The Hidden Warning Sign

Market Update + Macro Talk

The grind.

You turn your computer on, pull up the charts, rifle through your indicators, check the news, and then move on.

There is not much to get excited about now.

Times like this tend to happen after a sharp selloff. One that causes real damage.

Many who recall May 2021 will testify that the weeks that followed were rather boring.

Price bounced about creating temporary dopamine rushes. But nothing was indicative of an overarching macro trend.

And right now we are sitting in a similar rocky boat that will lull many to sleep.

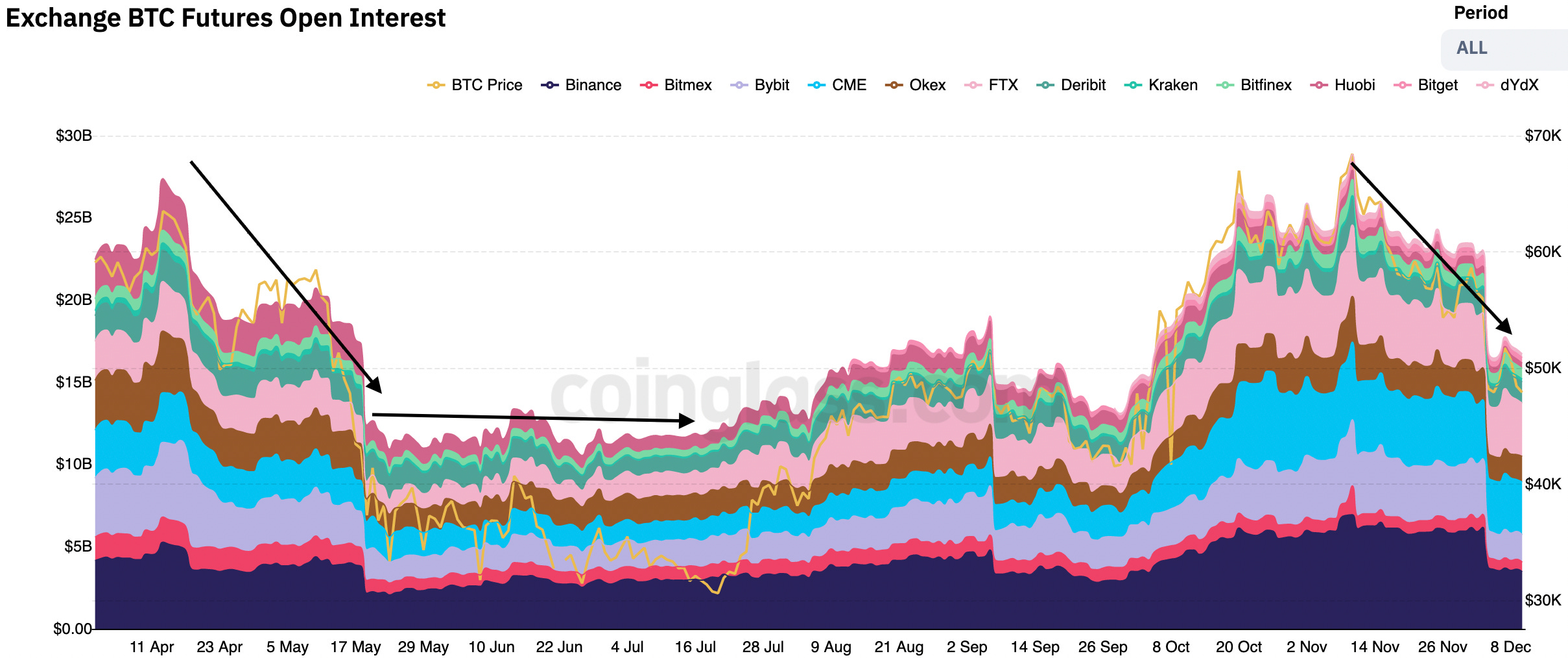

As mentioned, this activity tends to happen after open interest in the futures market gets chopped at the knees. It will likely take some time before we build momentum. You can see the last time open interest got whacked like this below it took a couple months before open interest started to trend higher again. It’s a sign of growing confidence in the market.

Luckily, for anybody wanting to accumulate on a weekly basis or at the bottom portion of the current trading range, this is a great setup.

Thus far, the main winners since the selloff appear to be the parties who sold volatility. This means selling options to take advantage of the higher premium that option writers demand due to the large and sudden price swing.

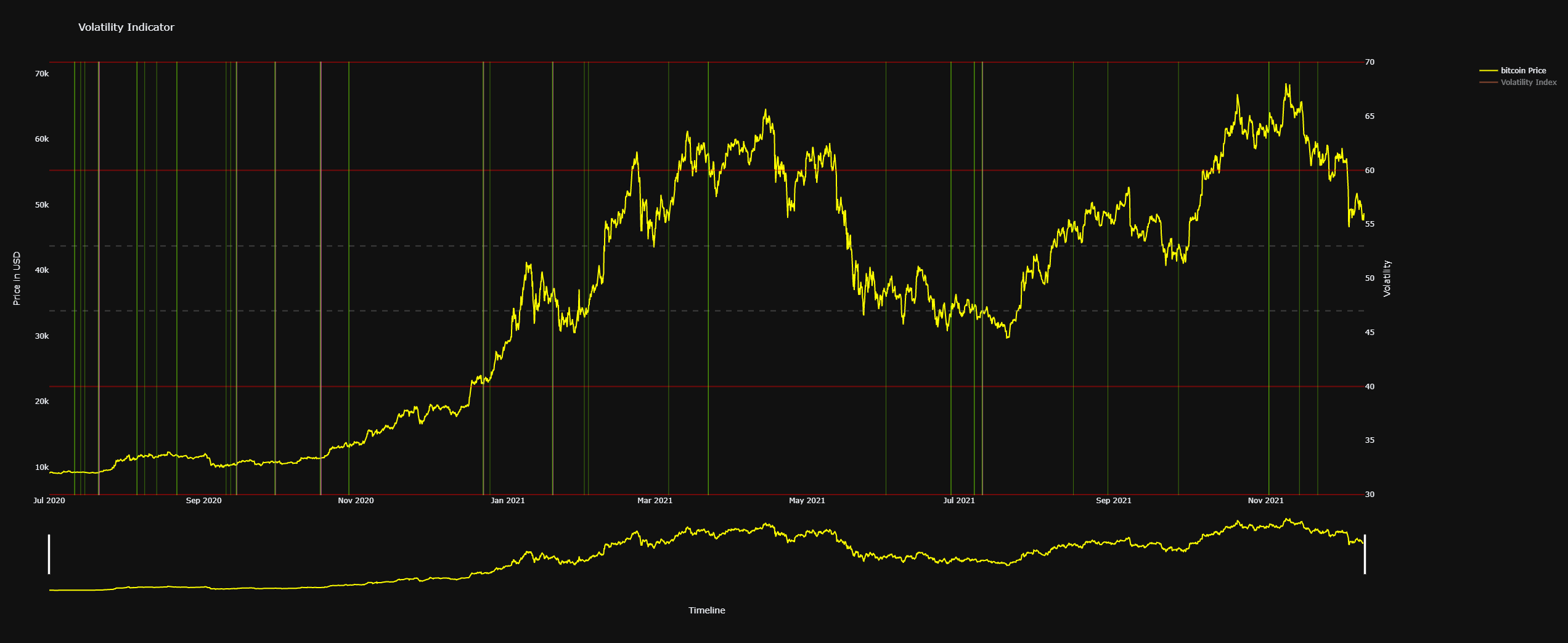

You can see the spike in volatility as measured by the BitMEX volatility index below. Last time volatility was this high it was due to the May 2021 selloff and the June dip that followed where price dipped to around $30k.

The reason we say volatility sellers look to be winners is our in-house volatility prediction model is saying no large price swings look imminent.

You can see this below with the lack of vertical lines on the far right-hand side. The yellow line on this chart is Chainlink’s price. You can safely assume it’s similar for the rest of the large cap coins.

Chainlink

Bitcoin

What this tells us is we can expect to stay in this trading range until at least the end of the month. Why that timeline?

Because the largest open interest in terms of open contracts is December 31st.

Right now there is nearly 120k BTC in open interest, no expiration beforehand exceeds 20k of OI, a sign of how much attention the market is placing on this date.

Unfortunately I don’t have a screenshot to compare what this expiration date looked like before the selloff, but if I had to guess, a lot of positions were opened up around the selloff.

So, with the expectation that the days coming up will be a bit of a grind, what do we focus on?

The man at the crank.

The child of the political swampland.

The king of the brrr himself…

Mr. JPow.

Next week Federal Reserve Chairman, Jerome Powell will command the media’s attention as he addresses them after him and his banker squad meet in oak adorned quarters.

Most are expecting hawkish tones to continue. These tones will be populated with words like tapering, rolling back QE, and hotter than expected inflation.

And because the market is also expecting this, I’m not entirely sure what to expect. Most of the time I build these events up to be bigger than what ends up unfolding. So I try to temper my own expectations. Which is why I’m leaning towards a non-event.

But part of me thinks a certain warning sign that happened recently might get addressed in some form.

The warning sign that I’m referring to was seen in the Eurodollar markets.

For those that don’t know, the Eurodollars futures market is akin to a prediction market for interest rates with “100” being a rate expectation of 0%. And a reading of “99” would indicate that the market is expecting a rate of 1%.

And since these are futures contracts, this expectations are centered on what the rate will be at the time of expiration. Meaning the December 2023 futures contracts indicates what the market thinks rates will be just before 2024 rolls in.

The chart below are Eurodollar futures contracts expiring every December from 2022 to 2026.

The part to focus in on is how the later expires (2024, 2025, 2026) are trending higher while the near term contracts are dropping (2022 and 2023). The warning sign here is in the cross over that happens in the red circle.

If this were the treasury market the media would be all over this event as it would be a yield inversion. But when it comes to the Eurodollars, this is more of a global barometer for future expectations… And it’s hinting at the prospect that the Federal Reserve will need to unwind rate hikes in a couple years.

A simple way to think of this is when the Federal Reserve will end their attempt at tapering. And based upon current expectations, the market thinks the Fed will hit this moment earlier and earlier as each day passes.

In fact, these expectations are alluding to the need to cut rates BEFORE JPow actually starts hiking rates. This is a bit unprecedented.

How unprecedented?

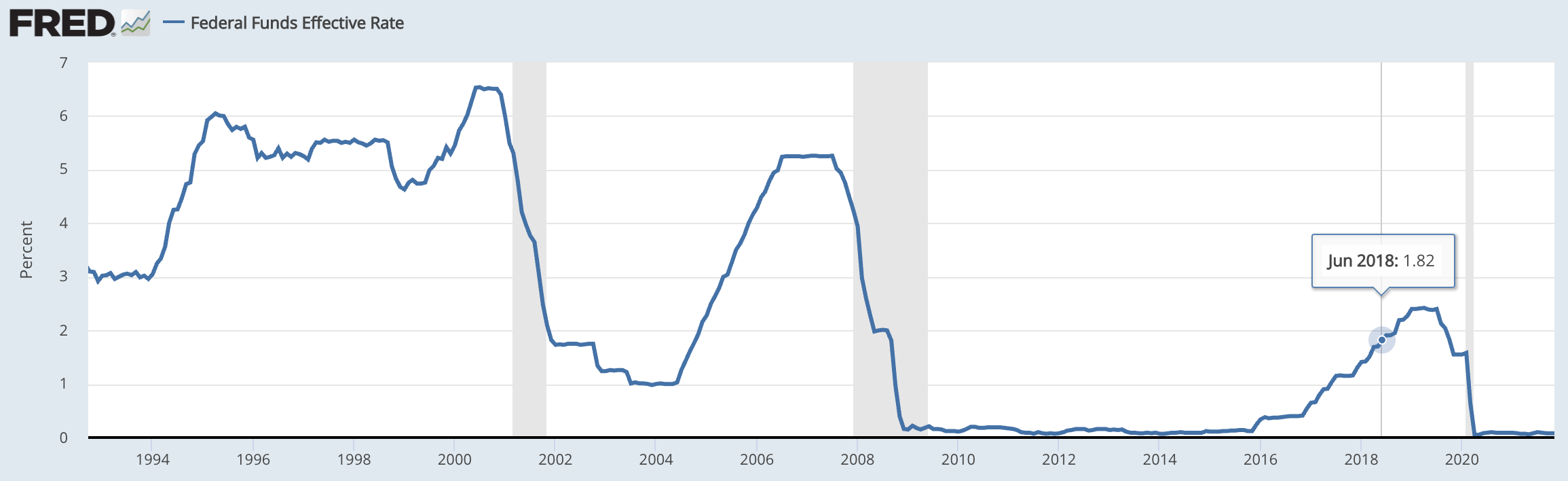

The last time we saw a similar inversion happen in the Eurodollar market was in June 2018. I know many of you are Jeffrey Snider fans like myself. He also wrote about the recent inversion and has a chart showing the last inversion in 2018 (hat tip to his chart as I did not realize this was the last inversion).

When the inversion took place in 2018, here is what the Federal Funds rate chart looked like… We were in the middle of a rate hiking regime, and in late 2018 the wheels started to fall off.

The difference this time around is the fact we are at zero rates already. We haven’t even started to hike rates. And we are starting to see warning signs with inflation readings coming in each month around 5-6%.

This is a very tough situation for market participants.

Anybody who knows how this will pan out in the year or two to come will make a fortune.

We will do our best in articulating what our flexible baseline after Powell talks. But one thing we need to do is take it one day, remain flexible, and consider alternatives each step of the way.

It is clear next year will be tough sledding. Part of that is because the response by the Fed will require tools that have never been used before. It is a tough task to tone down inflation after unprecedented new money supply being added… All while not creating a massive deleveraging effect in the debt markets that could result in a recession.

I do not envy these policy makers.

It is why they will require new forms of policy when combating this never before seen setup. Which is why we all need to keep an open mind in forming market expectations and potential policy responses if the market takes a hit.

If we keep an open mind while remaining diligent as well as flexible, this can turn out to be another great year in the markets.

Stay tuned…

Your Pulse on Crypto,

Ben Lilly