Don't believe everything you see

by Ben Lilly

There's Always More to it

Modus Operandi, it's defined as somebody's habits of working particularly in the context of business or criminal investigations. It's M.O. for short.

For on-chain activity we like to think this is one of the crucial ingredients to our success. Without it, we'd become the boy who cried wolf. After enough times of warning you about a big move on-chain, you'll probably begin to ignore us.

WhaleBotAlerts on twitter is a case in point here. It's a service that's heavily followed on twitter, telegram and throughout crypto as a whole. It reports large transaction happening in real-time.

Two days ago it sent this out:

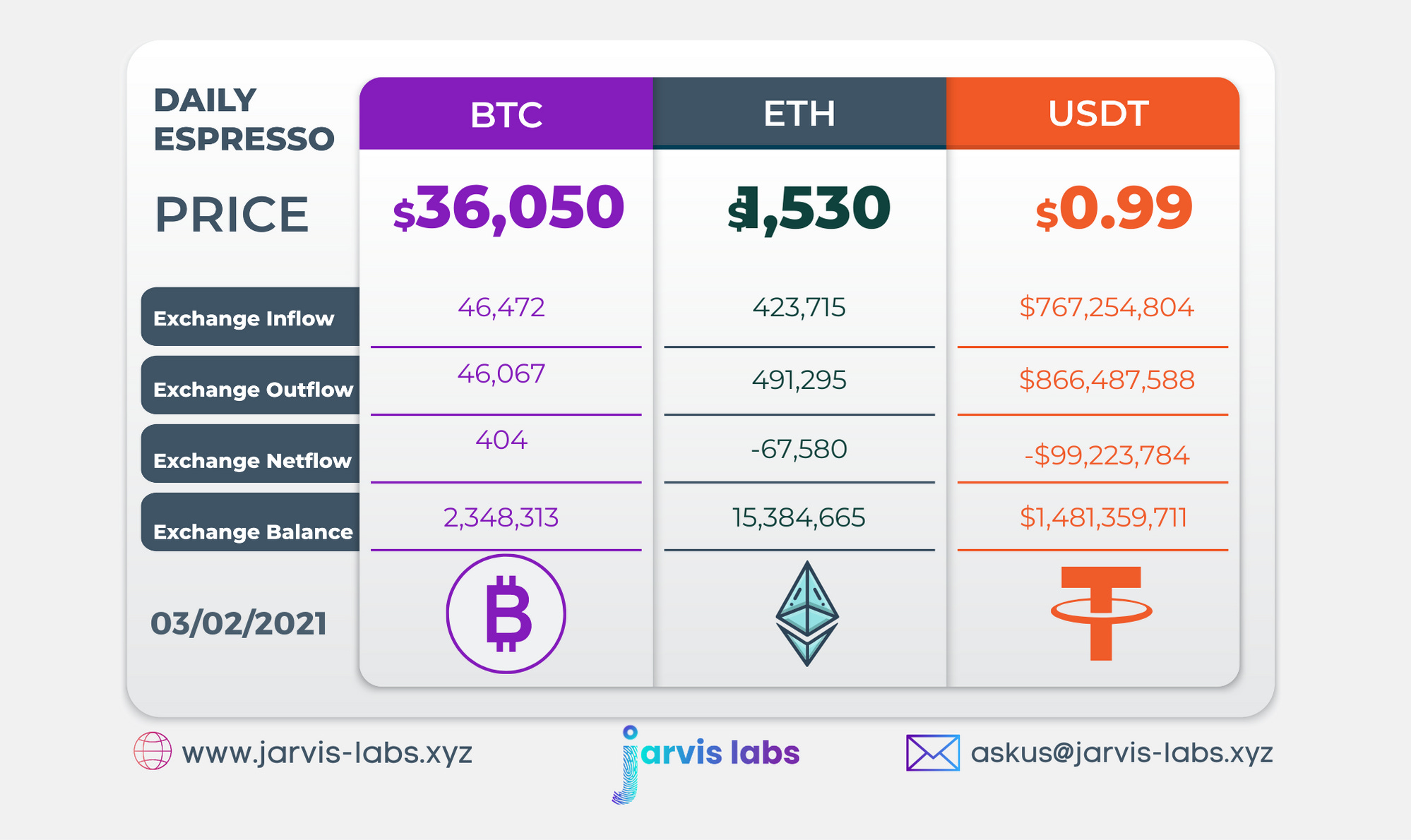

WhaleBotAlerts reported a little less than 15k BTC were on the move from Coinbase. Given the context of December, this is uber bullish news. That's because there were significant transactions that took place related to heavily accumulation in that month.

But many times understanding the M.O. of a business will help decipher if this is noise or just a signal.

On Sundays the bitcoin blockchain is quieter than the rest of the week. You can safely assume here as to why that's the case. This day of rest is an opportunity for some large custodians, like Coinbase, to manager their assets while transaction costs are lower.

To do this requires transactions to take place that help organize bitcoins in such a manner that reduces transnational costs for Coinbase during periods of higher activity. Being prepared ahead of time also helps lower costs for the user. It's a win-win. Even miners get a piece of the action.

This reshuffling tends to get picked up by whale bots like seen above and even in Cointelegraph at times.

So next time you see a large Coinbase transaction take place, take a moment to consider what day it is and what their M.O. might be. The chances are relatively low that Wall Street is loading up a bag on a Sunday morning.

Also, consider adding this type of analysis to whale wallets yourself. The M.O. of a few wallets lit up for us this week. Some of our members took advantage of this via GRT, BAND and THETA. To us, that's where on-chain tracking becomes a market edge.

Market Update

Following up on what we hit on yesterday, ETH went ahead and had its breakout. There are a few more tokens with a similar setup that are likely to break to the upside as well.

I'm not sure how sustainable this is at the moment. Funding rates only got scarier as coins are breaking to the upside... annual rates are as high as 450% to hold a long. This hints at irrational traders squeezing drops of juice out of a trade setup.

I don't know about you, but this is starting to line up pretty well with Ethereum futures set to open up on the Chicago Mercantile Exchange on Monday the 8th. For a reason why... When bitcoin futures opened up on the CME it was December 2017... Price didn't go higher until just a few months ago.

Now, I'm not saying ETH's high will be locked in when futures roll out. Just saying there might be a good trade setup coming for any traders looking to buy some downside protection for their portfolio.

Add in to the fact DXY (US dollar index) added some more strength to its price action. The macro structure from yesterday's issue still holds and things are stretching a bit more. For the sake of easy trade entries I hope the market bucks like a bronco for one day soon.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc.

Grow your portfolio while you sleep.