Inflation's Down, But Grocery Prices Are Set to Rise

Macro Update: The Food Shortage Is About to Get Worse

Simple is best.

That has always been one of the mottos that I firmly believe in.

There is a supermarket on the basement floor where my gym is located. Once or twice a week, after my workout in the evening, I would go down there and pick up a roast chicken for $4.90, a packet of salad, and whatever carbohydrate that I fancy.

Dinner is served. Simple. And cheap.

But something has changed. Something very unsettling.

That same roast chicken that used to cost $4.90 in March of 2022 went up to $5.90 in May. By autumn, it had gone up to $6.90.

And right after my latest trip at the end of 2022, I came back to a not-so-pleasant surprise. Please see the picture above…

The roast chicken is now $8!

I had to do a double take. In fact, I almost asked the attendant behind the deli counter to see if he had mixed up the price tag…

From $4.90 to $8 within 12 months. That is over 60% inflation in a year!

And it is not just roast chicken.

The pork knuckle that I enjoy once in a while with sauerkraut and a Bavarian beer went from $9.90 in May to $15.90 today.

It is an alarming trend. But this might just be the beginning of a prolonged period of higher food costs.

Why do wallets keep getting lighter than before after a visit to the grocery store every few months?

Let’s find out.

Black Swans

No one saw COVID-19 coming. When it disrupted the supply chain, it sent shockwaves throughout different layers of manufacturers and producers, who now couldn’t acquire or deliver as many raw materials as before.

The raw material shortages created end-product shortages. Since demand hadn’t fallen, but supply did, prices went up.

Not to mention that manufacturers and producers were paying higher prices to acquire the raw materials. Part of that price increase is because of higher shipping costs. The soaring price of fuel sent shipping costs skyrocketing.

On the topic of shipping costs, there were not enough workers to handle the large volume of cargo carried by freighters. Ships sometimes had to wait up to 30 days to unload.

It generated demand for empty containers and a spot on a freighter. Shipping a 40-foot container from Shanghai to Long Beach cost $2,000 prior to COVID. Later, it cost $25,000 for the same trip, and it was still overbooked. (Remember the Baltic Dry Index chart from our update two weeks ago?)

And these additional costs were and still are passed down to consumers.

Then, war broke out when Russia invaded Ukraine in early 2022.

As mentioned in the update in the first week of the year, both Russia and Ukraine combine to produce 25.4% of the world’s total wheat exports (Russia 18% and Ukraine 7.4%). That is a lot of wheat missing from the global supply because of the sanctions on Russia and Ukraine’s inability to export the bulk of its wheat during the war.

Expect a short-term price jolt coming soon once the stocks and inventories from the 2020 and 2021 harvests are depleted. Food manufacturers and feed producers will have to stock up on grains at a higher price and at a smaller quantity.

Both the pandemic and the war in Ukraine were black swan events. But the shortages and inflation generated by natural or geopolitical events are generally transitory.

There is one element, however, that can transition into a sticky inflation factor.

The Chemical Miracle

When it comes to farming, people picture tractors, 6-foot corn stalks, amber waves of wheat, and the imagery of Shoeless Joe Jackson along with the rest of the Chicago Black Sox walking out of the cornfield in the movie Field of Dreams.

But rarely will anyone connect those images to what actually affects farming.

Chemical fertilizer.

This is one of the most critical issues that will disrupt the global food supply and create long-lasting shortages.

The three most important types of fertilizers are nitrogen, phosphorus, and potash (potassium).

These fertilizers are the most vital component for farming aside from weather anomalies.

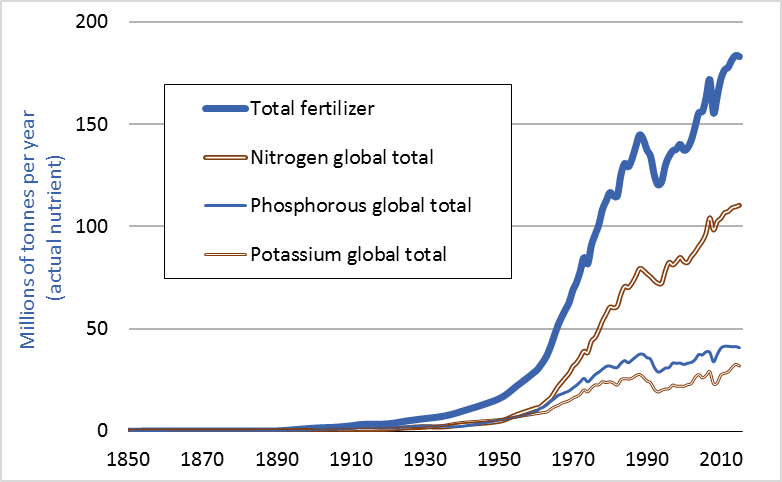

The chart below is the global consumption of fertilizer from 1850 to 2015.

The price of fertilizer has been soaring. Some fertilizers have already doubled in price.

This forced farmers around the globe to use less fertilizer or switch to crops that require less nutrients. Less fertilizer used translates to smaller crop yields. Smaller crop yields mean food shortages. Food shortages equals higher food prices.

This will be a pattern for years to come because the world is running into a global fertilizer shortage.

Who’s to Blame

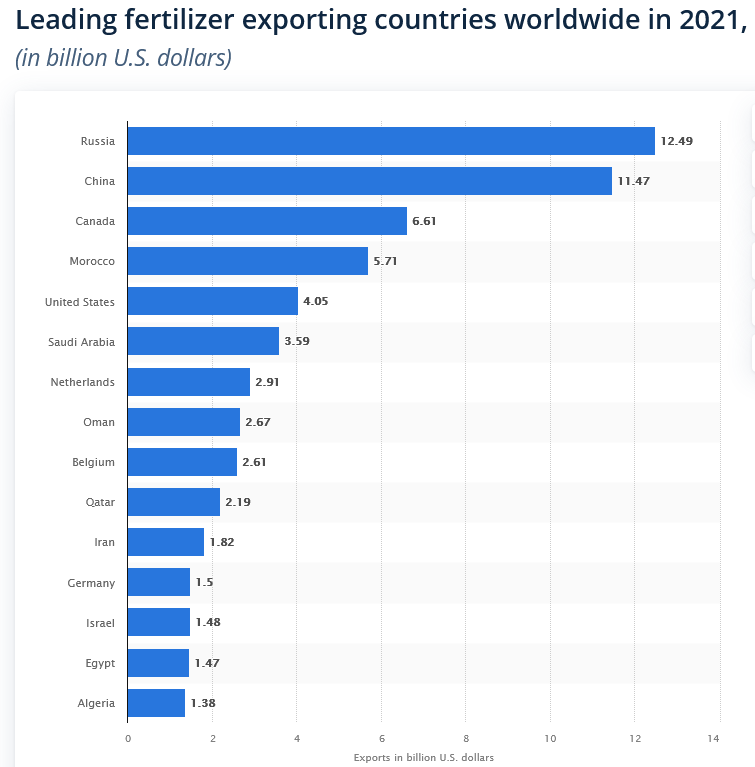

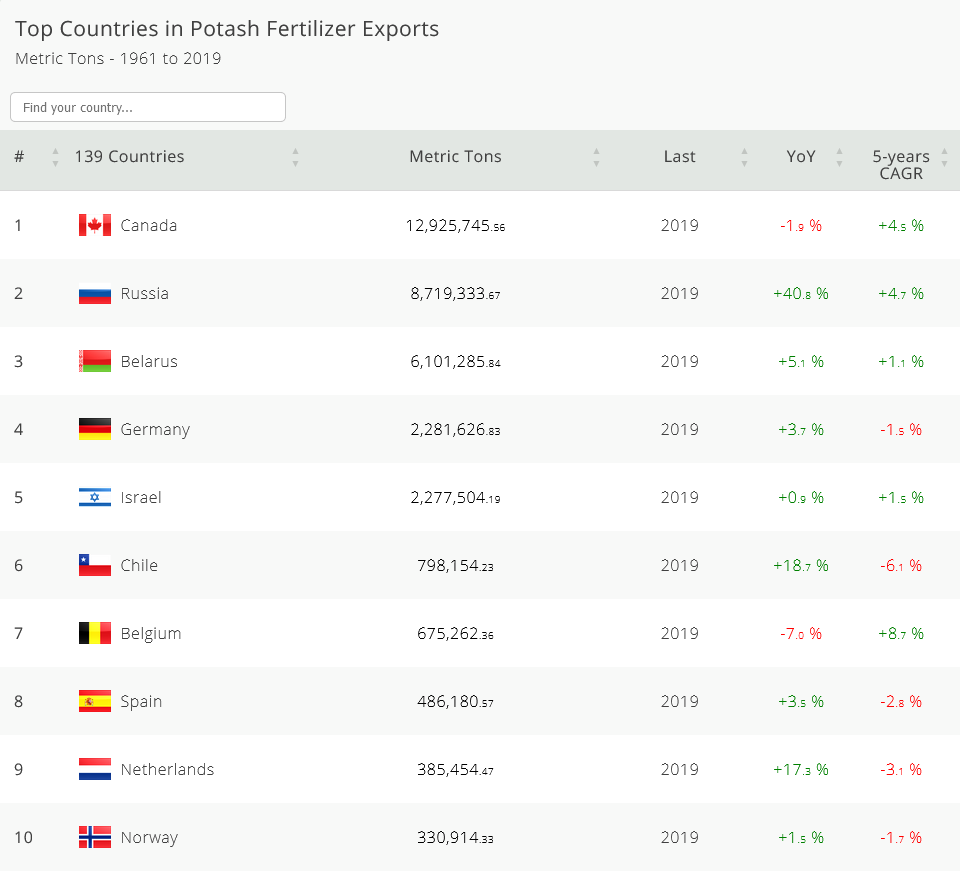

The biggest factor behind the fertilizer shortage is the war in Ukraine. The chart below says it all.

Russia is the largest fertilizer exporter in the world. The global embargo on Russian goods has already taken (and will continue to take) this large amount of fertilizer out of circulation and created a void in Western countries that won’t be able to be filled. Some fertilizers have already doubled in price.

While Russia is a major player when it comes to exporting all three types of fertilizers, the main impact points are nitrogen and potash.

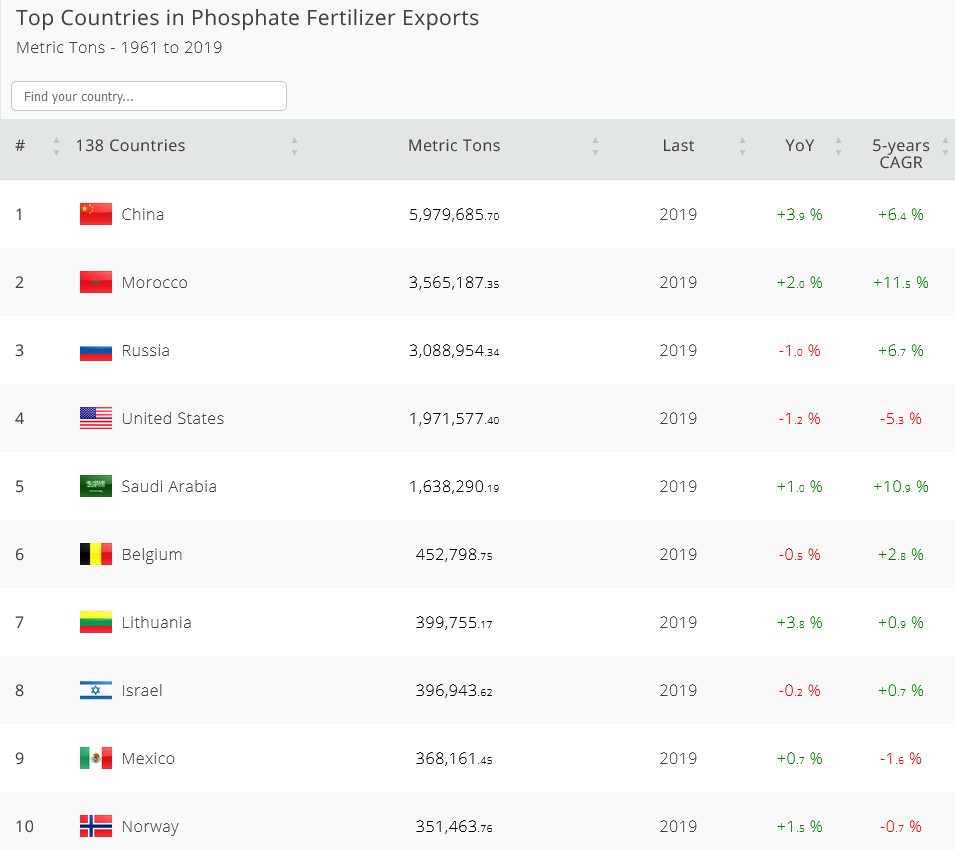

A quick sidebar: Even though Russia is one of the top producers of phosphate in the world, countries such as China, the U.S., and Morocco produce enough of their own to make up for the shortage. Hence phosphate is not a concern for the moment.

Below we have a chart of top exporters of phosphate fertilizer worldwide in 2019.

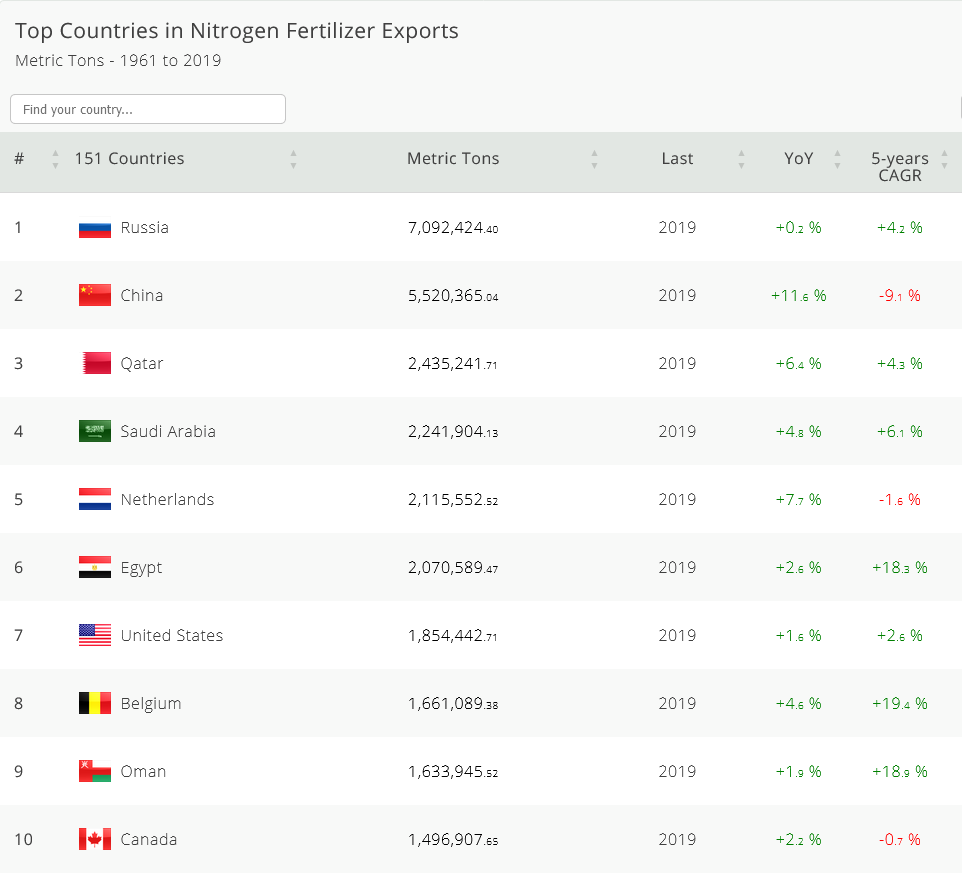

But nitrogen fertilizer and potash are different stories.

Russia is the largest nitrogen fertilizer exporter in the world.

Russia is also the second-largest exporter in the world for potash fertilizer, after Canada. But the potash situation is a bit more complicated.

Belarus, a Russia ally, is the third-largest potash fertilizer exporter in the world. As soon as the West announced the sanctions and embargo against Russia, Belarus decided to declare force majeure and took its potash fertilizer export off the global market as a show of support for Russia.

That is quite a big chunk of fertilizer supply that is currently and will be unavailable to farmers globally.

Unless the embargo on Russia goes away soon, there will be a prolonged shortage of fertilizer.

New Age of Food Inflation

Given there is no end in sight for the Russia sanctions, a fertilizer shortage might persist for years to come. This means higher prices for fertilizer, and that translates to less fertilizer being used. As a result, farmers will just grow less good.

Not to mention the potential food shortages due to national governing policies – another topic that we will discuss in a separate article in the future.

Nevertheless, we are entering a world of food inflation.

Your number of choices in the produce section at the local supermarket, depending on where you live, will most likely start to dwindle along with the amount.

And that will have knock-on effects elsewhere in the markets.

In the two most popular measures of inflation, the consumer price index (CPI) and the personal consumption expenditure (PCE), food and beverage have a roughly 13-14% weighting. As food prices rise because of shortages, inflation might not go away that quickly.

Which means the FED and other central banks around the world might not have the luxury to take their feet off the interest hike pedal anytime soon.

Yours truly,

TD