Not a Coincidence

The Weekly ChainPulse Report

The broad generalizations about the use of bitcoin in illicit finance are significantly overstated.

For the majority of readers, this is no surprise. Much like the next line…

Blockchain analysis is a highly effective crime fighting and intelligence gathering tool.

33-year CIA veteran and former Director, Michael Morell stated the obvious in his published paper commissioned by the newly formed lobbying group Crypto Council for Innovation (CCI). Those were his words above.

It’s not Earth shattering for crypto natives. But when it comes from a seasoned government official working at the most cloak and dagger government agency in the world, it’s noteworthy.

Recall last week we mentioned the newly formed Crypto Council for Innovation (CCI) lobbying group was founded by Coinbase, Fidelity Digital Assets, and Square with Paradigm in the mix as well. This commissioned paper was their first real publicity grab.

Then to spice up his stance he went on to mention there will be severe geopolitical repercussions for the U.S. vis-a-vis China if it wastes energy and resources chasing a ghost as opposed to leveraging blockchain.

He prodded the U.S. to keep pace with China. He also mentioned he once believed people like Secretary Yellen and ECB President Christine Lagard were the most informed people on the planet.

Shots fired.

Then on the same day the Congressional U.S. GOP Leader Kevin McCarthy was interviewed on CNBC and asked by the reporter…

(me paraphrasing) We have Coinbase going public… I don’t know if you saw Sec Yellen and Fed Chair Powell talking about it, but do you feel they have a good understanding of digital currencies or bitcoin? Do they need a remedial reading of the Bitcoin Standard?

Representative McCarthy responded with (again, me paraphrasing)…

They tried to get rid of it by ignoring it. They should not ignore it. The base will continue to grow. Those who regulate better start understanding what it means for the future. Other countries are moving forward, especially China…

I want to look forward, not backwards, and not keep my head in the sand.

Shot fired, again.

What’s important to note here is that this is not a coincidence. When there’s concerted efforts in Washington you’ll see similarities in language. And looking at the language from former CIA director turned CCI advocate and from the Republican leader in the House of Representatives, the jousting has begun.

I like to view it as a “Poke until they fight or flee” strategy.

It’s border line bullying in the sense these comments are done to generate a reaction… to provoke regulators.

And what’s even more interesting here is the China jab.

Remember, both voices here are saying the U.S. will get beat by China if they don’t embrace blockchain, digital assets, and in a weird way bitcoin.

It’s the same thing Peter Thiel said less than a week ago where he talked about China trying to bring down the U.S. dollar. And the way he did it was talking about bitcoin in such a way where U.S. regulators need to start taking bitcoin more seriously.

(If you’re interested in the Peter Thiel story, check out this podcast by Nathaniel Whittemore)

This is Peter Thiel… cofounder of PayPal… advocate of bitcoin.

These guys are using China as a way for bitcoin to get the attention it deserves using the facts.

4D chess…

These parties have a vested interest in bitcoin and cryptocurrencies, and ready to dual it out with regulators and central bankers.

I can’t think of a more entertaining reality television series.

And with Coinbase hitting the traditional equities market tomorrow, I expect Wall Street and VCs to perk up even more.

As I said in yesterday’s CoinTelegraph piece,

Coinbase is the watershed moment in terms of legitimizing some valuations you see in crypto, particularly around DEXs who have a tiny fraction of the amount of employees and opex [operating expenses] that a Coinbase or ICE has.

Crypto is an asset with incredible volume and diversity, which is poised to grow even more. Coinbase showcases how profitable exposure to this market can be.

I expect a wave of M&A and VC activity on the heels of this as private investors will be asking their fund managers for exposure to this space.

Money will be itching to gain exposure. And if the central banks and governments restrict its flow, we’ll see interesting reactions take place in the media.

Remember, the 12-month review on the Financial Task Force (FATF) standards pertaining to virtual assets and service providers is set to end in June. And in July we expect to get our first glimpse on the U.S. Digital Dollar. These two events are what is in the pipeline, and it’s why we’re seeing Thiel, CCI, and the congressman speak up.

The game has clearly begun.

If this is your first Weekly ChainPulse Report, our team at Jarvis Labs want to welcome you. In this piece we go over what the market looks like from the perspective of global macro markets, from a 10,000 ft view of bitcoin and crypto markets, and a granular view that helps you navigate the week ahead.

Consider it your roadmap for trading bitcoin and crypto.

Moving forward we publish this issue every Wednesday, and then publish short updates on this piece before the weekend on Friday and then during the start of the trading week - Monday. This way you know if we’re taking a detour.

OK, I spilled a lot of ink on the global issues impacting bitcoin already. So I’ll make the global macro section very short once again…

Macro

In this section we tend to hit on topics such as the FED policy, global monetary policy, DXY (US dollar index), gold, and bonds. We do this to understand what might effect bitcoin in the coming weeks.

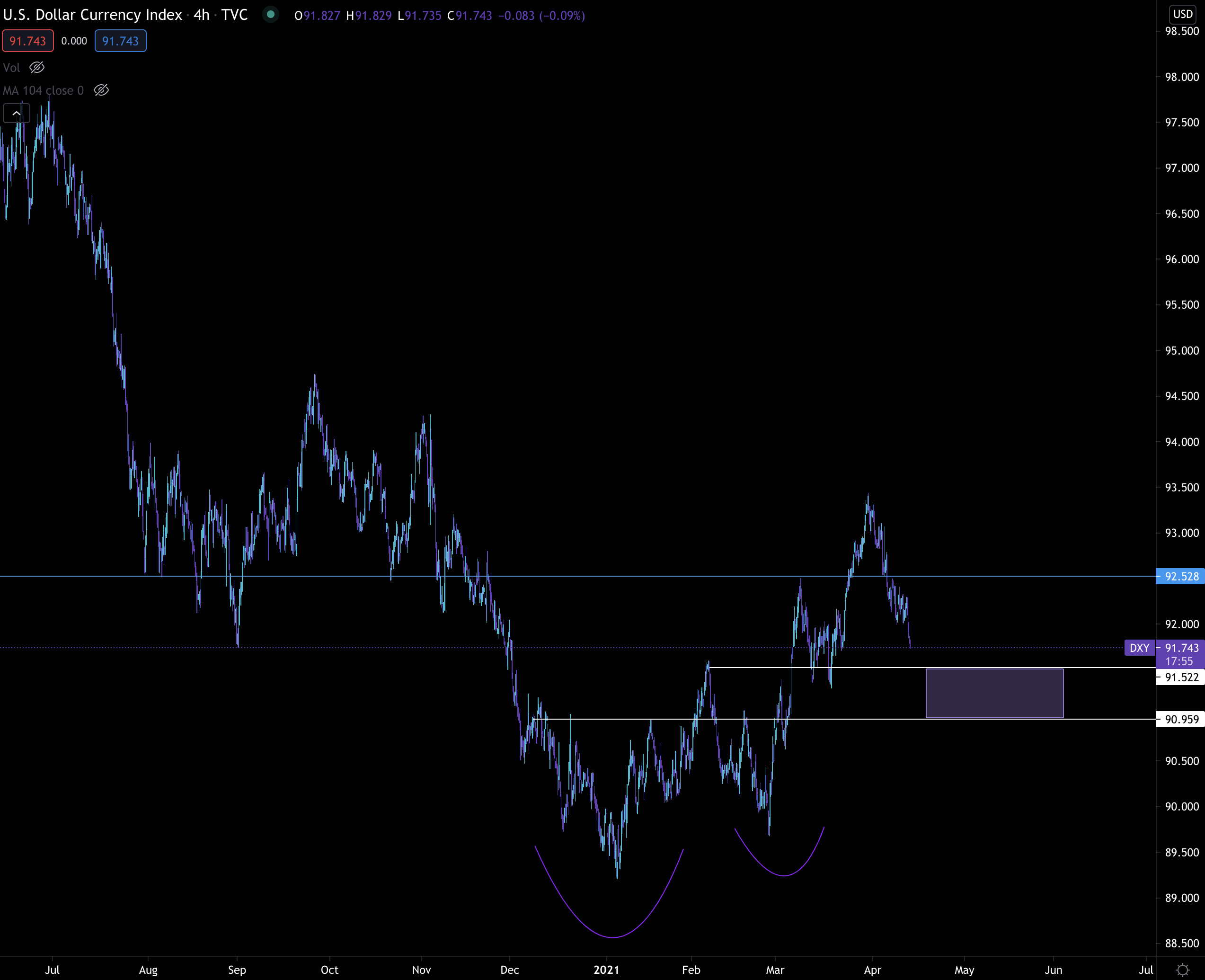

Currently, the DXY is favorable to bitcoin as it’s been sagging as of late. The index failed to hold that 92.5 resistance. This has let bitcoin’s price rise without impediment.

Right now we’re watching that purple box for an area that might pose as a pivot or reversal area. If the dollar loses this range, bitcoin is likely to rip higher.

Additionally, we hit on government bond yields frequently. That’s mostly due to their influences in the macro markets. When there are spikes or quick movements, it’s likely to ripple across other asset classes.

Also, with so much dependent on the FED and their actions on the treasuries market, it’s necessary to keep tabs.

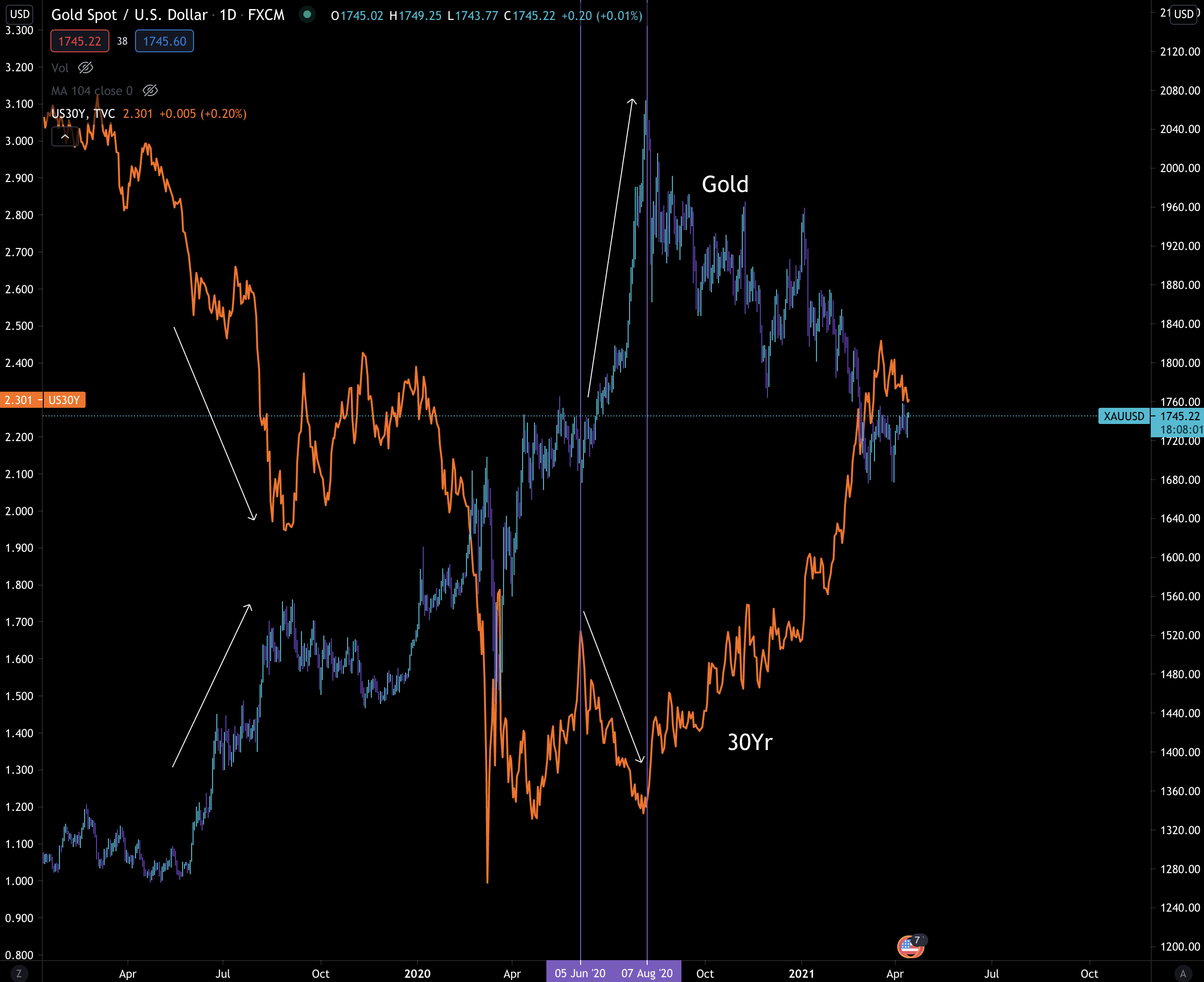

Right now, yields don’t look to show any strength. In fact, it seems to have lost its parabola trend, and even lost its current range.

In prior issues we talked about how any moves above 2.5 and/or 2.67 might result in the FED being force to take action through yield curve control aka more QE through additional treasury purchases.

You can see that in the written text of the chart.

Since this still holds, I’ll keep the text for reference down the road. But note, yields are not threatening to move higher. Instead we’re now forced to question what it means when they drop…

A drop in yield - if steady - is likely to lead to trends in other markets to continue.

To figure out why that’s the case we can lean on a gold versus 30yr yield chart.

Turns out it is in fact a bullish catalyst for gold. Only time it seems to act in tandem with yield is when the financial system is in emergency mode and everybody wants safety and cash.

(Anybody follow up on my gold chart from a few weeks back? Looking strong now)

In summary, DXY and yields are providing no immediate headwinds for bitcoin. Feels like its been six months since I’ve felt that way.

Macro On-chain Beat

This is the 10,000 ft view on what bitcoin and crypto look. We look to hone in on questions that ask, is the market overheated… is now a time to hedge… where do we stand in comparison to previous cycles.

Last week we dug into our toolbox to decide if the market was topping out. Our conclusion was no, the market can push higher.

Little has changed from then.

And in order to give this section the attention it deserves, I wanted to devote tomorrow’s Espresso to it. Expect a macro on-chain breakdown of the market as we begin to consider even higher highs in the weeks to come.

ChainPulse

This is the bread and butter of Jarvis Labs. Our specialty is in the day-to-day. What’s the current structure right now, what does it mean for price, and when is a good time to enter the market.

We built our proprietary trading software Jarvis AI with these questions in mind. We lean on it to find the pulse of the market.

ETH (51k) and LINK (544k) were a couple of the major exchange outflow transactions we saw over the last two days. They both responded quickly by notching all-time highs. I only mention these transactions as the team expect large cap altcoins to dominate over the next few weeks.

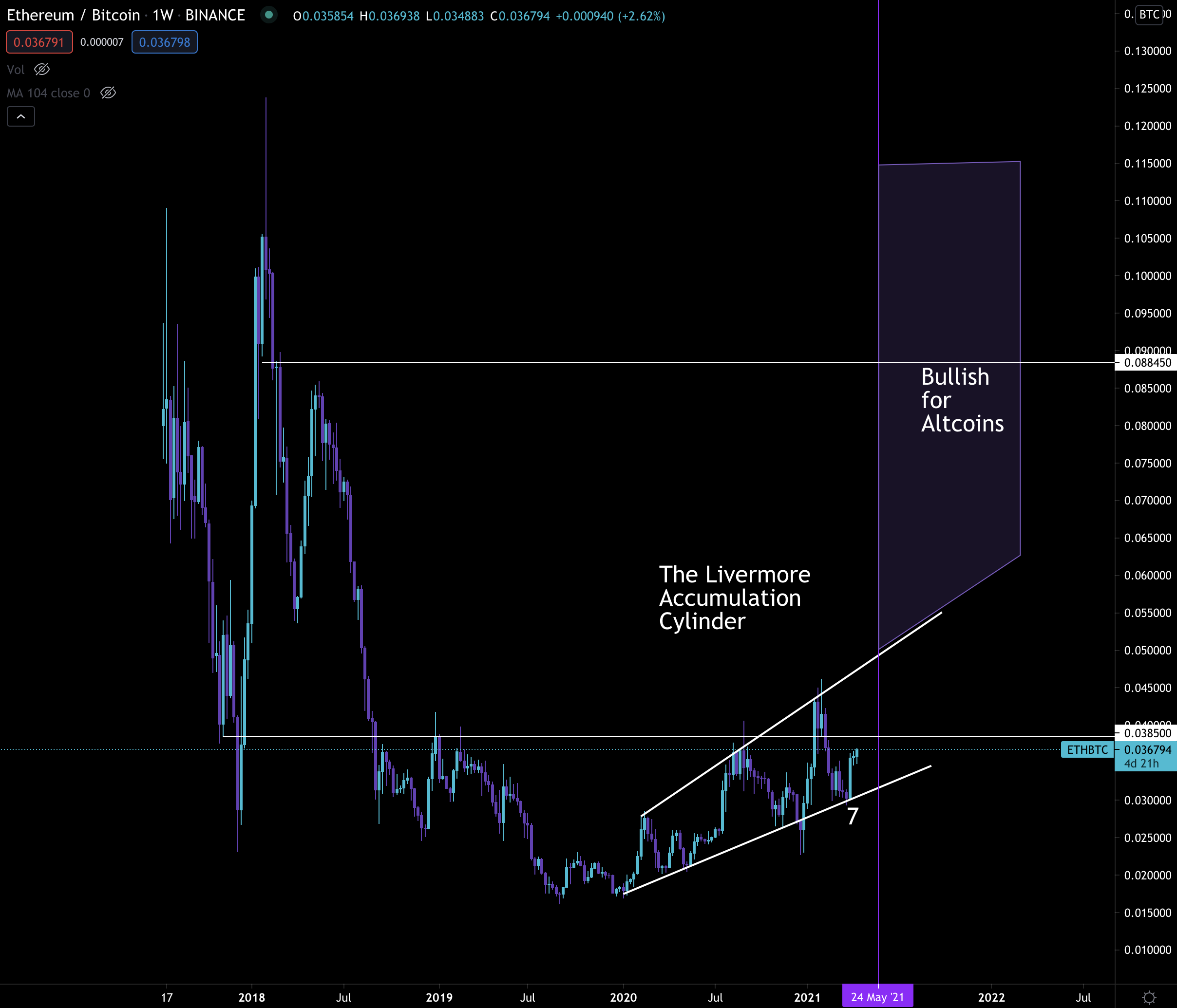

The easily way to show it is via the ETH/BTC chart. You can look at it below in The Chart of the Week.

Now, the only concerning issue about yesterday’s break higher for bitcoin and many other tokens was in funding rates. Per our issue last week, we’ve been expecting this scenario.

Our conclusion was this is likely to be the new norm. We need to get comfortable with it.

For our clients we outlined various scenarios in how this will unfold over the next leg. The most likely scenario is what we refer to as “scenario 2”.

In scenario 2 we detail how a crypto bull market might look like… One which is in full force with prices marching higher and funding rates continually spiking.

In this scenario, price will look like a series of fast spikes followed by periods of consolidation.

If that’s the case, the activity will be in the futures market.

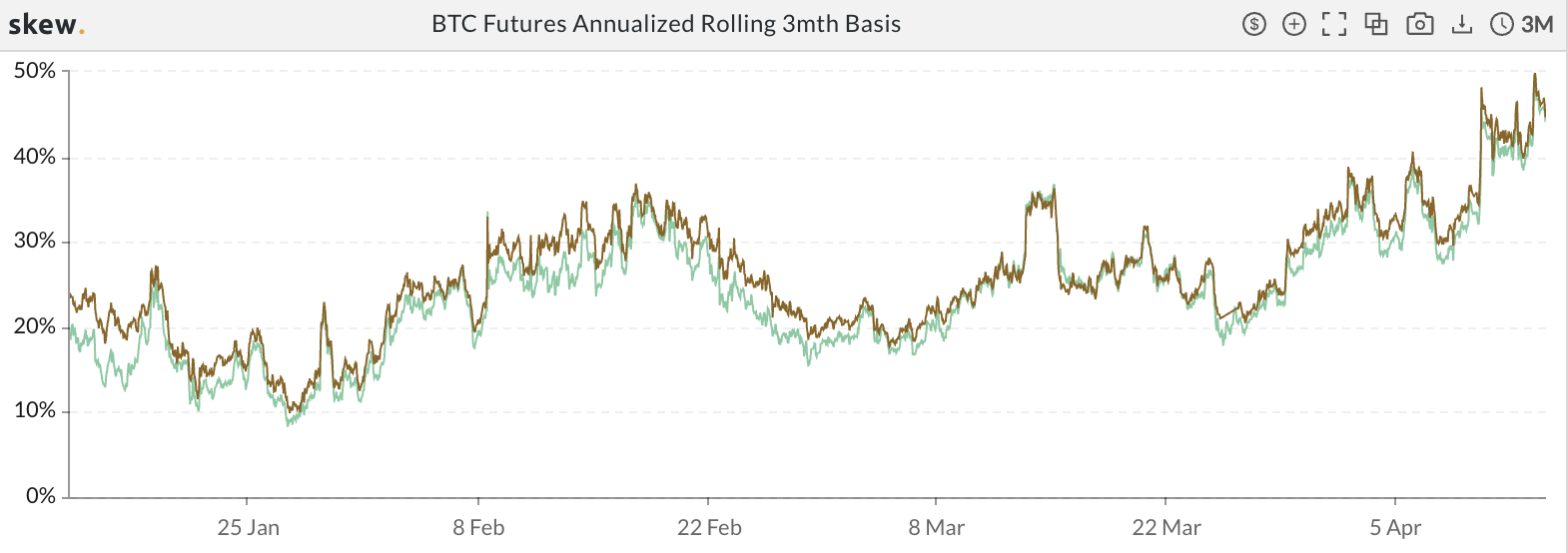

In particular we’re expecting traders to arbitrage each spike. The manner in which they’ll do this is via 3mo or 6mo futures. For example, here’s the rolling 3mo premium to spot prices.

As you can see over the last two week there were several spikes.

Traders taking advantage of this do so by: shorting the contract and buying on spot to remain delta neutral or directionally unbiased… then wait for the premium to drop as price consolidates… close their short to capture the premium… And then move back into crypto via the spot market.

It’s why we’ve been telling our readers this leg is best experienced via spot. Not going long in futures.

These spikes will continue. In fact, we’ve already seen funding rates just about double since Monday.

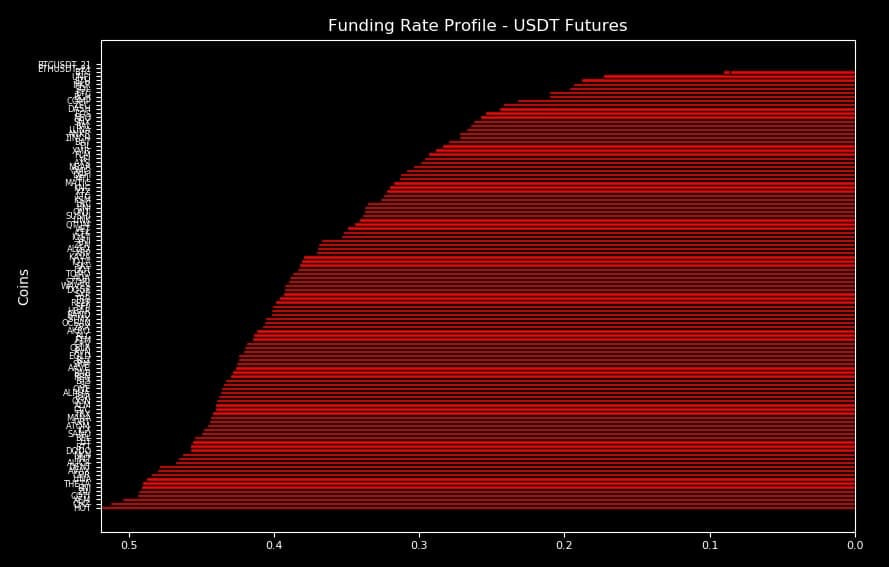

Here’s the latest funding rate profile.

Remember, a rate of 0.4 comes to 438% annualized (0.4 * 3 times per day * 365 days).

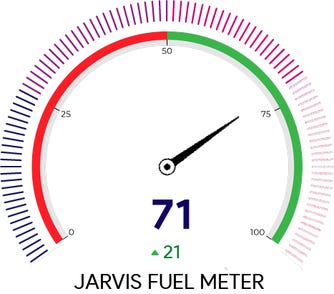

Our risk metric that uses unrealized PnL in combination with funding rates also saw a major spike. Value spiked to 75.

This hybrid feature helps by warning us of potential cascading liquidation events. The higher it goes, the more likely it can happen… That’s because high funding combined with low profits or unrealized losses means lots of positions can close very fast.

Luckily, the fuel in the market is still bullish for price to keep march higher.

To close it up, the current structure looks good.

The main thing we’re watching right now is how this current break out responds. Does it liquidate long positions before resuming higher or does the premium in the 3mo/6mo futures contracts get soaked up before resuming higher.

We’re leaning towards consolidation, but it’s merely an educated guess.

We’ll keep you in the loop.

Chart of the Week

The chart we are watching right now is ETH/BTC. It’s a chart we’re constantly keeping an eye on as this will dictate whether or note we get a future altseason.

For now, it looks to be alluding to bullishness for large cap altcoins.

Over the next few days we want to see how price responds when it approaches 0.0385. It’s a pretty significant area. And any break above this line will be very bullish for large cap altcoins. A rejection here will mean bitcoin is the best bet for the very near term.

Note… a break above the cylinder will likely create a full blown altseason. Keep this chart in your back pocket.

Your Pulse on Crypto,

B