Continued Silence

Market Update

The most adamant of bulls are now turning bearish.

We saw two comments from data platforms hint at a change sentiment yesterday. Several analysts compared the 2017 peak to the top witnessed just last month. And we got hit with another wave of China news that unleashed a ripple of negative sentiment cross the market.

It was an ugly day.

And even though our trading software kept clients on the sidelines and away from the carnage, it was still gut wrenching to watch.

The dejected comments seen throughout the day left me with a sick feeling.

I personally don’t enjoy days like yesterday no matter what side of the market I’m on. That’s because crypto is a community.

Yes, there are bitcoin and Ethereum maxis that can be unbearable at times. But the fact of the matter is everybody is pushing ahead in a common belief that decentralized blockchain technology will power the economy tomorrow while improving society.

Which is why when developer and believers spirits drop like that it saddening.

But hopefully yesterday marks the day of capitulation, and not just a waypoint.

I won’t spend too much time considering yesterday as a midpoint for lower lows… At least not until we form a new low. Until then, the idea discussed in “Patient Parabola” still has a heartbeat.

We’ve been stressing the onchain support in the $30-$35k range for about a month now. It’s held…

But the lack of onchain activity is concerning.

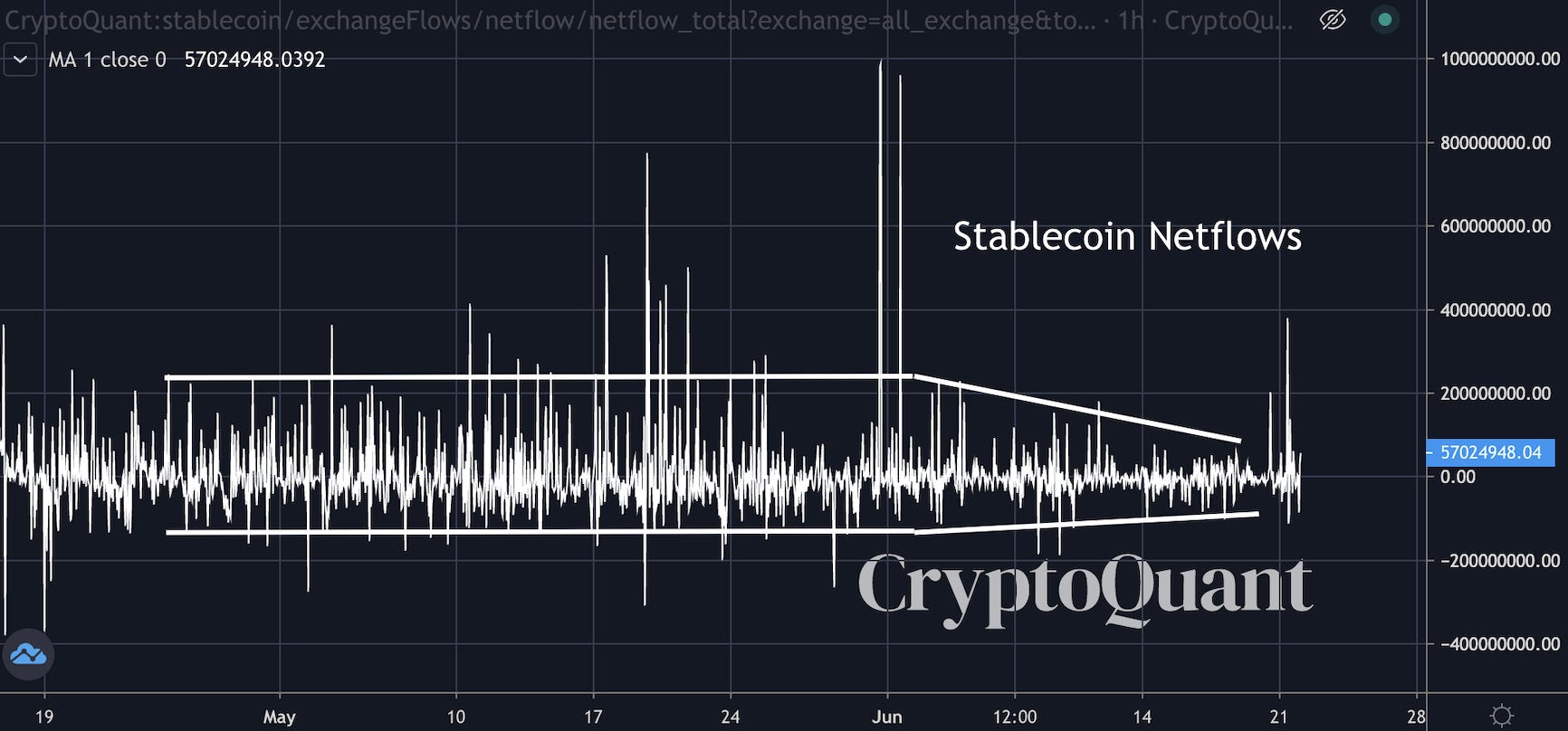

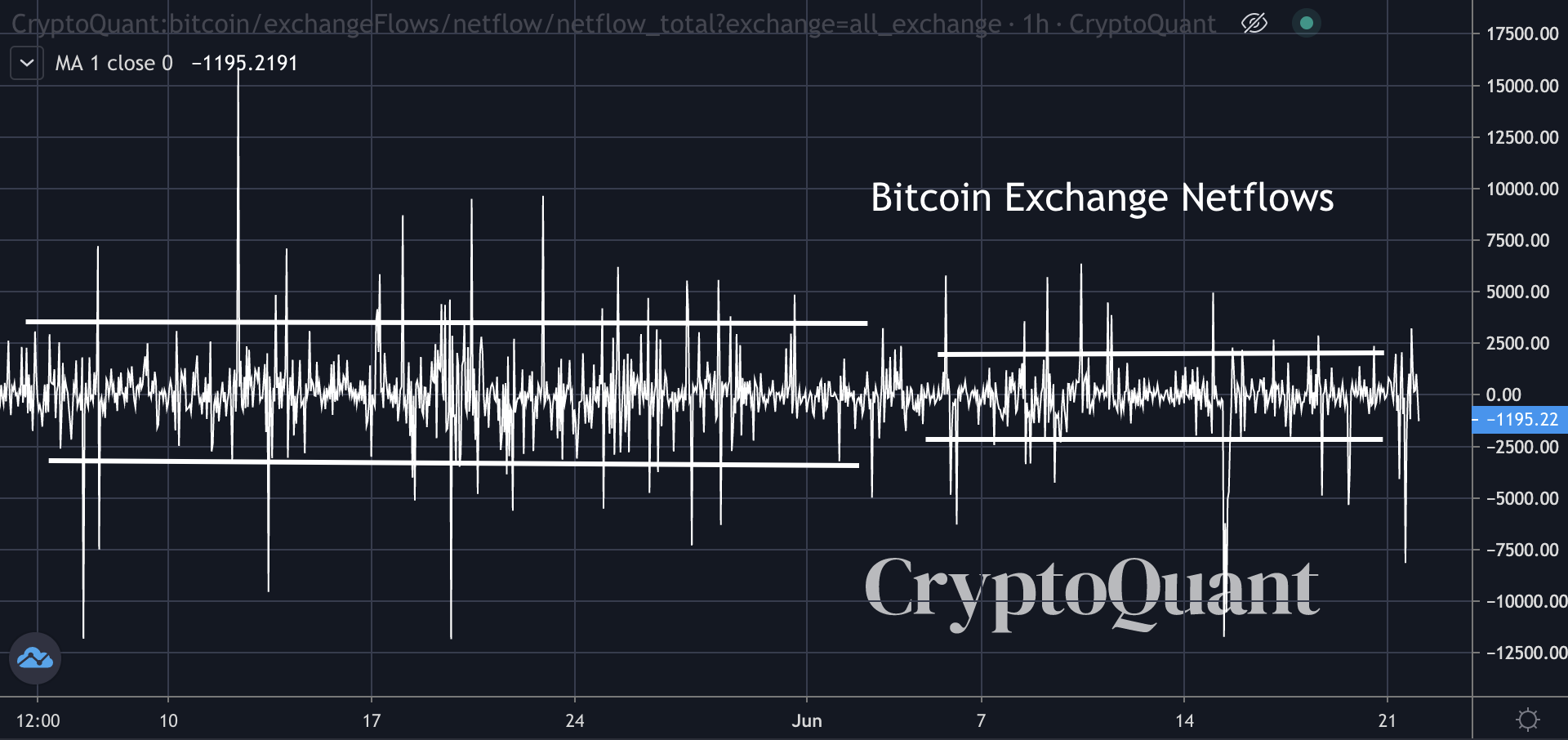

Here’s what I mean. In the following two charts, note the compression taking place. It’s a sign there is a significant drop in exchange flows.

This needs to pick up.

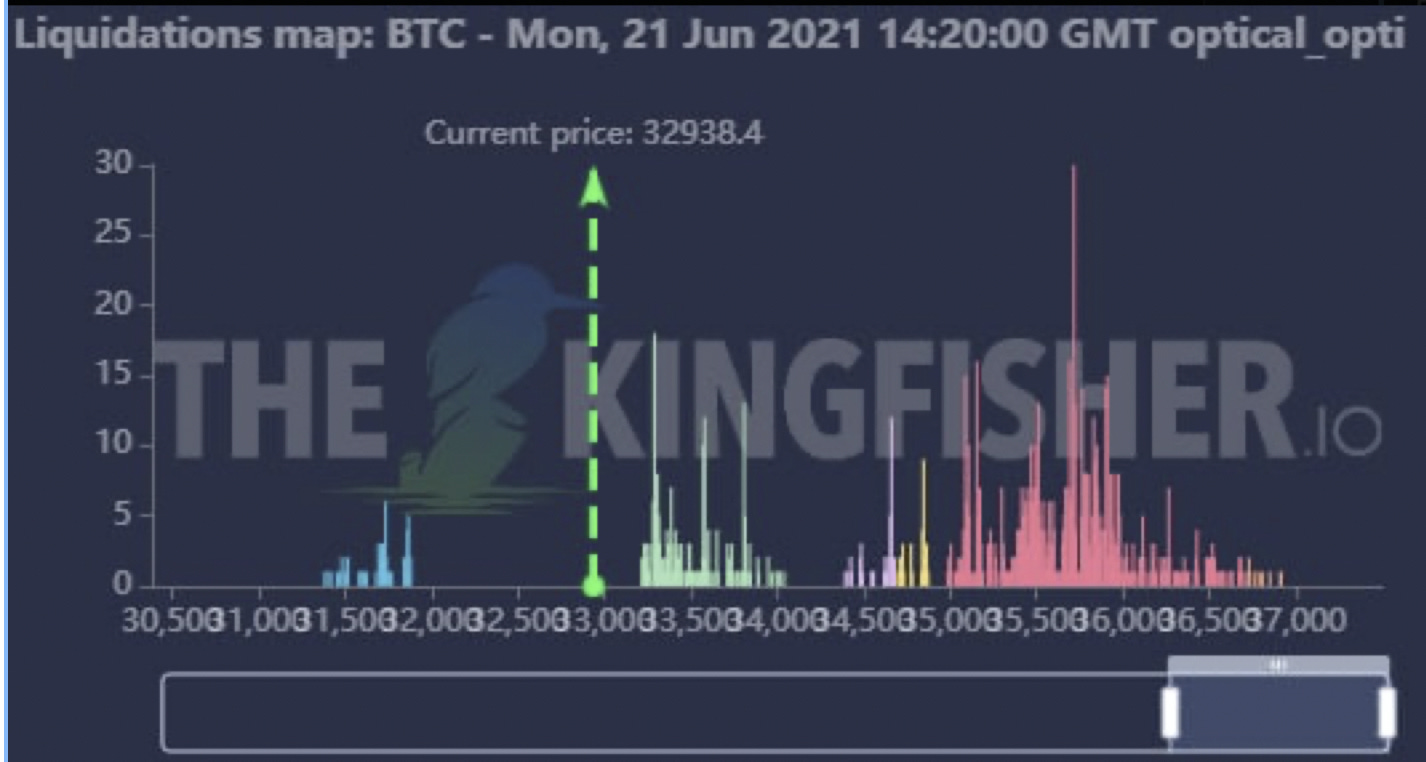

In the near term we expect some relief. We got some bottom signals around $31.4-32.6k.

When we pair this up with the chunk of liquidity that showed up with some late traders, we get a nice pocket that can be take out. Meaning price looks to head into the $36k range for at least a bounce. You can see that in the salmon colored bars below.

IF we get this bounce we hope to see onchain activity pick up. An uptick in activity can bring us back to the $40-42k range once again.

IF we don’t see activity pick up then we need to look at what’s lower.

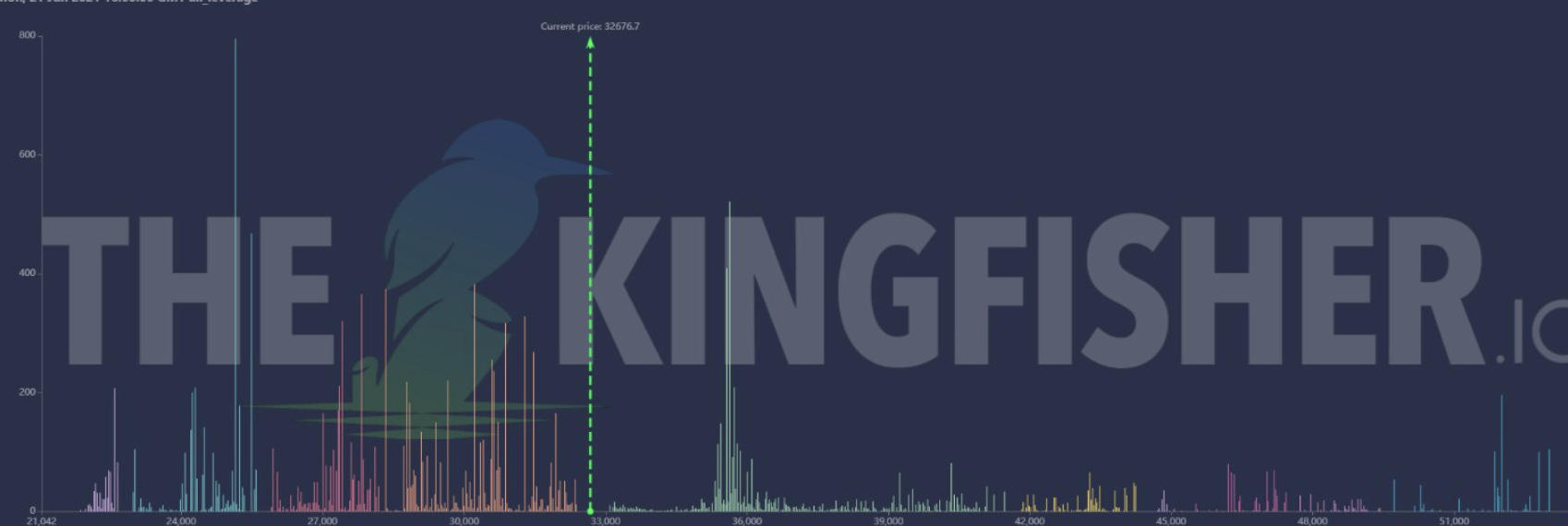

According to the guys over at The Kingfisher, there is a stack of liquidity to the downside. The chart above is zoomed out so the bars to the left of the vertical green line represent areas in which longs get liquidated.

One statistic on the favorable argument for a bounce is the open interest in futures dropped by nearly $1.7 billion over the last week with nearly $1 billion over the last 24 hours.

This amount matches up with the open interest that showed up as price just recently rose to $40k. It tells us a lot of those longs have since been closed and much of the market is getting pushed via leveraged activities on exchanges.

The flip side of this is in order break up and out of this range we need an uptick in flows. If we don’t, then we are at risk of losing $30k.

Let’s see how far this relief bounce takes us and if it can turn into something with momentum.

In the meantime, Powell testifies in front of Congress today. During the hearing, members of Congress will either underhand throw some softball questions his ways that a five year old can answer. Or a few might look to dig into a few topics

It’ll be interesting for sure to see what unfolds as many believe the amount of cash in the system is becoming too big of a problem to handle.

What worries me is why does that cash not enter crypto? I’m not sure. For now, let’s see what gets said tomorrow.

Keep in mind any comments that create softness in the DXY could be a great opportunity for bitcoin to garner some renewed interest.

Until next time…

Your Pulse on Crypto,

Ben Lilly