The Liquidity Crisis Part Two: ETH

This is the most potent combination in markets.

I liken it to a freight train.

At first its engine grunts until the creakiness gives way to a low pitched roll. Bystanders aren’t paying attention and the passengers barely even notice. The event unfolds without flashiness.

It is just a slow roll generating momentum so vague it goes almost unnoticed.

Once the train leaves the platform bystanders express subtle amazement with a raised brow in response to the 14,000 ton machine’s cadenced movement. The momentum builds… And already nothing can stop such a force.

Then as it builds speed the train exhibits a controlled velocity with destructive capacities demanding you watch as it barrels down the tracks. You don’t get in its way. Nor expect it to stop soon. And the passengers enjoying the trip boarded well before the train’s momentum reached such impressive heights.

This is the bullish momentum I see when I look at a chart of Ethereum priced in bitcoin (ETH/BTC). The price is building slowly with only a few taking note.

And even for those noticing, I don’t believe most appreciate the magnitude of what’s about to unfold.

The explosive mix of dropping ETH supply in the face of rising demand will spur the biggest mania of this bitcoin halving cycle. And it’s getting ready to unfold in a couple months.

Let me show you…

The amount of Ethereum on exchanges are dropping fast. This is similar to what we saw unfold in 2017.

From March 2017 to shortly after the market’s top in January 2018, exchanges saw 9.75 million less Ethereum in their reserves. This came out to be 44% less.

Fast forward to this bull cycle, and exchanges are witnessing 6.5 million less ETH than what was there about nine months prior. This comes out to be about 25% less in reserves.

What’s interesting in the current chart is the breakaway speed at which ETH is leaving exchanges.

In the chart below I highlight the drop in reserves in 2017 which led to ETH’s prior ATH (vertical blue line). It’s the breakaway speed at which ETH is leaving - shown in a green box.

We’re experiencing a similar momentum now. The only difference is the percent of ETH which ultimately left exchanges was 39% before hitting the prior ATH. This cycle, if repeated, would give us a lot more room and time before we hit a similar figure.

What makes this a bit more interesting is in understanding where a lot of the ETH not on exchanges are now sitting… That’s because unlike last time around, a significant percentage of ETH are less liquid or literally illiquid.

Here’s a breakdown:

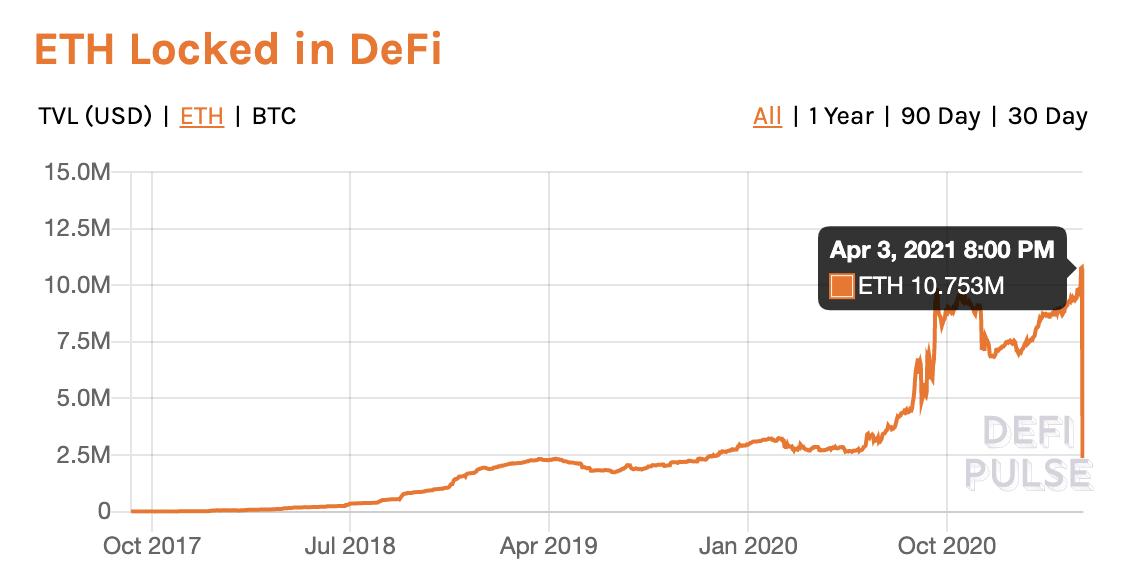

10.7 million ETH are locked up in DeFi.

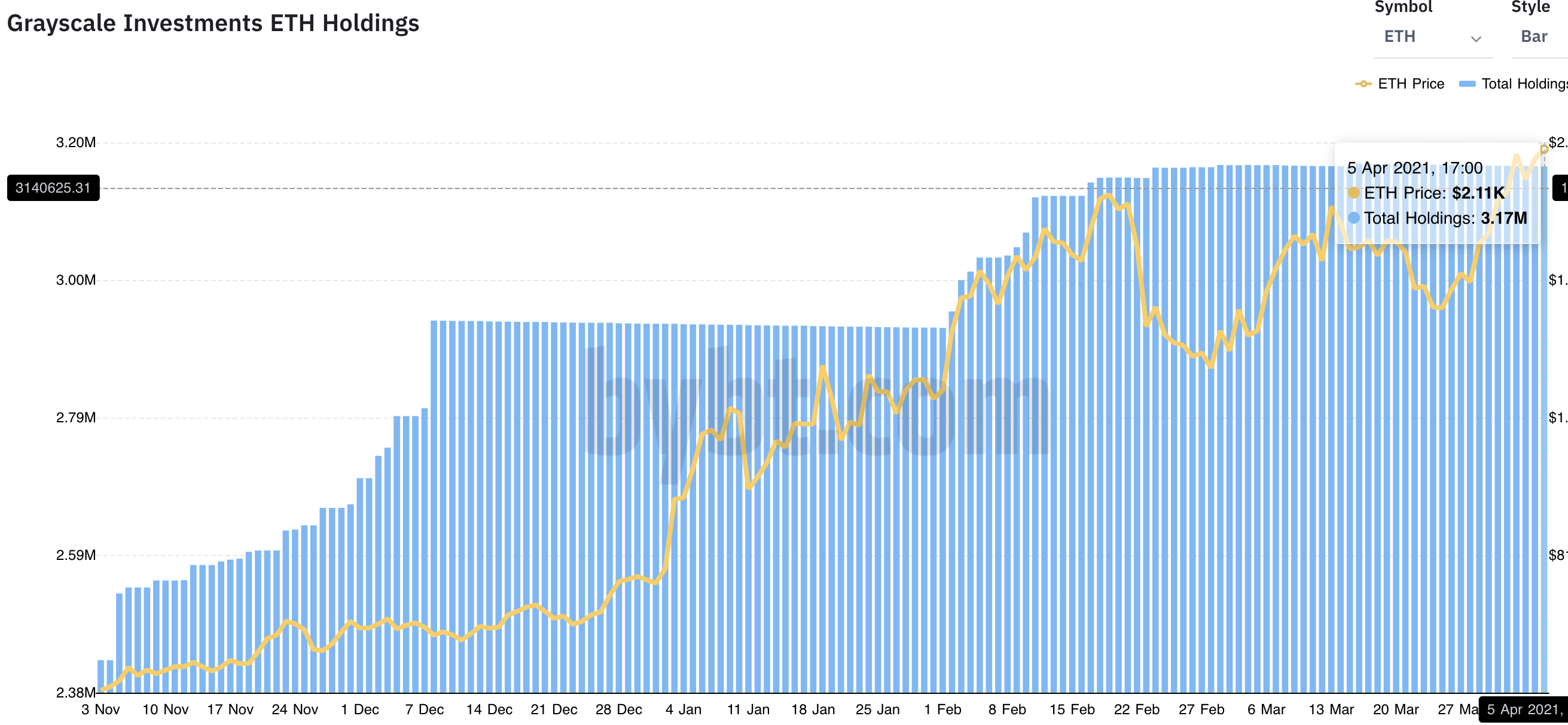

3.17 million ETH are locked up in Grayscale’s Ethereum Trust (ETHE).

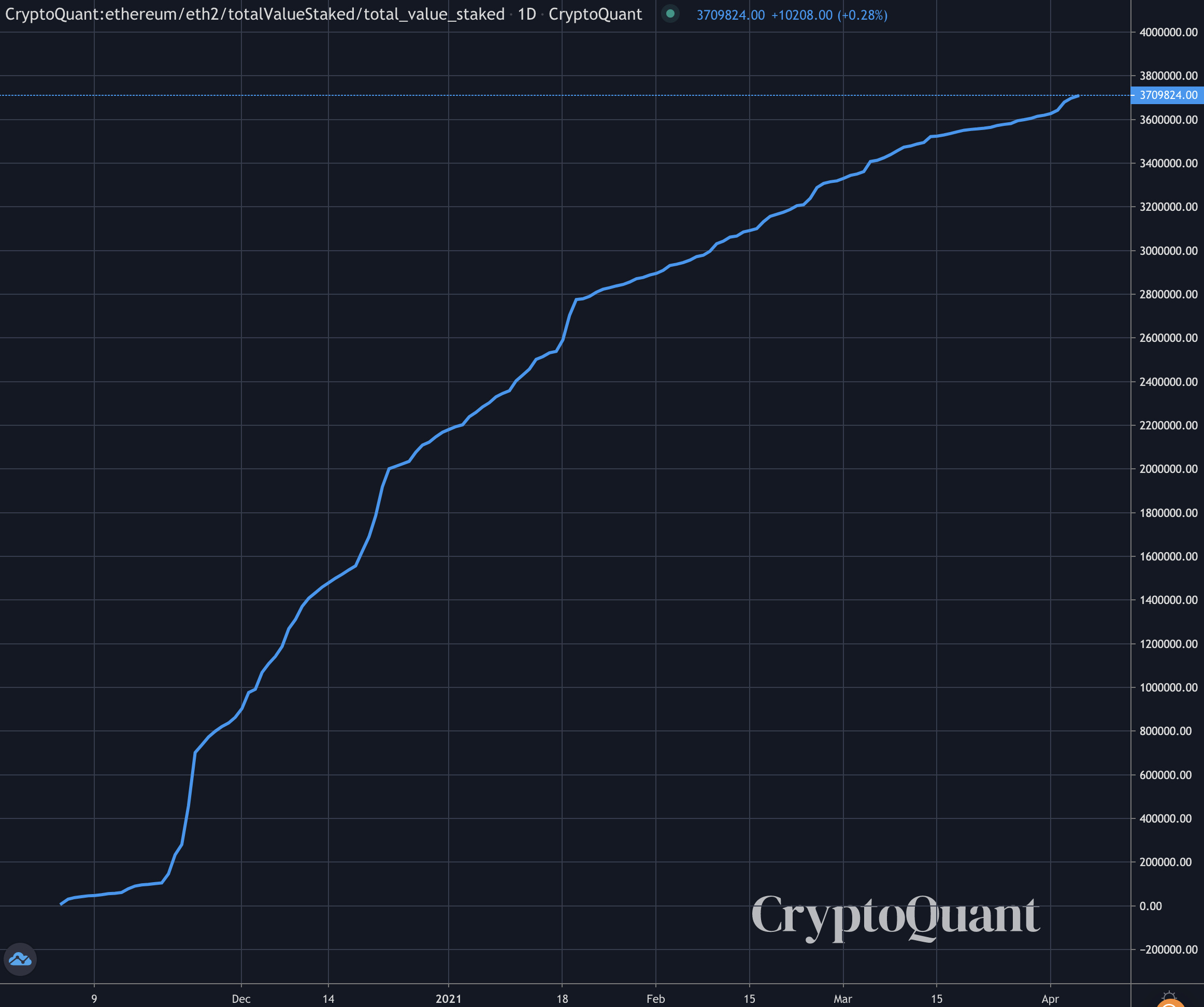

3.7 million ETH are staked on Ethereum 2.0’s Beacon Chain.

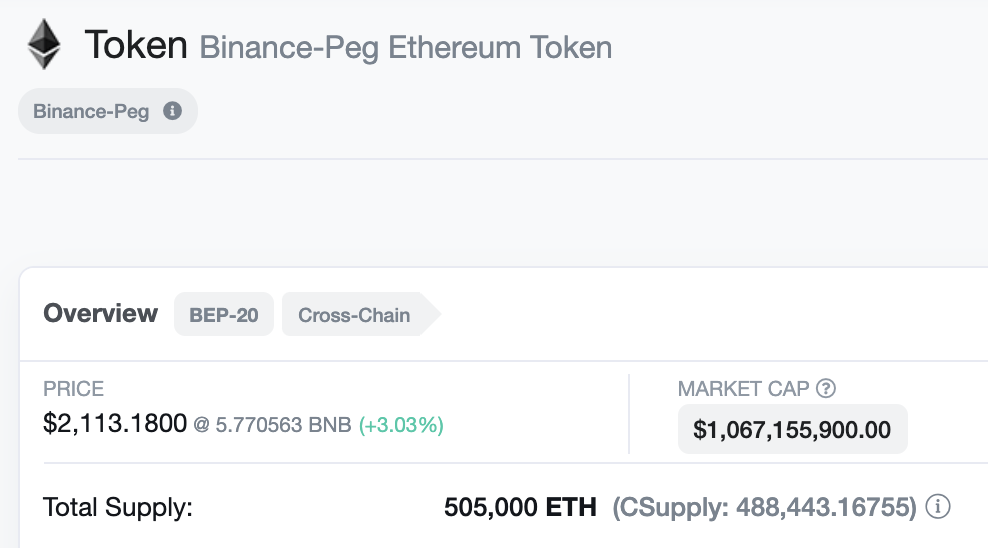

0.5 million ETH are sitting over as a BEP-20 token on Binance Chain.

That comes out to be just a bit more than 18 million ETH less liquid or virtually illiquid.

When it comes to the first part of our freight train, the reduction of supply is what goes unnoticed. It’s happening slowly and its effect on the market is not flashy.

The demand is what creates the explosive moves. And based upon what we’ve been laying out in Espresso the last few weeks, demand is not only here, but preparing to ramp up.

This is thanks to growing institutional demand due to the unethical management of the dollar, Grayscale Effect, and crypto slowly getting used as an everyday solution as opposed to just a speculative market (ie - Mark Cuban’s recent statements).

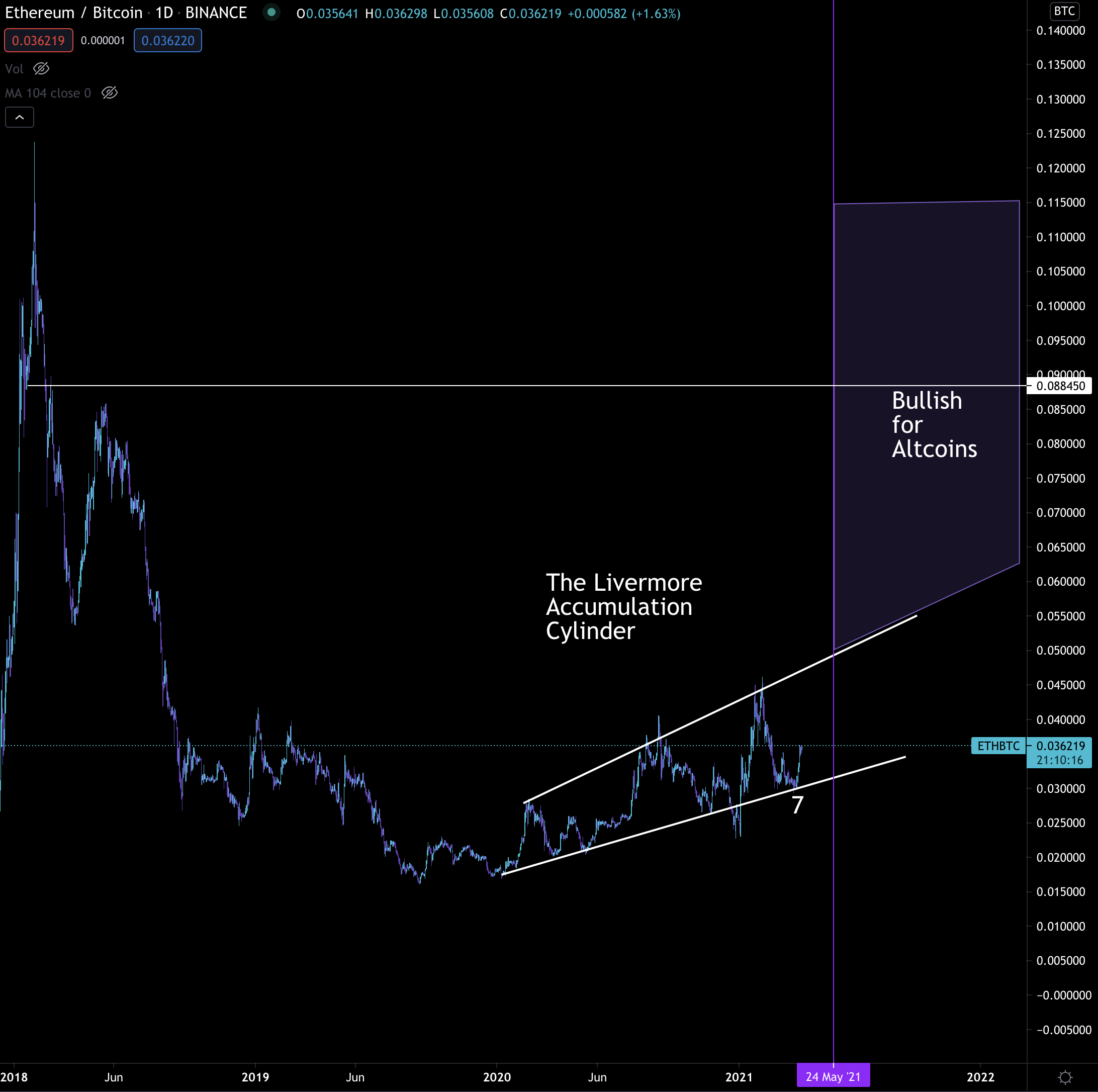

What this means is ETH’s price is gearing up for a historic run. Regular readers have been following along with a chart we posted nearly a month ago. It’s the Livermore Accumulation Cylinder chart.

The pattern is a very bullish formation that takes place before an asset turns parabolic. It’s most often seen during a cyclical bull run, which is what we are currently in.

What’s interesting is we are already witnessing momentum building near the “7”.

When price breaks this cylinder, it’ll create breakaway speed. Price targets can get pretty wild if one decides to take the time to do it.

That white horizontal line is a likely first target for this formation. That’s 0.08845 per bitcoin. If bitcoin is $120,000 when this target is met, that’s $10,614 per ETH.

If you think that’s wild, wait until you see what that type of price action does to altcoins further out on the risk curve.

It’ll be the first “altseason” in three and a half years.

Punch your ticket now before Ethereum’s liquidity crisis leaves you behind.

Your Pulse on Crypto,

B