In Search of Pools

Market Update

Ideas come about in two different ways.

The first one is the lightbulb type of moment where you need to get it out of your head right away. If you don’t, it’ll get caught up in some unretrievable part of the brain. And no matter how hard you try you can’t force it to resurface. Only the combination of time and being in the middle of something completely unrelated will it return.

The other one is just the opposite. It’s almost a painful process. The first hints at an idea starts as a spark in the brain. Like a quick glimpse into an insight that seems just out of arms reach.

And while it’s gone, you somehow have feel a strong pull to pursue it. You don’t quite know what it is you’re looking for, but you start searching for podcasts, research papers, old market reports, and even weird theories in other fields of study.

It all seems completely unconnected, yet at the same time related.

So you sleep on it. Go for a walk. Take a run. Meditate. Read a story about somebody’s take on the Matrix.

Hopefully one of these things can kick off the plaque build up on the brain neurons to allow the spark to grow into something more.

To me it’s just part of the process now. I don’t know if it’s a sign that I’m aging, not getting enough sleep, or not remembering lunch again. Whatever it is, this is what it takes to put an idea together from time to time.

And while I hope one day these ideas help bring about societal change, for now they are more self serving. The most recent of which is merely an investment thesis. And today I wrung out the first version on paper.

With Bitcoin dropping like a rock, grayscale still sitting at a discount, Powell not able to provide much help we needed to form the reasoning for why bitcoin and crypto continues to be or no longer is a buy.

As you’ll soon find out, we are still very bullish on the entire space.

And in order to make sure we still have our sanity, we publish it with the hopes of open sourcing it in a sense - gain some feedback.

Then after it gets pecked at enough, we look to solidify it.

It’s part of our process. We like to think of it as a direct result of being in crypto for almost six years. A lot of what we do is somewhat open sourced.

I look to publish it in the coming days…

In the meantime, it seems like the question on everybody’s mind is will we hold $30k?

After price wicked into the $28k range for hot minute before rising 12.9% before the close (wow), price came within arms reach of $35k.

It was the scenario we hit on in our last issue where we talked about the shorts that began to pile up late. They formed a nice pool of liquidity near $36k.

Here was the chart we shared from our last piece.

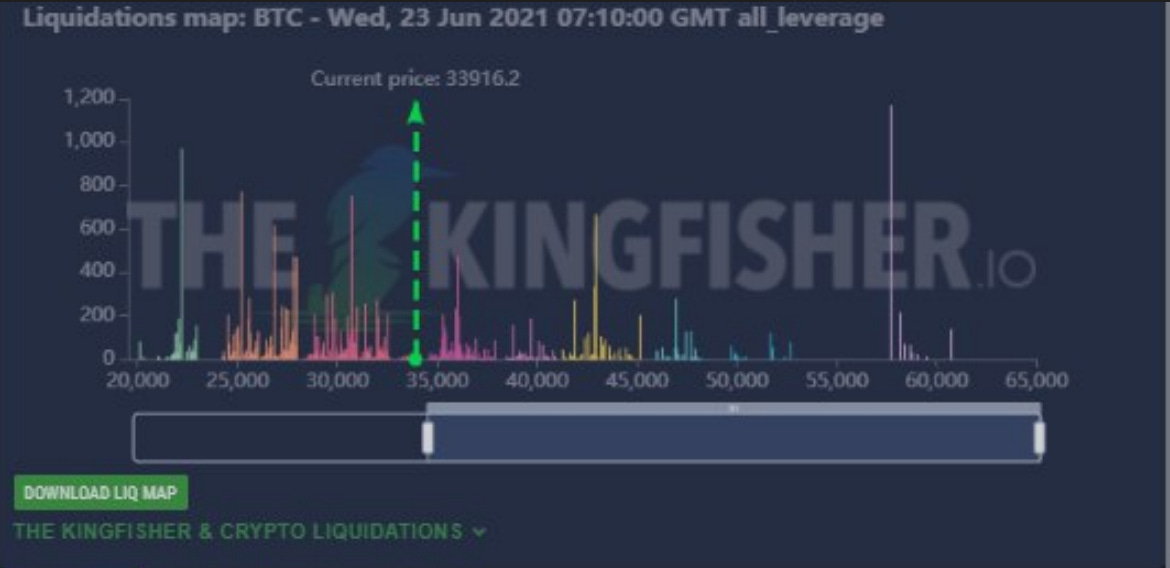

I bring this up because here’s how the liquidation map changed.

More liquidity showed up at higher prices.

This matters because price is attracted to liquidity. For technical analysts out there it’s similar to prior trading ranges, pivot points, or order blocks.

These liquidation maps are somewhat similar, but best viewed as where the easy money sits.

As price approaches these pools of capital, any $1 sell or buy creates a bigger move in price. Meaning if you want to move the price higher towards a pool of capital, each dollar that goes towards buying will go further the closer you get to these pools of liquidity as seen in the chart above - courtesy of our Kingfisher friends.

That’s because as price approaches these pools, traders are forced to either add margin or get liquidated. When positions are liquidated its a market order. Meaning the market order takes whatever is available on the book.

Maximum efficiency with every dollar.

Now the fact liquidity is beginning to appear to the upside is a sign the market is showing signs of coming back to life.

Feels like its been a while since I said that. But let’s hope this trend continues. We still have a ways to go to get back to where we were before.

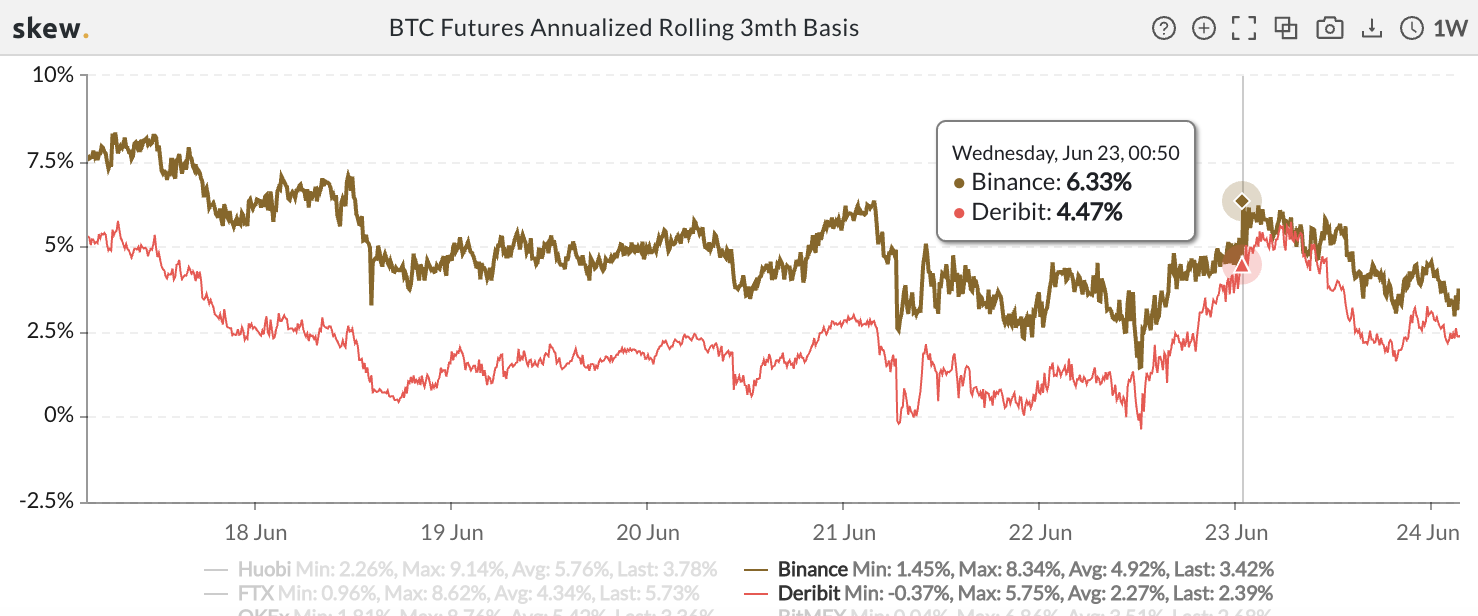

Another interesting observation taking place during the price movement to $35k was the spread in futures. Remember the spread is the difference between spot prices and the price of a futures contract. Below is the 3 month spread.

Note how quickly the Binance and Deribit dropped from about 5% to about 2.5%.

In order for price to gain momentum higher, you don’t want to see these spreads rise and stay elevated. The fact it came back down without a major selloff is a healthy sign. A sign that price can move about more freely.

Unfortunately, the onchain flows over the last 48hrs were a bit uneventful. We’ve seen a few glimmers of stablecoin flows take place, but seems those glimmers already had their day.

We’re now waiting for the next move. Right now we’re leaning towards a bit of downside momentum after traders got a bit euphoric during the intraday rally yesterday.

And with price taking out some liquidity near $36k, I wouldn’t be surprised to see a bit of weakness today. At least until more liquidity pops up to the upside.

As an aside… The reason we are talking about pools of liquidity is because of how dry the market is right now.

When the market acts in this way, price begins to move towards liquidity pools like this. It’s the easiest way for traders to make money in these conditions.

Now getting back to the weakness talk, you might be wondering how weak it looks.

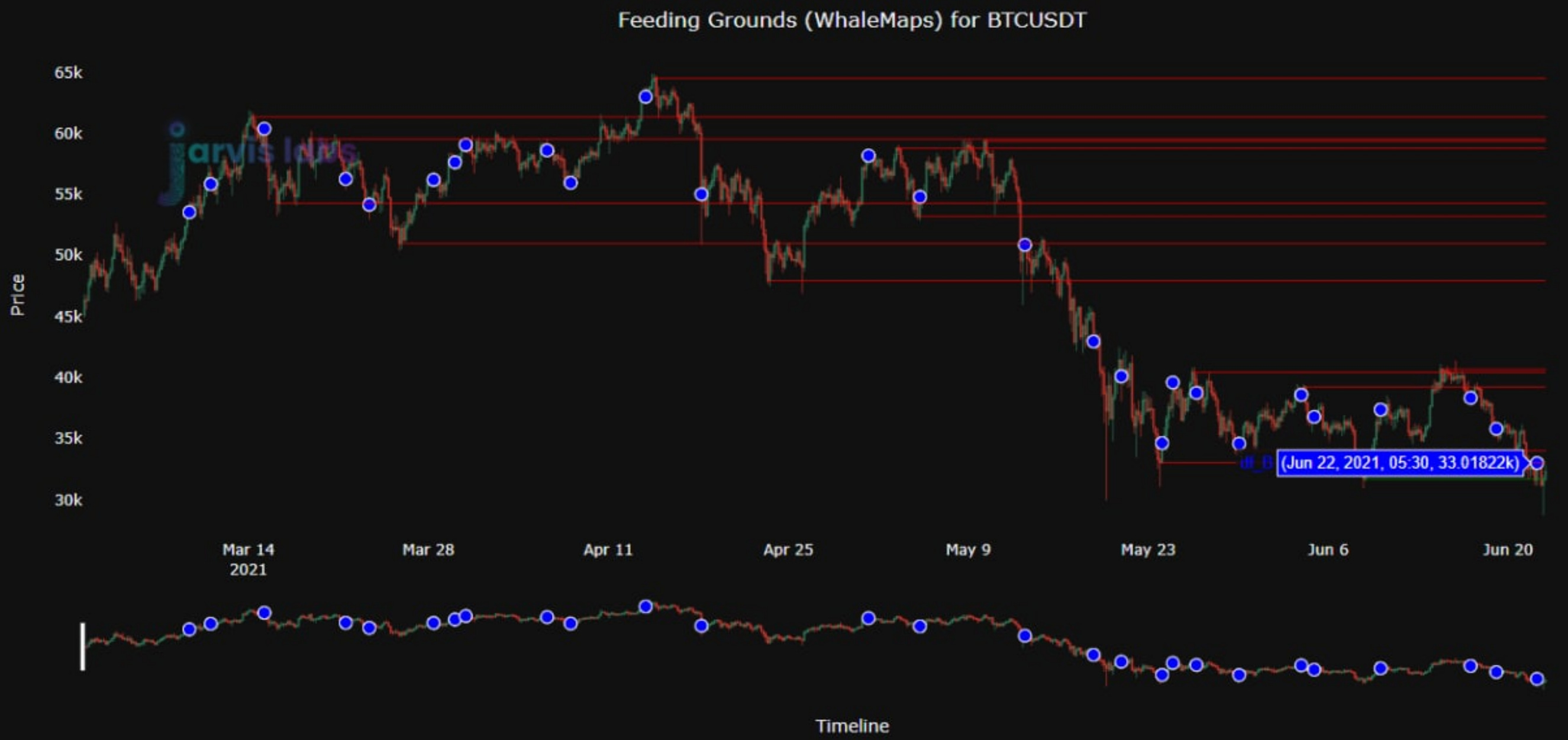

Fortunately, during the bucking of the wild market bronco earlier this week we got some support pop up in our onchain support/resistance chart near $33k.

This is newly added support at the bottom of the range. It marks an area that market movers are likely to defend if price approaches.

It also marks an area of interest to the downside. And with more liquidity to the downside, this area of interest becomes an interesting area of interest for potential trade opportunities.

But to make that leap we want to see stablecoin flows pick up, bitcoin/ethereum/stablecoins flow off exchanges and into market mover wallets, and/or large market orders (not limit) pop up in recent trade history. This will tell us when enough movers and shakers are beginning to dictate direction.

It’s something we can get behind.

Once we get it, it’s time to get back to it. For now, we remain ever patient.

Until next time…

Your Pulse on Crypto,

Ben Lilly