Ethereum Is No Silicon Valley Bank

Token Insight: How ETH is Faring One Month After Shanghai

Let’s go back to the beginning of April.

Anticipation for the upcoming Ethereum (ETH) upgrade, Shanghai (or Shapella), was on the rise. Soon, ETH stakers would finally be able to withdraw their staked tokens after years of waiting.

But not everyone was optimistic at the time. Plenty of people were worried that enabling withdrawals would lead to mass selling and a dump of epic proportions.

Just check out these headlines.

The backdrop was certainly ominous. Just a month earlier, a number of U.S. banks were declared insolvent after depositors fled en masse following liquidity concerns.

So, just over a month after Shanghai was implemented on April 12, how is ETH doing? Was there a massive run on deposits? Did ETH take a swan dive?

Quite the opposite, in fact.

What Dump?

Regular readers of Espresso might remember that in March, my fellow analyst and resident JLabs janitor J.J. took a close look at ETH’s technicals heading into Shanghai.

The day before the upgrade, he said that ETH had plenty of bullish momentum behind it, although the upgrade might make it fall and retest the crucial $1,700 price level.

Turns out, ETH has held up even better than expected. The lowest it’s dipped since Shanghai is just under $1,800, and it even saw a spike up to $2,120 a couple days after the upgrade.

And as J.J. noted, a lot of the bearishness surrounding Shanghai didn’t factor in all the details about the upgrade:

It’s also worth noting some important nuances surrounding the Shanghai unlocks. For one, there are withdrawal limits that cap how much ETH can be unstaked per day, mitigating the immediate effect of sell pressure on price.

Plus, a large amount of selling is already priced into the market. Many stakers who need access to cash ASAP have already sold claims to their staked ETH over-the-counter, or hedged their long position with shorts via options and futures contracts.

So we didn’t get the token dump that many feared post-Shanghai. But how is the network itself faring after this significant event?

Hotel Ethereum Is Booked Solid

We all probably already know that validators stake their ETH to participate in the chain’s consensus and earn ETH rewards (currently, validators can earn 8.66% annually). Post-Shanghai, validators can now choose to unstake their ETH whenever they want, but the number of validators that can exit at any given time is capped.

If a lot of validators want to unstake, they will have to wait in the exit queue.

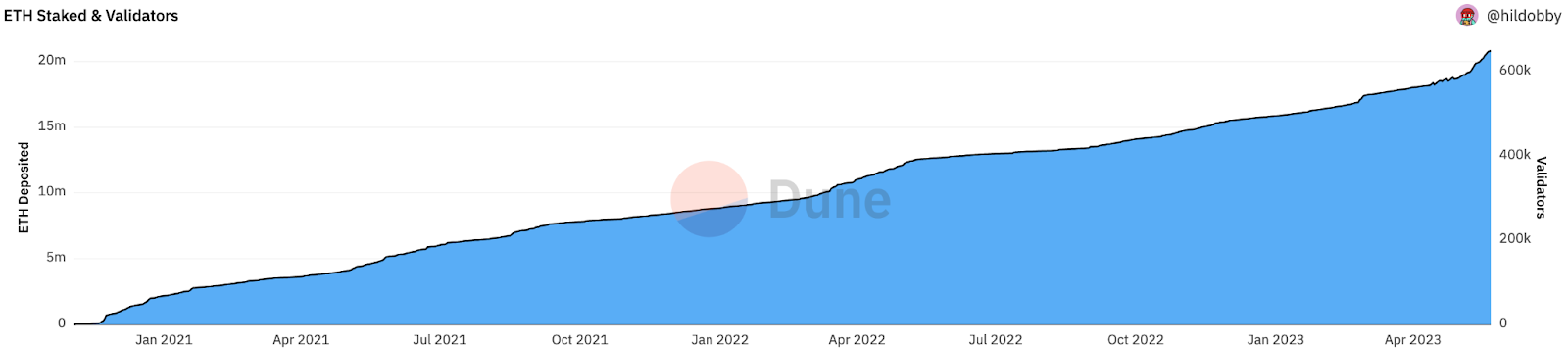

Ever since Shanghai went live, almost 55,000 validators have fully exited. This equals around 1.7 million of ETH being unstaked.

But this pales in comparison to the almost 140,000 new validators that have joined since then, staking over 4.3 million ETH. Not counting partial withdrawals (withdrawals of only rewards, not the principal), the network has seen a net inflow of 2.6 million ETH.

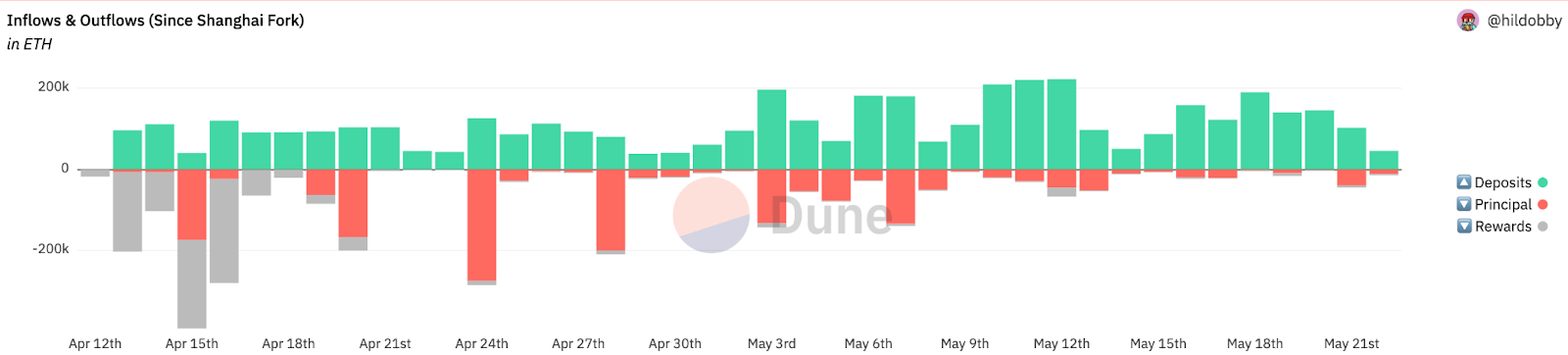

You can see this in the chart below, which shows incoming ETH deposits in green, and withdrawals in red (for initial deposits) and gray (for staking rewards).

Certainly not the en masse withdrawal that people were expecting.

In fact, it’s the entering queue that’s booked solid. Over 66,000 validators are in line waiting to stake their ETH. This means that, if you wanted to stake your ETH now, you’d need to wait almost 36 days.

So not only is no one heading for the exits anymore… but everybody is trying to get in to earn yield on their ETH. And they’re willing to wait over a month for the privilege.

At present, there’s a total of 21 million ETH staked, about 17.5% of the current supply. Prior to Shanghai, about 15% was staked. And these numbers will likely continue to rise.

What’s clear is that just over a month after Shanghai, all the fears of massive withdrawals and waves of selling were unfounded.

Enabling unlocks has de-risked ETH to the point that everyone is clamoring to stake their tokens, and few, if any, are trying to get out.

Keep it fun,

Kodi

P.S. I plan to discuss topics like this on an upcoming podcast called Alpha Bites. It’s produced by a new studio we’re launching called xChanging Good.

Each episode will feature a group of analysts, including Ben Lilly, J.J., and myself, debating what actually matters in crypto and what we have on our radar. The first episode releases this week. Stay tuned for more.

Thank you for reading Espresso. This post is public so feel free to share it.