Market Update - TGIF

It's Friday, time to focus on the weekend

It’s Friday and you’re probably in a rush to clock out early. We won’t slow you down today. This is a quick update on the macro structure and one potential catalyst to look for in the coming week.

Yesterday we got $400 million of Tether added to supply. Nothing sweeter than fresh USDTs hitting the blockchain before the weekend. This typically is bullish on-chain activity since more stablecoins in the market means more buying pressure.

Also, the CVD indicator we hit on yesterday looks strong going into the weekend. In case you missed the talk on the CVD indicator yesterday, read up on it here. There are some good pictures to get you through it.

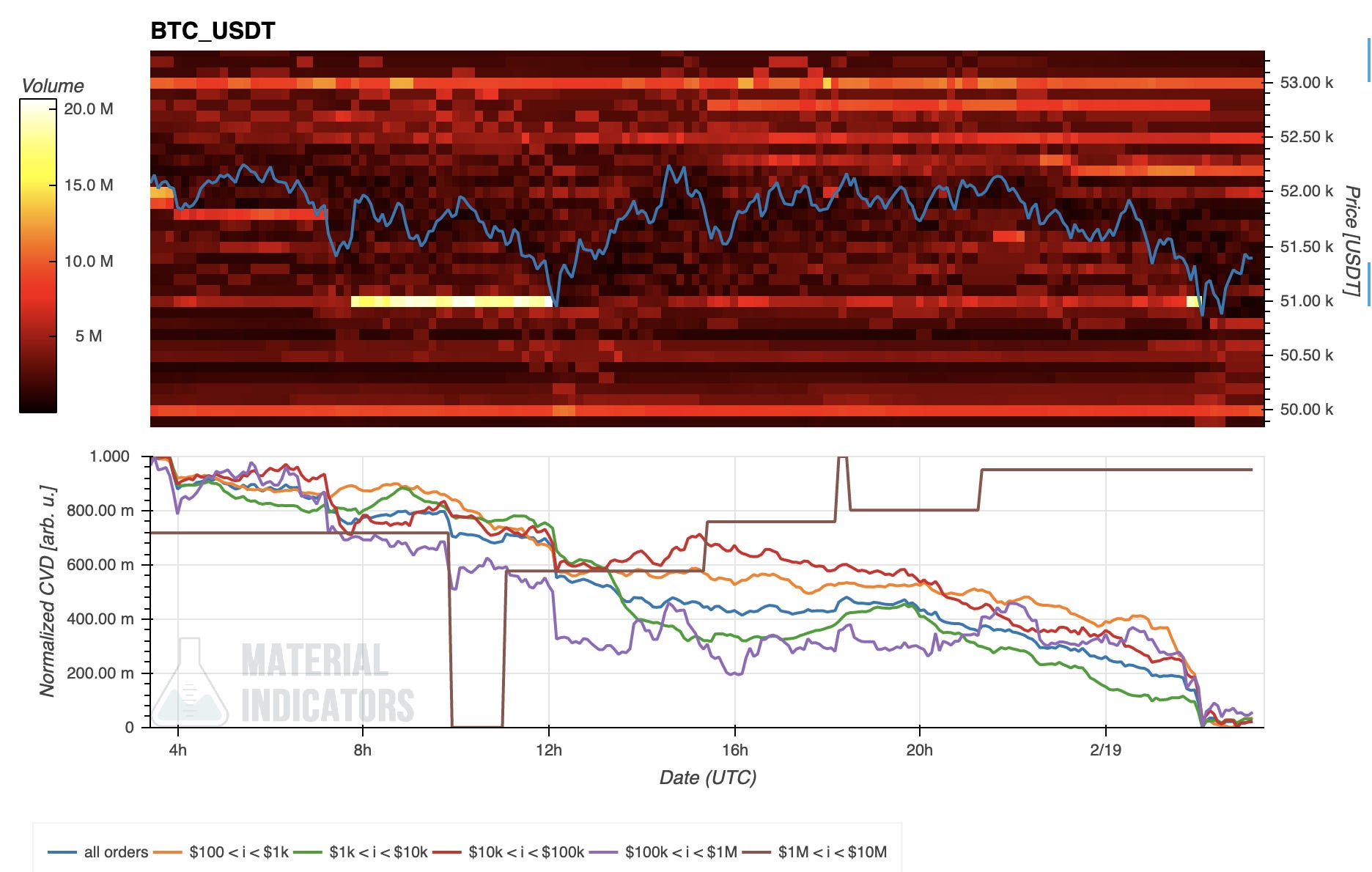

Here’s what the latest CVD indicator looks like from our friends over at Material Indicators. They were nice enough to let us trial their #FireCharts.

The bottom half of the chart is CVD. If the lines are rising then buyers are purchasing at whatever price the sellers are asking. You can think of this as market buying.

The brown line is leading the way, and this is the whale line. Meaning these buys happening are setting the tone of the market right now. If whales are buying, it’s generally a good sign.

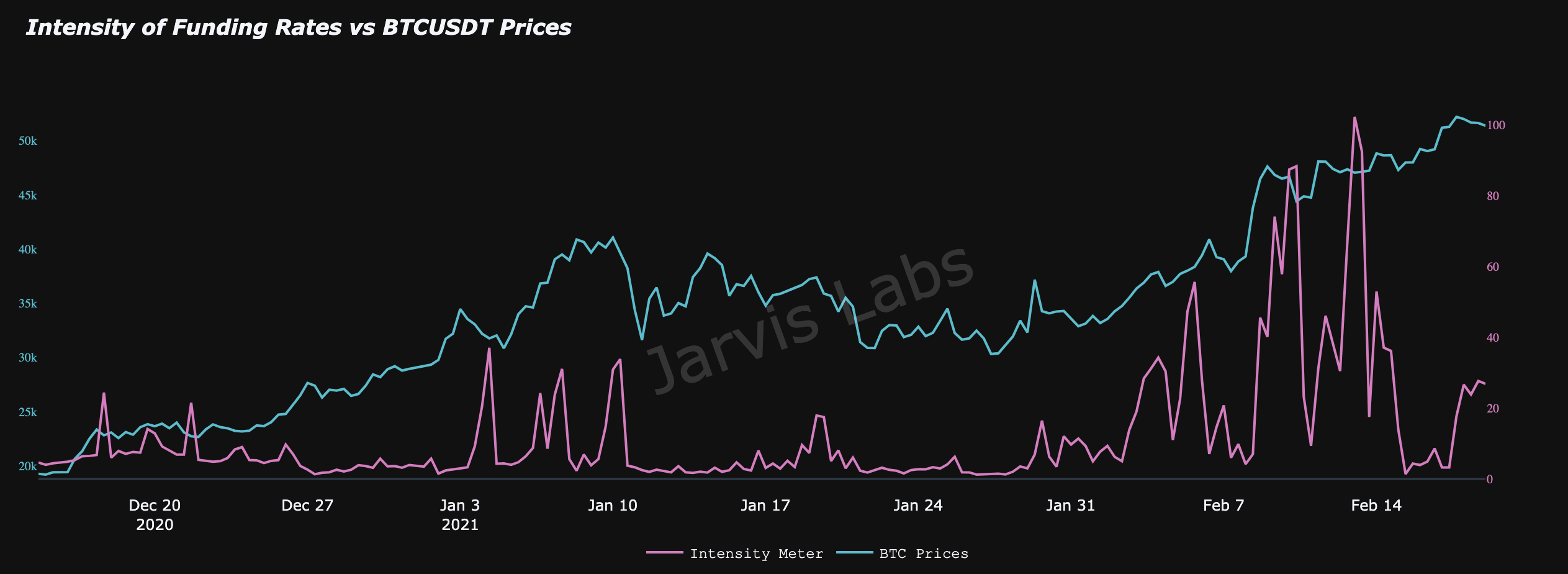

What’s more is the funding rates aren’t as crazy as they were a week ago. The pink line in the chart below measures just how crazy derivative traders are. The higher the line is, the more ludicrous.

As you can see, it’s nothing to get too concerned about right now.

Fresh Tethers, bullish CVD, decent funding rates… The table seems set for BTC to make a run here if it’s going to go for it. ETH will likely follow close behind towards its $2,240 “pin” we hit on yesterday in the options market.

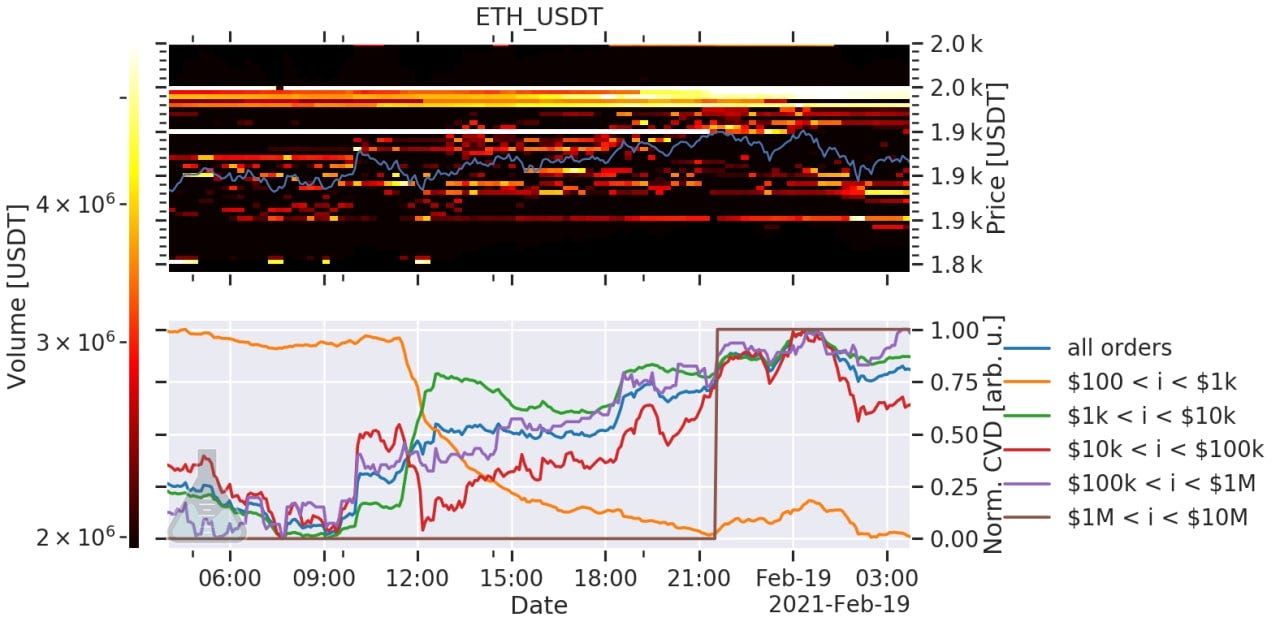

CVD also looks nice for ETH. Only thing holding it back right now are those white colored lines on the top chart. Those indicate major sell orders on Binance since it’s just above the blue price line. Once these orders get lifted price can run.

On to the interesting catalyst to look out for in the coming week… Binance Smart Chain (BS Chain). It’s a chain built by Binance that’s compatible with Ethereum’s Virtual Machine.

The Virtual Machine is just tech jargon for the part of the network that smart contracts use. This is important to note because projects looking to move from Ethereum to a more gas friendly environment can do so with minimal tweaks to their codebase when it comes to BS Chain.

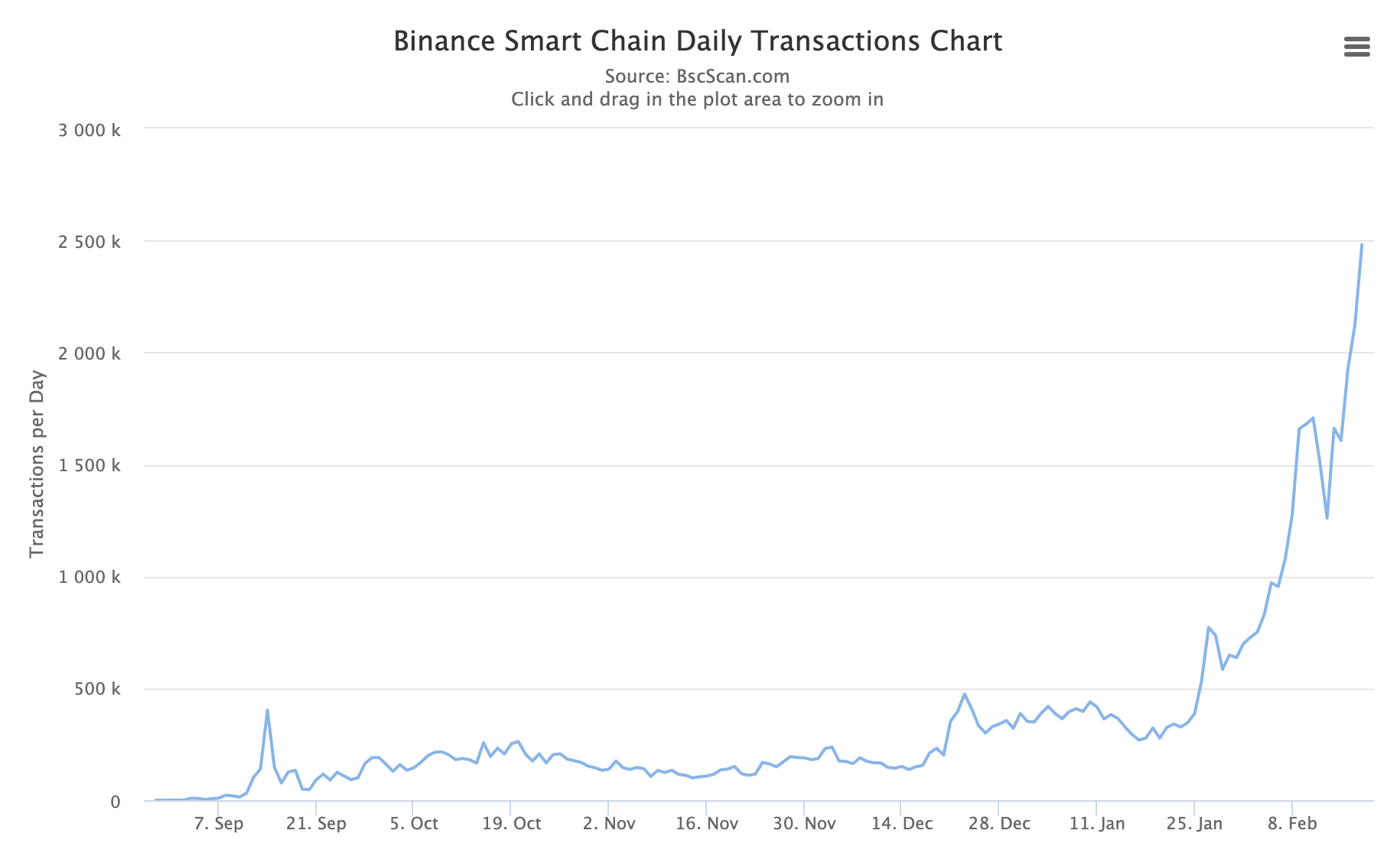

It’s in part why transactions on the network are skyrocketing. The chart below highlights this.

The Uniswap-like project, PancakeSwap is in part to thank with its attractive yields.

What we find interesting is the amount of capital sitting on BS Chain. PancakeSwap alone is up from under $700 million market cap to about $2 billion. Another $2 billion in BNB sits on BS Chain. And more.

This is incredible capital creation happening. DeFi is fueling it and its acting as a lower cost solution to Ethereum. While I don’t think this is an issue near-term, it’s important to consider what this capital can do if it begins to move.

These investors are more nimble than most, are willing to try new projects out early, and have no problems testing out new chains. This money represents good returns if tracked.

If BS Chain turns out to be a short-term novelty, there’s still capital that needs to go somewhere. If it heads to Ethereum it’s a flow to track. Or maybe it begins to flow into Polkadot, Cosmos or Solana. These are potential competitors to Ethereum in the mid-term, and have DeFi ecosystems taking root as well. If they are beneficiaries to this BS Chain outflow they’ll make good investments.

Nonetheless, keep an eye on PancakeSwap. If it starts to cool down and yields start to drop, try to understand where the money is going. Wherever it’s headed will be the next playground money goes to play.

Enjoy the weekend.

Your pulse on crypto,

Ben Lilly

P.S. This is an important tip from Benjamin : In the next few days we are going to see massive accumulation and outflows from Coinbase Pro that are going to custodial wallets. Be prepared as you know what will follow. Get your wallets ready.

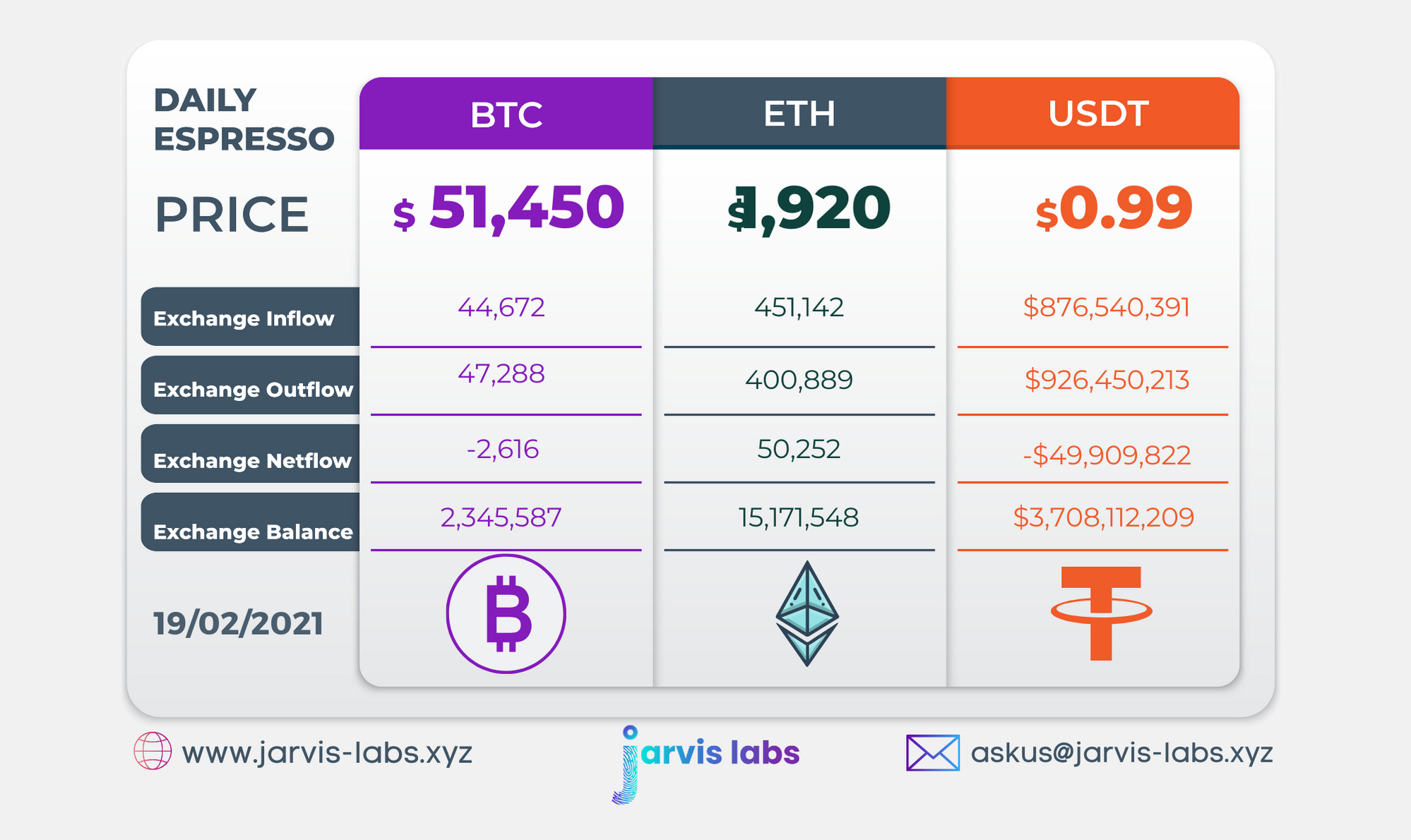

Below is our daily exchange flow data. This is a great gauge for understanding if BTC, ETH and USDT are flowing into exchange or leaving. If BTC and ETH are entering exchanges it can generally be viewed as bearish. The opposite scenario is bullish.

When USDT is flowing into exchanges it’s typically viewed as bullish. The opposite scenario is bearish.

This should only be used as a general gauge. Tagging the exact wallets these flows move into or out of helps improve the reliability of this data, which is what we do at Jarvis Labs. To date we have over 800 market mover wallets and 16 million wallets tagged all together. Consider us your on-chain trackers.