Zero Gravity

Market Update

You’ve been riding shotgun in the car for over five minutes now.

It was a mad rush to get out the door and simultaneously jam everything the two of you needed for a weekend away from how. But you and your friend managed to get it done.

Anxiety was maxed out at ten as you had a deadline to arrive at your location. Needless to say your blood was pumping.

And after five minutes you notice you’re still leaning forward in your seat. Like you’re about to get called up to the batter’s box at any second.

You don’t simply unwind at the snap of a finger. It takes time to settle back into the rhythm of life after such chaos.

This week is no different.

And as we roll into the weekend, I don’t think we can really tell one another to simply relax.

After all, there is no closing bell on Friday for the weekend. This is the cryptocurrency market.

Each week is seven days. Each day is twenty four hours.

There is minimal relief.

And right now with the weekend near, we are reminded about how low liquidity can get on the weekend.

Books are thinner, market makers less active, and capital is simply flowing less. Its why Coinbase spends their Sundays shuffling coins around for managerial purposes.

But what it also means is if any major movements happen, they tend to be magnified.

That was on full display last weekend.

There is no need for me to remind you of it as you sit there hunched forward in your chair from the movements of less than a week ago. Everybody’s anxiety levels are all still turned up a bit.

Unfortunately, there is no rest for the weary here.

We still don’t have anything clear forming on-chain. And the market movers have not set the tone.

Its what I like to refer to as zero gravity price movement. Nothing is really pulling or pushing prices one way or another.

The only sliver of price movement we really saw was the price action towards the $40-42k range. A range we were mentioning had strong on-chain resistance earlier this week.

Price hit, then proceeded to recede lower. Nothing crazy there.

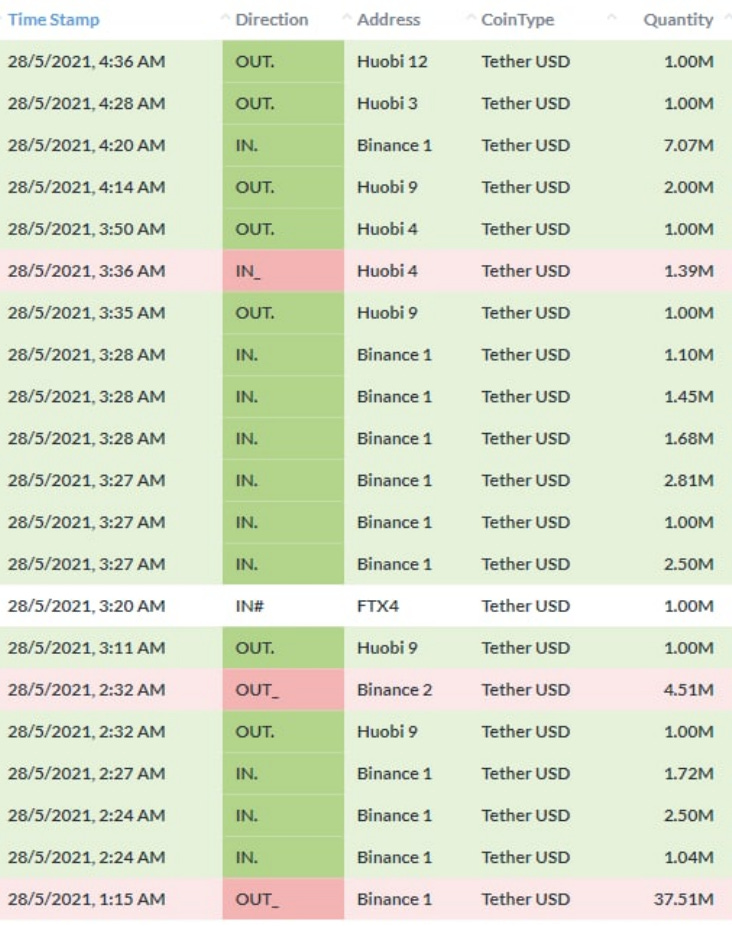

A sign of this range being one of accumulation was seen in the drop to $35k today. On-chain activity pick up nicely as stablecoins entered to buy the movement into $35k.

I hate saying this more than anybody can imagine, but it’s playing out as expected.

Which means… there is literally zero chance the easy to anticipate price action continues. Its the markets… it always takes everybody by surprise.

Now, if there is a time where we think the market might takes us by surprise, this weekend is as good as any.

We’re on the heels of a major drop so excitement is muted, which means volumes are down. The weekend is here, which is typically a time when liquidity is lower than normal. This tends to accentuate any price movements. Throw in the fact the U.S. has a holiday on Monday, meaning the lower liquidity is now spread out over another day.

Then to top is all off… Market movers are being incredibly patient here.

They are letting the market decide which way it wants to go. There is no need to front run anybody in such an environment. Its a situation where those looking to fill their bags let price methodically fall into their orders.

Which is why we need to be on alert in case softness emerges. If it does, it can get attacked for the sole purpose of accumulating at lower prices.

We’ll be keeping watch over the weekend as there is no rest for the weary now.

In the meantime, as we go into the weekend we stand relatively neutral on our fuel meter and risk meter with both at a 60 reading.

This means there is decent stablecoins in the market with decent stability. We don’t expect any imminent volatility.

The main odd ball reading we do have is the negative funding rates. This means those looking to open up a long position are being paid by those shorting. It’s a situation that takes place when the crowded trade is filled up by bears.

The market’s sentiment is down, and funding rates display this.

Its times like this that short squeezes can occur. Which is one other thing to be on the look out in the event we get a slow selloff.

Shorts can pile up and act like fuel for fast price action higher.

It happens in choppy markets like this quite frequently, and often times are reminiscent of the 2018 bart price action history… It was a series of squeezes as we chopped around in a low liquidity ennvironement.

So as we move into the weekend hours, let’s remain on alert. Nothing is as calm as it seems when price is stuck in zero gravity.

Your Pulse on Crypto,

Ben Lilly