Japan Prepares to Toss the Curve

Macro Update: The World’s Longest-Running Easy Money Program Might Be About to End

One of the most frustrating feelings is the feeling of being disenfranchised.

The sense of futility of one’s effort, and the inability to take control to change an outcome, can be infuriating and defeating.

Perhaps this is why so many people are feeling anxious about the future of the world in economic and geopolitical terms.

As the so-called experts are offering their opinions on the state of things, we start to feel like we’re trapped in a chamber filled with cacophonies and distortions. But we can always detect how close or far off reality is compared to the messages being fed to us.

It is as simple as pulling up to the nearest gas station or heading to the closest supermarket.

When the time comes to pull out the money and pay for the gas or groceries, the number on the digital display does not lie.

We know something is off. We know things are broken.

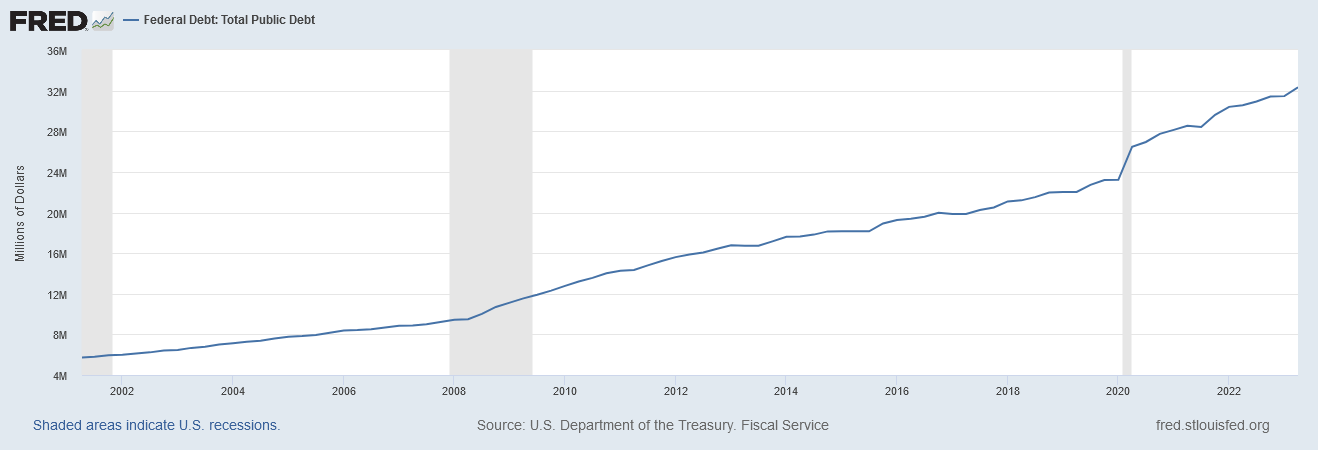

And when we look at the chart below, we see why.

The United States government’s debt just crossed $33 trillion on September 18. It was $30 trillion in February 2022 – a 10% rise in seven months.

We know this is not good. We know this is not sustainable.

But we are powerless to do anything about it. And neither side of the political aisle seems to be interested in reducing the deficit, restricting government spending, and balancing the budget.

It’s like having the front row seat to a train wreck happening in slow motion. We can see it coming. And yet, we are powerless to stop the trains from colliding.

In our last article, we spotted three potential trouble spots: Commercial real estate (CRE), corporate credit, and personal credit card debt.

In this article, we will take a look at Japan. We will target other hotspots in the next few months.

Let’s go train(wreck)spotting.

The Land of the Rising Rates

If quantitative easing (QE) were an Olympic sport, Japan would be competing against the U.S. for the gold.

Japan started its easy-money, low-rate policy in the late 1980s after its economic bubble popped. That effort continues into the present day. It’s just been given a fancier name: yield curve control (YCC).

For the readers who aren’t familiar with the concept of YCC, please refer to this article we published last October to brush up.

In a nutshell, YCC pegs a bond of a certain maturity to a yield range, rather than letting the bond’s yield fluctuate based on market activity. Central banks choose a range that they feel will promote economic growth and achieve the desired inflation rate.

The Bank of Japan (BoJ) kicked off YCC back in 2016. It keeps the short- to mid-term interest rates at zero or near-zero to promote lending, in order to boost its deflationary economy.

Meanwhile, the long-term rate is left alone and allowed to rise, so entities such as pension funds and insurance companies can invest in long-term Japanese Government Bonds (JGB) as high-quality liquid assets.

The BoJ chose the 10-year JGB (JGB10Y) as the benchmark rate for YCC. It started out between 0.1%/minus-0.1% back in 2016, and it was raised several times before it settled at 0.5%/minus-0.5% in December 2022.

Fast forward to July 27, 2023.

The BoJ announced that it will allow JGB10Y to trade up to 1%, but said that the target is still 0.5%. So essentially, BoJ telegraphed that the range is rising to 1%.

It certainly raised eyebrows in the financial markets.

Many interpret this as the harbinger of the BoJ getting ready to jettison the YCC policy and end the world’s longest-running QE program.

But why now?

The Nagashi Band Cannot Keep on Playing

To start off, the recent wave of rising commodity and energy prices is only causing trouble for a depreciating Japanese yen (JPY).

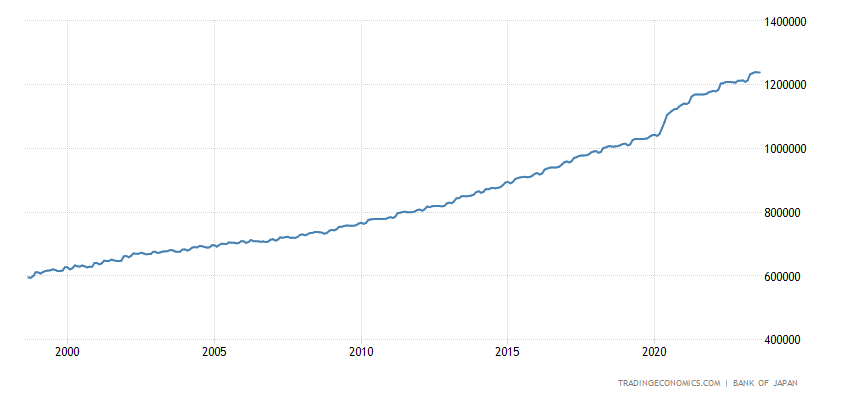

For decades, the Japanese government printed an incessant amount of JPY. The chart below is the current JPY M2 money supply (M2 includes cash, checking accounts, savings accounts, and other short-term accounts such as certificates of deposit that cannot be instantly converted into cash).

The current figure stands at 1,238 trillion JPY (or 1.24 quadrillion JPY).

China and Japan are the only two countries in the world that are still doing QE. For decades, Japan printed a limitless amount of money to buy its own debt in order to keep the economy floating and not fall into a recession or depression.

But a weakened JPY does not help with keeping prices down for consumers, especially regarding imports of raw commodities and energy, which are vital for the Japanese economy.

Next, Japan is running out of JGBs for the government to buy.

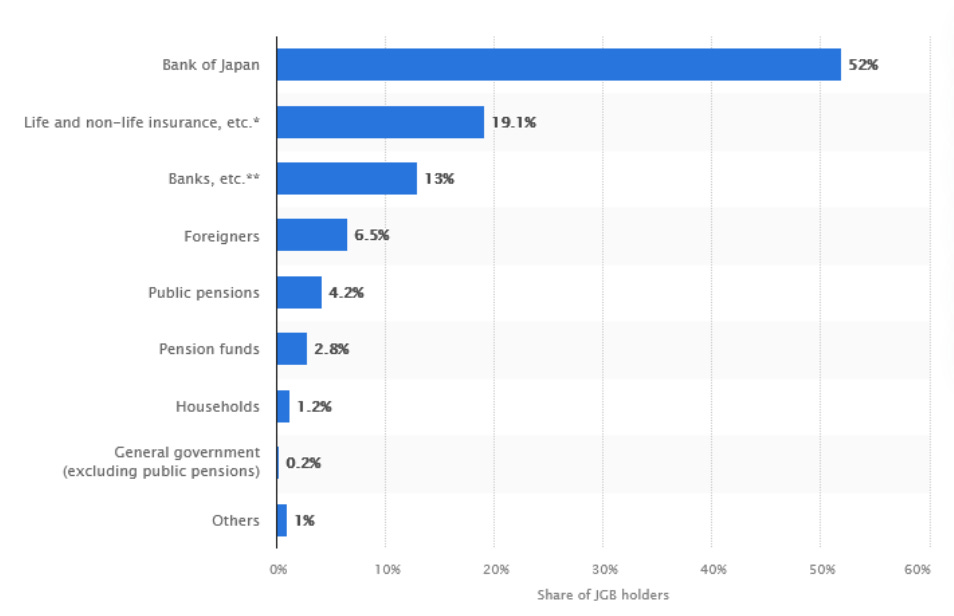

The chart below shows that as of December 2022, the BoJ owns 52% of JGBs (60% if you count pension funds among the owners, and maybe more if you expect the Japanese government to eventually take over the banks and insurance companies in a crisis, as I do). Foreigners only own a paltry 6.5% of JGBs.

The sovereign bonds of the world’s third-largest economy should be considered a pristine asset by foreigners that can be used as investment-grade collateral and a high-quality liquid asset. After all, Japan is also the world's second-largest debt market.

But if the Japanese government owns more than 60% of the bonds, then that liquidity does not really exist, because the Japanese government is the market. There are not that many participants and buyers in the market for JGBs, and the trading book is thin.

This is not a healthy bond market. It’s another reason why the Japanese government is looking to pull the cord on YCC.

So what are the implications should the BoJ terminate YCC?

The End of the Gravy Bullet Train

Internationally, we can expect turmoil and chaos in asset classes such as real estate and risk-on assets.

In the past few decades, the yen carry trade played a big part in what made all the speculation in the financial market possible. Investors and institutions borrow cheap yen at almost no cost to invest in other risk-on assets or real estate. One can make the argument that this trade allowed SoftBank Group, a $64 billion multinational investment holding company, to grow to its size today.

Many also partially attributed the flourishing of Silicon Valley to the yen carry trade.

Now, those investors and institutions that borrowed JPY to invest will be going up against the double-whammy headwinds of JPY appreciation and rising borrowing costs.

The global stock market will take a hit, as cheap money will not be available for investors and liquidity will dry up.

The chart below says it all.

This is a daily chart of the S&P 500. The yellow arrow points to the long, red candle that was recorded on July 27, 2023 – the same day the BoJ announced the YCC “tweak.”

As one can see, the S&P 500 dropped like an anchor that day. In fact, it was at the highest point of 2023 at 4607.07. Since the BoJ news came out, it has not recovered, with it currently trading around 4,330.

Real estate properties bought using the yen carry trade will have to start the trade unwinding process. This will hit the global real estate market, both residential and commercial. It will also create a strain on the pension funds, banks, institutions, and insurance companies that have real estate exposure.

The bond market will be impacted by the removal of YCC as well. More Japanese money will be flowing back to Japan and away from U.S., U.K., and European Union bonds as Japanese institutions offload their holdings in those markets.

Domestically for Japan, higher interest rates also pose problems for companies that rely on business loans and bond issuance to tide them over.

Rising rates also means rising yields, and the banks and institutions holding on to the older, lower-yielding JGBs might start facing the same issues that Silicon Valley Bank and other U.S. regional banks faced. The assets they are holding will not be worth as much as they once were, which could pose problems should they need to liquidate and mark the assets to market value.

The Global Liquidity Seppuku

In the post-COVID era, every country has its own fires to put out in its economy, but some of those issues could spread beyond their borders. The fallout from Japan’s potential removal of YCC and its depreciating currency is one such case, although right now it barely registers on most investors’ radar.

But it has been getting more and more attention lately. Especially after the announcement from the BoJ in July that took the global markets by surprise.

The earth-shattering aftermath that everyone expected from the Federal Reserve’s quantitative tightening has yet to materialize, except for the collapse of a few regional banks in the U.S.

Should the cheap Japanese yen start to dry up, it could create a bigger jolt on the global economy than the folks sitting at 2051 Constitution Ave. NW.

We might soon find out.

Yours truly,

TD