Market Update

by Ben Lilly

Cooling Down

The inferno that persisted over the last couple of months is calming.

The culprit can be linked to Grayscale. The Grayscale Effect, which we broke down yesterday and in case you missed it read here, very well might be calming down for about a month or so.

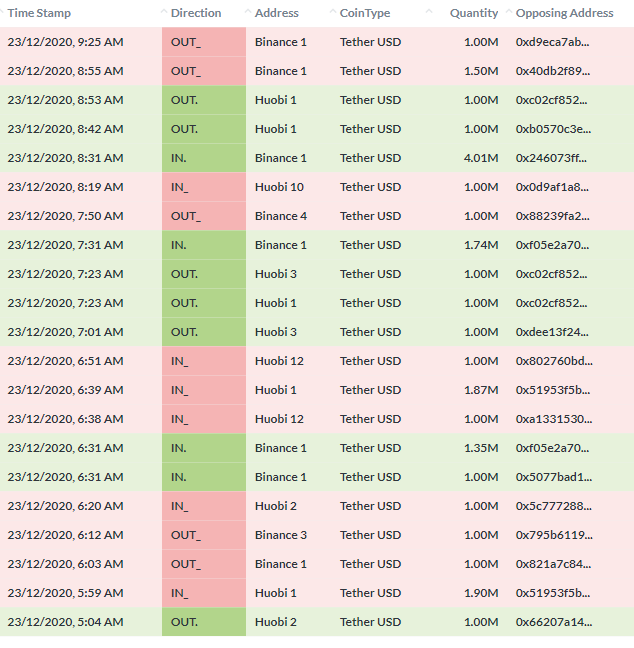

The on-chain activity to and from exchanges support the fact the market is beginning to settle down. Here's a snapshot of recent inflows that matter according to Jarvis.

The red-colored transactions in the picture above are linked to wallets that indicate bearish activity while the green can be interpreted as bullish.

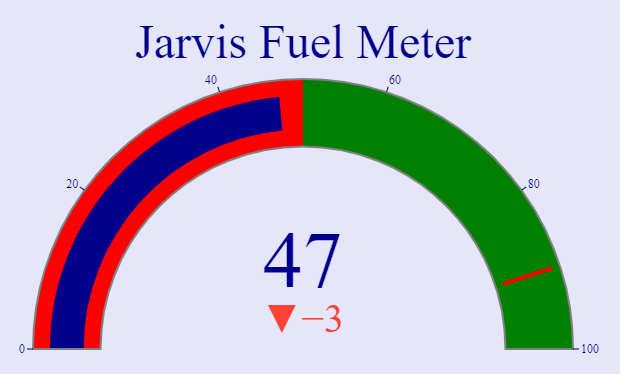

Pairing up this information with Jarvis Fuel meter we come to a similar conclusion. Here's the fuel meter.

The fuel meter is great in telling us if the market has enough funds to push higher. The higher the reading the more likely price will rise. The lower the reading, the less likely we'll get any major moves to the upside.

What this tells us is higher prices are unlikely in the near term. The Grayscale effect is starting to wane, inflows are turning bearish, and the fuel meter is rather weak.

This lines up with the lower liquidity levels the market expects to see over the holiday season. Many traders and desks are inactive. More importantly, the institutional buyers are enjoying time with the family. Which is what we all should be doing.

Protect yourself from any downside moves while spending time with loved ones.

Also, if you enjoy Jarvis and want to let your friends know about it, here's a referral link. Each subscription purchased using your link puts 10% directly in your pocket. Check out our affiliate program here.

Enjoy the holidays.

B. Lilly

Let Jarvis Trade For You

Click the button below to learn more on how Jarvis turns the market into a second stream of income for you... while you sleep.

Any questions you may have please don't hesitate to reach out to us at askus@jarvis-labs.xyz or on our website via the chat button in the bottom right hand corner: www.jarvis-labs.xyz