The Hopium Seeds Are Starting to Sprout

Plus: Uniswap V4 Wasn’t the Biggest DeFi News Last Week; Triple-A ETH Yield; The Metaverse Is Now Compatible With Apple

It’s in the air.

Mild notes of bullish hopium, floating among the remnants of what can be best described as a now forgotten place.

That forgotten place being crypto.

It was once all the rage. The promised land. A new world. And so much more.

But today, you are no longer able to eavesdrop on conversations about crypto, Web3, or Bitcoin (BTC) at a coffee shop… Because those discussions have gone silent.

And if you do hear such conversations, you’ll note those words describing a land that was. Not an industry that is.

I can’t blame them.

Those conversations ring true in part. And they remind me of an old picture I often turned to in the aftermath of what was a terrible Q4.

It’s from a book called The Lorax by Dr. Seuss, a famous children’s book author in the U.S. In that picture, a single word was prominent: “Unless.”

In the pile of rubble that was FTX. All of us couldn’t help to think, what a mess.

Yet, if one person decided to think unless…

Unless there was hope, unless there was this, or a bit more of that…

Then we can build a place that was seen as the best.

Don’t know about you, but as soon as I think about Dr. Seuss, I’ll literally start to attempt to rhyme… Not well, might I add. So I’ll reel it back in now.

Point here is that back then, things were terrible. It couldn’t get much worse. The forests full of life that once filled the space had disappeared, leaving behind only a few stubs in a scorched land.

Then, the SEC and regulator banter started. It suppressed any “Unless” thoughts from coming to the surface. So I kept the picture on my screen as a reminder.

But recently, I took it down. Because I and many others are finally starting to see green shoots coming up from the ground.

A new draft bill sprung up in Congress that is ginning up lots of optimism. BlackRock is taking a stab at getting a Bitcoin ETF approved, and rumor has it Fidelity will, too. Citadel is coming back into the picture with their exchange going live. And Gary “Shades” Gensler is turning into sour milk by the day.

The cool breeze of bullish hopium is making its way across our barren land.

And while BTC might go ahead and retest the 200-day moving average in the months to come, I’m here to say I am extremely optimistic about what I hear on the ground. There are a lot of things to be positive about. Yes, it’ll take time. But things are headed in the right direction.

More to come on that front soon enough. In the meantime, let’s get to our Blend of topics…

The Bane of Liquidity Providers Might Be Going Away

The Uniswap v4 white paper dropped last week, but what really got our team’s attention was another project’s announcement that might have bigger implications for liquidity providers (LPs).

Before we get to that, we have to explain why current LP yields aren’t what they seem.

The first problem is impermanent loss. It’s a fun way of saying if you own 1% share of the entire pool, and one token appreciates in price, you will be holding less of the token rising in price and more of the token that didn’t move.

Womp womp. But that’s the cost of supplying liquidity.

Uniswap v3 tried to combat this by enabling LPs to set price ranges at which their tokens are swapped. Meaning if one token shot up in price, their token might not be swapped (but the LPs would also lose out on fees for those trades).

The unfortunate truth is that most people are terrible at setting these ranges. Meaning true yields on v3 are nowhere close to what we expect based upon calculated pool averages. For this reason, Uniswap v2 tends to be better for users.

But the second problem is what is called JIT, or “just-in-time” liquidity.

Let’s say a big order comes through the swap pool. It’s in your price range, so you’re sitting there all giddy. All of a sudden, as you see the order come through, there’s a quick uptick in LPs. And by the next block, those same LPs are gone.

Welcome to JIT. It’s where bots add liquidity into a very narrow range where an order sits, and removes the liquidity – in the same block. Meaning your share of the trade fees got partially hijacked. And it was done so with minimal risk to the JIT LPers.

Life is not fair. And your yield is not what you think it is often for this reason.

Well, that’s where the project formerly known as CrocSwap comes in.

Launched two years ago, CrocSwap was a smaller project that set out to improve yields for LPs. It recently rebranded to Ambient Finance.

And it looks to address JIT, which is why the JLabs team got excited. Ambient claims they do not allow same-block liquidity provisioning.

You see, because of the problems above, yield for v3 is a bit of an unknown. Sure, we track the data and compute the averages like most. But the truth that exists below the surface is very murky. And how to present this murky data is an even bigger unknown.

The hard part is we know that retail is getting the short end. And if many are not getting the yields they expect, then liquidity will dry up even further.

That’s a problem for a space that’s trying to become less dependent on offchain exchanges and solutions. Seeing solutions like Ambient’s come into play means we should see similar types of possibilities spring up within the ecosystem’s largest pool of liquidity, Uniswap. That’s a win for the smaller apes.

Ethereum Needs a Risk-Rating System

Nobody’s checking out of Hotel Ethereum.

We’ve talked about how the fear of a massive exit of Ethereum (ETH) validators was a bit overblown. Sure, there was the initial surge of validators that exited as soon as they could. This list likely included service providers like Kraken who were obligated to do so.

But since that initial rush, the exit queue has vanished. And instead, we have 620,880 active validators, with 91,000 more looking to get in. That would be a nearly 15% uptick.

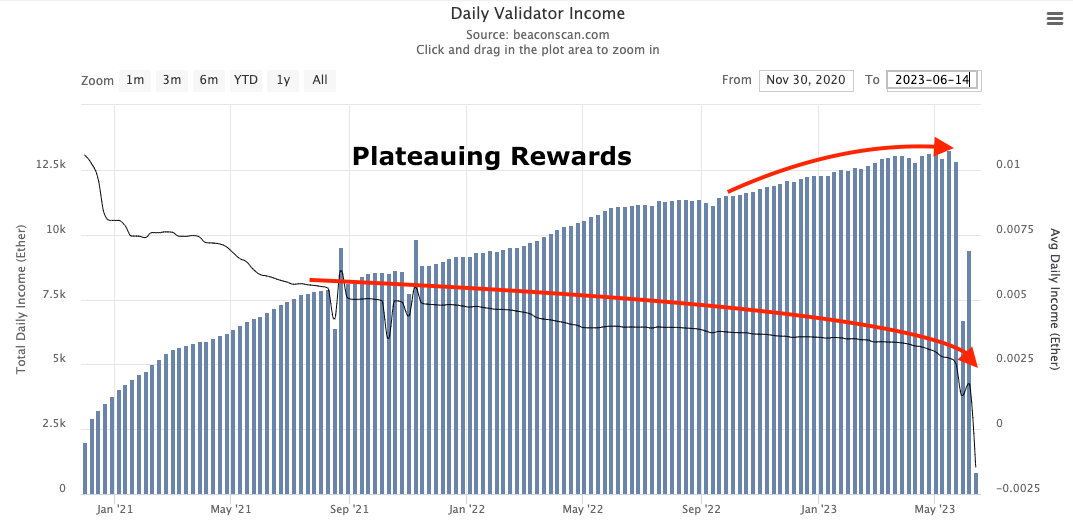

Meanwhile, the rewards validators earn are beginning to plateau. You can see this in the chart below.

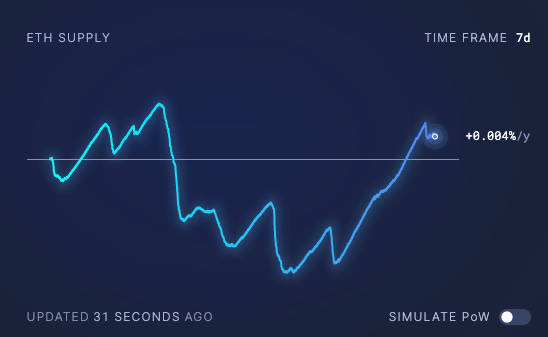

This is due in part to the low amount of activity taking place on the Ethereum network. It’s also why inflation has started to creep into the monetary realities of the system, as seen below on a 7-day view.

If you zoom out, the inflation is still negative. But I use this granular view to make a point.

ETH yields on staking are around 3.5% based upon the figures seen above. Once all the validators waiting to enter the queue get onboarded, this rate falls below 3%.

Which begs the question, will we start to see a slowdown on ETH locked?

To better answer this question, we need to look at other forms of yield for ETH. One of the simpler ways to look at this is becoming an LPfor the Uniswap v2 stETH/ETH pool.

This pool gives the user continued exposure to ETH. It will also benefit in the event that individuals look to exit their stETH position due to a decline in rewards.

Considering the yield on a 30-day moving average, we see that this pool is rather attractive.

I covered it when talking with Marconi Wight last week, on how these other alternatives are likely to become ever more attractive.

But due to the ability to really address risk, these yields are hard to compare. There is no apples-to-apples comparison when it comes to Triple A-rated Beacon Chain yield.

It’s a showcase of how this ecosystem can take the next step on the maturity scale to improve ecosystem liquidity and yields, and build out the next financial system.

Your Next Podcast Is Airing in the Metaverse

Speaking of this Marconi Wight character…

He will soon be viewable on a pair of Apple VR goggles as he hosts his Alpha Bites show in the Metaverse.

It’s a future that feels far off. But it speaks to just how close we are getting to a Metaverse we may start to use… Maybe not on a daily basis, but let’s say, on an occasional basis.

For those that are unfamiliar, Marconi is the individual behind xChanging Good (XC). You may have seen his name and “face” appear as you watched the Sustainable Web3 Design series brought to you by Jarvis Labs and our in-house analyst, Rishi. And while you may have seen it, you likely don’t know what it’s all about.

The xChanging Good Studio is meant to be a place that maintains a permissionless and decentralized attitude towards sharing insights. Meaning any analyst or entity, anon or not, is welcomed here. The Studio in turn helps turn ideas, insights, and knowledge into easily digestible content by providing the resources you need to get the alpha across.

Now, the reason for bringing it up here within Espresso is the XC team began to look at a project called oncyber. It’s a metaverse platform that makes it easy for anyone to create their own 3D, immersive experience that can be accessed from the browser.

You can see a snippet of a space one of our designers put together quickly using XC artwork to gauge the platform’s capabilities. Sort of neat.

My initial impressions after the novelty wore off was the fact the space is rather awkward in some ways. There is a bathroom, bed, and kitchen… All things that are not needed in a virtual environment. The avatar even moves through the dimensions of the room rather fast.

Could I really move from one side of the condo to the other in less than two seconds? No chance, let’s just say I’m not threatening any Usain Bolt records anytime soon.

But if we ignore some of the cons here, we can see there is a lot to be positive about. The ability to place digital assets on display is rather easy. We were able to put on the most recent Alpha Bites episode in the room in case the team missed Marconi’s 1950s cigar-smoking detective-like voice.

And we could even talk to others in the same space. Which is a refreshing alternative to the chat software we use like Discord.

And by the end of this experience, I viewed it as an impressive start to making virtual worlds easily attainable to everybody.

Then I learned something that really tilted my head.

Oncyber will be available on the Apple Vision Pro on Day 1 (the goggles launch sometime early next year). The biggest splash of June in the tech world is something oncyber is looking at.

That’s because oncyber is compatible with Safari, and Apple made sure its browser was updated to handle 3D on its fancy swim goggles.

This opens up some interesting possibilities for Web3. And it’s in part why the xChanging Good team is starting to look into this technology.

Hopefully, we’ll see you in an upcoming Metaverse soon.

That’s it for me this week.

Your Pulse on Crypto,

Ben Lilly

P.S. - Aave Part 3 will be released today (June 21) at 16utc. We hope you can make it. Rishi, myself, and likely others from the team will be in the chat as we release the episode. We look forward to hanging out with you all, so if you can, please stop by! You can set a notification for the event.