Here Comes the Sun

Notes From the Lab: Is the End of Crypto Winter in Sight?

Volcanoes, supernovas, and crypto markets all have one thing in common — destruction giving way to rebirth.

During each bear cycle, conditions worsen until those vulnerable to being forced out of the market – namely narratives, traders, and projects not equipped to last – are fully purged.

And just like winter changing into spring, this shedding of the old makes way for the new.

As we learned last year, market Darwinism is brutal, but necessary, as it allows us to clearly separate true growth and innovation from what’s illusionary.

We see signs of this market evolution from weak to strong still taking place, as just yesterday reports came out that Genesis made plans to begin its bankruptcy filing.

Today, however, we’ll be discussing signs of optimism in the data that are signaling we are closer to a new beginning, rather than the beginning of the end.

So if you’ve been following along with me since I started my journey here at Jarvis last year, I thank and commend you for surviving some of the harshest market conditions ever known to man.

If you were a newcomer in 2020-2021, you have now fully earned your stripes and can be considered a battle-hardened veteran.

You persevered through the crucible.

You made your way through the infinite minefield of scams, deception, and outright theft.

You withstood a full year's worth of price action and events so horrific, that it would make those who traded through the 2008 Global Financial Crisis shudder.

And yet, you’re still here.

And so is the crypto industry, even without the aid of a taxpayer-funded bailout.

Bloodied, but unbowed.

That which is truly decentralized (primarily BTC and ETH) has passed the existential stress test with flying colors.

These protocols remained steadfast through it all, and continued to operate as intended, unencumbered by the noisy chaos of our emotions and roller-coaster prices.

Prices which have rapidly appreciated to start off 2023 (as discussed last week), with crypto now having recovered the entirety of its FTX-driven November drop in January.

Will one more telegraphed bankruptcy change this renewed optimism?

That doesn’t seem likely. Rather, it seems more like the endless storm that was 2022 is finally near its end, and we’re on the verge of sunny days again for the first time in what feels like a lifetime.

That’s not to say these events won’t cause volatility and pullbacks in the short-term. But as we’ll discuss, such dips in 2023 might offer more opportunity than despair.

Today, let's revisit some familiar metrics, as well as a new one, to see why confirmation of a new bull-trend is becoming more and more likely each day.

Rest now, weary traveler. Your journey through the bear market is near its end…

Movin’ and Groovin’

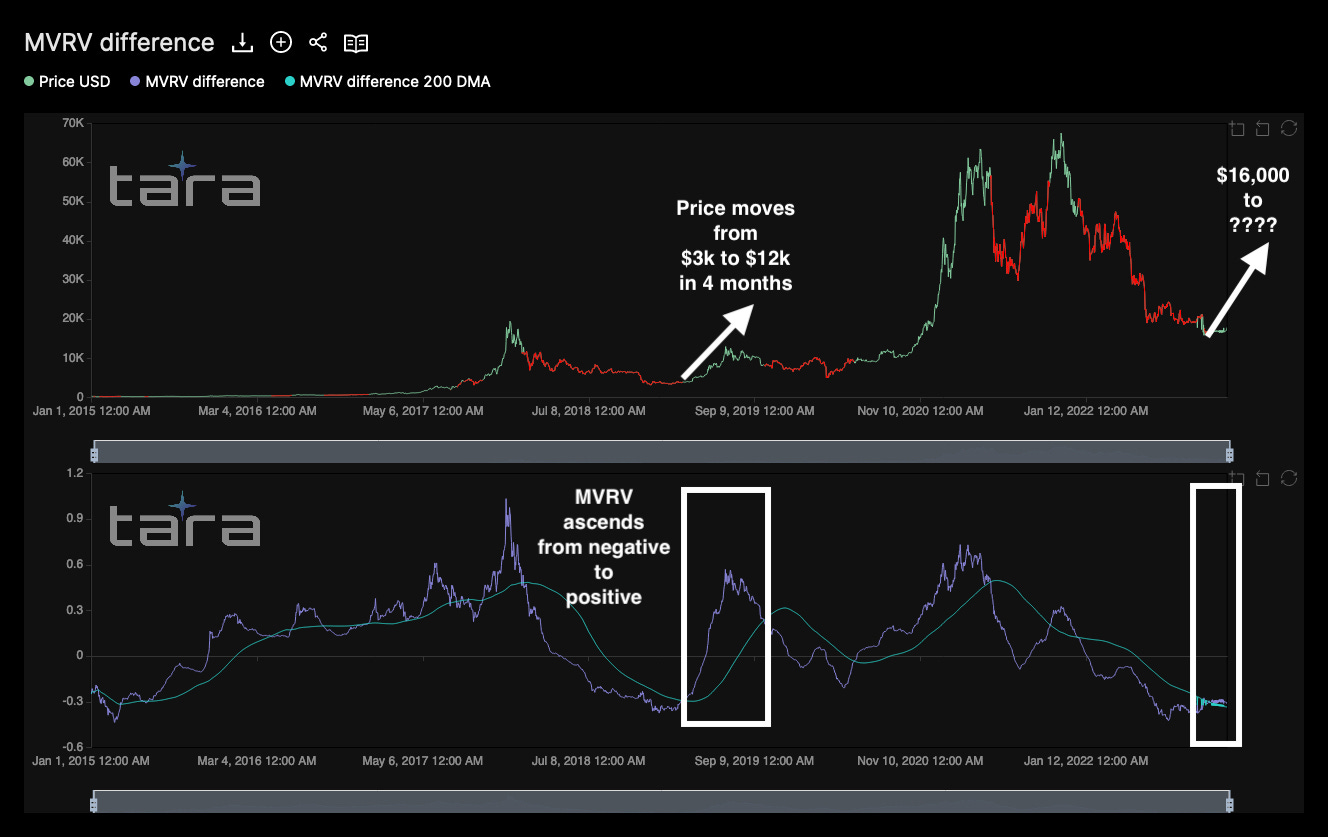

Just before Christmas, we discussed the potent signal known as MVRV. As a simple reminder, MVRV is the ratio of BTC’s market value (MV) versus its realized value (RV). That ratio tells us what percentage profit or loss the average BTC transaction is currently realizing.

In that piece, we explained how MVRV was declaring to us that the bottom was in (at least temporarily) while BTC was under $16,500.

And despite BTC rising over 10% since December, it looks like this trend has only just begun. As we’ll see below, MVRV still remains deeply negative with a current score near minus-.30 at time of writing. To reiterate what we covered in that essay, an MVRV difference score of minus-.30 means the average cost basis of coins being transacted today is still 30% higher (~$30,000) than today’s prices of ~$21,000.

Based on all previous cycles, any time MVRV has moved above its 200-day moving average (MA) it has not stopped rising until it’s deep into positive territory. This implies an additional price increase of +30% at minimum is statistically probable before this rally reaches an end.

In the image below, the top chart shows BTC’s price while the bottom shows MVRV (purple line) and its 200-day MA (green ribbon). The first white box shows us what MVRV looked like in early 2019 just prior to the major squeeze that took us from $3,000 to $12,000 in under four months.

As you can see, our current set-up looks quite similar to that of March 2019, which was the last time MVRV was this deeply negative.

But before we get ahead of ourselves with delusions of grandeur over a new raging bull market in the months to come, we have to reassess BTC’s position in the current structure and think about what it would take to get there.

Reconquering Lost Ground

A few days after we covered the technical structures of DXY, BTC, and ETH last week, an important development came to pass on Friday…

Bitcoin reconquered its 200-day MA (red line, ~$19,520).

A critical advance as the market now looks to cement 2022’s bottom and begin a new bullish trend. (The green and dark blue lines represent the 50- and 100-day MAs, respectively.)

In order for BTC to expand upon its current momentum and provide this rally some longevity, what will ideally happen next is a period of bullish consolidation above the 200-day MA prior to the next leg up.

This consolidation would solidify a flip of the 200-day MA from resistance to support, not unlike what we saw in April 2019 after prices bottomed and recovered all major MAs.

As you’ll see with 2019’s breakout below, consolidation periods below and above the 200-day MA are crucial, as time allows for price digestion. This eventually will lead to the 50- and 100-day MAs rising above the 200-day MA, which creates a technically sound and sustainable market structure.

A necessary first step for parabolic advance.

And while there is still a reasonably high probability that early January price levels will be revisited again at some point in 2023, there is also a strong piece of data which suggests any such retest would present a prime buying opportunity.

Let’s take a look.

Packing the Bags

You may remember this excerpt below from After The Storm, which was published just days after the fall of FTX.

It explains how megawhales (wallet entities holding greater than 10,000 BTC) viewed that temporary moment of chaos and instability as a prime buying opportunity.

These trend numbers are staggering. Over the past 30 days, megawhales have absorbed the selling of all other holding classes, and net accumulated over 70,000 BTC, with extreme upticks happening over the past week.

Now that’s some serious conviction.

This is important, because a trend of strong accumulation acts as “concrete” being poured that can support the weight of the next bull run.

And if we dig deeper into the data, we find November’s megawhales weren’t the only ones capitalizing on chaos in 2022.

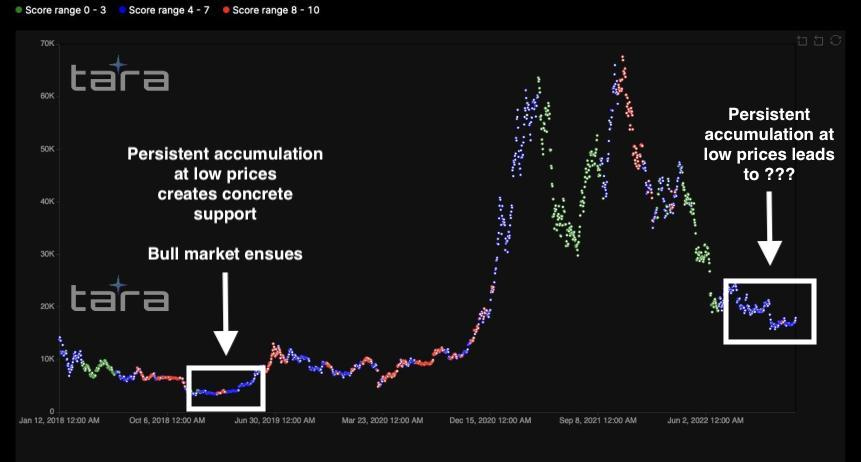

The chart below, from our TARA-NFT dashboard, allows us to visualize these accumulation trends.

- Green = little accumulation

- Blue = moderate accumulation

- Red = aggressive accumulation

The Bitcoin market has now been in a perpetual state of accumulation since it first fell below $20,000 in June 2022.

This prolonged accumulation trend is very similar to the blue wave accumulation pattern we also saw in late 2018-2019 when BTC was near rock-bottom prices as shown above, albeit there were deeper shades of red in there.

That accumulation channel became rock-solid floor support which would hold during the COVID crash of 2020 and provide a strong foundation for the two-year bull run that followed.

What we saw in the final months of 2022 was concrete being poured once again.

Due to the length of that consolidation period, there is now a firm foundation in the $15,000-$17,000 range that could serve as a launchpad for the next cycle.

It would also not be shocking if in the months to come we find out major financial players saw the crash of 2022 as an opportunity to increase their BTC holdings.

Many legacy titans chose to sit on the sidelines during the 2021 bull run in anticipation of the better trade entry points 2022 provided. Just this month, we heard news of a surprising big-name allocation when Morgan Stanley reported buying a small, $3.5 million starter position in GBTC.

Due to the mimetic nature of markets, it is unlikely they are alone.

When assessing the confluent data of all the above, it’s hard not to feel optimistic about 2023 and beyond.

In the sore eyes of this lowly janitor, it looks like the stars are beginning to align, and crypto is entering a spring cycle of rebirth.

Which is exactly what we needed after that long, cold winter of despair.

And I say, “It’s alright…”

Your friend,