Will Price Stay Above $100k

Will we see sub-$100k again? Here's a scenario you might want to be ready for.

At the bottom of the valley he paused from his midday drink from a mountain pond formed from seasonal snowmelt.

As he glanced to his side our eyes met.

Within me I felt nothing... Literally, frozen.

It was like one of those moments where you're doing something that's not fully legal like jaywalking and mid stride you lock eyes with a cop taking his first bite into a glazed doughnut.

You hope he's one of those cool cops that gives you a wink... So you give a humble nod in acknowledgement to desperately illicit that response... But not too aggressive. You don't want to appear arrogant, sparking his primal instinct to remind you who runs the show.

The Moose I'd locked eyes with at the bottom of the valley didn't wink.

Nor did he need to remind me that he's 1,000 pounds of uncoordinated body mass that gets spooked by his own shadow.

I was likely a gnat within his existence... But seeing those antlers on top of a stilt like body of unpredictable-ness was all I needed to realize I clearly missed my checkpoint.

The comment from my friend came quickly back to memory - if you find yourself going downhill towards the West, you've gone too far.

The moose, snowmelt pond in the valley, and sun falling towards the Western horizon were all directly in front of me... I tend to get lost in thought. I'd clearly gone too far.

With only an hour or two of sunlight left, I wasn't about to find out what other animals like to frequent this water source.

As the Moose turned his antlers back to the pond, I took that as confirmation I needed to mind to my own business as well.

I turned NorthEast and ventured on.

Checkpoints are no joke in helping any traveler avoid trouble.

Don't get me wrong, I'm a fan of veering off the well traveled path. But when you're already far removed from any asphalt covered land, there's no need to try to skip a helpful signpost to save on time.

And for those that tuned into last weeks Squeezing Lemons essay, I dropped a few checkpoints to use for the market in the coming week. I also added an additional one as the orderbooks started to turn late last week.

So today, let's bring these checkpoints to the forefront and make sure we're not about to stand face to face with an unexpected bear or bull candle of destruction.

Checkpoints

It's July 1 and Bitcoin price is sweeping some liquidity at $105k.

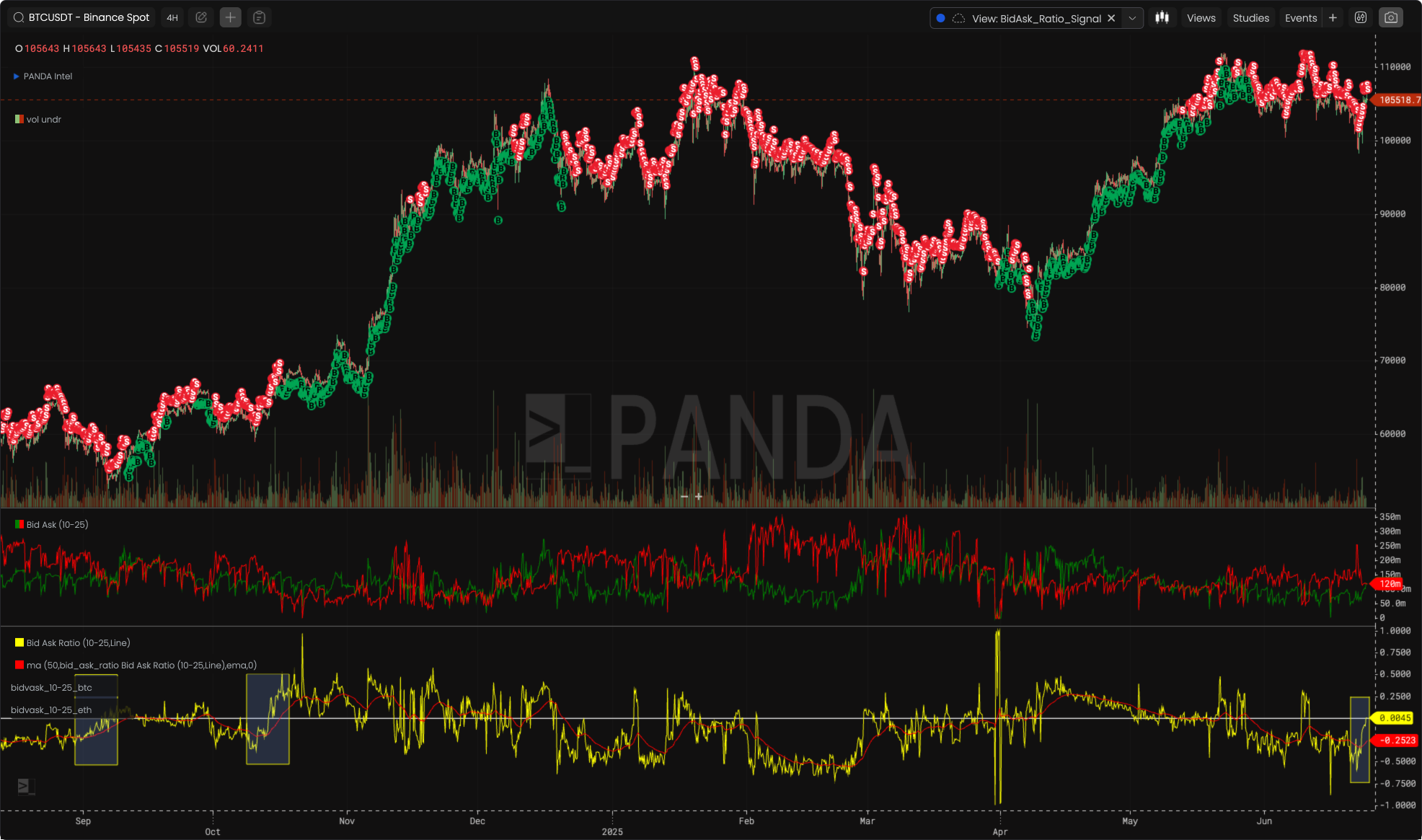

For those in the Another Boring Chat or watching your X feed for Jlabs Digital threads, you might have seen the chart showcasing some Bid/Ask Ratio indicators.

The chart showcased how bids compared to asks look at certain regions of the orderbook. The chart below looks at 0-1% range (red), 1-2.5% range (white), and 2.5-5% (yellow).

I went ahead and dropped some PANDA intel on the chart. It's the bubbles on the price line. The color of the bubble corresponds to the bid/ask ratio range while "S" is a bearish signal and "B" a bullish indicator. TLDR: we want "B" bubbles.

I know it's a bit difficult to read it all, feel free to click the image as it'll direct you to a image that's easier to zoom in on.

Now, since the last Espresso, we've seen "S" bubbles in every color start to show up. This tells us orderbooks were heavy on the asks to the point where price will likely feel its influence.

We can think of it as telling us the path of least resistance is down.

This paired up with our regime chart (same chart from last week pictured below) which looks at the orderbook further away from the current trading price... It too was leaning bearish.

Nothing has changed since this chart was posted last week except we've had more red bearish bubbles.

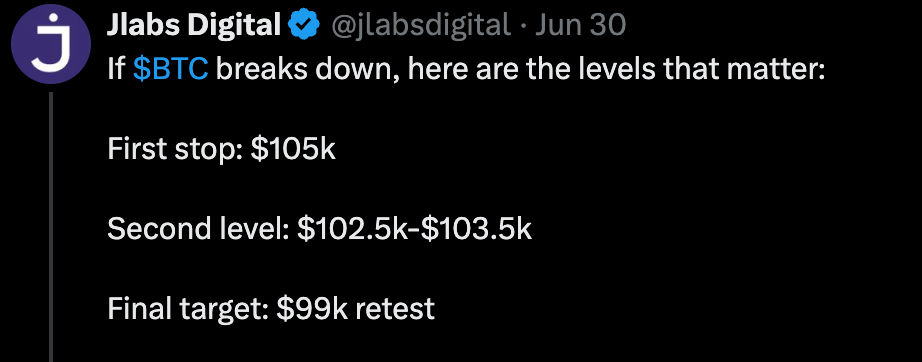

Since our last Espresso, price has corrected down. The checkpoints posted on X were seen in this post:

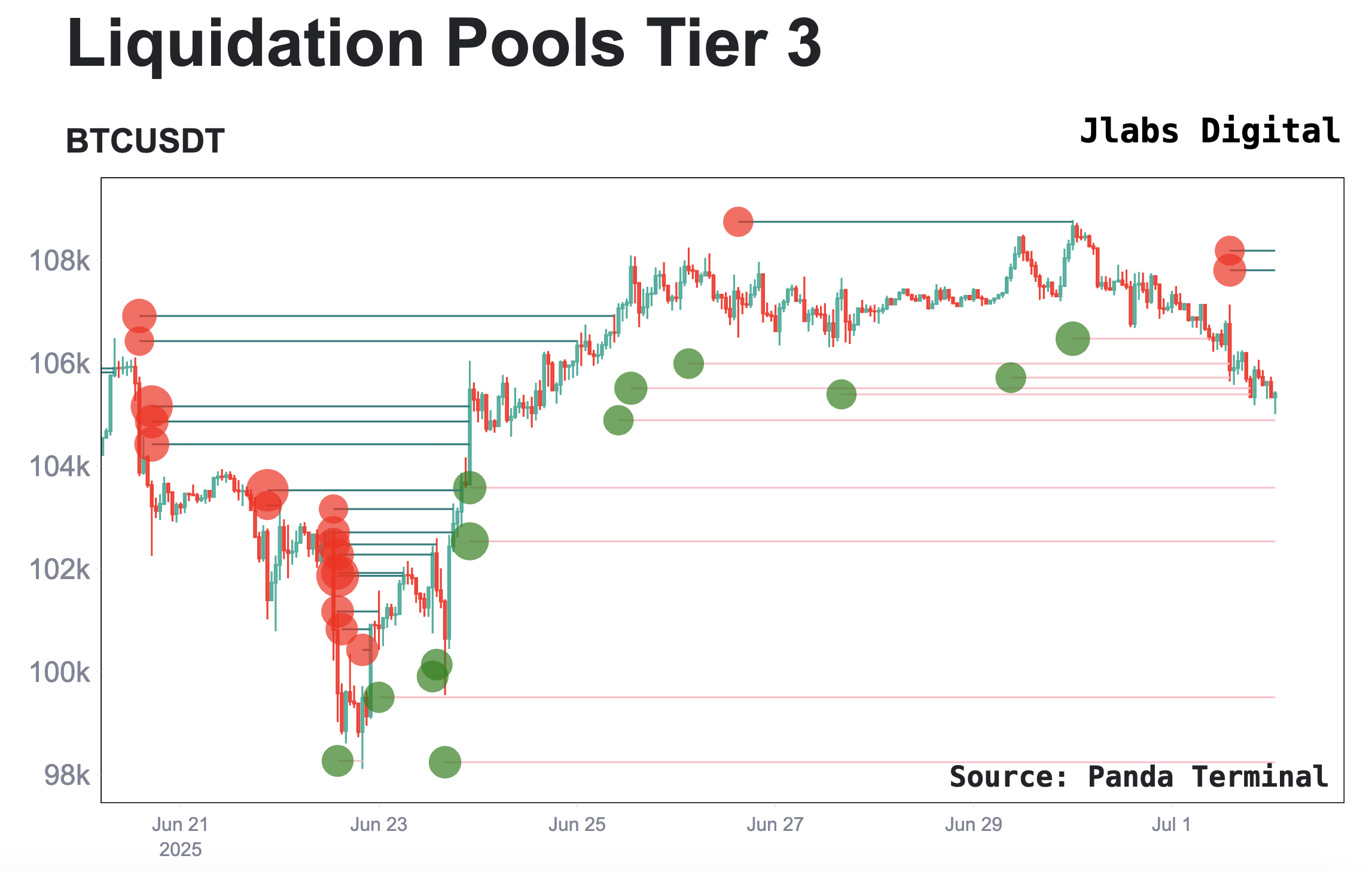

We got those areas of interest from our liquidation pools chart... Essentially a map that tells us where the largest pools of liquidity sit and where price is likely to be attracted to.

Another way to think of this map is where price might slow down. $105k was the first stop.

Price is now ping pinging around those pools right now.

Now, if we pause for a moment and see what's going on here, we can find something interesting.

Here is a one hour timeframe chart looking at those same bid/ask ratios. Here, let's focus in on the 0-1% range. When price began to whip around $105k, there were some bids that stepped up.

It's an indication a little relief or bounce is in the cards.

But note, this isn't the most reliable indicator. It just highlights bids or asks trying to step up within a very small range (0-1%) from price. By the time this essay reaches your inbox and you open it, price might have already moved on.

I'm simply using it here to show that liquidation pools and some bid activity showed confluence.

Getting back to the bigger picture, it remains... unfortunately, bearish.

That's despite a strong Coinbase premium and Saylor emptying Wall Street pockets for more (cue up Robin Williams impersonation) liquidity - dry powder.

This means the next checkpoint lower of $102.5-103.5k that we hit on last week still remains in play unless we see a major shift in the orderbooks in the coming days.

The Final Checkpoint

The last checkpoint for now is a revisit of $99k, which is also where the 100-day moving average will sit after a couple more daily closes.

A close below $99k scares me. I don't know about you, but I want to see some higher highs this summer. I miss seeing bullish posts on my timeline.

But here's the hard truth...

The 200-day moving average sits down at $96.5k (orange). That represent a potential wick tap if the move to retest $99k happened with velocity... And also, there's a support line (white) that many traders are likely drawing on their chart that sits right around the same area.

There's quite a lot of confluence piling up for a dive below $100k.

But we can't get ahead of ourselves. We need to take it one checkpoint at a time.

We're at our first checkpoint. While we're here, we checked in on the market to gauge what it's doing. It's not looking great, so it's ok to start eyeing the lower checkpoint...

But don't worry. I'll acquiesce and give you what I think might happen next instead of leaving you hanging.

I'm expecting to see bids come in at $102.5k. At that level, traders are left out in the cold wishing for that 200-day moving average and support line retest. Those wanting that 200-day retest and support line to get hit represent capital that's willing to re-enter the market.

And what better way to pull them in by stirring up some FOMO.

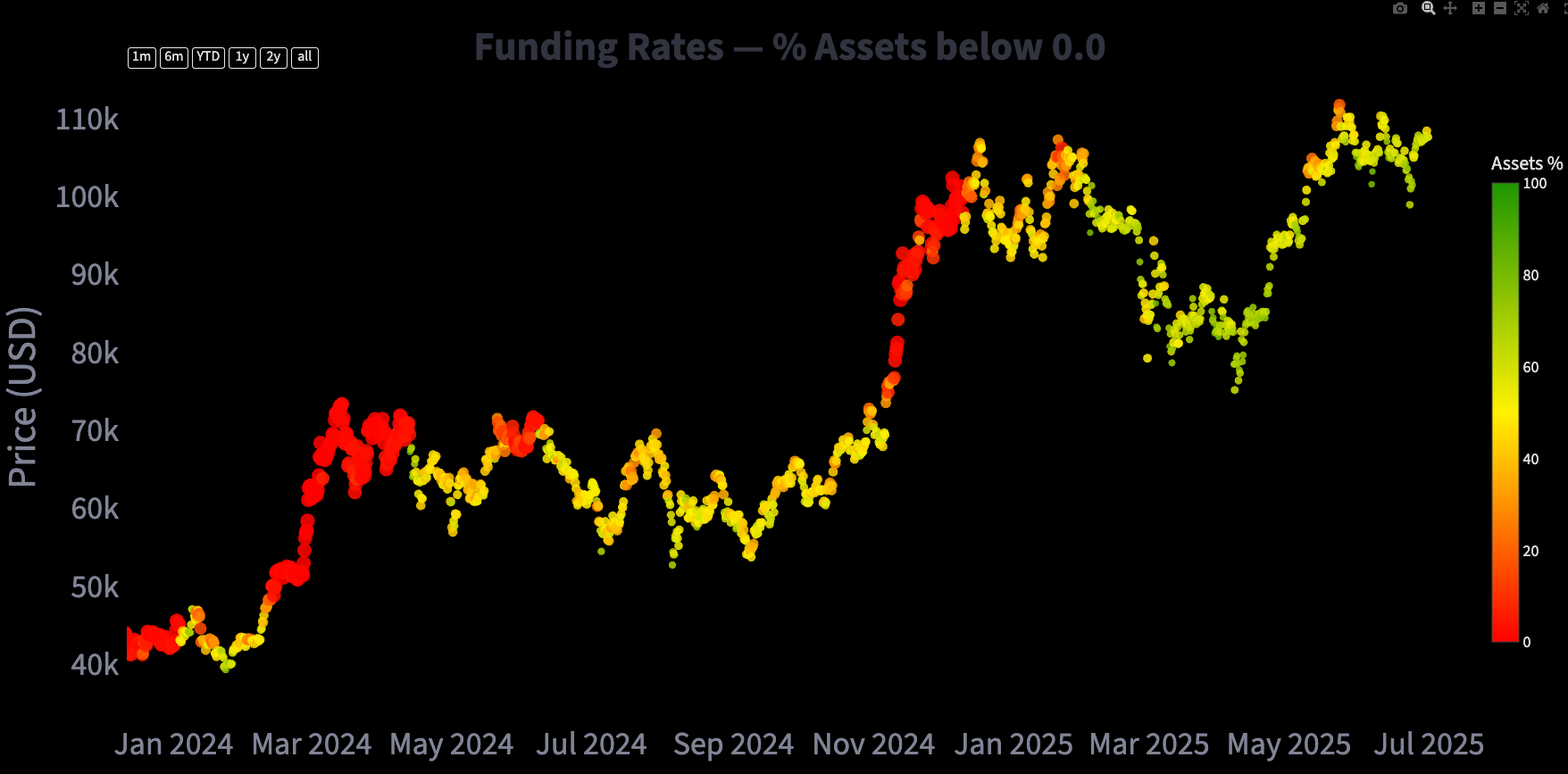

After all, funding rates are already pretty low. This charts uses the price of Bitcoin and paints dots on it to represent what percent of assets have a funding rate below 0%.

We are getting quite a few readings in the 60%+ region, which isn't that common.

And if price were to dip closer to $100k, this chart would be the greenest its been in two years.

There's only so much negative sentiment a bullish cycle will allow. Nearly 100% of assets with a negative funding rate just doesn't seem allowable.

Not to mention, there's quite a bit of strong developments happening on the supply side for Bitcoin and Ethereum. There are some undercurrents at play that suggest the market has plenty of fuel to give a rally higher plenty of boost.

But we can spill more ink on that if and when conditions present themselves.

Until then, we'll just take things one checkpoint at a time.

Your Pulse on Crypto,

Ben Lilly

P.S. - From November 2024 until recently, I've been unable to dedicate time to Espresso. The reason is simple... Our team at Jlabs Digital has been all hands on deck building out a solution to make it easier to access curated strategies developed by us.

But not any interface would do. We wanted to make it as simple as possible to use. That solution is deploy.finance and you can deploy an agent within minutes. Once deployed, the strategy runs in a self custodial wallet. We encourage you to give it a try and let us know what you think. We've poured our heart and soul into this.

Deploy is the solution we've been wanting to bring to market since 2020, the year where we began to develop onchain solutions. The technology, execution, and solution is finally ready for prime time. So give it try, deploy today.

Any questions, you can find any of our team members online at any time of day here. Thanks for giving us a try.