Capital Flow

Comparing 2017 to Now via BTC Dominance

What was the first and second asset you bought in crypto?

My guess is it was bitcoin and then Ethereum in that order.

This was my experience at least. I purchased bitcoin at first and about a year or so later finally got into Ethereum.

During that 12-18 month stretch price wasn’t very volatile believe it or not. I saw these investments as an asymmetric bet on blockchain technology that likely wouldn’t gain traction for at least five years.

Asymmetric meant I didn’t need to bet a lot for the potential to realize massive gains later.

Now while I waited for the market to actually do something I slowly inched my way down the crypto rabbit hole via YouTubes, papers, and other easily accessible online resources.

Mastering Bitcoin was the first book I purchased on cryptocurrency. But with my background in economics and not coding, I didn’t make it past the halfway mark.

Eventually I stumbled across some writings that hit on any business in the world being able to mint a token. Then after ascribing certain rights and traits to the token the issuer would have seigniorage - its essentially the ability to print money.

This meant Suzie’s lemonade stand at the corner could mint LEMON tokens and essentially trade alongside Apple in the market. Only difference is Suzie could pay employees of the stand in LEMON, and those employees could pay for goods and services right away.

That was my ‘aha moment’ which led to a week of information gluttony.

I bring this up because this ‘aha moment’ was about a year prior to the Summer of the ICO in 2017. A time period when anybody and everyone issued a token to raise capital. To me it was the “It’s Happening” moment for crypto (lol, a bit early).

What transpired during that time period was a flow of capital from bitcoin and Ethereum to other tokens in mass.

It was a stampede of capital migrating to the far reaches of the risk curve in hopes for the next 10x move.

Witnessing a token double in a matter of hours was not uncommon. And the more it happened, the more traders sought the next small cap asset to pile into.

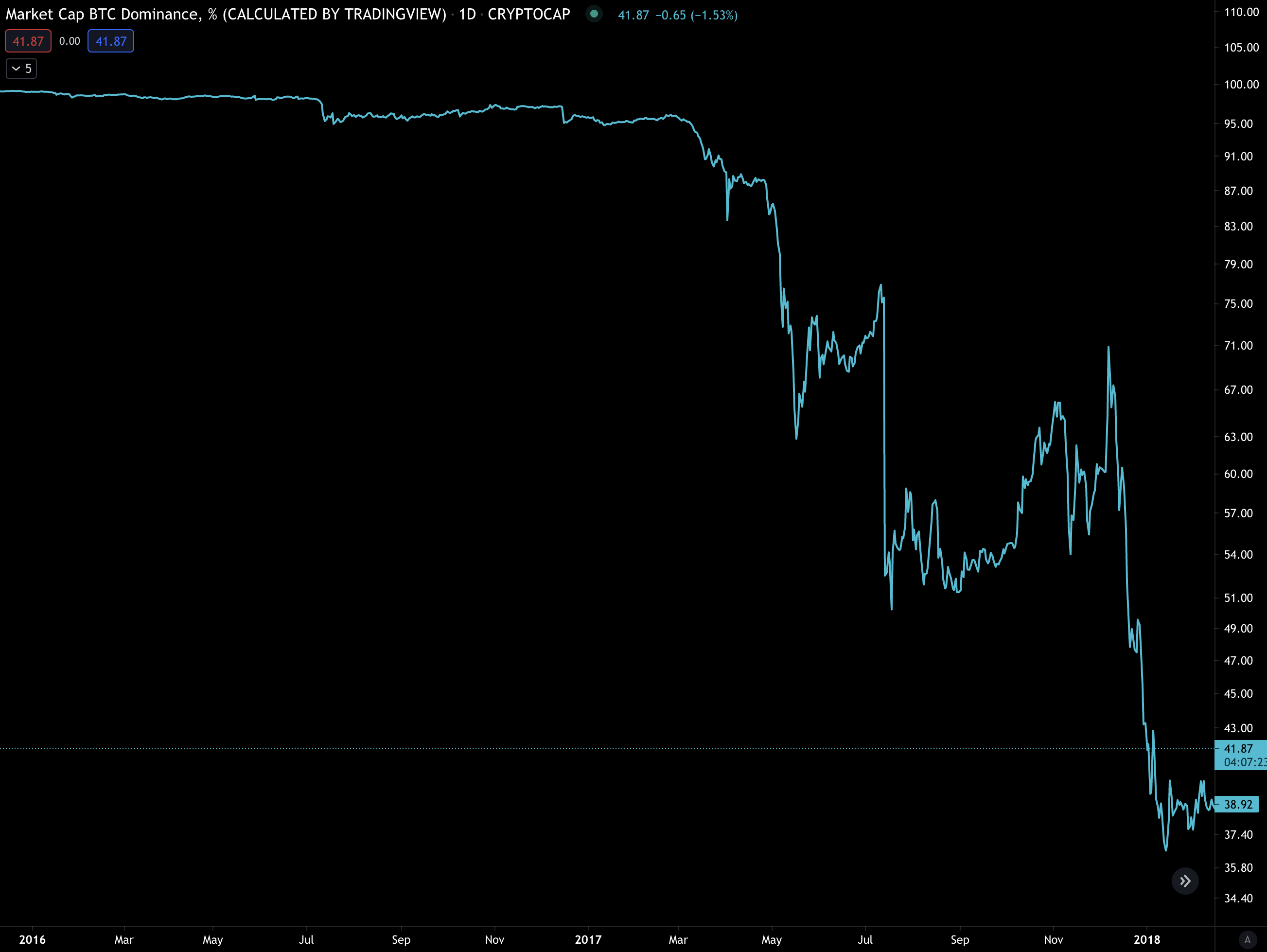

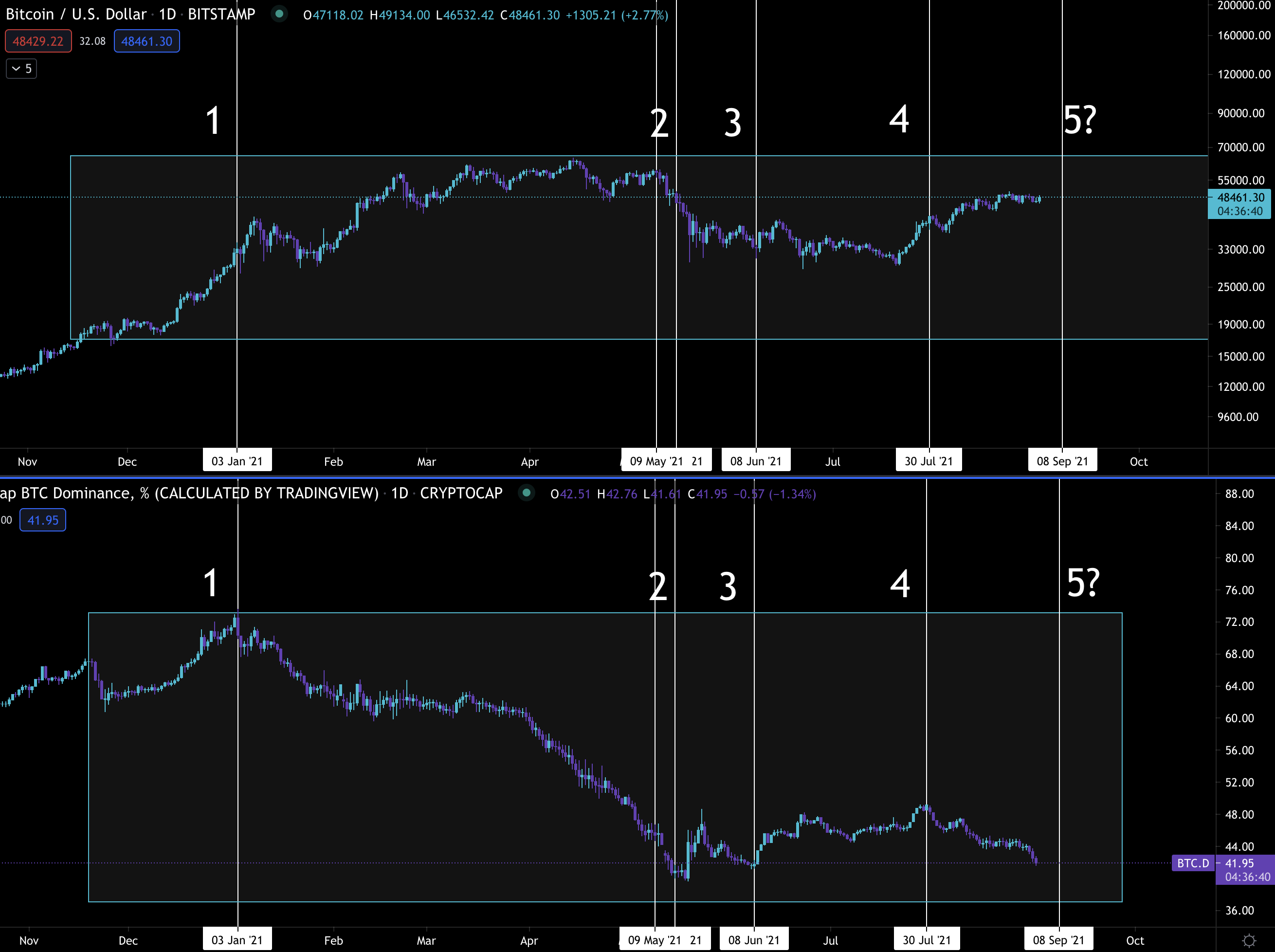

This flow of capital is best viewed in a chart called BTC.D, which is a measure of the market share of crypto made up by bitcoin’s market cap.

As you can see bitcoin made up over 95% of the market until 2017. It then went on to drop below the 40% mark in under a year. It was an exodus.

And just like most things, the market overdid it. Over the next year and a half BTC.D returned back to around 70%.

It didn’t return to its prior figures, which is expected after the bazooka of altcoins that entered the market which fulfilled various niches throughout crypto.

But what was incredible during this short-lived stretch was again, the flow of capital in crypto.

Fiat -> Bitcoin -> Ethereum -> altcoins.

Many investors take path similar to this and each step along the way they go further out on the risk curve.

But just as the market starts to get rocky or uncertain, the flow of capital walks back on the risk curve towards the assets deemed to be safer.

In the last bull cycle it was bitcoin.

This time around it will likely remain bitcoin, but also include Ethereum and stablecoins at the very least.

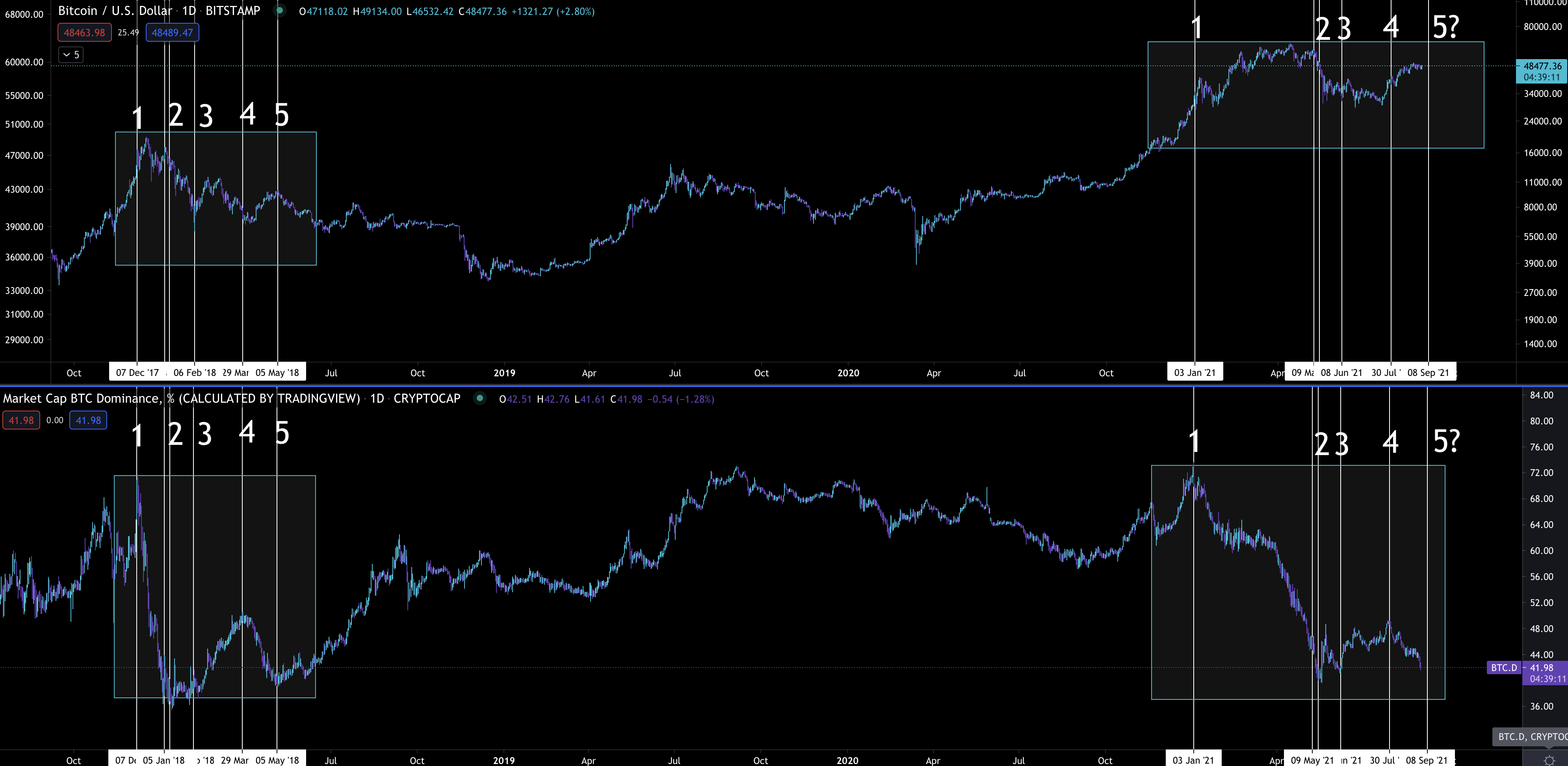

Now, I bring up this thought because of a recent chart I posted on Twitter earlier this week. Here it is below.

On the top is bitcoin while the bottom half is a BTC.D chart. You can probably spot some similarities that we will can expand on here.

I added some labels so we can use them as reference points when discussing the chart.

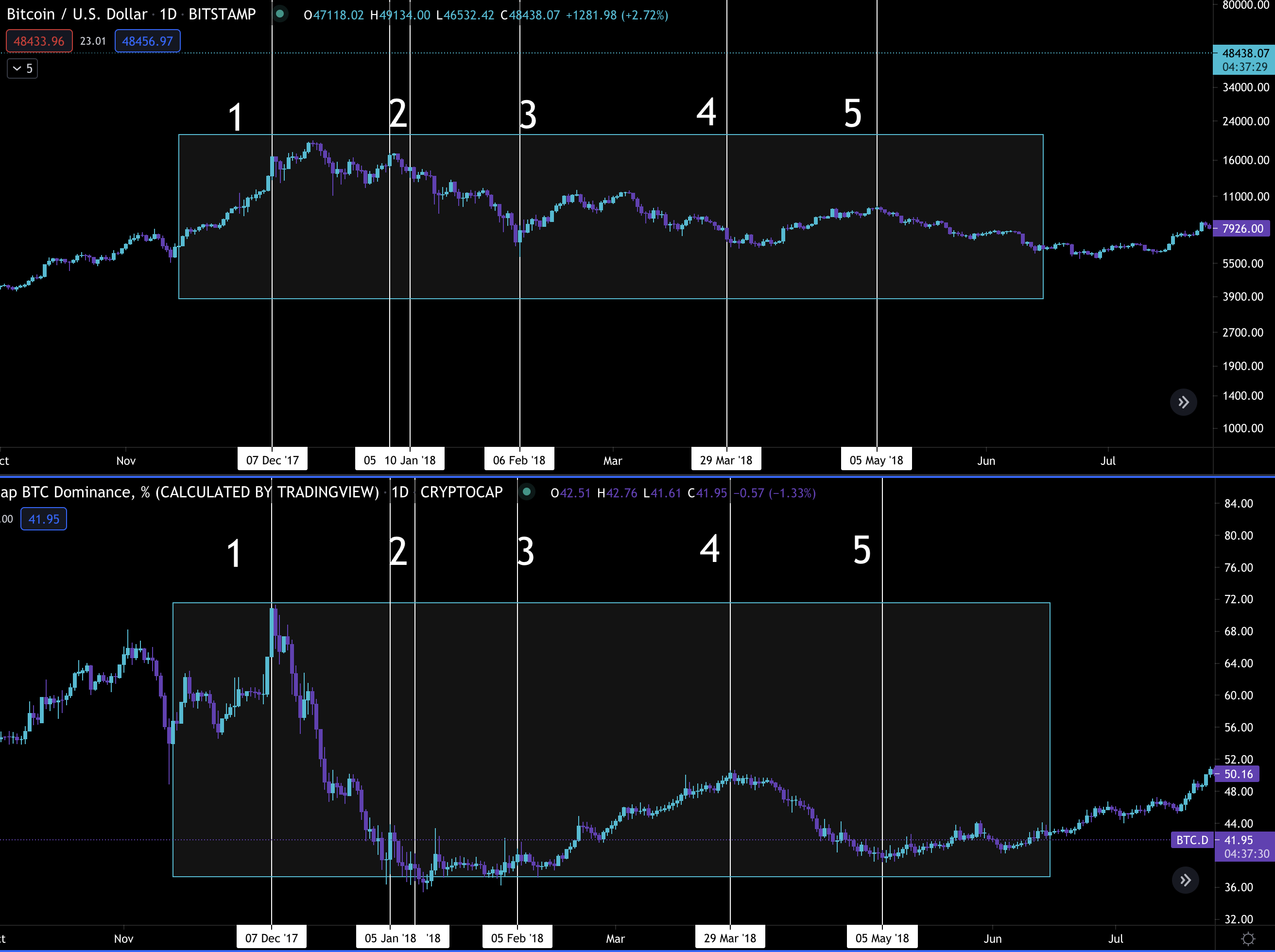

The 1->5 sequence on the left is the 2017-2018 cycle that we can look at first. Here’s a more zoomed in look at that time period.

Starting with 1…

This marked the build up and excitement of the entire crypto market. Bitcoin was nearly at $20k by this point. And as bitcoin pulled back after reaching its high soon after… which was then followed by a lower high… capital flowed into the rest of the market.

This flow of capital is seen at point 2.

On the BTC.D chart you see the drop from 70% to about 35% in a span of weeks. This was market euphoria at its finest. This is when every newcomer was a genius and looking to open up a hedge fund to showcase their inherited at birth crypto picking gift. It marked the moment crypto went full tilt on risk.

What happened next was the “oh shit” phase for crypto. This is when bitcoin dove and tested a support level that would hold for the next nine months at $6k. This is 3 in the chart. And capital was still at the far reaches of the questionable coin cryptoverse.

As bitcoin bounced off the $6k low over the ensuing months, capital flowed back towards safety. In this case it was bitcoin and fiat. This is 4, and in the BTC.D chart you can see the march from below 40% to just above 50%.

The last phase marked as 5 is what can be described at the sucker’s rally. This is when altcoins start to run a bit again in the hopes the market would return to its glory days from six months prior. BTC.D never would give way and just sucked capital up for the next couple years.

There are a lot of little nuances in there like what type of projects were making the biggest gains at any particular time, but that is outside the scope of this piece. Right now I’m just looking to generate a framework to view the market today.

If we apply this framework to what we see today, it looks like the chart below. Let’s dive into it a bit more to see if this holds.

Point number 1 is similar to 2017 since it was the new ATH at the time. It was also followed up by the actual ATH.

The follow up for 2017 was only a few weeks while in 2021 it was a few months. One explanation for this is the market of today has more breadth than in 2017. More investors, exchanges, onramps, assets and tools for the world to get lost in.

Then the first signs of potential trouble lurking with a lower high, point 2, was paired up with the flow of capital rushing out on the risk curve. We can see the flow out on the risk curve with BTC.D dropping from over 70% of the market to about 40% during this stretch.

Then point 3 was the “oh shit” moment. Remember in 2017 this was the $6k support that held for nine months. For 2021 this is the $30k level that we have tested a few times now.

Following this time period capital began to flow back towards safety. And bitcoin was going sideways for the most part between point 3 and 4.

And from point 4 to point 5 bitcoin recovered some ground both times while BTC.D retested prior lows, which we are seeing today.

If we got a repeat of 2017 this would be known as the suckers rally. And there are some signs that this might be the case.

One of which is the euphoria happening in NFTs.

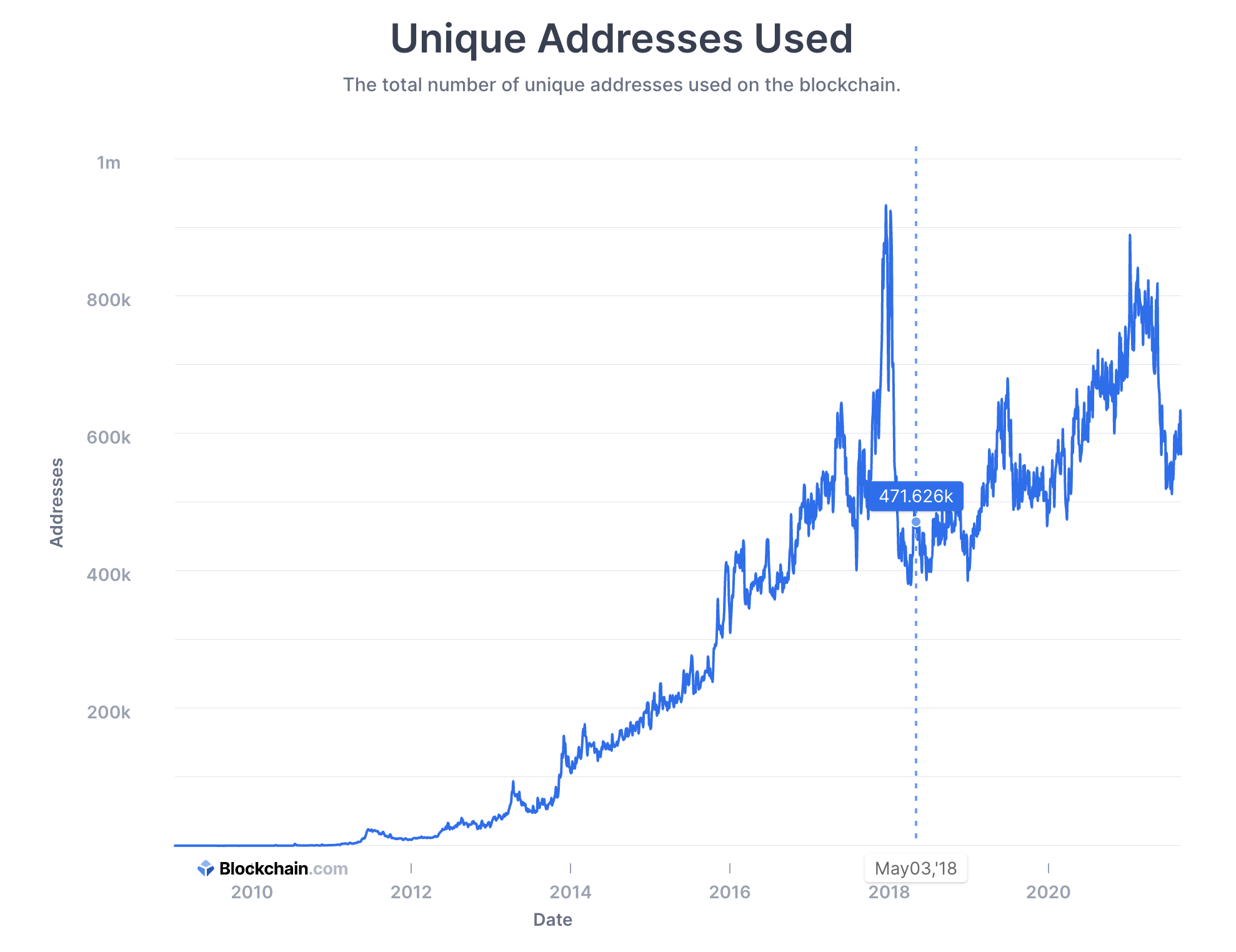

Another is unique addresses, a sign of how much new activity is coming to crypto. Below is a chart for unique addresses. The vertical line below that is being displayed matches up with the sucker’s rally from May 2018 or 5 in the charts above.

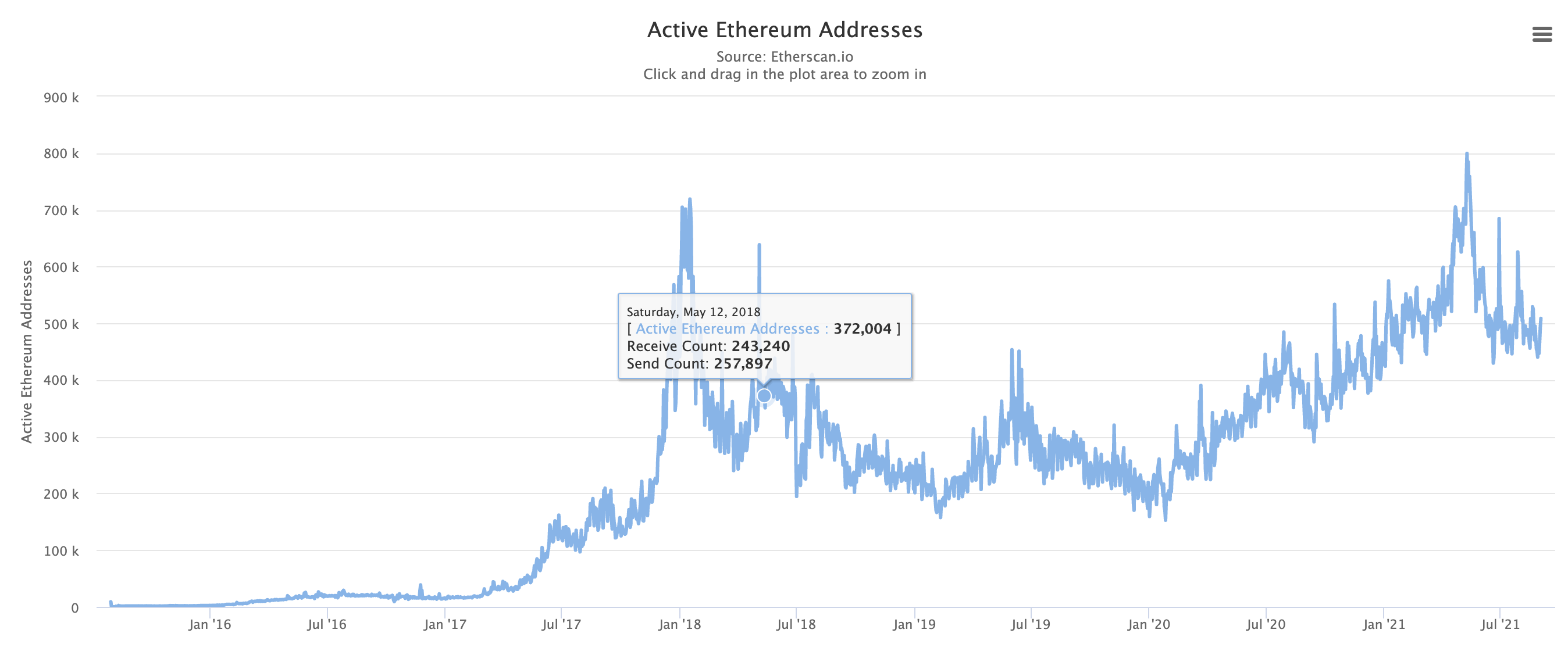

Even when it comes to Ethereum we see a similar pattern despite the euphoria going on with NFTs… Active Ethereum addresses are down below their recent peak as seen below. May 2018 is again highlighted in the chart below.

Further, we discussed in our issue that came out earlier this week called Finding Direction that a lot of our internal metrics and models were point towards a bearish market despite the current price action.

I personally hate this as it makes me feel like a beartard.

The entire cryptoverse is hell bent on $100k BTC right now, most everybody is expecting a euphoric Q4 with an imminent ETF approval happening soon, and the global leaders around the world are still printing money despite signs of inflation.

Meanwhile, prices are still going higher.

So it forces me to ask… what needs to happen for the above argument to fall flat?

One alternative here is BTC.D forms a new low and immediately blows this framework happily to smithereens.

For this to happen, BTC once again needs to do what we discussed earlier this week and at least re-enter its previous trading range above $53k. It also needs to keep strength above the 200d MA.

Any signs of weakness will be met with a run to safety.

Unfortunately with some profit taking happening onchain this morning, this weekend might prove telling for us to see how much strength the market and this rally really have.

Moving forward, let’s watch how BTC acts on signs of weakness. This will be more telling than anything else.

ETH and altcoins as I mentioned in the original Twitter post I referenced at the start is likely to keep flying despite BTC showing lackluster strength. As long as BTC’s actions don’t scare the capital hanging out on the far end of the risk curve, this will likely continue.

So for now consider de-risking a bit in case weakness does present itself and the framework I mentioned above starts to play out.

Also, I never recommend shorting unless you are hedging in a sophisticated manner. The name of the game is preserving capital, not risking capital.

In Search of The Pulse,

Ben Lilly