We Remain Steadfast

Monday ChainPulse Update

Prolonged consolidation. It brings about boredom, and with it… bears.

Bearish charts are starting to make the rounds as we continue to move sideways. I’ve even witnessed some popular analysts begin to turn bearish.

This is exactly what you want to see.

As the consolidation phase comes to an end many bullish traders begin to turn bearish. The FOMO is weeded out of the market. And derivatives begin to respond less and less to subtle market moves.

It’s how a market is able to take people by surprise.

Now, we must admit. We’re not immune to this type of phenomenon. When given too much time to think, we - just like everyone else - start to second guess what we believe to be true.

But instead of wavering, we just go back to our toolbox to decide if our premise still holds. That’s what we did over the weekend. And on Wednesday we’ll explain why our premise of continued bullishness remains.

For now, we’ll simply mention that in the coming weeks there’s a high likelihood euphoria returns. Funding rates will get high enough for you to consider borrowing money from a loan shark as opposed to the exchange. And options prices will double just on account of rising volatility.

There’s a lot to be excited about.

Today, we will focus on the ChainPulse Update…

Approximately 50,000 BTC was bought up the past few days. That’s about $3 billion. The entities behind such these moves are not small.

And while many who watch these type of movements are anticipating a major announcement any day similar to the way MicroStrategy or Tesla made their purchase of bitcoin known, we need to realize timing is everything with an announcement.

Once bitcoin starts climbing higher we will probably witness some of these players come out and reveal prior purchases.

That’s because if bitcoin is ripping higher it can bring positive attention to their stock. It does little good for a company to announce it purchased bitcoin as the asset trades sideways or at a price range that some are questioning to be the market top.

While there is no major announcement being made, make no mistake, major buyers are attacking every dip. It’s in part why we see the series of higher lows..

Note: We have not adjusted the curved white lines in a few weeks. We leave them there to help create consistency from week to week on the charts being used. The third higher low looks to have already happened - a bit faster than we anticipated.

In terms of us seeing price drop below $54k ($53,450 to be exact) - a price point that we believe to be an important price to hold - the chances are getting very low.

Again, we plan to dive into this more on Wednesday.

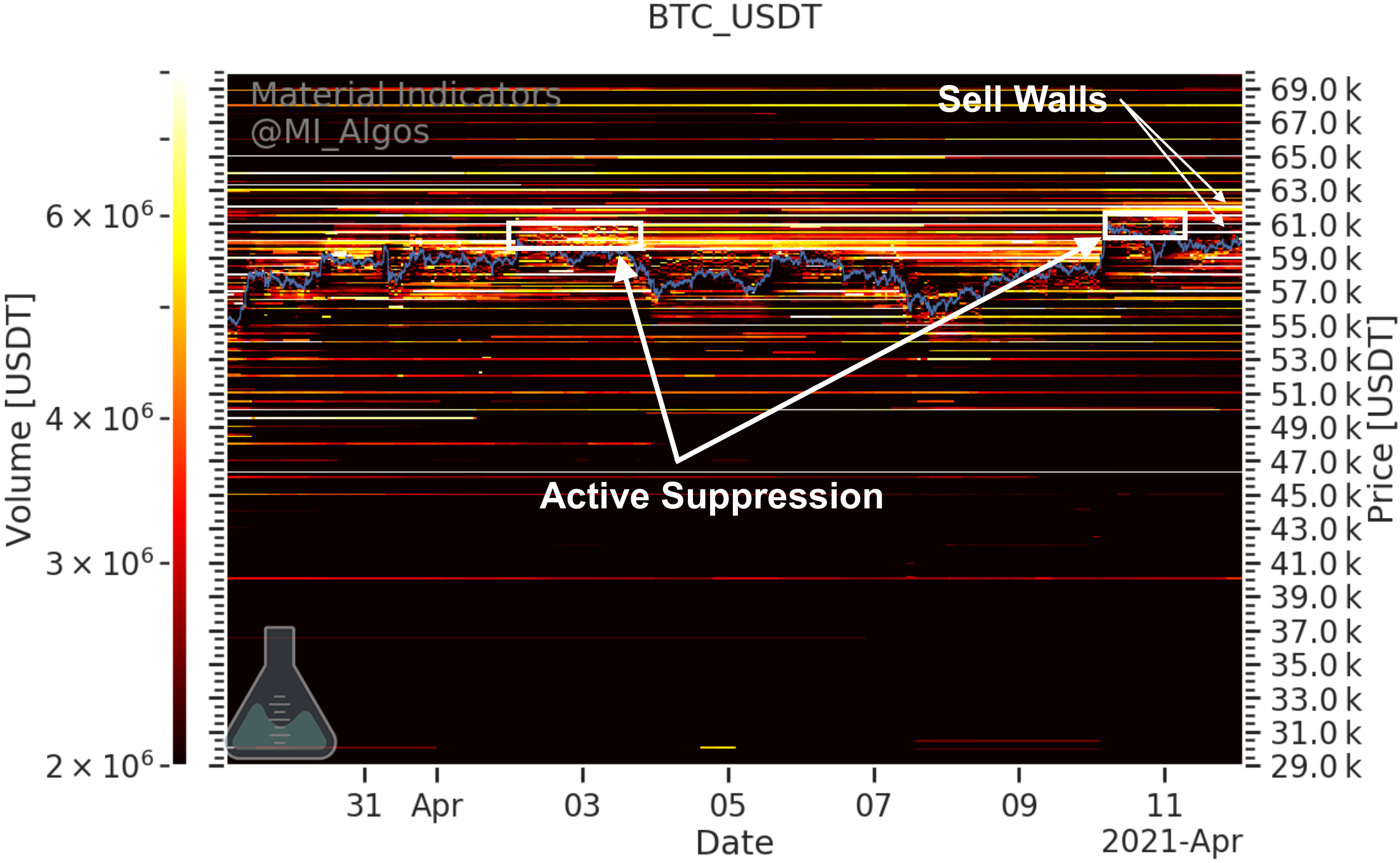

For now we have price testing the all-time high again. To see what the order books look like, let’s take a quick look at a Material Indicators chart.

In the chart below I point out the current sell walls. They aren’t as thick as they were prior.

More importantly, the active suppression on the books is not seen. I know it’s hard to see on this image, but the small little hashes are sell walls that are very short lived. These pop up and then start to move up and down the order book, and can really be another layer of suppression to an extent.

We don’t see that right now. Which is a good sign for BTC to attack the remaining sell walls.

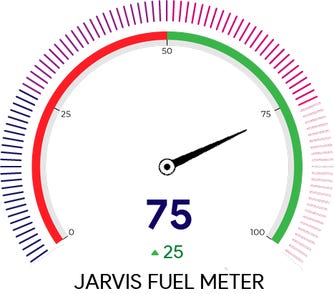

In terms of bitcoin having another fuel, our Fuel Meter sits at 75. There’s plenty of ammo to break the walls.

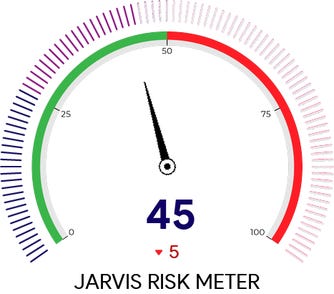

And the risk is pretty neutral as it sits at 45.

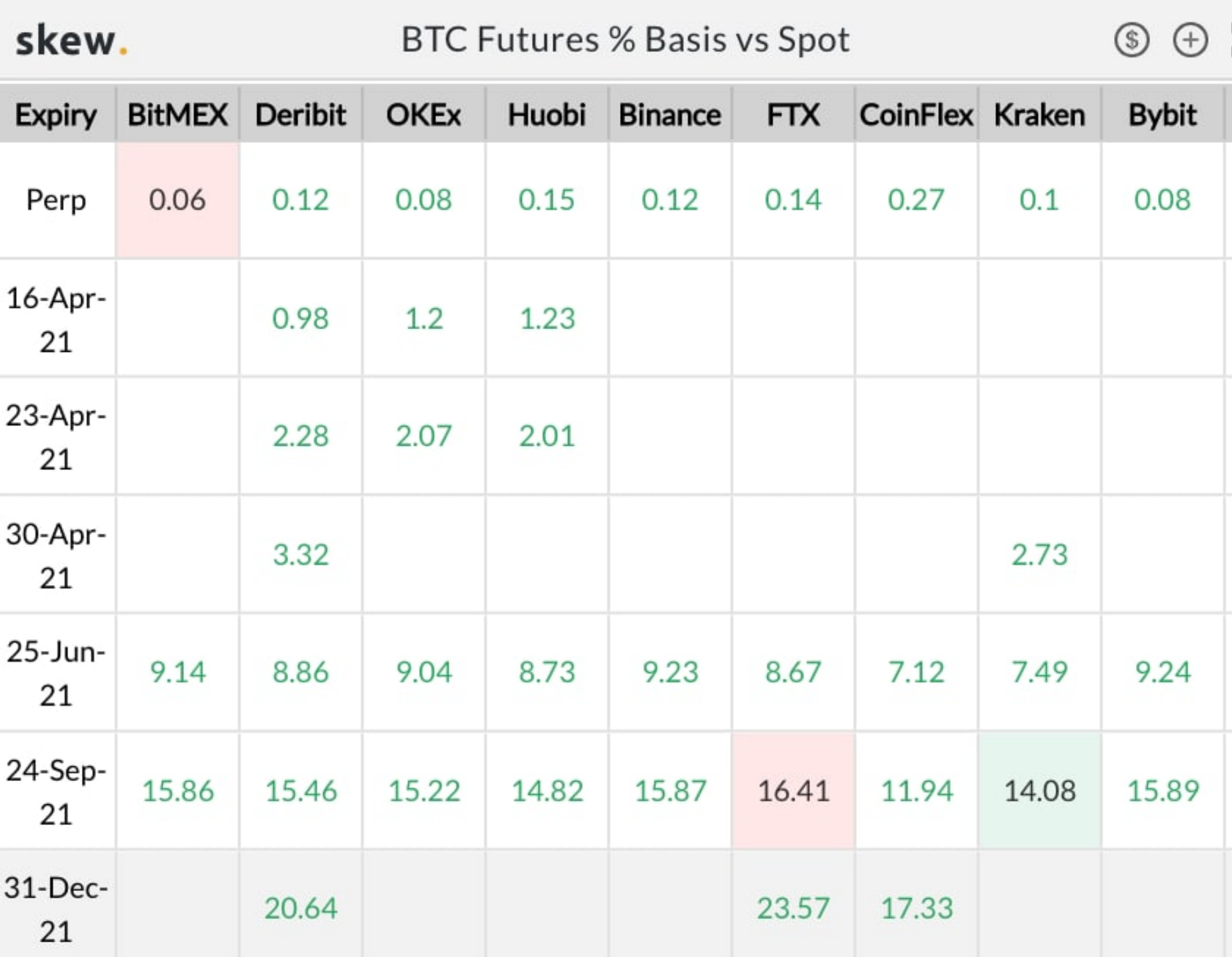

Futures on the other hand are getting a bit crazy. December futures are trading 17-23% higher than spot prices at the time this screenshot was taken.

The market is beginning to price in the next leg higher for bitcoin. With volatility still relatively low as we spotted out on Friday, options remain a better bet in terms of using leverage. This is opposed to futures. And frankly, we don’t expect futures to calm down for several months if we break out of this trading range to the upside.

This is another topic we look to touch on for Wednesday… How does the market behave with funding rates consistently high? And what do you do about it?

For now, let’s start getting comfortable with higher funding rates and assume they went be as good of a mean reversion signal in the coming months.

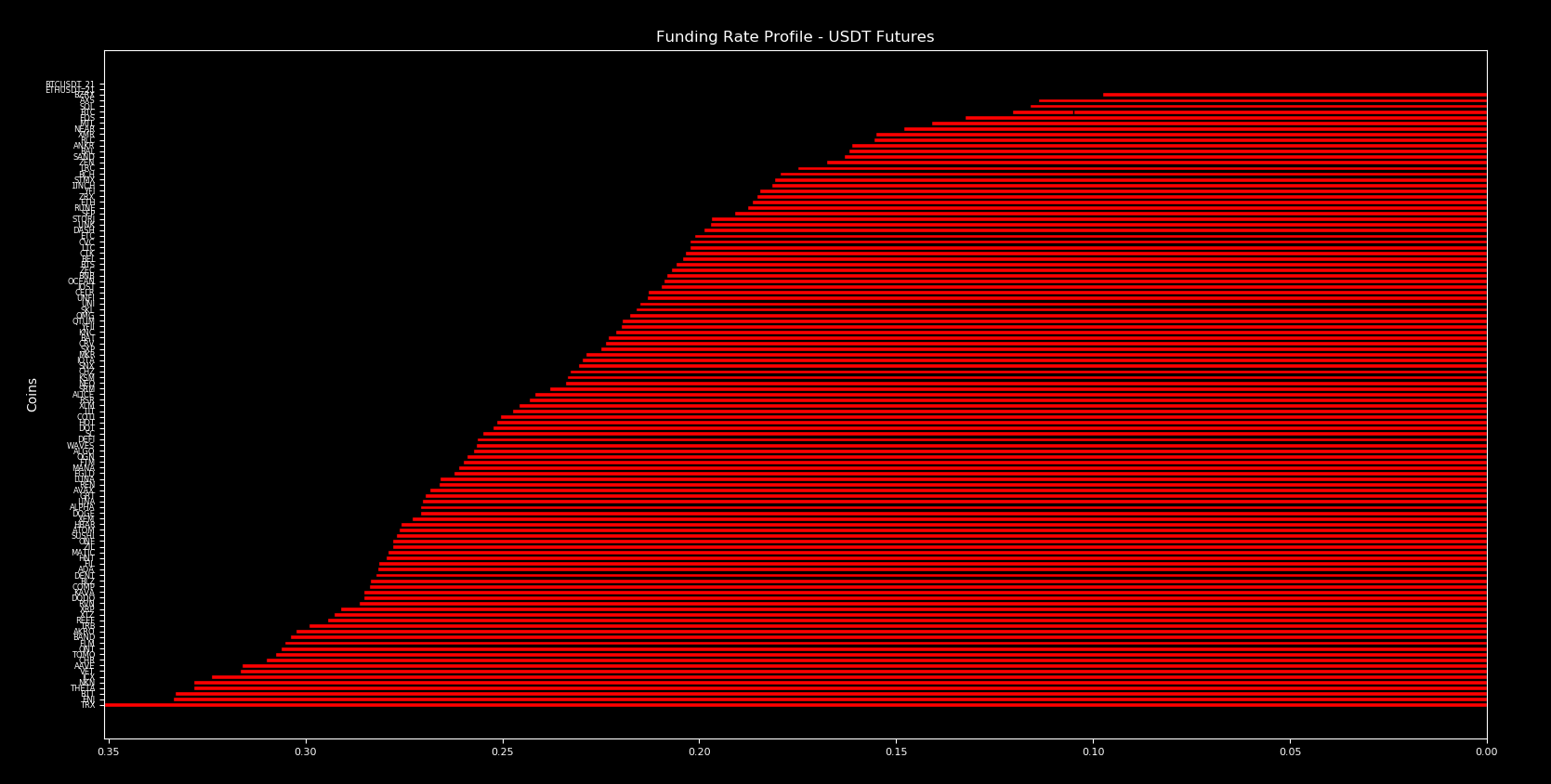

As a starting point, here is the profile for funding rates.

To sum up today’s issue…

Bitcoin is making a series of higher lows. Heavy accumulation is taking place. Fuel and risk look good for higher highs. The order books are showing less active suppression on bitcoin’s price. And if you’ve been following along for a while you’ll know on-chain and the Grayscale Effect are both painting bullish biases on the brain.

We remain steadfast on our view the the current market structure for bitcoin is pointing to higher highs in the coming week(s).

Your Pulse on Crypto.

B

P.S. - We had a fruitful discussion in Wednesday’s issue last week regarding Pi Indicator. The comments were in response to our team essentially tossing the indicator to the side for now even though it’s about to flash a warning sign that the market might be topping out.

My (Ben) analysis was the indicator would not hold this time around. The way in which I chose to prove it was a bit of a short cut, and I apologize for that. I thought I could prove my point using a few sentences as opposed to an entire essay.

While my takeaway doesn’t change, the analysis in which I used could have been better.

Anyways, what was interesting is the creator (Philip Swift) himself on Friday published this in his newsletter,

“My current near-term market outlook for Bitcoin is neutral-bullish, so my personal view is that there is a good probability this is not the market cycle top for Bitcoin when the Pi Cycle Indicator moving averages cross in a few day’s time.”

And here he is again on Twitter yesterday:

@woonomic 2/ I agree, the overall market structure this time suggests that the Pi cycle observation is very unlikely to play out again this time around.

— Philip Swift (@PositiveCrypto) 4:40 PM ∙ Apr 11, 2021

I shared my more detailed thoughts on it here:

Our reasoning is rather similar. But more importantly, I think we should all give Philip a lot of respect for mentioning his creation might not be valid this time around. Not an easy thing to do.