Collecting Pennies in Front of a Steamroller

Notes From the Lab: What 2022 Taught Us About the Dangers of Centralization and Chasing Yield

TRADE OFFER(!):

I receive: 100% of your crypto

You receive: 18% APY

Sounds pretty good, right? Well, how about if I present it this way…

I receive: 100% of your crypto

You receive: a small percentage of the returns I make while gambling with it.

Not quite as appealing.

Yet that’s exactly what most crypto lenders were offering investors.

They advertised option #1 as “high-yield, risk-free” crypto savings accounts to give depositors the illusion of safety and trust. But they were actually delivering option #2, a high-risk, low-reward investment product.

Just ask the victims of Celsius.

As we discussed last week, users who deposited their funds on third-party platforms that offered yield, like Celsius, were unwittingly providing their liquidity to private hedge funds and trading desks.

The yield these platforms offer is simply the premium you receive for being exposed to their high-risk venture. It is your reward for loaning capital to their trading operation. But again, this is not the way it’s advertised.

In reality, there is no such thing as “risk-free yield,” only varying degrees of risk along a wide spectrum.

On the low-risk side, you can deposit cash into a FDIC-insured savings account and earn on average 0.19% annually, with minimal chance of ever losing your principal.

On the high-risk side, you can deposit your crypto on CeFi exchanges and receive upwards of 18% APY…but if they blow up, you also lose 100% of your funds.

This is why Ray DeVoe, a longtime financial newsletter writer, said, “More money has been lost chasing yield than at the barrel of a gun.”

So why have so many people been willing to take yield trades like this one despite the horrendous risk-to-reward ratio?

The answer to that is the core of what we’ll be discussing: how inflationary monetary policy creates a vacuum, which crypto, for better or worse, fills.

From 2020 to 2022, we saw what happens when this impulse leads the uneducated to trust third parties. It was disastrous.

Fortunately, the self-corrections happening within crypto now give hope for the next cycle to be driven by fundamental adoption, rather than leveraged speculation.

Sooner or later, central banks will return to inflationary policy and create another vacuum. It’s in their nature.

Today, let’s take a look at how the next time that happens, we can be better prepared to not be caught off guard with somebody counting cards next to us.

The Vacuum Revisited

In “Complicit In Catastrophe,” we talked about a figure of speech Mr. Ben Lilly taught me: “Nature abhors a vacuum.”

In this context, it means that in the absence of an expected dynamic, something else will soon replace it. And if the voids aren’t filled by conventional means, then they become filled by unconventional means.

This is the best way to understand what happened with the rise of crypto yield-chasing between 2020-2022.

It began all the way back in March 2020, when markets crashed as a result of the COVID-19 pandemic reaching the U.S. In response, the Federal Reserve slashed interest rates to 0% and flooded the money supply in hopes to prevent a deflationary crisis. And it worked!

Well, kind of. It stopped the immediate risk of deflation from escalating. But the tradeoff was these policies fueled the massive speculative asset bubble of 2020 and 2021, and the high inflation rates we currently struggle with.

Below, we see how immediately after the Fed slashed rates and began printing, the dollar’s value (represented here by the U.S. Dollar Index or DXY) collapsed.

Since asset prices and the dollar have a high inverse correlation (meaning when one goes up, the other goes down), this breakdown created all sorts of second-order consequences.

For one, within a few months, the S&P 500 not only fully recovered its losses from the COVID crisis, but made all-time highs! Given that large sectors of the economy remained shut down, this was not due to exceptional profits or fundamental reasons, but rather thanks to speculative fever.

The trillions of freshly minted dollars the Fed injected into the economy shifted the public’s psychology from being scared of the next Great Depression, to suddenly having more cash than they knew what to do with.

Pair that phenomenon with interest rates remaining at 0% for nearly two years after, and it’s easy to see how this yield-seeking vacuum was created.

Regular banks were unable to pay out interest to savers as they do under healthy conditions, but that didn’t kill the market’s demand for yield. It only sent their dollars in search of a new home…

The Wild West of high-yield, low-regulation crypto. Vacuum filled.

The multi-decade high inflation rates of 2021 made this frenzy for yield so out of control that many average people with little to no understanding of crypto, its ethos, and its technology entered the market simply to speculate, because they didn’t know where else to safely park their money.

“Money printer go brrrr” memes went viral, and everyone on the internet, from soccer moms to professional traders, piled into crypto as they frantically tried to outpace the suddenly high rate of inflation.

And what sounded better to them than just owning inflation-proof assets like Bitcoin (BTC) and Ethereum (ETH)?

Earning high APY interest on their crypto deposits, of course! Counterparty risk be damned.

Like moths to a flame.

The problem was, the majority of those who migrated their money into crypto from TradFi were unaware of the drastic differences between exchanges offering “high-yield” products like Celsius and banks that actually insured deposits. They saw CeFi as the crypto alternative to regular old banking and were oblivious to the inherent risks of lending to them.

This naivety allowed the exchanges to cash in on the arbitrage between the public’s desire for yield and the lack of regulation which would’ve prevented them from embezzling deposits and stealing fortunes.

The final result was a tragic irony: retail investors who were chasing yield in order to keep pace with inflation ended up getting totally decimated by a deflationary crash. Just as prolific investor Stanley Druckenmiller predicted.

The cruel and unforgiving nature of markets.

However, this disaster is not without its silver lining. If there’s a positive thing to be said of 2022 in crypto, it is that all of these schemes fell apart not because of anything inherently wrong with genuine innovations like BTC and ETH, but rather because of a lack of education which led to people placing blind trust into centralized third parties.

If anything, these top-down failures have only made society’s need for truly decentralized monetary systems stronger.

When the next cycle of inflationary monetary policy hits, there will likely be an even larger demand from the public for an alternative system of money that doesn’t dilute their savings.

A problem crypto can solve for, but only if we’re willing to embrace its principle fundamentals rather than its speculative appeal…

Back to the Roots

If we look past the appeal of NgU (number go up) technology, the primary value crypto provides the world is its unalterable ledgers. This is where the ethos “don’t trust, verify” originates from.

Unalterable ledgers are the antidote to fractional reserve banking schemes run amuck which have victimized average people time and again.

In 2008, it was banks investing customer deposits into mortgage-backed securities they knew were toxic. In 2022, it was centralized exchanges gambling customer funds without consent.

These were both symptoms of the same disease: a blind trust in third parties. A trust that is unnecessary thanks to blockchain’s ability to provide open books in the form of on-chain data.

Using this transparency is what will allow crypto to improve upon traditional finance’s failures, rather than mimicking them as it did this year.

Thankfully, there have been signs of the market self-correcting for this recently.

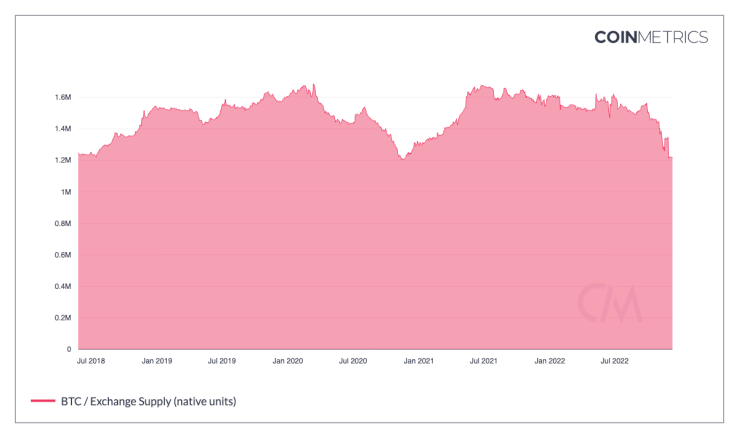

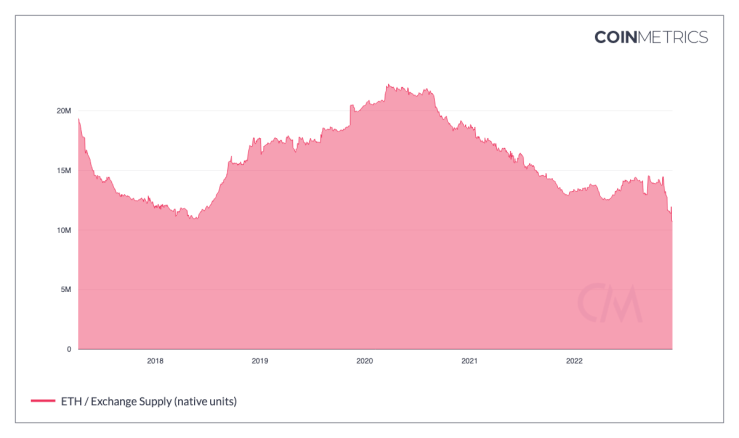

Last week, we talked about how the removal of Bitcoin from exchanges has reached a record pace. This trend has continued, and supply levels of BTC and ETH on exchanges are now at multi-year lows.

This activity increases decentralization and implies that most remaining investors understand the value of their coins as self-custodied assets. Should this continue, it will also be favorable for prices long-term. If available supply is low when the next vacuum of demand hits, prices could move in a fashion that makes 2020-2021 pale in comparison.

Another encouraging sign of change is exchanges like BitMex, Crypto.com, and Kraken releasing their full proof-of-reserves and liabilities, which has put pressure on others to do the same.

This isn’t a perfect solution, but it’s a step in the right direction, and it’s much better than the complete black box other exchanges offer. The more this becomes the standard, the less likely another FTX becomes.

There’s also the fact that decentralized exchanges (DEXs), which don’t require any trust from users, have continued to operate without issue during the crisis which strengthens their appeal. And the ongoing development of zero-knowledge proofs, which allows users to verify information such as reserves without revealing extra information, also encourages more transparency.

The scaling and use of technology like DEXs and zero-knowledge proofs will bring us closer to a fully decentralized economy in the years to come. In time, they will totally eliminate the need for trusted third parties, enable adoption, and provide the foundation which the next bull run can be built upon.

But for that to happen, we’ll have to do a better job of educating newcomers on the importance of this decentralization and the risks of blind trust. The most effective way to prevent the next 2022-like disaster is to keep user funds away from trusted third parties from the get-go.

Unless you’re actively trading, there’s no reason to keep your funds on an exchange, ever. If you’re unsure how things like cold storage work, feel free to message me on Twitter and I’ll walk you through it.

If we don’t take this time to teach others, the way the team at Jarvis Labs has taught me this year, then crypto is unlikely to ever evolve beyond being a highly speculative asset class. Forever subjected to the same boom-and-bust cycles as legacy finance.

Instead of alternative economies, it will only ever be a digital casino.

For that sake, let’s encourage further decentralization to continue. If so, I believe we’ll see crypto’s full potential unlocked next time around…rather than a repeat of cycles past.

What do you guys think?

Leave a comment below, or message me on Twitter @JLabsJanitor.

Your friend,

JJ