A Crypto Bull in the “China” Shop

Macro Update: Hong Kong’s New Crypto Hub Could Be Beijing’s Latest Trick Play

Down by one. No time left. One last play to decide the game.

It was the perfect setup for one of the greatest trick plays in college football history.

At the 2007 Fiesta Bowl, ninth-ranked Boise State (BSU) was down by one to seventh-ranked Oklahoma (OU) in overtime.

BSU had a chance to either attempt a field goal for an extra point, tying the game and forcing another overtime, or try to put the ball in the end zone for two points and the outright victory – or defeat, if they failed.

The BSU players lined up to go for two. The ball was snapped, putting the play in motion. OU’s defense converged on BSU’s receivers, as the quarterback brought his arm back to throw the ball…

…except he never threw it. Instead, he faked the throw, brought the football behind his back, and handed it off to the player behind him, who easily ran it in for a touchdown.

It’s known as the Statue of Liberty play. And it won BSU the game. You can watch the play on YouTube here.

Nothing gets a stadium full of American football fans going crazy like a well-executed trick play, especially one to decide an end-of-season game.

But the successful execution of trick plays relies on one thing: deception. How well the team sells the deception to its opponent determines the outcome and the effectiveness of the trick play.

Speaking of plays that make you scratch your head, China’s recent 180-degree reverse on its cryptocurrency policy certainly had plenty of peoples’ scalps red with fingernail streaks.

But there’s likely more going on here than meets the eye.

Sit back. Relax. Grab a drink and a bag of chips or crisps. Don’t change the channel, and let’s take a deeper look at this trick play from China.

The New Crypto Hub of Asia?

It was not that many moons ago (September 2021) that China installed a nationwide ban on cryptocurrencies that made token prices go cliff diving and sent a massive wave of exiles to seek shelter in locations such as Singapore, Dubai, and Malta.

And just as swiftly as Beijing put the ban into effect, now it’s given Hong Kong the blessing to be the beacon of the cryptosphere in Asia.

Earlier this year, the Hong Kong government made the announcement it would allow retail trading of crypto.

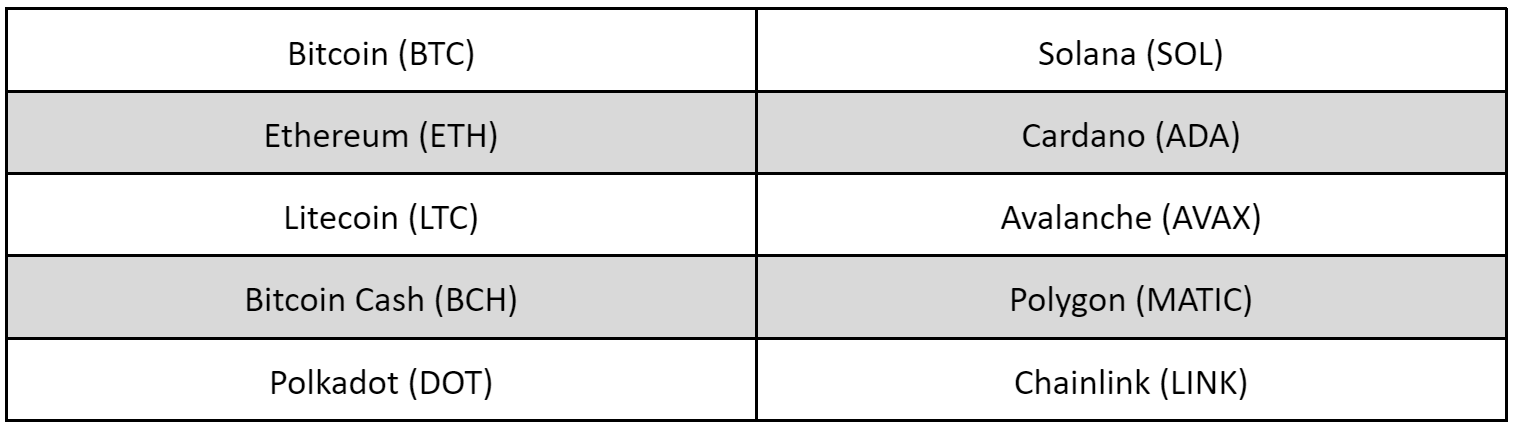

As of June 1, retail investors in Hong Kong can trade cryptocurrency on any licensed exchange or from his/her own bank account if the bank has crypto offerings. Only the following 10 cryptos can be legally traded:

The Hong Kong government is also putting pressure on international banking giants such as HSBC and Standard Chartered to on-board crypto exchanges as clients. HSBC decided to go one step further and allow its clients to trade Bitcoin and Ethereum ETFs listed on the Hong Kong exchange from their bank accounts.

This is quite a refreshing and stark contrast to cryptocurrency policies in the rest of the world.

While the West and the majority of the world are installing measures to cripple the industry, Hong Kong is looking to foster and nourish crypto to make it flourish.

A once-glamorous global financial hub is now turning into a global crypto trading hub with the blessing of the government, just like Dubai.

This is indeed a breath of fresh air in the smoky den which the cryptocurrency has been tossed in. Crypto zealots cannot hide their excitement as the industry gains adoption in one of the superpowers of the world, which is also the second-largest economy.

Which begs the questions: Why? And why now? There stands to be a reason or reasons behind the policy reversal.

The official words and the common speculation are that it’s to save the floundering economy in Hong Kong, which used to be called the “Pearl of the Orient.”

But we speculate this is smoke and mirrors that China is using to pull off its trick play.

The possible true reason might be observed from the two charts below.

China Never Turned Off the Printing Press

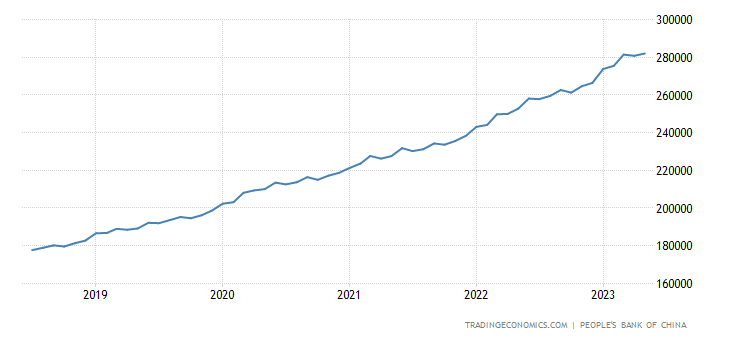

The first chart is China’s M2 money supply from mid-2018 to May 2023. M2 is a measure of the supply of currency in the country that tracks both physical currency, like bills and coins, as well as money in bank accounts.

Almost every other country and region (except Japan) has taken up measures to tighten its money supply, but China never stopped printing money and doing quantitative easing (QE) to save its economy, which is still floundering. China’s M2 grew 11.6% year-over-year from May of 2022, and now it stands at 282.05 trillion yuan ($39.5 trillion).

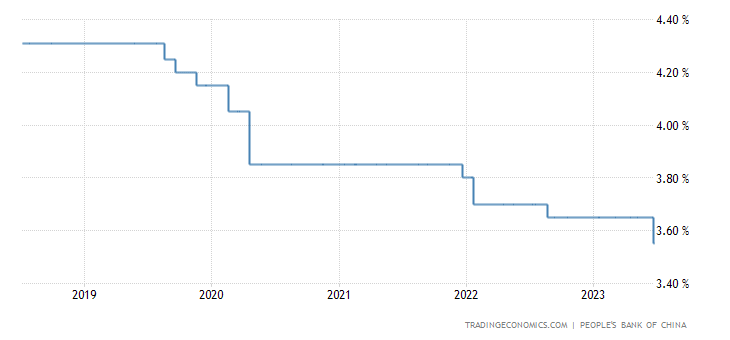

The next chart below is China’s prime rate for lending from June 2018 to June 2023.

While the rest of the world (again, except Japan) is raising interest rates to combat inflation, the People’s Bank of China kept lowering its funding rate and thus the lending rate.

In short, the world’s second-largest economy never stopped doing QE and rate cutting.

Money is still cheap in China.

And it is about to get much cheaper.

The economic headlines coming out of China in the past few months have been nothing but ominous.

The re-opening of the country after its draconian COVID lockdown sought to repeat its performance of uplifting the global economy. But the recovery is just not there.

Unemployment is still high among the young generation, and domestic consumer spending continues to fall.

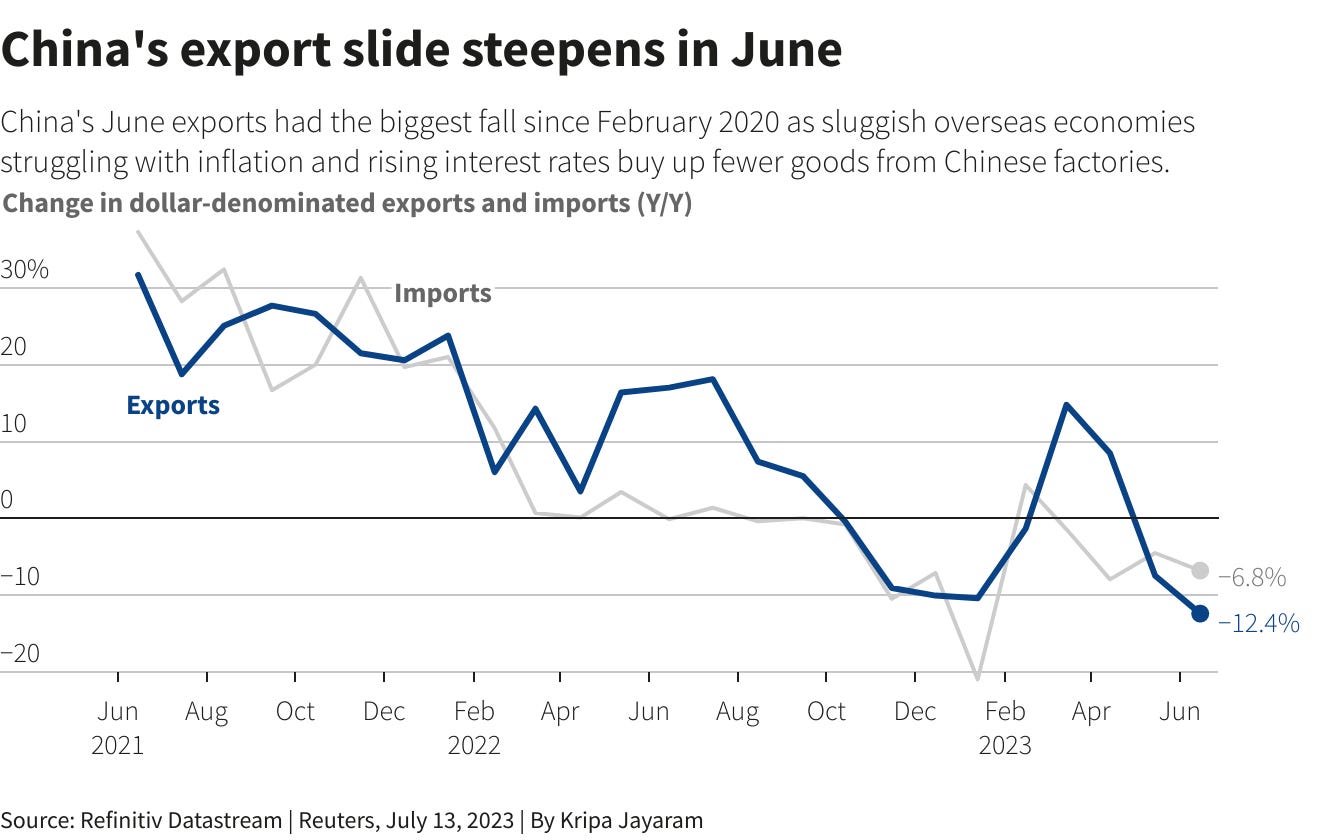

And as the chart below indicates, both exports and imports are down as well.

The tour de force of the growth locomotive that China once was back in 2009-2010 which spurred commodities demand and assisted in the global economic recovery during the Great Financial Crisis is nowhere to be found today.

In fact, China is looking more and more likely to fall into a deflation spiral even after all the QE and rate cutting exercises.

So what to do?

We can expect the Chinese government to print even more money and to keep on lowering the rates.

This combination of adding to the already overabundance of money supply and lowering interest rates equals a buildup of massive inflationary pressure.

This is most likely why Beijing decided to open up Hong Kong as a crypto trading hub.

Just as a pressure cooker lets steam off through a safety valve, China will need an exhaust valve for its potential domestic inflationary pressure should the QE and rate-cutting policy start to work.

The Inflation Sink

This is because unlike the United States, China does not have an inflation sink.

The U.S. dollar (USD) is the global reserve currency. All commodities are priced in USD. And all of its transactions are done in USD. There will always be a demand for USD.

Simultaneously, U.S. Treasurys (UST) are the most liquid asset on the planet. The market is enormous, and there will always be a buyer for USTs because the U.S. is the creditor and backs the bonds, making them the safest places to park capital.

Hence the rest of the world has valid and strong reasons to hold USD and USTs.

Even if the U.S. Treasury starts to print more money or the Federal Reserve starts to lower the funding rate, the inflation impact within the U.S. is small (well, up until 2022) because there will always be someone out there willing to buy USD and USTs. There will always be strong demand for it.

That is why when the U.S. Treasury starts to print more dollars, the US can export the inflationary pressure to the rest of the world. So the rest of the world acts as the inflation sink for the U.S.

China does not have this luxury.

By China’s own design and own will, the Chinese yuan (CNY) is still a closed currency. It is not openly traded in the rest of the world because the Chinese government is afraid (with good reason) of capital flight from China.

In other words, there is no demand for CNY, as we pointed out in our macro update back in May.

The same conundrum goes for Chinese government debt, as we mentioned in the same update:

But the interesting thing here is that even though Fitch and other rating agencies give Chinese Treasuries top marks, the Chinese government still holds the majority of them.

Foreign investors’ presence in China’s onshore bond market remains small, accounting for only 3.2% of the total holdings.

This means Chinese Treasuries aren’t very liquid. And to top it off, it is not a free economy. The state controls everything, including the bond market. This does not sit well with investors.

The appeal of a yield-earning instrument for CNY holders is just not there for now.

Therefore, the lack of demand for the Chinese yuan and Chinese government bonds means China just does not have the inflation sink that the United States has to offload its domestic inflation.

But opening up Hong Kong as a cryptocurrency hub might solve this issue.

A volatile, speculative asset class that is highly liquid and has strong demand might be just what the doctor ordered for China’s dilemma.

Cryptocurrencies such as Bitcoin and Ethereum denominated and traded in Hong Kong dollars (HKD) can act as the equivalent of U.S. Treasurys in this instance.

Given that Hong Kong was once one of the major financial hubs in the world, HKD is one of the most liquid and accredited currencies in the world. HKD is also pegged to the USD. This is the ace in China’s hand.

In very simplified terms, this is a dual-currency system where China can exchange CNY for HKD, and the HKD can help China export its domestic inflationary pressure with cryptocurrency transactions in Hong Kong. This offloads the inflationary pressure within China, and simultaneously, it also helps China to devalue CNY and to assist with its export in hope to provide a spark for China’s lagging economy.

After all, how can one be labeled as an exchange rate manipulator while devaluing against the currency of its own region?

Not to mention that with its Central Bank Digital Currency (CBDC), known as the e-CNY, ready to go, the Chinese government can exert near-absolute control over this financial experiment.

Thank you for reading Espresso. This post is public so feel free to share it.

What Does It All Mean?

If the true intent to open up Hong Kong is indeed to provide an escape valve for the upcoming, potential inflationary gas building up in China’s domestic sphere, then this should be extremely bullish for crypto.

The positive price action aside, it will help bolster the status of the likes of Bitcoin and Ethereum as a bona fide investment vehicle.

When the world’s second-largest economy is using cryptocurrency as an instrument to assist in its domestic economy management, it will be a major turning point for cryptocurrency as an asset class.

For China, it will indeed be uncharted territory.

With a sinking economy showing no signs of reviving, the Chinese government is backed into a corner and has no choice but to keep the funding rate low and the printing press going. This mounting inflationary pressure must be let out. With Hong Kong and HKD at its disposal, this is the best, if not the only, alternative.

The caveat here is China might not be able to devalue CNY too much. China is the largest importer of energy, food, and raw materials in the world. A cheap CNY does help with that cause. So there will be a delicate balance that China will have to maneuver.

Perhaps China can deliver a win for cryptocurrency with this trick play.

We shall see.

Yours truly,

TD