Fear Mongering

Tether Talk and Market Update

The warnings signs are becoming prominent.

I tried to brush them off. Pretend they didn’t exist. Even chalk it up as fear mongers mongering.

After all, fear sells. Chants from those preaching fear are sure to gain greater attention on the heels of such a major selloff.

And anybody that is precariously holding on to their non-battle tested sliver of hope will likely subscribe to the monger.

Because these investors who never took part of such an event watched their crypto net worth get chopped in half. They are now the ones devouring fear mongering news waiting for the next shoe to drop.

This is in part why I’ve ignored the topic of today’s issue for over a week now.

I didn’t want to get swept up into that crowd.

After all, our beat at Espresso is market structure. Where capital is flowing, what are the market movers doing, and what’s the momentum.

But after doing some research this weekend and diving into some on-chain flows we found ourselves asking ourselves the unique question of why 80% of the USDt in the market even exists.

This is figure represents the amount not on an exchange or in a smart contract. And with the amount of USDt at nearly $62 billion, this elephant in the room totals nearly $50 billion.

It’s enough money to where if it was a small county, it would amount to a GDP greater than Lithuania and Slovenia.

It’s significant.

What’s more is the $50 billion has some of the most relaxed regulatory guidelines attached to it.

For anybody looking into this amount there clearly is an economy of some capacity in existence that depends on Tether. And I’d reckon this economy is not as clean as the bitcoin saviors making mention that bitcoin is rarely used for illicit purposes make all of believe.

Now, while their comments about bitcoin are likely true, the same might not be said of USDt.

And after having this train of thought over the weekend, I was quickly reminded me of a conversation Benjamin and I had back in 2019.

He was busy scouring the blockchain with a magnified glass per usual… And as he came up for air, we started to wonder what the heck was going on in China. There was just an insane amount of flows taking place with Tether that had little to do with price.

It didn’t take us long to figure it out as we came across an article from Coindesk hitting on Tether being used in Russia-China cross border transactions. It alluded to a real use case of crypto outside of speculation and therefore price movements.

Unfortunately the players involved were not the type to be gracing the covers of Fortune anytime soon.

What stood out to us then and what stands out today, and why I bring it up now, is this line in the article,

To buy or sell USDt for dollars from Tether itself, a trader must be verified through the company’s know-your-customer (KYC) process. However, since the token runs on top of public blockchain networks (bitcoin, ethereum and tron), anyone can receive or send it, and secondary trades are unrestricted.

continuing further…

Back in China, the merchants can exchange USDt for fiat easily, even though the People’s Bank of China banned fiat-to-crypto spot trading in September 2017.

The article alludes to an economy separate from crypto trading.

At the time the two of us simply viewed this as an interesting tidbit. The flow of capital was apparent and the movement to the exchanges facilitating this process was apparent as well.

But in terms of what we do, outside the scope of our daily activities. We simply look to see how on-chain flows impact price. We aren’t criminal investigators. That’s a mission industry giant stalwart Chainalysis conducts.

So at the time we moved on to the next task of the day and stored it away in our memory.

Until recently…

What brought this back to the limelight was a quote from The Block Crypto’s piece on the recent China crackdown. The article says,

That means local traders, including miners, are seeing an increasing volume of orders to liquidate their USDt into Chinese yuan through OTC desks amid the uncertainty cast by the State Council meeting comments.

Meaning miners were liquidating their USDt holding.

In fact, here’s a chart from Venture Capitalist Dovey Wan showing this discount in the market at the time of the recent selloff.

The chart above reflects a 5.5% discount on USDt. That’s a massive haircut for a stablecoin.

Now, I don’t necessarily believe this event is harmful to crypto in the near term. What I think we need to be aware about is the arena USDt is beginning to compete in.

Which is cross-border transactions, sovereign issued currency, and central bank digital currencies.

It’s an arena where the competitors can decide who can stay and who goes.

Which framed in this light, we start viewing China’s ambitions with a new perspective.

It’s common knowledge that China is getting closer to issuing their own currency. It’s not a secret. And the Chinese authorities currently have the pedal to the metal on its development. So you can likely assume the government does not want a competitor like USDt messing with its success.

And the Chinese are likely not the only governing authority looking at USDt with heightened scrutiny.

U.S. bankers are beginning to sound the horn and act like Tether stole their lunch.

In fact, nobody has done more to fear monger crypto users for their own benefit than Caitlin Long, founder and CEO of Avanti Bank & Trust in Wyoming.

She wrote in a recent piece…

Since May 5, regulators from Washington to Beijing have issued a near-daily stream of announcements aimed at taming cryptocurrency markets.

This is her way of taking a sledgehammer to the alarm bell.

And while I’m not so sure the announcements are daily, I’m actually agreeing with her take with the caveat of knowing her end goal is to secure business for her bank, and her own pocket.

That’s because it benefits her to bash Tether. That’s a $62 billion opportunity. She wants that capital in her bank.

But even with that caveat, I don’t think she’s too far off the mark.

One of the reasons is the mere fact it is now June. You might recall several months ago we wrote the comment period for FinCEN’s FATF guidelines and travel rule for VASPs will come to an end this month.

The main critique FinCEN has on VASPs is DEXs like Uniswap should implement know your customer (KYC) policies. This is the stuff you have likely done with your fiat to crypto exchange where they verify your identification.

But for DEXs they have yet to implement these procedures.

The thing is, VASPs are more than just DEXs… It applies to virtually all smart contracts in DeFi. If these policy recommendations stick and countries start adopting them, crypto would suddenly become a hot bed of regulatory issues overnight.

That’s because any smart contract that sits on a Uniswap, Aave, or the like will need to implement AML/KYC measures.

It’ll be a blow to DeFi.

(If you want to read it for yourself, the report is here. Skip to item 72 “a”. )

The other potential outcome to note is if FinCEN holds their ground on VASPs requiring AML/KYC, USDt will likely be sold at a discount again.

That’s because a massive chunk of USDt that is operating outside of the KYC purvey will have even less avenues to travel through if these AML/KYC measures appear on decentralized protocols.

And frankly, I believe this is what the industry is waiting to sort out. The issue with all of this non-KYC’d stablecoins and smart contracts… Regulators and global leaders want to get rid of it without harming the crypto space. Which is why they are moving so slowly.

But once this is sorted out I wouldn’t be surprised for an ETF get approved soon after.

The FinCEN comment period coming to a close later this month is an important event to watch for. It’ll also coincide with the U.S. unveiling some preliminary research and thoughts on the CBDC its been working on, which will be a great time to issue a fresh wave of warning shots to the crypto sphere.

This is not a full stop, act now warning on Tether. It’s simply a discussion on risks and upcoming policy measures that might impact prices later.

Its more of let’s see how this plays out over the coming weeks to months.

Alright, enough of us focusing in on market fears, let’s get a quick update on the market to hold you over for the next 24 hours.

Market Update

Turns out not much has changed from this tweet yesterday.

As we get closer to the top half of this range we begin to see some flows... of the bearish variety. Seems this rise was fueled a bit from the overly bearish sentiment seen in derivatives turning more neutral.

— Ben Lilly (@MrBenLilly) 3:02 PM ∙ Jun 2, 2021

Here are historical funding rates showing neutral rates.

We got some bearish inflows to exchanges. One of which was 1.3 million MATIC sent to Binance. I wouldn’t be surprised to see MATIC take a bit of a dive here after enjoying such an incredible run.

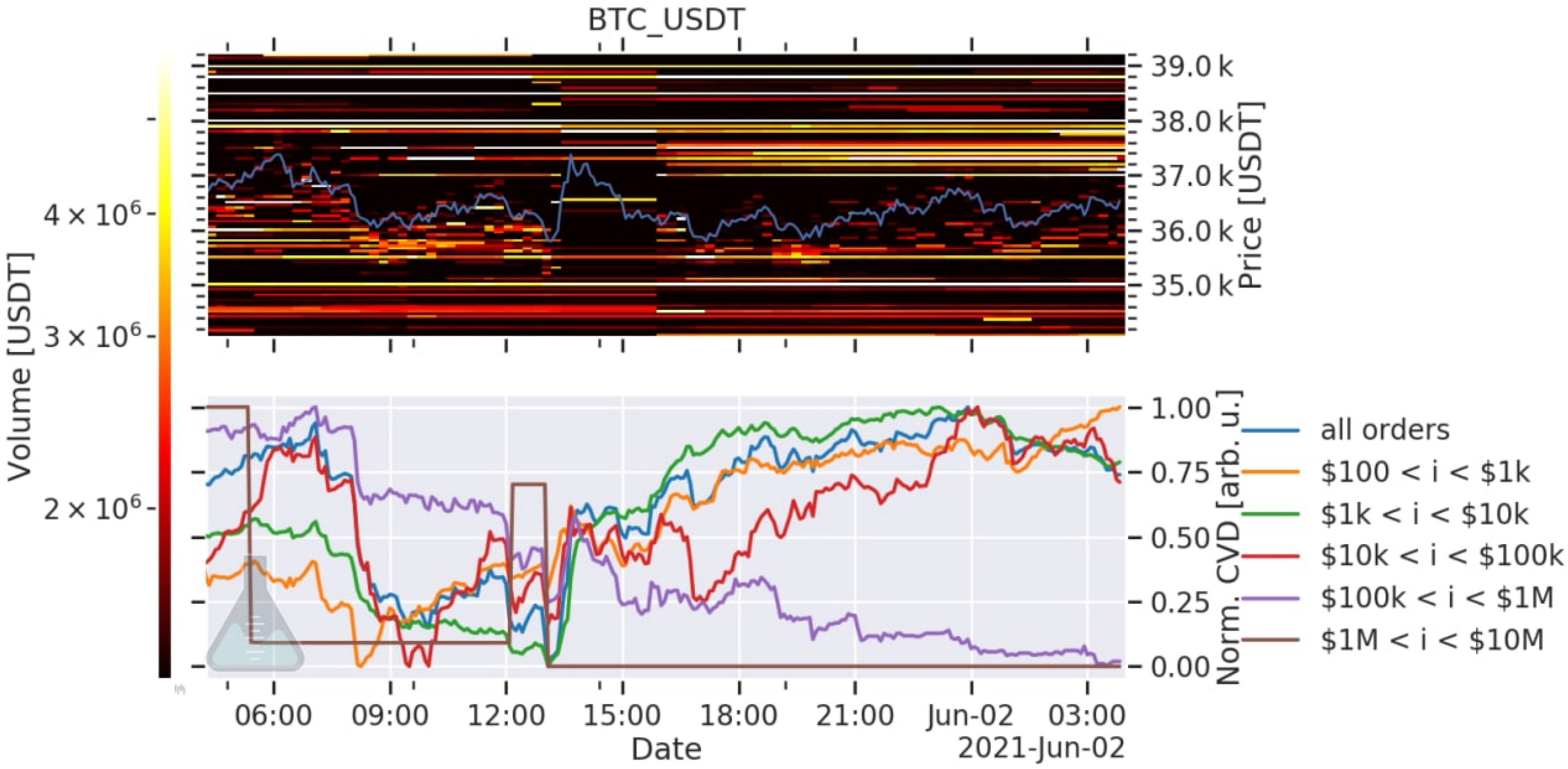

Additionally, to help visualize what we are seeing on-chain, our friend Fred made the chart below available.

The real takeaway is the purple and brown line on the bottom half, they are trending down. Translation… whales are selling, not buying.

Also, on the chart on the top half… Note all the yellow lines above the blue price line. Those are large sell orders. They are populating the area from 37k to 38k. This is the same area we got a subtle rejection from yesterday.

Bearish whale orders. Bearish on-chain flows. Bearish sell walls. And whenever we get a bit of a dip, we see liquidity come in for some bag filling.

For now, it seems our sails are slack as we navigate through choppy waters. Let’s see what tomorrow brings.

Your Pulse on Crypto,

Ben Lilly