the moment where Bitcoin Cash was born from the hardfork event in 2017.

Regardless of what you think of BCH, the market cap stands at $2.7 billion as of today. And the more than $50 billion market cap BCH commanded shortly after it was born in Q3 of 2017 meant a lot of BTC holders made significant sums from this event.

Meaning it paid to hold BTC before the hardfork. Which brings us back to Galois Capital and their discussion of being price neutral. It suggests their positioning is to profit on any secondary or tertiary coin that unfolds from this merge event.

So talking about the unknown unknowns invites the trader to form a similar thesis for The Merge - hold a bag of ETH.

So getting back to the prior charts… We can see solid accumulation taking place by large entities for much of July. But as price began to rally this behavior waned.

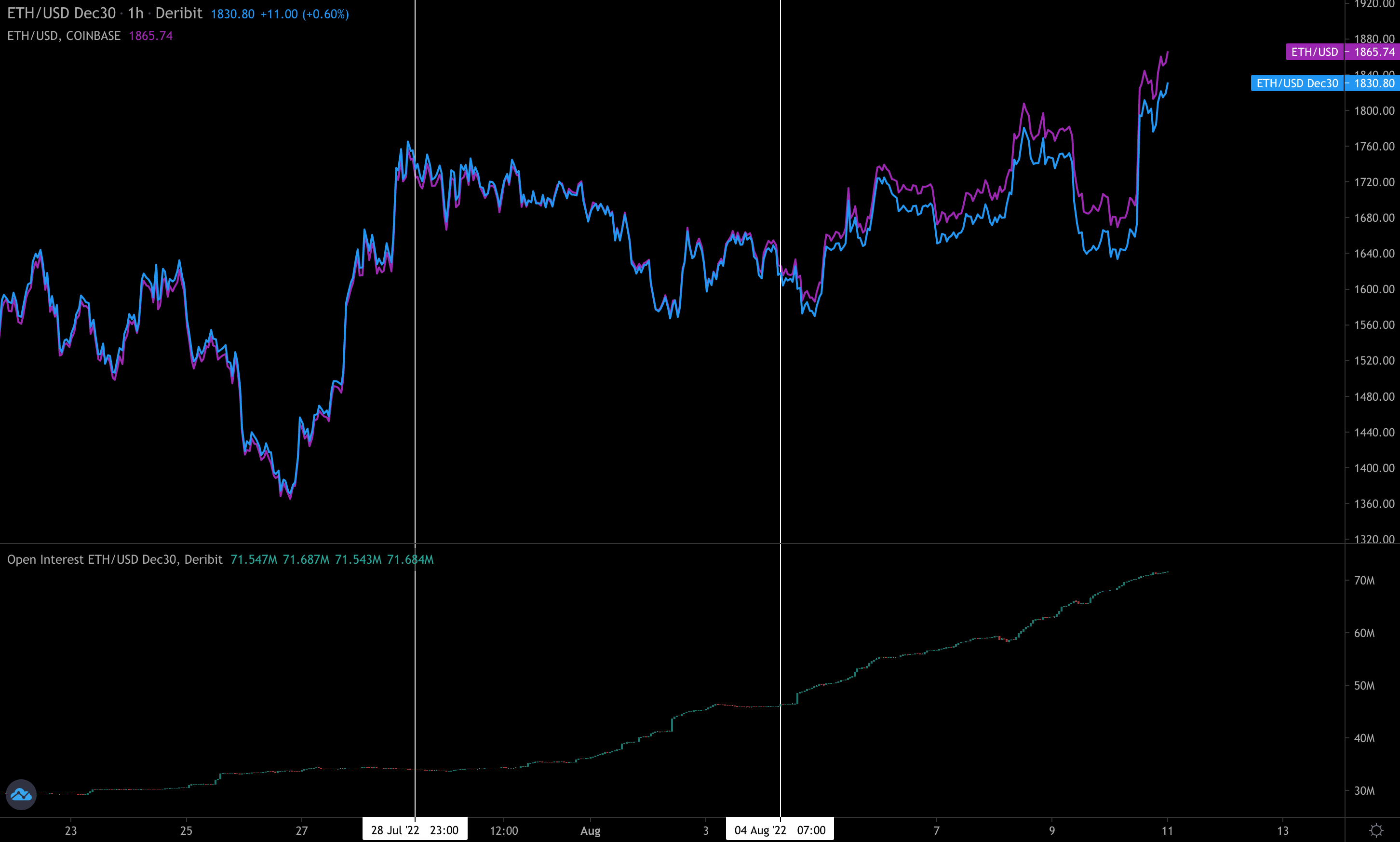

This coincides with when the December futures contract - an expiration date well after the expected Merge date of around the 19th of September - went into backwardation.

Backwardation is when the price of a futures contract trades lower than the spot market. It isn’t normal to see, and is a result of selling pressure.

It also means if you want to be delta neutral or be price agnostic into the Merge event you will likely be short December futures while holding ETH via the spot markets… And transfer this ETH to your wallet - which is what we saw onchain.

In the chart below you can see the backwardation I’m talking about which began in late-July

So what does this all mean?

It means the market is positioning for The Merge by going long on spot and short on December futures. This isn’t entirely new or that groundbreaking… But seeing this all line up based upon onchain activity, commentary from Galois Capital, and derivatives going into backwardation is insightful in itself.

Now the thing we do need to be aware of moving forward is all the derivative exposure on the short side of the market.

The Fuel

The majority of this positioning for The Merge has unfolded over the month of July. This includes spot as well as the futures market.

If we look at one of the December ETH futures contracts at FTX for example, we can even see most of the Open Interest appeared from the middle of July onward.

We see a similar unfolding with Deribit’s December contract. The backwardation here showed up after FTX and Binance, but nonetheless saw backwardation as Open Interest grew.

I quickly looked into the options market, but want to reserve that conversation for next week… As for now, I think you get the point here.

The market is long spot, short derivatives. And with the market’s backwardation getting more pronounced, I think it’s wise to not be a hog here.

While I understand a second token can be quite lucrative as seen in the chart below, which shows BCH held between 8% and 18% of BTC’s value for about a year after it forked from BTC.

Nonetheless, wait for the market to give you a better opportunity.

The Backwardation is about -2%, so looking at historical context it might seem like a good deal. But once you start considering gas fees in a time of high volatility, shorts beginning to unwind that cause the backwardation to no longer exist, and who knows what else… is -2% a worthwhile starting point?

Likely not. And it is why spot accumulation has slowed of late.

I anticipate this trade to pick back up once markets on larger exchanges (FTX and Binance) start trading the second token. If this begins it’ll allow traders to unload a small amount of risk.

But more importantly, if price trends lower in the week following a successful Goerli testnet merge event, we could see the backwardation ease up a bit and invite more long spot / short futures which would be good for price action higher.

We’ll see. For now enjoy the testnet event, talk next week.

Your Pulse on Crypto,

Ben Lilly

P.S. - I want to thank everybody for their support and great feedback as of late. It is very enjoyable to be writing to you all again and sharing the teams’ thoughts. We do take considerable time to put these discussions together and hope you find a lot of value in them. If you do, it would go a long way if can share our work with a friend or within your community. Thank you so much, enjoy the rest of your week.