We are Not Out of The Woods

Pep Talk and Market Update

Imagine if you caught the wick.

And further, imagine if you caught it at 20x, 50x, or maybe even 100x leverage.

The amount made off the bounce might be enough to last you the year. It’s a home run bet.

But here’s the thing…

You couldn’t even if attempt it. Exchanges were down left and right. CoinMarketCap and CoinGecko were stalling out.

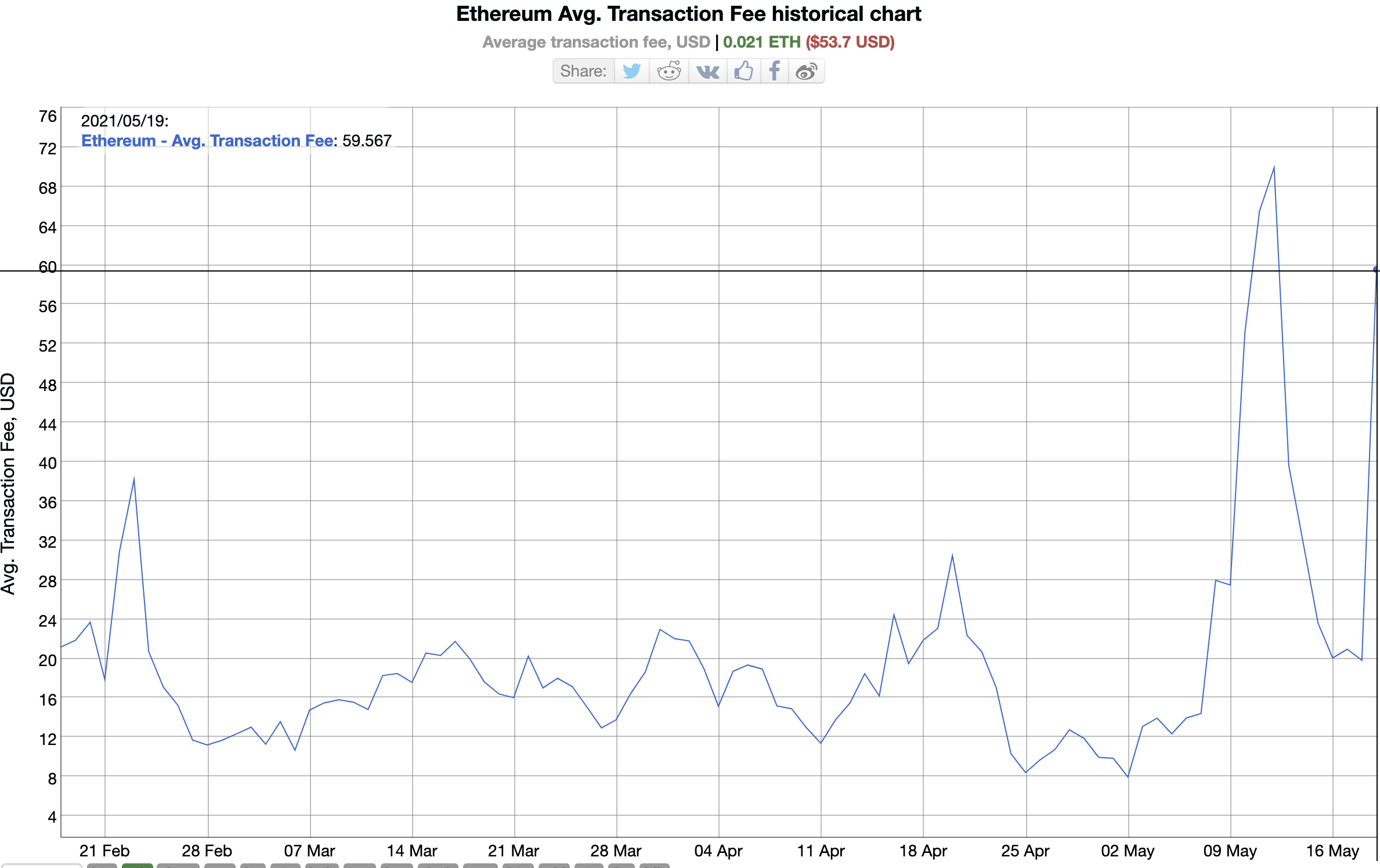

Wanting to trade on a decentralized exchange like Uniswap… Enjoy the third highest day ever in average transaction fees at $60 per the chart below.

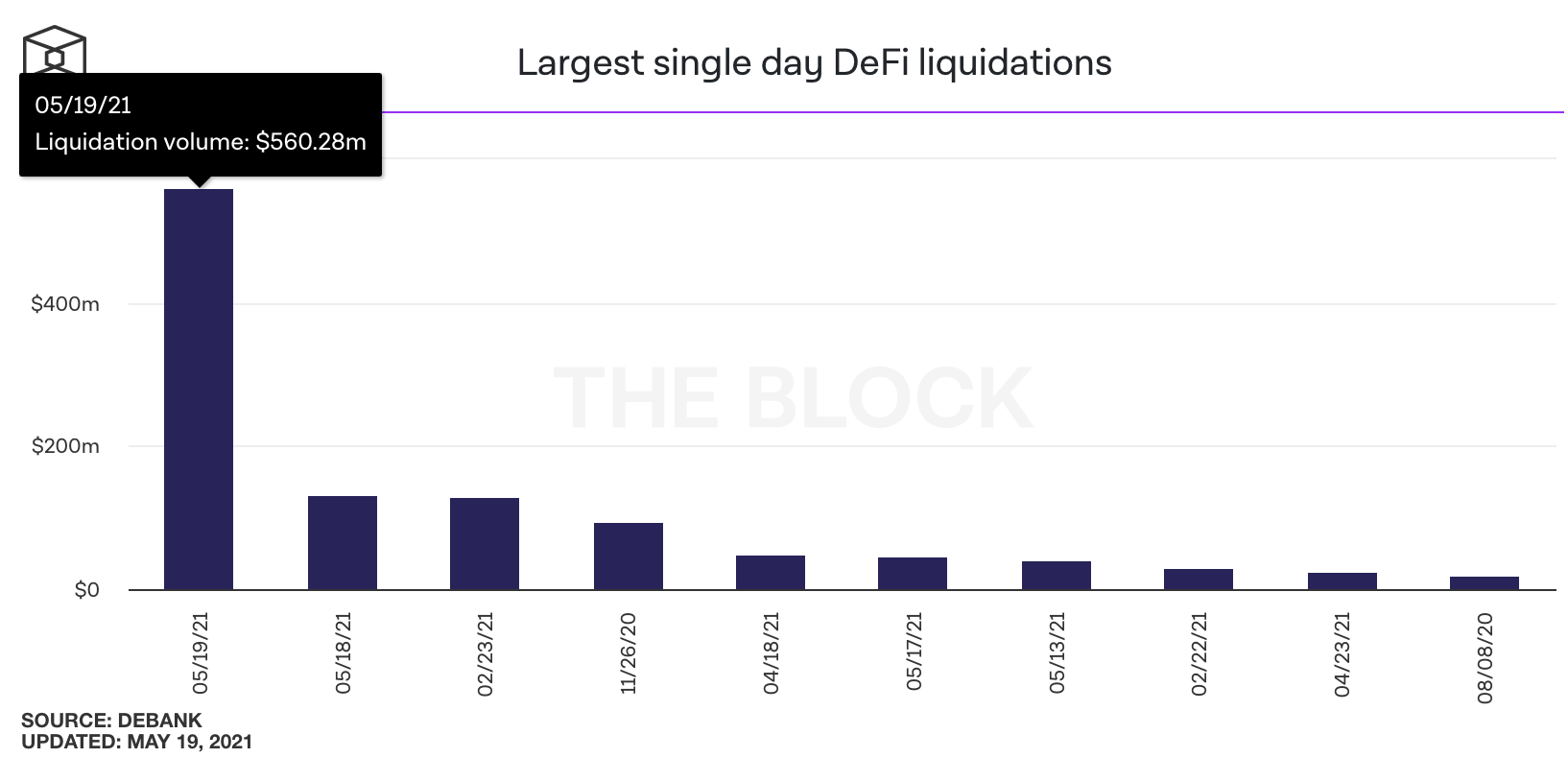

Not to mention liquidations on DeFi protocols like Aave and Compound were off the charts yesterday.

You couldn’t move.

And if this is your first drop of more than 30% for bitcoin and more than 40% for altcoins, welcome to the show.

This is crypto.

You’ve likely heard that three worded phrase many times by now. And now everybody here today reading those three lines have a better understanding of what it means.

When you are in a shit storm, nothing works.

It’s why we put risk management as such a high priority Avoiding massive hits to the portfolio like yesterday provide you with a massive leg up over the market.

And for those who were HODL’in and watching everything bleed, no need to panic. If you made it this far, you can ride out the next few months as the market gains strength again.

How can I be confident that this asset class will rise over the long-term?

Because… This is crypto.

What we learned yesterday is that crypto is still in fact an adolescent. The inability for exchange infrastructure to operate at scale is glaring.

In turn this leads to liquidity issues as market makers cannot respond as APIs across the majors were non responsive.

This lack of liquidity was on display as dislocations presented themselves across the spectrum.

Even Coinbase was trading $3,000 higher than other exchanges.

These are kinks in the system that the space is ironing out. And its in part why we see such massive selloff.

Yet, despite all of crypto’s inefficiencies, we’ve come a long way. We now have the ability to trade derivatives on-chain, take out loans, and more.

Despite having done so much, we still have a ton of progress to make.

Which is why I can confidently continue to spill bullish ink all over this newsletter.

It’s also why I’m stressing to remain risk averse. Meaning don’t run in front of a steamroller to pick up those sats. Preserving your capital gives you a better shot at riding the entire asset class higher.

OK, enough of the pep talk. I hope some of that made sense to you.

Typically I’ll write about a few odd ball topics here and there, but I’m pretty sure I can assume what everybody wants day in, day out for the next few days…

Market Update

It’s no secret we received a lot of unusually bearish profit taking transactions for BTC in the lead up to the drop.

It started earlier this month and caught our attention enough to write about it on May 7th in “Gaining Momentum”.

Here’s what we mentioned…

“When we pair this up with the on-chain profit taking we see taking place for bitcoin over the last two weeks, we can paint a pretty strong bear case for a drop.

Not a “top is in” type of bear case, but more like a drop where altcoins get whacked 30-50% while bitcoin drops 10-15%.

Then soon after bitcoin leads the market higher.”

At the time we noted Señor Pablo was starting to make his move. His signature move is in selling into a soft market.

There were two times prior that his selling did not buck the trend and ended up creating the last sell before price made a “V” reversal.

It’s in part why we actually brushed off his first transaction when we saw it. The thinking was the market had more than enough liquidity.

Regardless, we knew the threat. Jarvis AI knew the threat. We went risk averse and waited for the market to tell us where it was going.

Sub $30k. Wow. So how did it unfold on-chain?

Alerts were literally pinging our algorithms and risk modules left and right due to unusual bearish wallet transactions of BTC being deposited in exchanges.

Further, large sum of liquidity in the form of USDt was leaving exchanges.

Then as the London session neared, bearish transactions began peak. Meaning a massive volatile bearish move was in the making.

As price bungee jumped off $40k the bid side of the order books was stacked to absorb the impact. But due to exchanges being inaccessible there was almost no market buying, meaning crypto free fell into any bid that lay dormant.

Once exchanges fired up their dial-up modems we got some panic selling. Pablo never ceased but just dealt blow after blow after blow. We literally haven’t seen that unfold in years. This was put simply, carnage.

And now here we are after Elon’s nuke, Pablo’s haymakers, and even sub optimal infrastructure creating conditions for the nail to be driven into bitcoin’s coffin.

Yet it still stands above its prior halving cycle’s high of $20k.

Good stuff.

So as far as where we stand…

I’m going to quickly take pause for a moment and pick up a helmet. As what I’m about to show you might cause some blowback. If that’s the case, just remember this is the long-game here.

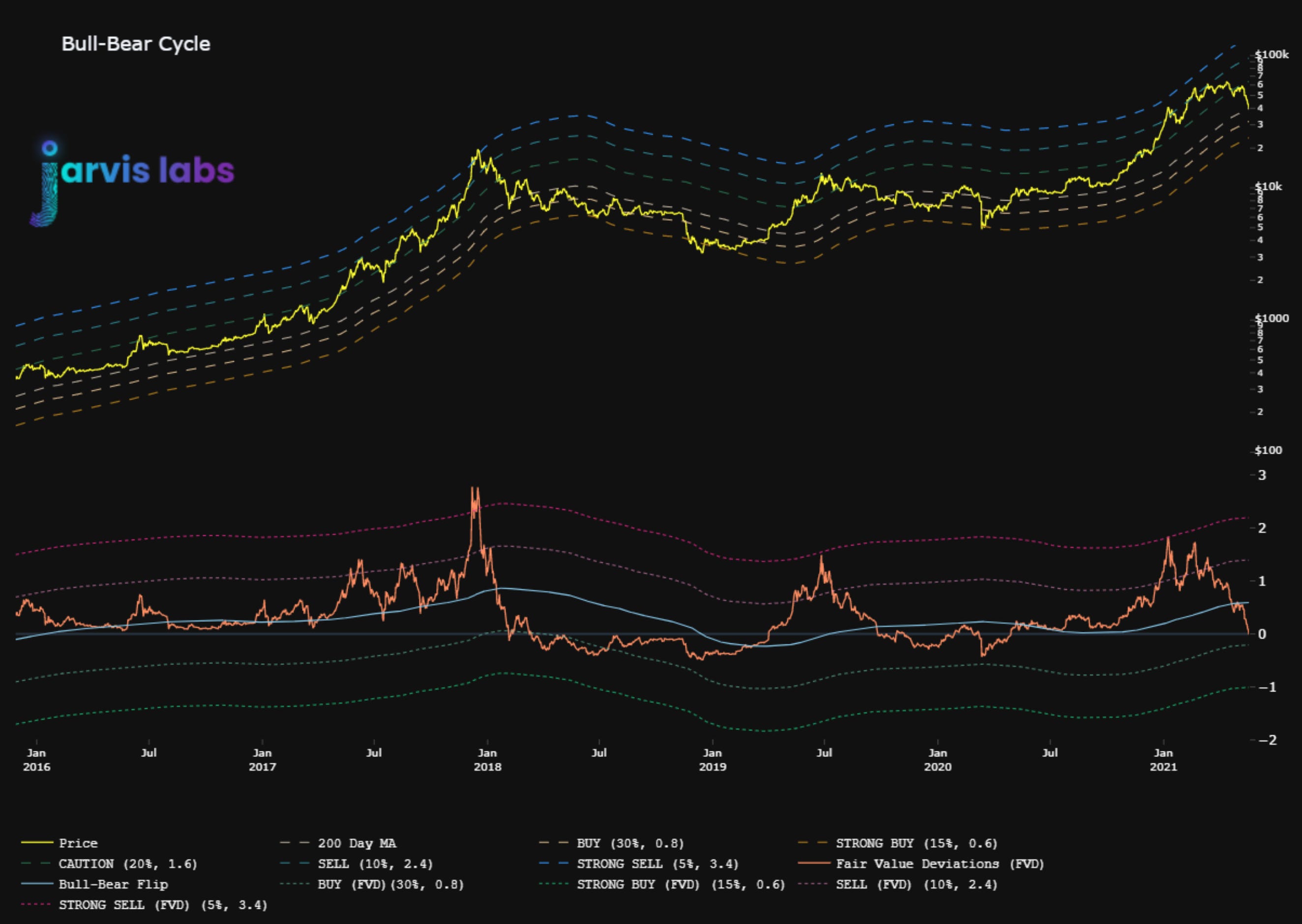

We developed a new Bull-Bear metric late last month. It was then getting finalized in-house as Benjamin was getting assaulted by COVID. And when Benjamin got back, he cleaned it up to meet his expectations.

Well, it was telling us we were in a bear market before Elon’s tweet.

In the bottom half of the metric below there is an orange line we call the asset’s fair price or “Fair Value Deviation”.

It crossed the blue line as we topped out a few weeks ago. That blue line is the bull-bear threshold.

We are now below it, and based upon this metric we are in a bear market.

(me grabbing my helmet)

What I first want to mention is no, we are not saying bitcoin has entered a bear market. This is a new metric so we need to take it with a grain of salt.

But what’s clear is when the fair price dips below the threshold we get bearish correction. And thanks to its steepness, it can still rebound with strength similar to the second half of 2017 in the chart.

So we plan to bring this chart up when needed and evaluate where we are in terms of bitcoin’s fair price.

For our Jarvis AI users, the metric helped us get out of positions much earlier into a bearish trend and as close to the top as possible rather than after a large correction like yesterday.

For now, let’s find some stuff around the house to do. Perhaps clean out that overstuffed closet. Now is not the time to make trades. Let the dust settle. I know I said it might be the last flush yesterday, but we’re not out of the woods yet.

Until next time…

Your Pulse on Crypto,

Ben Lilly