Mid-Week ChainPulse

The ink cartridge is loaded

Tether is here.

There's not much more you need to know for your trading day assuming you've read Monday's ChainPulse Report.

Tether printed $400 million USDt on the Ethereum network. While the supply is in reserves and not circulating yet, this is bullish. When the reserves increase like this that means somebody called them up and asked for some dry powder. We expect this to move from inventory to issued USDt within the week.

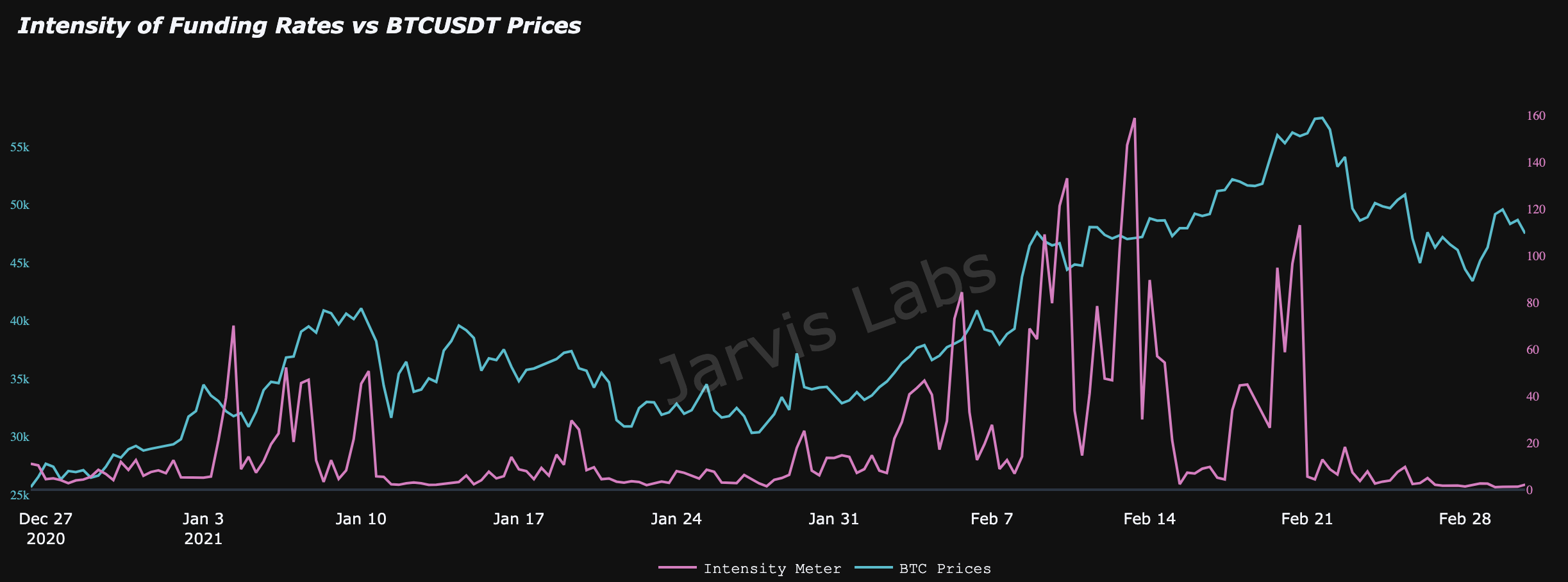

As far as indicators, they haven't changed much from what we showed you last week. The amount traders need to pay for keeping a position open in the futures market is low. This is good for price to build momentum and possibly break out of this range.

As you can see in the chart below, long periods of funding rates being low allow price to make a run.

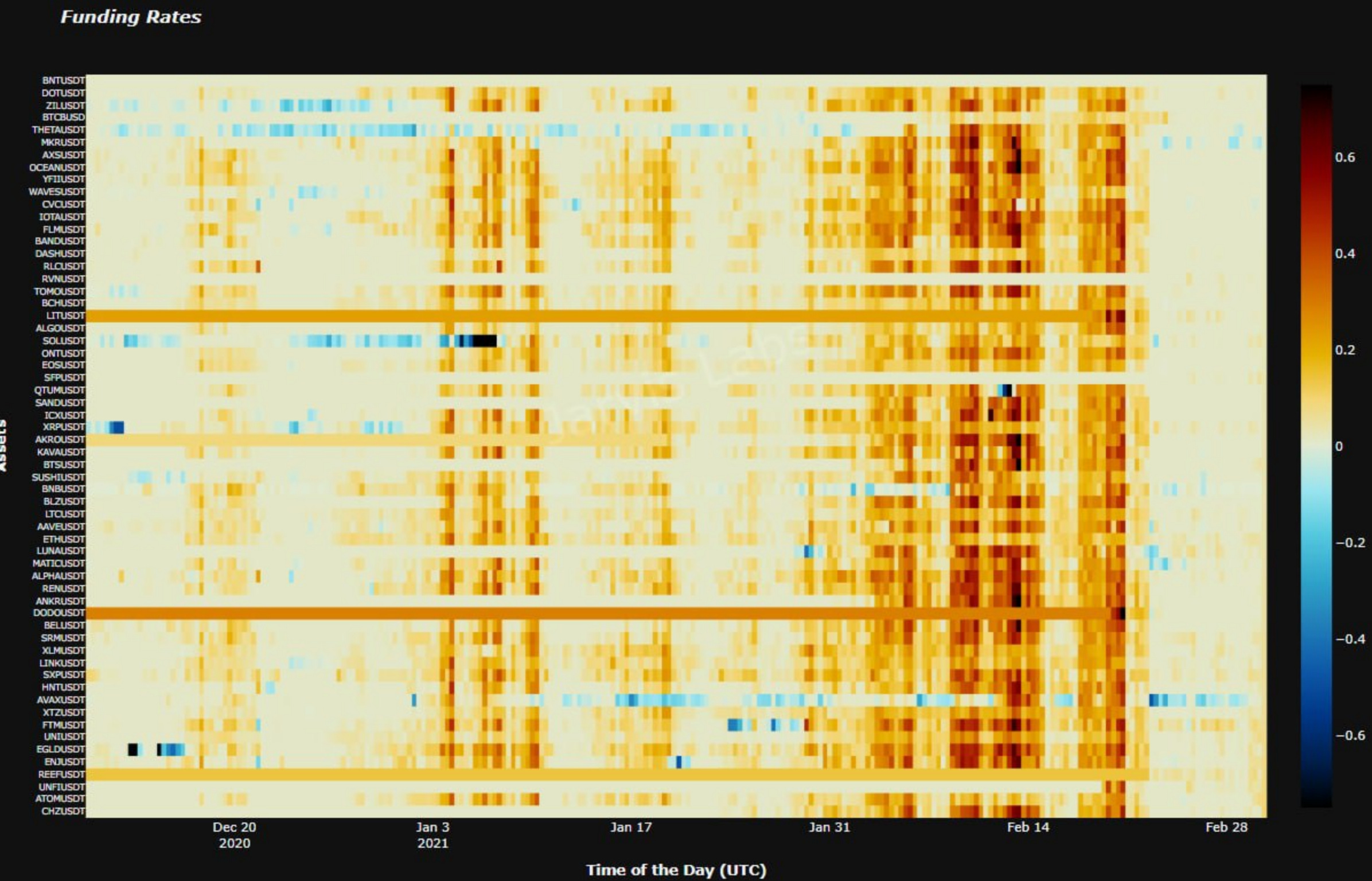

The heat map shows a similar story.

It’s still the void of red on the right-hand side. This is good. What's better is we see a lot of white, meaning traders have become a bit disinterested in the market. It's why we find now to be a good time to build a long.

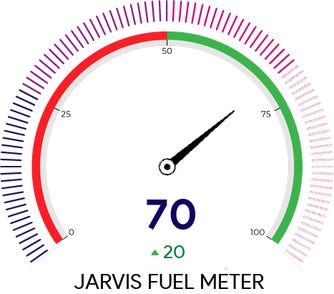

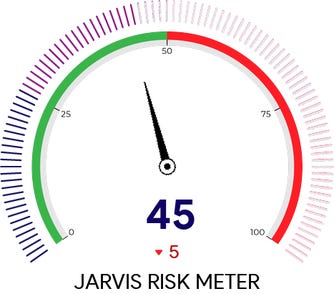

Our risk meter is neutral. This means it’s not too risky to open up a long at the moment. It’s night and day from where we were just a couple a weeks ago with readings as high as 99.

And with tether being printed, our fuel level is now at 70. This is what we want to see.

The only overhang was the whale wallet that moved 10k to exchanges and another 5k in waiting. The 5k BTC hasn't moved. We're not sure why, but we will continue to track.

The big takeaway this week is we got the signal we were hoping would come. USDT is here and even with the New York Attorney General watching over their shoulder, Tether continues to operate as before.

Tether mints and Grayscale unlocks are the biggest drivers of the market. Today we saw one stepping up to the plate.

Your pulse on crypto,

B

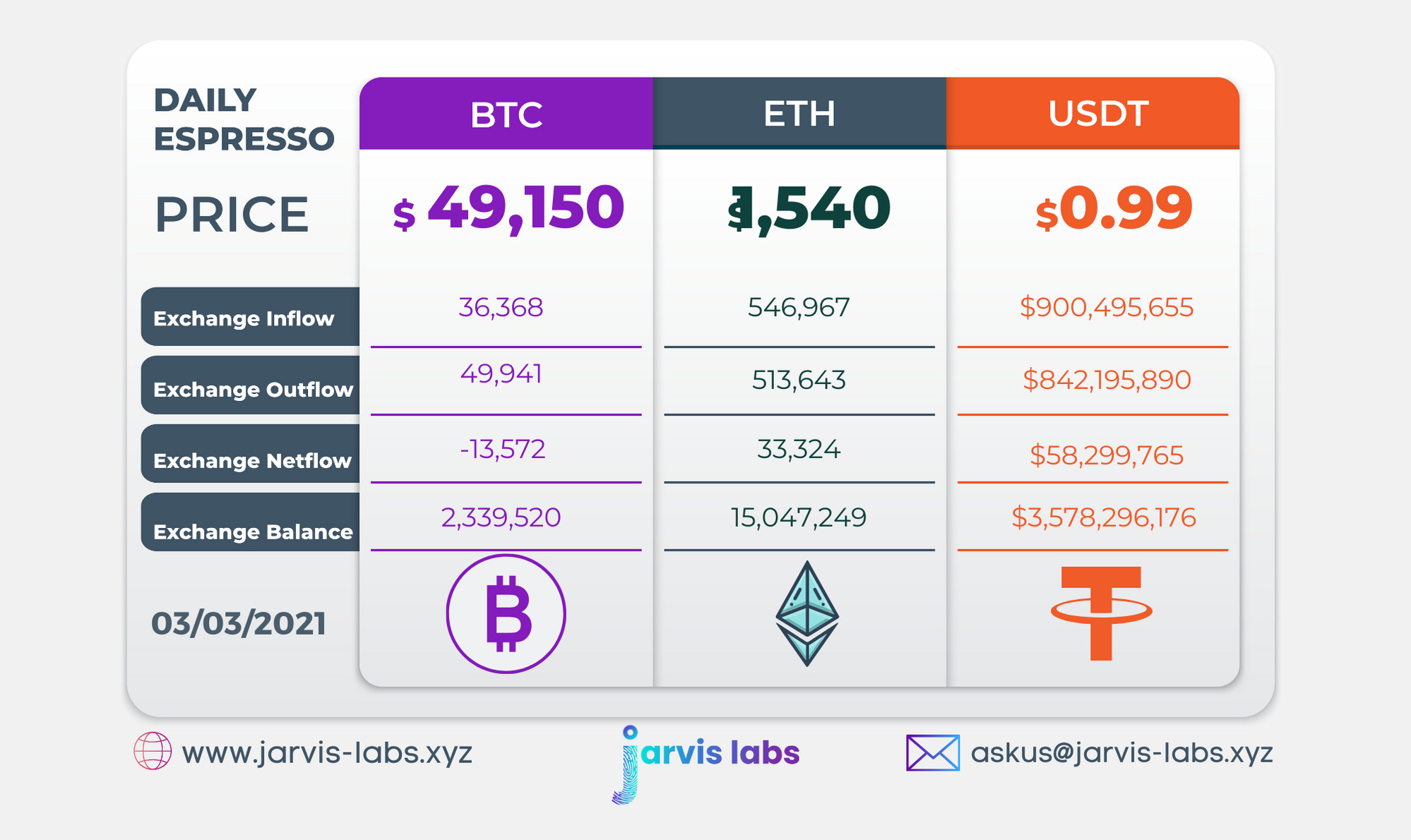

Below is our daily exchange flow data. This is a great gauge for understanding if BTC, ETH and USDT are flowing into exchange or leaving. If BTC and ETH are entering exchanges it can generally be viewed as bearish. The opposite scenario is bullish.

When USDT is flowing into exchanges it’s typically viewed as bullish. The opposite scenario is bearish.

This should only be used as a general gauge. Tagging the exact wallets these flows move into or out of helps improve the reliability of this data, which is what we do at Jarvis Labs. To date we have over 800 market mover wallets and 16 million wallets tagged all together. Consider us your on-chain trackers.