The Next Opportunity

Market Update: 20 December 2023

We can sum up the market with one chart.

Price is running and larger wallets for Bitcoin are still accumulating. That’s what the red color is telling us here.

This is not a coincidence. The timing is pretty apparent.

In fact, that first red arrow in the chart above is when BlackRock filed for a spot Bitcoin ETF. Ever since, accumulation has been very strong.

And in case you might think this chart is cherry picked, here is what it looked like last year. Hardly any red, but heavy green, the color that tells us larger wallets are not accumulating, but selling.

It’s a great chart to see what the general flow of Bitcoin looks like onchain. And it helps us understand the bigger picture.

As for what that big picture is…

If you haven’t read the news or follow random cartoon figures on X.com, then maybe you don’t know…

But Grayscale, the largest custodian of Bitcoin, is meeting with regulators frequently now. BlackRock met with the SEC and Nasdaq to discuss listing rules for the Bitcoin ETF yesterday. And much of the market is expecting the SEC to approve an ETF the second week into the new year.

The big picture is bullish.

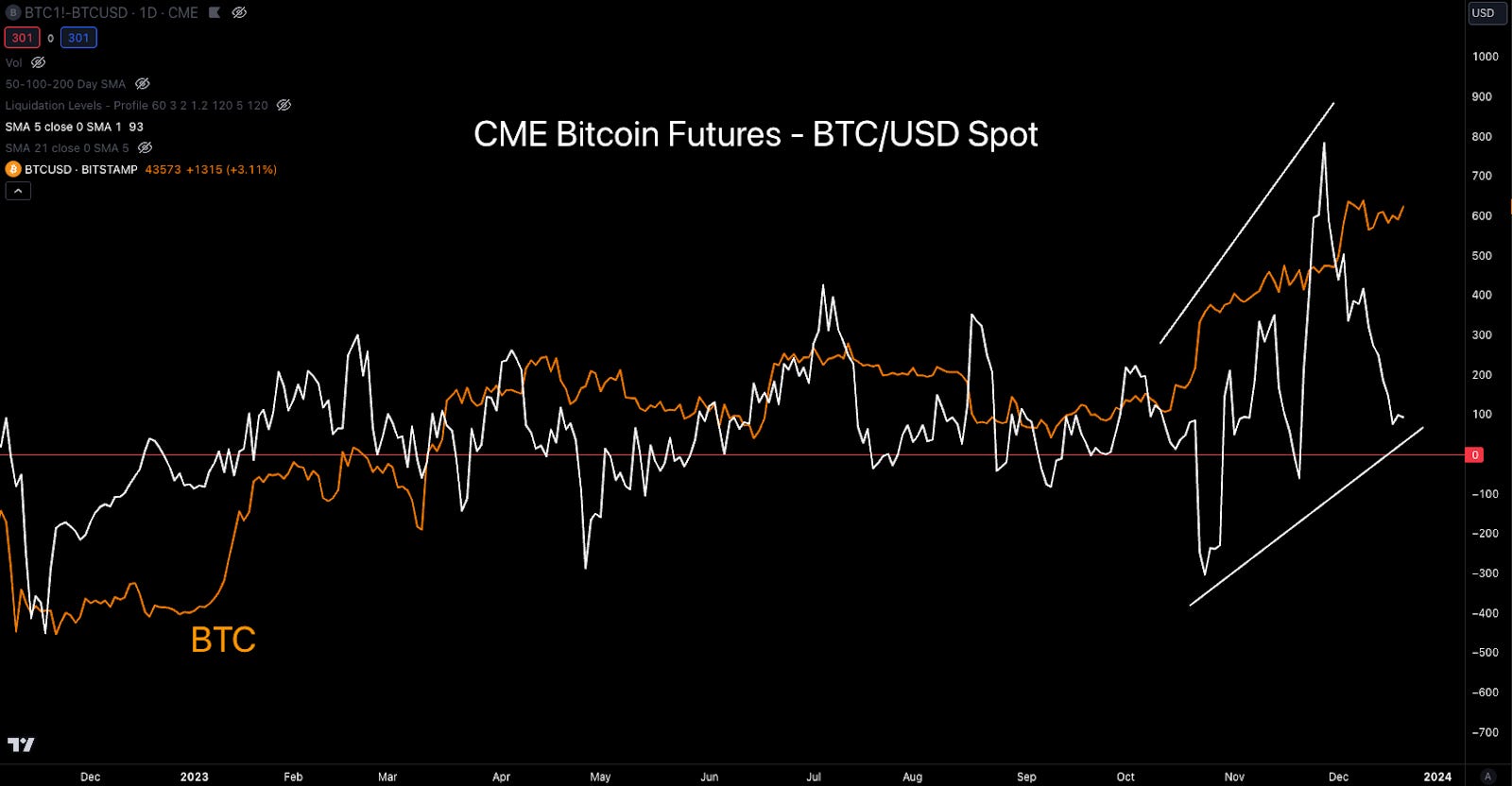

And to bolster this viewpoint that sometimes a trade is in fact that easy, here is the price of Bitcoin per CME futures minus the spot price of Bitcoin on Coinbase. I applied a 5-day moving average to make it a bit more visually appealing.

When the white line is above $0, then CME – where TradFi gets Bitcoin exposure – is trading at a premium.

This premium keeps heating up.

Sure, there’s a bit of alpha in that white line when you compare it to local Bitcoin tops, and also when it goes from a negative premium to a positive one, but that’s outside the scope of this quick write-up here…

The point here is, TradFi is piling in.You see it onchain. You see it in the CME vs spot premium. And you see it in this next thing…

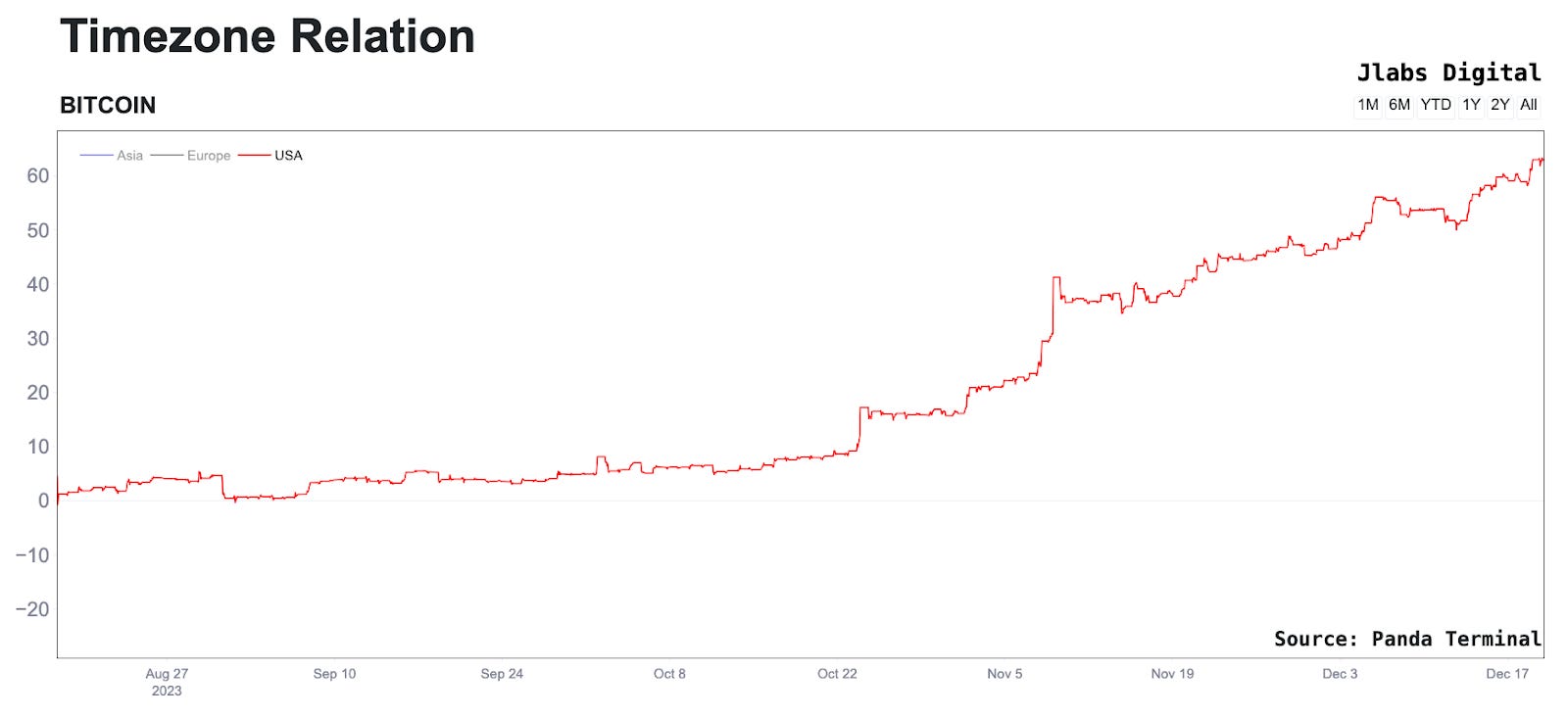

if you remember a piece that we wrote in August 2022, we made note of the New York trading hours. If the gains realized during that trading session show a strong bullish trend, don’t fade it.

Here’s what the New York trend looks like today…

It’s consistently and persistently up.

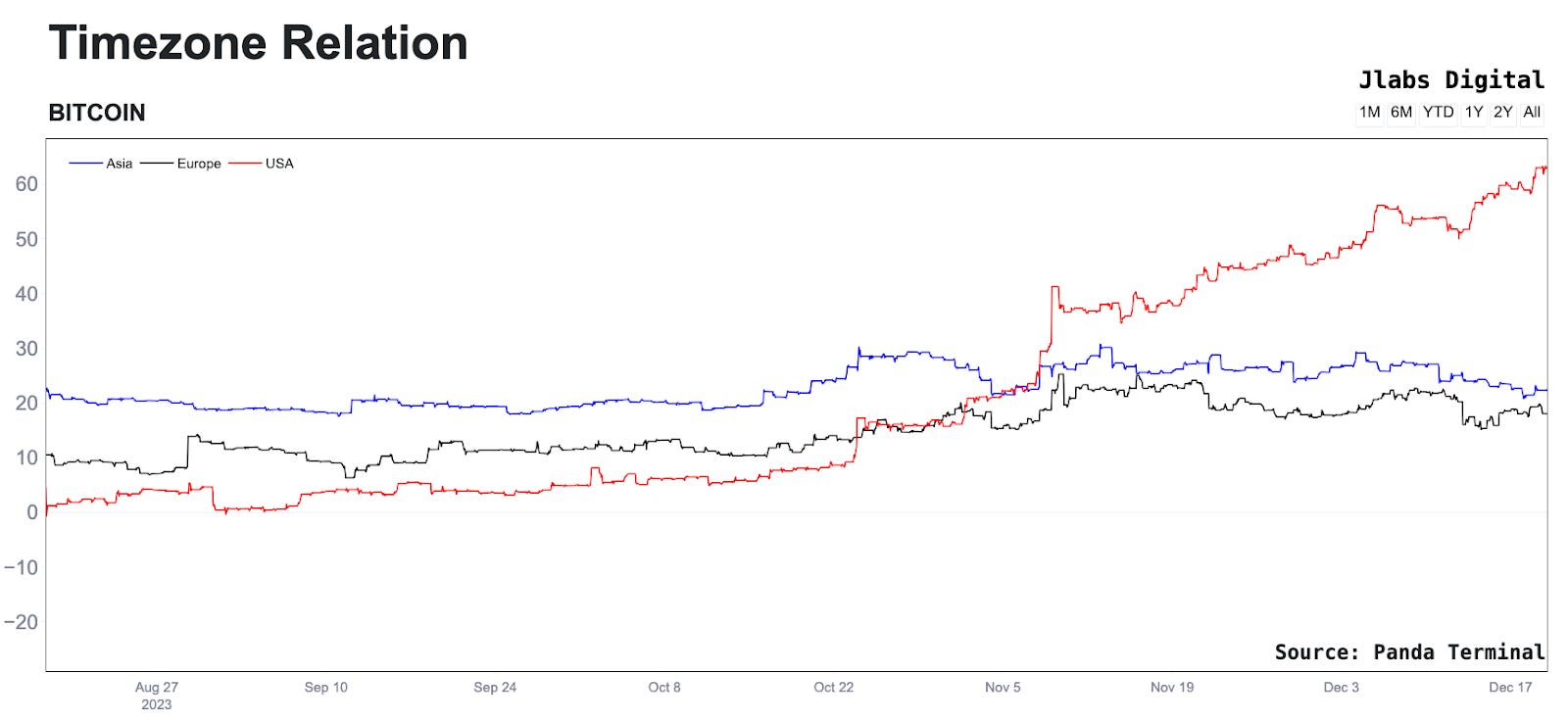

Meanwhile, the other two trade sessions, or the other 16 hours of the day, are flat. Blue is Asia hours, while black is Europe. The chart is below.

It’s hard to ignore the momentum here, despite the fact that we’re approaching being oversold. In fact, I even went into today’s podcast at xChanging Good prepared for such statement.

But with what we see here… In the coming weeks, Bitcoin might just have one last major rip higher that pulls liquidity from all the fresh new narrative and memecoin gains of late.

As for what to do if the market decides to simply ignore all signs of being oversold, refuses to take a chill pull, and rip higher… Well, if you’re not riding this wave, don’t rush in. Just let it unfold.

If anything, look for the next opportunity.

As for where that opportunity might sit, we discussed that during today’s LIVE show of The Trading Pit on xChanging Good (I linked the channel there, the show will be made available on December 21 around the New York open).

For a quick glimpse into what that DeFi narrative might be, here’s a chart that might give you a clue… It has to do with what Crypto Twitter is referencing as the most hated asset in crypto

(recall on xChanging Good we discussed Solana the most hated asset in crypto months ago. While I’m personally not as bullish as everyone else in 2024 for Solana - even though I do own a Saga phone - we acknowledged it was overly hated and was recoiling from that oversoldness).

Note that in the chart, the price line has finally changed color from green/purple to red… Suggesting accumulation is starting… And if one crypto ETF is approved, a second one for another token should be approved in due time.

Don’t listen to the noise happening in social media. This will rip some faces off. But until this catches a bid, don’t lose sight of the simplicity of the strong momentum taking place with BTC.

Until next time…

Your Pulse on Crypto,

Ben Lilly