We Shouldn’t Be Afraid of Less Volatility

Filtered: August 7 – 11

If you looked at the big headlines this week, you might be fooled into thinking the bull market is finally here.

PayPal announced it’s launching a dollar-pegged stablecoin. Coinbase’s own blockchain, Base, finally went live. Hopium is growing that the SEC will approve a spot Bitcoin ETF. And even Microsoft announced it’s looking into digital payments in a partnership with Aptos.

But it’s not long before the price charts bring you back to Earth.

After breaching $31,000 last month, Bitcoin (BTC) has fallen and stayed under $30,000 for most of August.

It’s the same story with Ethereum (ETH), which has declined from its high of $2,000 in July to trade within a tight range of $1,825–$1,875 this month.

If this is your first bear market, you might be close to tearing your hair out, either out of boredom or frustration. And I wouldn’t blame you. This market just plain sucks right now.

But while this stale price action can take a toll on your psyche...I spent some time earlier this week explaining why a lack of volatility in crypto’s long-term future is a goal worth striving for.

I know that may sound odd at first, since I’m sure many of you got into this space specifically because of the outsized gains that volatility offers.

But in my Monday Single Origin essay in Espresso, I laid out the case that if crypto is going to take the next leap forward, achieving a degree of price stability has to be on our agenda.

In other words, crypto should take a lesson from the “corn economy” (or any industry that is relatively stable). If the corn economy experienced the kind of chaos that often hits crypto, this is what would happen:

If kernels…rain down from the sky, and the inputs that go into each kernel keep falling, the value of each kernel will collapse. This makes intuitive sense.

However, if events take place like a disease that impacts kernels around the world, the price of each kernel will go sky high. This is scarcity.

It shocks the corn economy, and as a result, many businesses close their doors. The volatility of kernels makes it harder to pay salaries, maintain margins, and most importantly, grow.

This causes productivity levels to get hammered in the corn economy. And as a result, workers, entrepreneurs, and farmers start to leave in search of less volatility.

Volatility is a bitch.

In the rest of the essay, I explained how ETH and the corn economy (not Bitcoin, but you can replace the analogy of ETH with BTC) are more similar than you might think...and even why government money can be useful in the quest for price stability.

I also discussed the piece with Marconi Wight on the latest Alpha Bites podcast. But that’s not all we talked about.

Marconi naturally wanted my take on PayPal’s stablecoin, PYUSD, and how it could relate to the recent launch of FedNow, a 24/7 payments system run by the Federal Reserve:

It's good for stablecoin diversity to have another option out in the market. Also, if there's an opportunity for people to see those methods that PayPal was doing back in the day – freezing customer assets – and [PayPal] starts to use similar methods [on the stablecoin], I think it will be able to attract some of the ethos of what we're all here for and make some of the other stablecoins more attractive in general.

One thing I was wanting to look at: the FedNow network's being deployed for federal banking member networks. And I think PayPal uses Synchrony and Bancorp on the back end for a lot of their banking needs. And I didn't see either of them listed on the FedNow website as one of the early adopters. So I'm wondering if there's going to be a response here from the Federal Reserve or Treasury. We'll see.

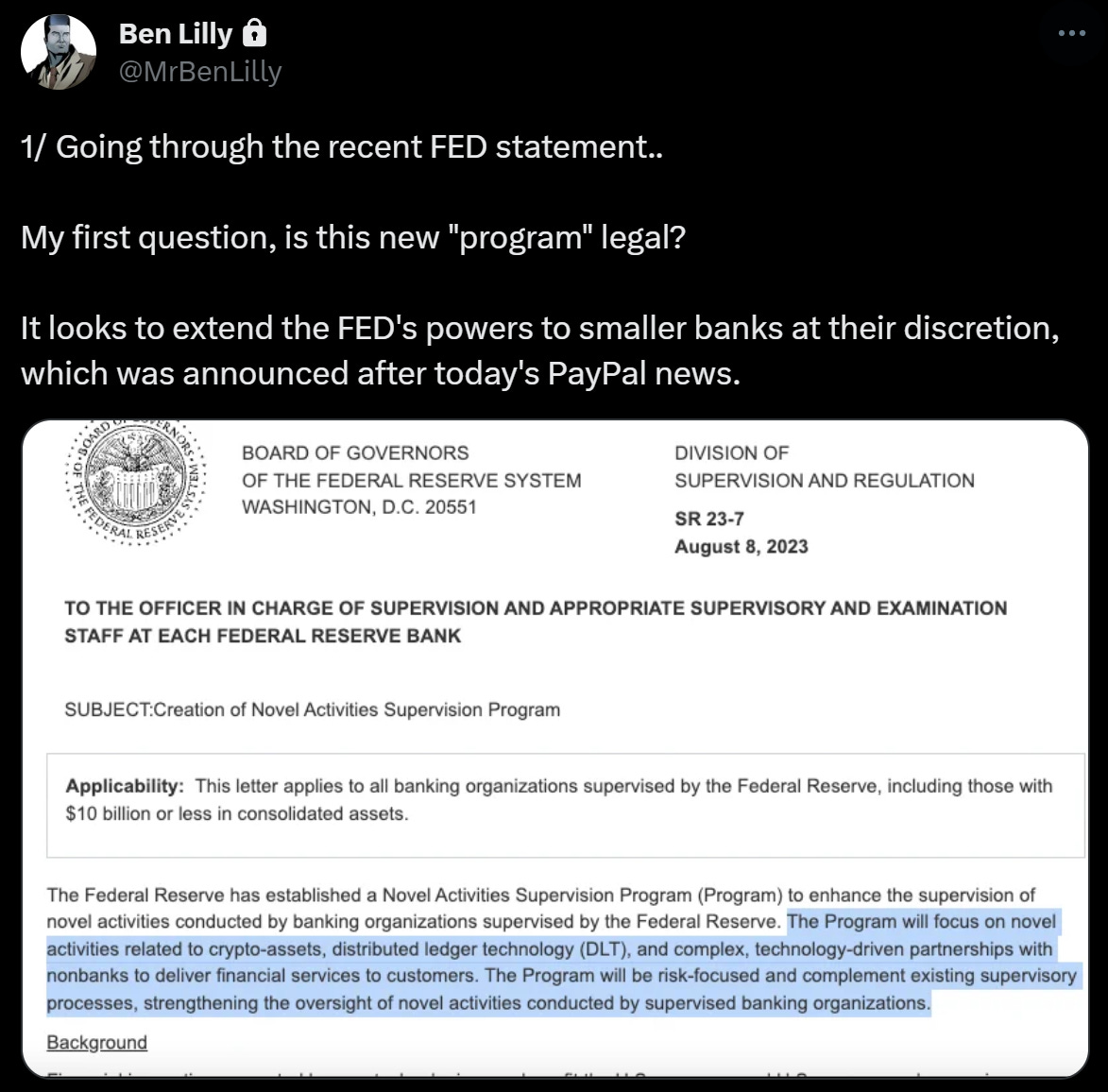

I guess Jerome Powell was secretly listening on our recording, because sure enough, the Fed swooped in with a response before we could even release the episode.

On Wednesday, the Fed essentially declared that it has full authority over banks’ crypto activities, and that they need to get its permission before dealing with stablecoins.

I’m still not entirely sure whether this maneuver is legal (check out the Tweet of the Week below for more). But even then… I’m actually not that worried about it, as I explained in this week’s Blend:

Well, here we are. The Fed showed its hand, and now it looks to gain widespread adoption through rules it made up by itself in order to protect the U.S. dollar.

I say let ‘em have it.

For crypto to truly showcase itself, its main use case cannot and should not be the transaction of stablecoins. It should be to promote smart contract technology that resides on the network.

In doing so, the various decentralized blockchain networks will be viewed as beehives of pure, unadulterated, golden productivity.

Hopefully, that take doesn’t deter you from reading the rest of my Wednesday piece, where I also discussed the chart to focus on when volatility returns...and “the zombie chain” down 97% that’s starting to show signs of life again.

Meanwhile, on the Alpha Bites podcast, the topic of the state of yields on Ethereum once again came up...and independent analyst Ray decided to let loose on the whole era of liquid staking derivatives (LSD) and why he thinks it’s a “ticking time bomb”:

I am bullish on Ethereum long-term, but I am very skeptical and nervous with the whole LSD-Fi collateralizing, staked ETH, IOU tokens, rehypothecation, [and] hidden leverage. I'm just not long-term bullish on any of this ETH staking stuff until more real-world assets come on-chain and are a part of the Ethereum staking ecosystem.

DeFi as a whole needs to step away from liquid staking derivatives of synthetic IOU tokens. And that entire liquid staking derivative concept needs to be replaced with real-world tangible assets that have value and can be fractionalized and do produce yield coming on-chain, so that the actual tokens are backed by something that has value and is more than just speculation.

If Ray’s rant scares you away from trying to use Ethereum for yield, there may be another option.

Each week on Alpha Bites, our token design expert Kodi gives a quick take on a handful of projects in his “Like It or Spike It” segment. And this week, he highlighted an LSD on Cosmos that’s gaining ground, called Stride (STRD).

Here’s Kodi:

Stride is basically the Lido of Cosmos. It allows you to stake a lot of [different] tokens for Cosmos and get a liquid staking token in return. So you can earn yield on your tokens and also use those tokens in DeFi across Cosmos. And right now, it's sitting at $30 million in TVL [total value locked], which doesn't sound like a lot. But it's quite good for Cosmos considering that all DeFi over there kind of disappeared overnight.

...

It's the first liquid staking solution in Cosmos. And it doesn't look like anyone is going to catch up to them. They have 24 million locked in ATOM.

…

It feels like liquid-staking solutions is a [sector] that is going to explode over there, because up until now, there wasn't a single solution for it.

Kodi went into more detail on why Stride and its token could offer some opportunities for people who may have been disappointed with Lido’s performance so far (not financial advice). You can listen to the full episode of Alpha Bites here, or on Apple Podcasts or Spotify.

As always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

Espresso:

- What Crypto Can Learn From the Corn Economy

- This Token's Down 97%. And It's Looking Strong

Alpha Bites:

Tweet of the Week:

After you finish reading my take on the Fed’s move in the Blend, check out my thread here.