The Scapegoats, Elon and Retail

The Trifecta Selloff and how it impacts Grayscale

Call it a Wyckoff… Call it a distribution top pattern… Call it whales unloading on retail… Call it miners selling... Call it OTC desks wanting lower prices…

It's all accurate.

The only thing you can’t do is say Elon or retail caused it.

They are the scapegoat.

And if any analyst you follow is stating one its Elon or retail, unfollow them or stop reading their work. They are doing you a disservice.

Instead, there was a trifecta at play that led to current prices.

And today I’d like to walk you through this trifecta, and how we are now witnessing this reverse.

What’s more is these pieces are moving in such a manner that long-term bullishness is not only intact, but gaining strength.

Then I’ll end today with a bit of Grayscale fodder and hopium.

There’s a lot to cover so let’s get to it.

Culprits

The trifecta is made up of whales, miners, and market movers.

The first two are topics you may have read about. And the latter is a topic you might have seen us hit on with our alerts. Truth is, they all helped contribute to the selloff.

I know everybody enjoys the 4chan guy, miners front running the market, or other conspiracy like stories. But the realist in me is saying that these three entities all acted on their own.

First up are the whales.

The best way to view them is through accumulation patterns.

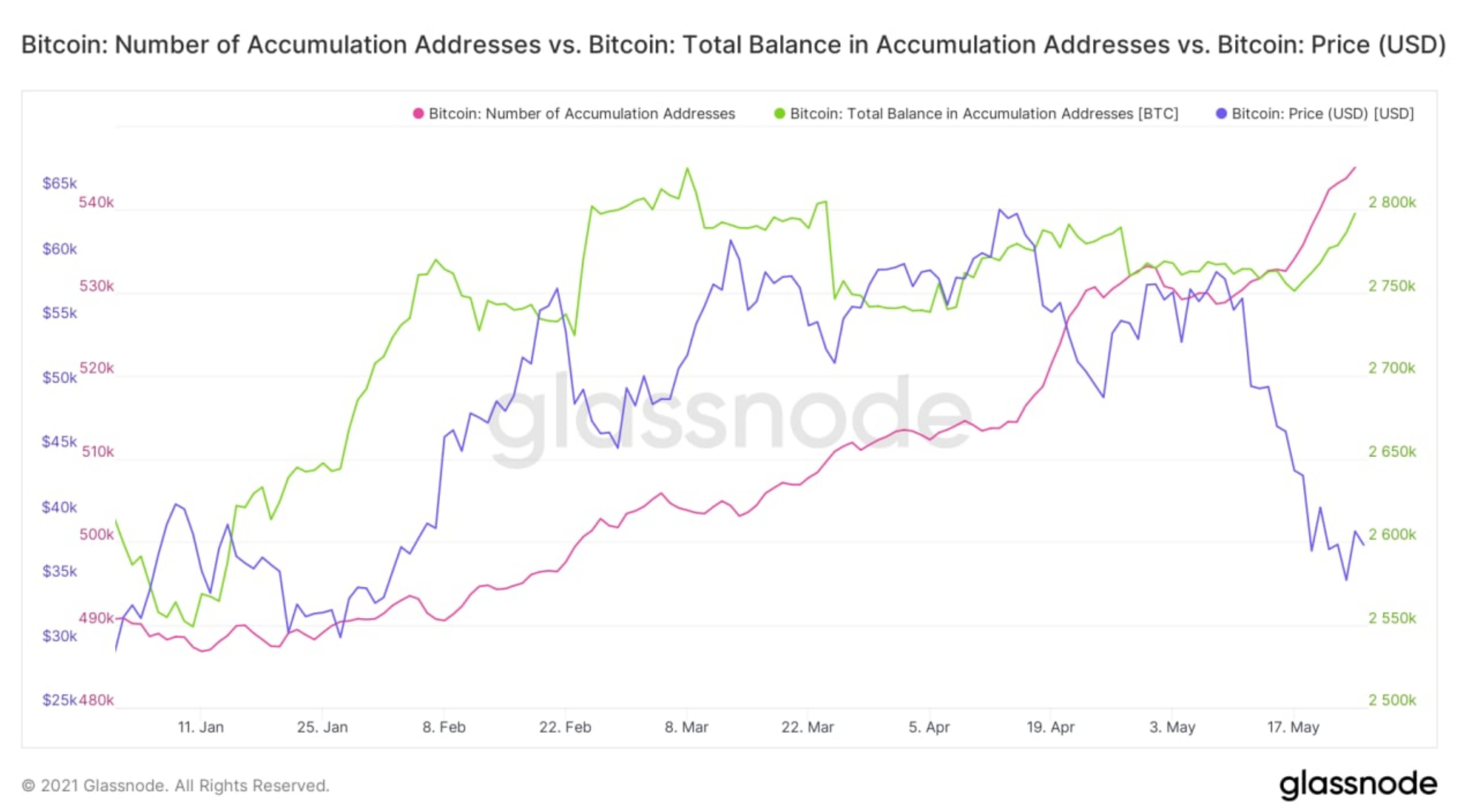

During the stretch from Mid February to the selloff, the total balance of accumulated addresses stalled out. This is the green line in the chart below. Blue is the price of bitcoin.

Meanwhile, the number of accumulation addresses were growing.

How does the number of addresses grow while the balance of BTC in these addresses go sideways?

Through a change in hands.

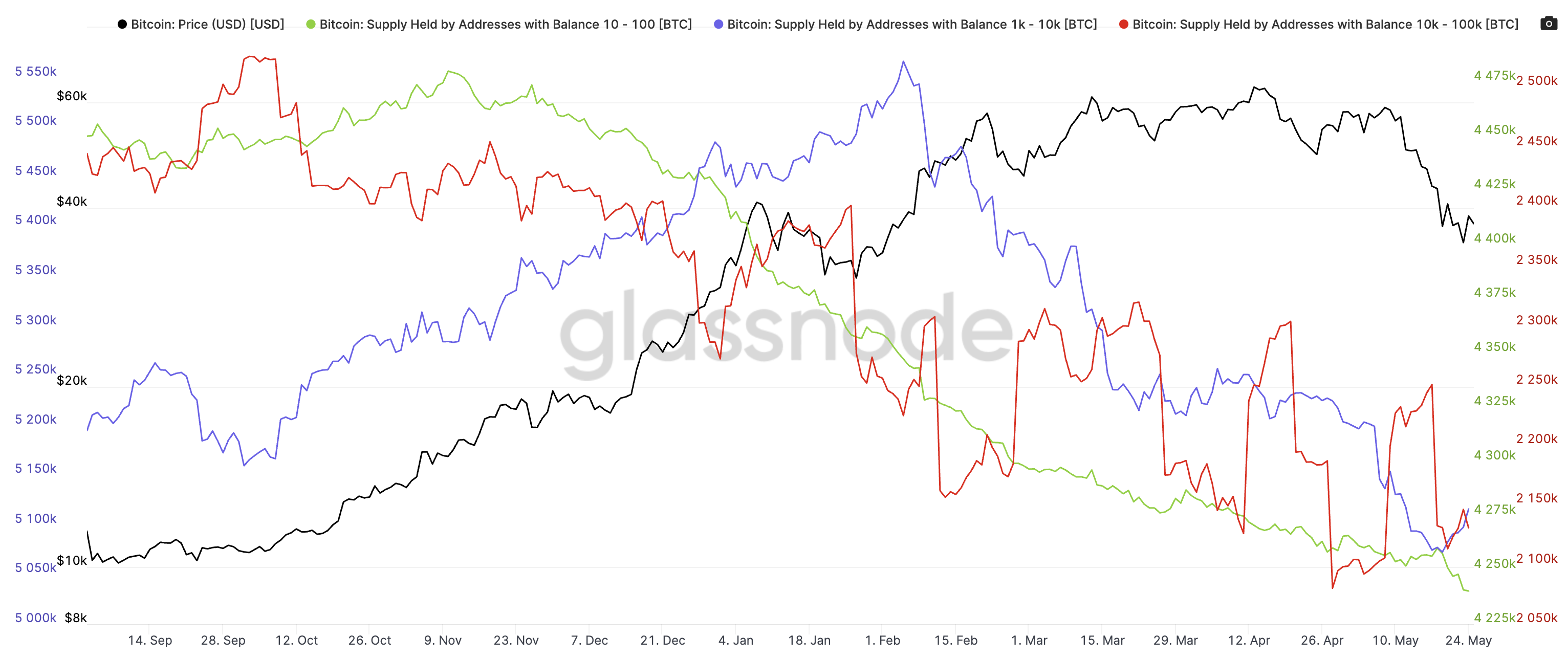

Here are some demographics of large wallets. Each show decreasing supply over the course of March, April, and May.

Don’t get too hung up on this chart. Its easy to get caught up in a lot of different things like how wallets are used for staging before selling, how Coinbase seems to use a new custodial protocol that breaks BTC into smaller amounts, and how many whales don’t just use a single wallet anymore…

The fact I’m simply conveying here is just bigger wallets that were once showing up as accumulating in the chart above were no longer doing so. Aka larger wallets that were once accumulating were selling.

The entities picking up the sold BTC were smaller wallets.

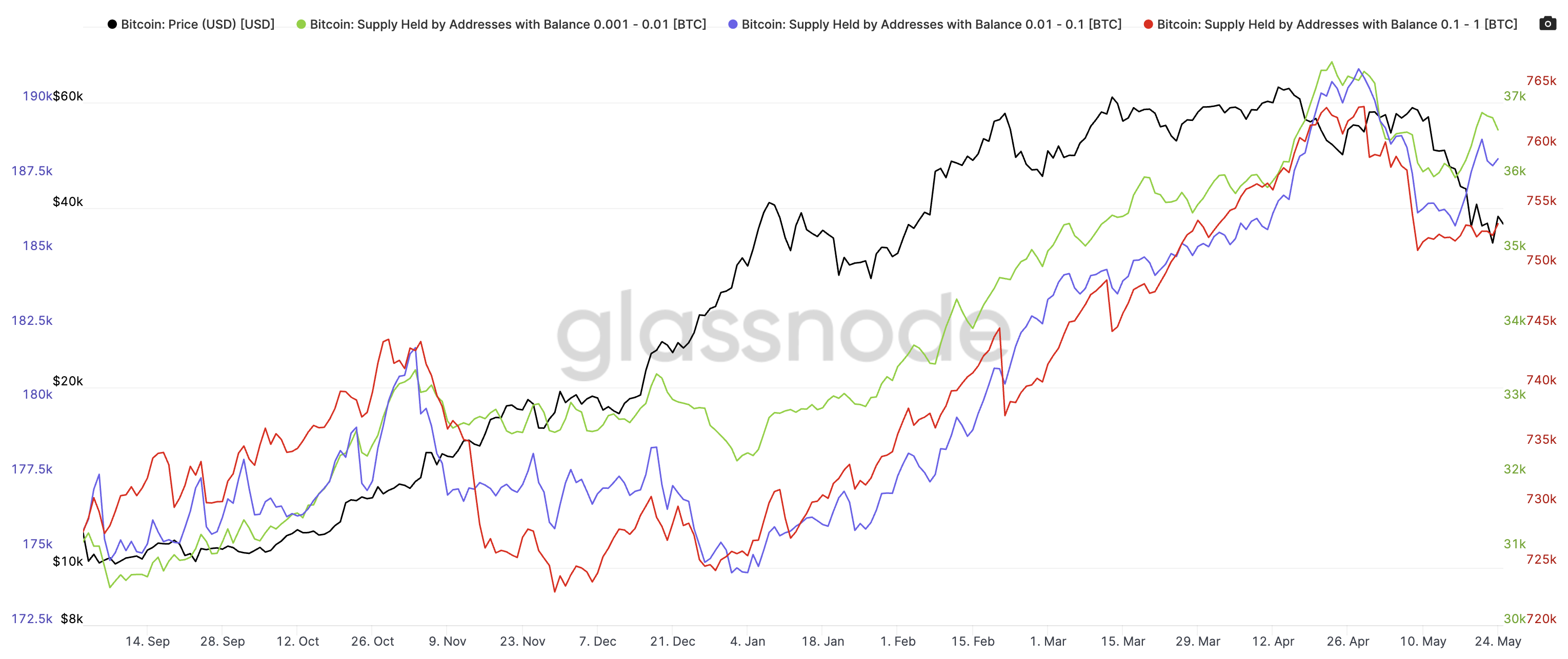

Sure enough, when we change the demographics of looking at wallets with less than 1 BTC… We see buying.

Now, in the chart below, that’s not enough to pick up the 100k+ of BTC that hit the market.

This is simply to show that those with smaller balances were accumulating while those with larger wallet sizes were no longer accumulating.

Its how we can call this sideways pattern a distribution event of larger wallets to smaller. And over time this isn’t sustainable in terms of price. You need large wallets driving demand to get higher prices.

Then acting like a pile on factor were the miners…

From May 11th to 16th miner wallets were ‘spending bitcoin’. This is seen in the green line in the tweet below. It was thanks to our friends at ByteTree who do good work tracking miner wallets. Its important to look at price on May 11th as that’s when the selloff really began.

Miner 1st spend data from our friends at

— JarvisLabs (@Jarvis_Labs_LLC) 6:40 PM ∙ May 23, 2021

@ByteTree

(Best reliable source about miner spends and generation). Past weeks they have been spending more than they generate.

So we had whales selling and miners selling at that point.

Then finally…

The market movers.

The most notorious of which is Pablo. He was a big component of the Covid crash in March last year. He or She was active again this time.

It appears the entity was testing support around $50k whenever we approached it during the last few months. They tested it again as price drove towards $50k in the lead up to Elon’s tweet. Then after Elon's tweet, the movements escalated. And once price broke there was no letting up.

The market movers we track saw the softness in price and aggressively attacked it.

Was this an OTC dealer wanting lower prices for the client as one of the conspiracies online tend to suggest? Perhaps.

Regardless, market movers piled on further and drove prices with no mercy. These were recorded in the wallets we track that are correlated to price. They sent our alert system into overdrive in the lead up to these drops.

Now, what this all boils down to is whales were selling for a while. Miners were selling before Elon tweeted and added on to the whale selling. And sharks (market movers) attacked the softness in the market that was building from whales and miners selling.

What’s more, retail did not sell on the Elon tweet.

Elon’s tweet was just something that happened during this pile on that was in effect well before he showed up.

Further, this was spot driven. Many say leverage was to blame. But here’s a quick stat…

On April 17th there were over $9 billion worth of BTC liquidated. On that day price dropped 15%.

The day of Elon’s tweet $7 billion was liquidated. Price dropped 35%. And that was after bitcoin fell 23% in the week leading up to his tweet.

And yet some industry veterans point the finger at derivative exchanges for enticing users for 100x longs… That’s definitely not the culprit here. And we need to be asking why these veterans are trying to point blame? It’s likely to push their own agenda.

But without getting off topic…

Whales, sharks and miners drove prices lower via spot markets. They got their dream of exiting at high prices. But will they return, and if they do, will go up?

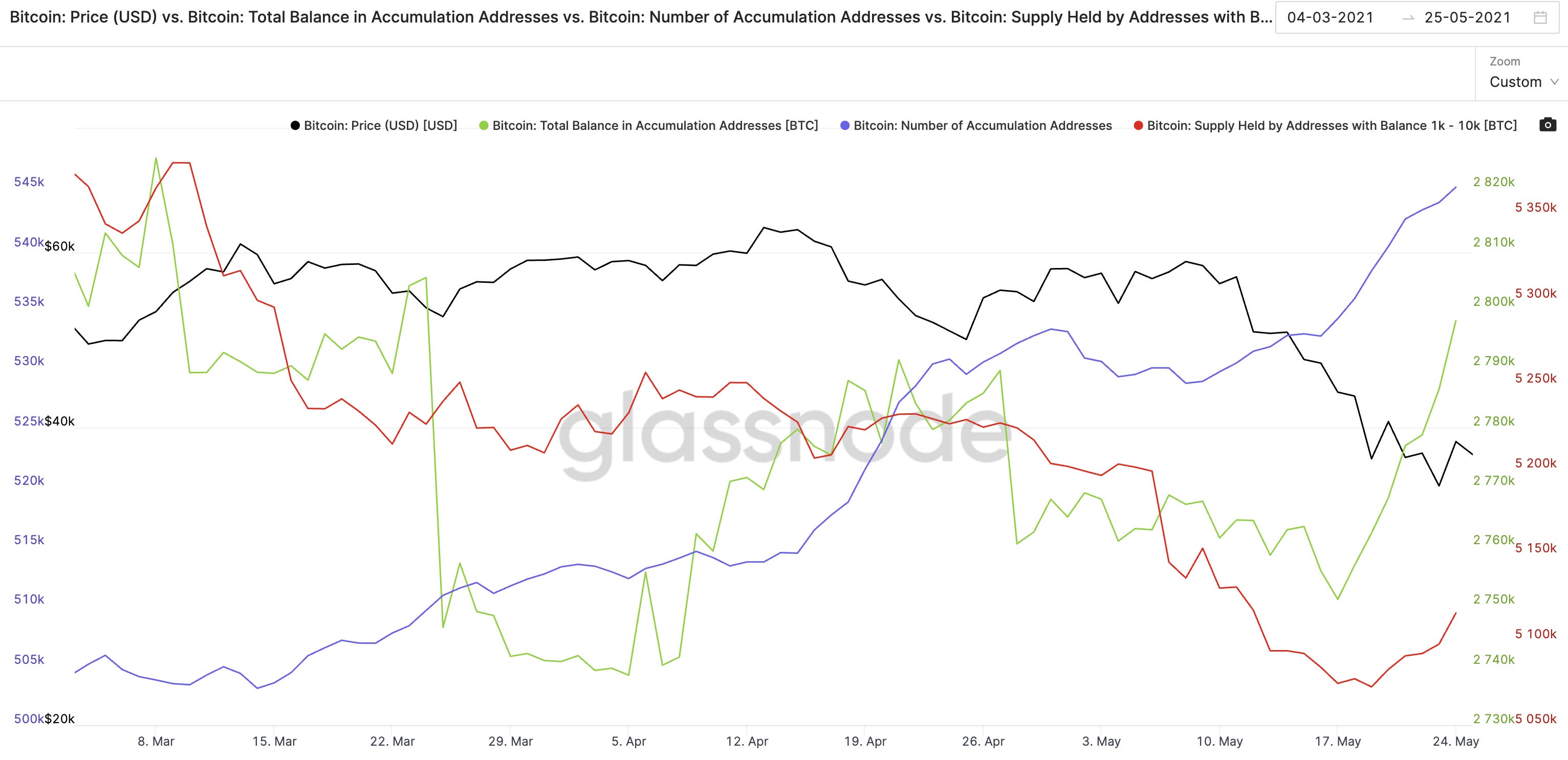

In the chart below the number of accumulating addresses (blue), total balance of accumulating addresses (green), and one whale demographic (red: 1k-10k size) is accumulating.

So right off the bat we can see these entities didn’t leave crypto. They are still here, and buying. And if they buying, then its likely in belief that prices will be higher in the future.

Which is good for the long-term bull cycle viewpoint to remain in tact. And we’ll continue to look at this now and then to reaffirm this belief.

And as for how Grayscale plays out in all of this…

Grayscale

If we assume what we see on-chain (whales now switching from selling to buying) and the fact we are in the midst of series of unlockings…

We need to assume GBTC was getting unloaded. Which is why the discount continued to grow.

But with this dip, and the discount shrinking, the same demographics and accumulation patterns are likely seen in Grayscale as well. Unfortunately we can’t see those demographics like we can with on-chain tools, so we need to assume its similar here.

If our assumption is correct, then it is good news for those looking for the premium to return. And in reality, it seems the path for the premium to return is more likely than ever before.

We have whale demand growing, the discount shrinking, and lower asset prices. Meanwhile, we are at the early stages of a massive unlocking with some big names coming due at the tail end of June.

(New to Espresso and don’t know what The Grayscale Effect is? Read here for more information)

Throw in new GBTC share demand via the new ETF called Simplify (SPBC), DCG dry powder ready to buy GBTC, and market FOMO currently six feet under as seen in funding rates... the playbook is drawn for the premium to return before the end of June.

All is needed now is price to charge higher before the end of June. That’s where my focus has turned in terms of when the discount needs to shrink for the effect to play out here.

Good developments taking place here. And it tells us we can have a strong second half to this bull run. It’ll just a bit of time to warm up the engine again.

Your Pulse on Crypto,

Ben Lilly