When to Expect the Final Shakeout

Market Report: This Signal Hasn’t Flashed Just Yet

Ben Lilly here.

If you’re a regular reader, you know here at Espresso we strive to offer you a variety of insights, no matter what part of the crypto community you call home. Whether it’s musings on Web3 or a token design breakdown, part of our goal is to provide you more than just one flavor of content. And we plan to continue doing so.

But we’re always looking for ways to better serve our readers. And we know many of you benefit the most from our market analysis. So rather than abandoning you to separate all the noise from the signal on your own, we decided to ramp up our coverage in this area.

Starting today, you can expect regular updates in Espresso – likely twice a week – that touch on what signals the market has put out recently and how you can take advantage.

These updates will be shorter than our usual essays, and they’ll come from both Benjamin and myself (The Bens). You’ll find the first one below.

We hope that along with The Blend, these short-term pieces help you stay even-keeled as you navigate the markets day-to-day. And remember, we’ll still provide you longer, more in-depth insights as well from TD, JJ, and Kodi.

Let us know what you think in the comments below. Otherwise, let’s get you caught up on how we are viewing the latest market rally. That way, we can be on the same page for why we will be focusing on a certain set of metrics…

The seasonal change from winter to spring always plays out the same way.

The weather hints at warmer months to come as snow gives way to barren land. There is a week of higher temperatures that has you reaching into the back of your closet to find your favorite shorts.

But soon after, the cold returns, and spring retreats for a little while longer.

You know the cold won’t last long, but this typical springtime tease is something we all know too well. And while it doesn’t happen on the same date every year, it tends to take place around March and April – at least in the temperate climate.

We can lean on this seasonal understanding when looking at Bitcoin. The main difference is that instead of the sun making these seasonal changes, it’s Bitcoin’s halving, which occurs about every four years.

Through this seasonal change, Bitcoin tends to have its spring time tease… And as I’ll show you right now, we need to be paying attention.

The next bitcoin halving isn’t until April 2024. As we’ve mentioned before, BTC tends to bottom out about 13-18 months prior to each halving. With the next one just 12 months away, the strong price action off the lows should be taken seriously.

But there are a few other factors to consider before we all pile in, one that brings back the latest memories of winter.

Ignore This Signal at Your Own Risk

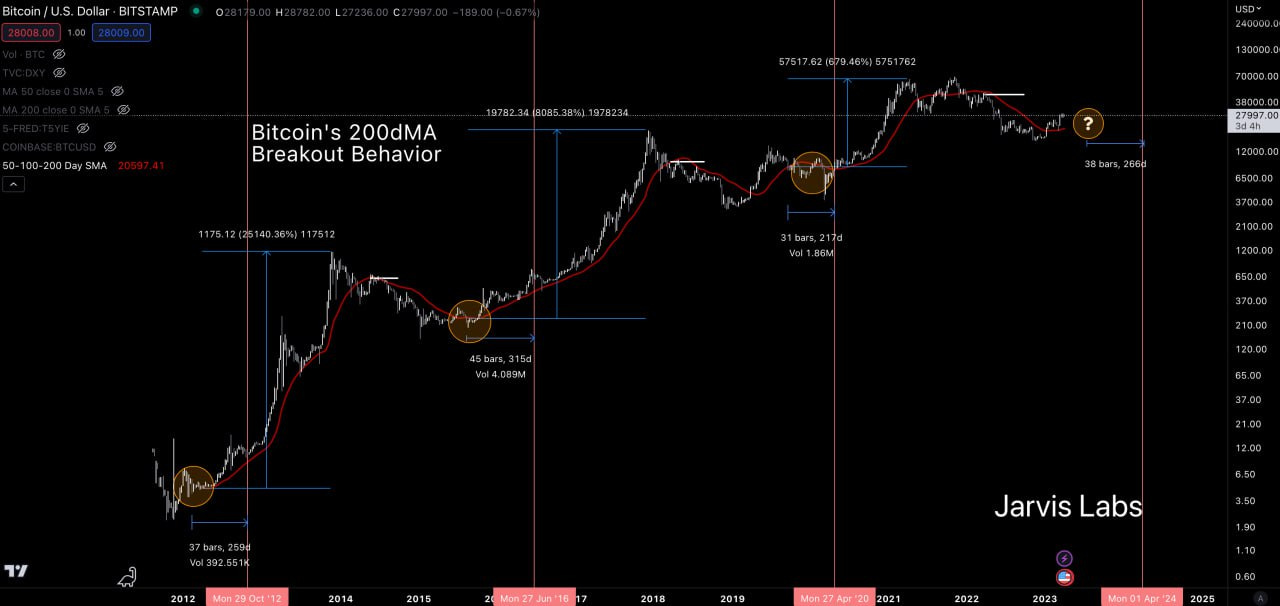

One of the most important metrics to watch is whether BTC is above or below to its 200-day moving average (MA). This is a well-known sign of strength or weakness.

So when BTC climbs above this MA, it can be an incredibly bullish signal.

This past January, BTC broke above its 200-day MA for the first time since the end of 2021. The first signal like that in over a year is not one we should ignore.

And in another sign of strong behavior, it retested this MA in March (red circle in the chart below), holding firmly above it.

At first glance, this might appear to be the first sign of spring. But things are never that easy… We need to consider the current halving cycle we’re in.

When bitcoin is coming off halving cycle lows, price does not automatically clear the 200-day MA and stay above it. Instead, it likes to return below the 200-day MA before going on to form all-time highs.

In the chart below, the dark red line is the 200-day MA. The orange circles are when price dipped below the 200-day MA. The light red vertical lines represent prior halvings. And the percent gains represent the price changes from when price broke below the 200-day MA to the high of that halving cycle.

There’s nothing to suggest we should expect anything different this time.

In fact, I'd argue there’s a catalyst coming this summer that will coincide with price dipping below the 200-day MA…

Help From the Fed?

We’ve written before about the upcoming rollout of the Federal Reserve’s CBDC, FedNow, this July. If that happens as scheduled, the timing might be rather helpful here.

In each of the last three halving cycles, price dipped below the 200-day MA between 217 and 315 days before the halving itself.

If that happens again this cycle, that puts us sometime between June and August... with FedNow set to roll out smack in the middle of that period, we can expect regulator war drumming to be ear deafening by then.

Which means two things.

First, there might be some truth to “sell in May”... and go fishing.

Second, if the war drum bangs louder with FedNow rolling out, it might provide a final shakeout moment as price drops below the 200-day MA. It’ll represent price action that carves out a higher low in the market. And it might be that cliché market moment where you’ll finally get an attractive price…

But will fear paralyze you into indecision?

That’s why we shared this analysis now, so you won’t be caught off-guard. It shows us the typical price action during halving cycles, so if bitcoin decides to dip back below the 200-day MA, we’re mentally prepared for it.

In the meantime, let’s be on the lookout for when the market begins to get overheated. That way, we can derisk our portfolios (or hedge longer-term positions), and even watch for a mini-alt season to unfold as that overheated moment nears.

Now is not the time to be on the sidelines with your parka on.

Your Pulse on Crypto,

Ben Lilly