Wait For The "Beep"

Jerome delivers a dead fish handshake that is worrying the market. Crypto is no exception, and this weekend looks ripe for some price action.

The dead fish handshake met expectations.

Jerome's speech was non committal, didn't try to provide any guidance, and was ready to end as soon as it begun...

But he wouldn't be the first to end the "shake" as that would indicate a possible policy stance he doesn't endorse.

Typical dead fish type of move.

Now, what I found most interesting was during this 47 minute statement and Q&A session on Wednesday, nearly every question fielded by Jerome was an attempt to get a timeframe on when the cut is coming and projections on how many are coming.

As he replied, he was noticeably uncomfortable. You could hear it in his voice.

But why. Why would a central banker seem so uncomfortable during a Q&A session where everybody simply wants to know whether September will be a cut.

And I think it's simply that Jerome doesn't expect September to be the meeting where we see a cut.

After all, the committee unanimously voted to keep rates unchanged. For a September cut to be close, I wouldn't expect to see such agreement in the vote.

His uneasiness is him reading the room.

The room knows Jerome can give the cut. The room thinks Jerome will give the cut. But Jerome knows like a man flush with cash uncomfortably walking by a beggar on the street, he won't give anything.

This is the impression I'm left with as I continue to get re-acquainted with the markets. The cut isn't coming in September.

And this is causing an uneasiness in the market.

Today, I'll get into what this uneasiness means for crypto in the coming days.

September Seems Unlikely

The market is more worried today, than yesterday.

It's almost as if the hopium for an early rate cut is starting to dissipate from the market. And in its place, worry enters.

If we rewind to earlier this year, many were projecting a rate cut would happen by now. The combination of the Federal Reserve loosening conditions and the U.S. Treasury / Repo markets helping ease the Federal Reserve's balance sheet runoff, would be insanely bullish for risk assets like Bitcoin and crypto at large.

Especially with Bitcoin's halving being in the rearview mirror, a time period when prices are exceptionally strong.

But here we stand. It's August, a month when our six month younger self believed prices would start to gathering momentum.

Yet, Bitcoin sits at the same price level as it did before the halving. Rates remain the same. And if anything, the ETH ETF seems like a dud.

What gives?

It's that question that is slowly creeping in and causing a lack of position building. If anything, the positions that are being build are on the worrisome side.

Here's what I mean...

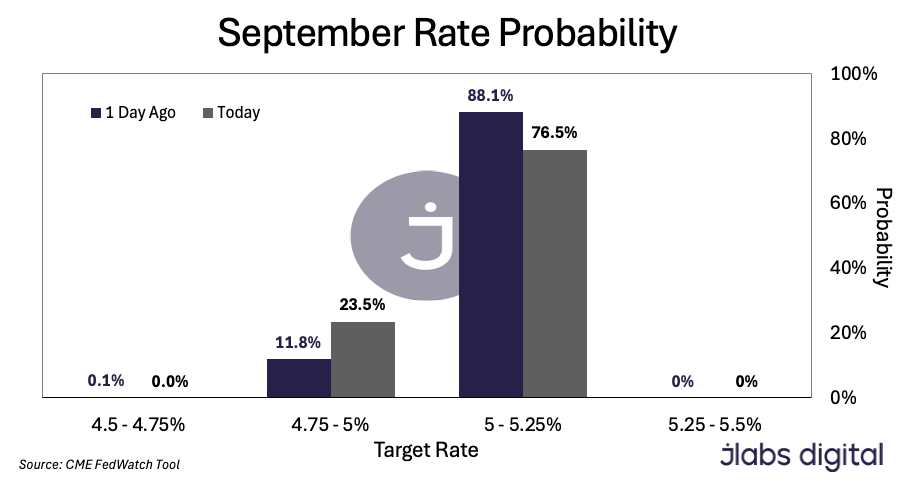

The probability for the target rate to be 50bps lower in September just went from 11.8% to 23.5% overnight.

For anybody that listened to Jerome's Q&A, he pretty much rejected the idea of multiple rate cuts when the question was raised. And the committee doesn't even have a break in the vote for one cut - unanimously voted to keep rates unchanged.

Yet the graph below suggests nearly 1 and 4 odds of multiple cuts.

For those that wonder why such a cognitive dissonance, check out the prior discussion, The November Cut, where we explain that the bar chart above hints at more rate hedging. Not the actual probability.

The reason for this is likely due to the market becoming more fearful that the Federal Reserve is waiting too long to make its move.

We saw that sentiment in the questions as well, even the Fed Whisper, Nick Timiraos alluded to this. Central bankers might be putting themselves in a position to be reactionary instead of preventative.

That's sort of par for the course when it comes to the Fed.

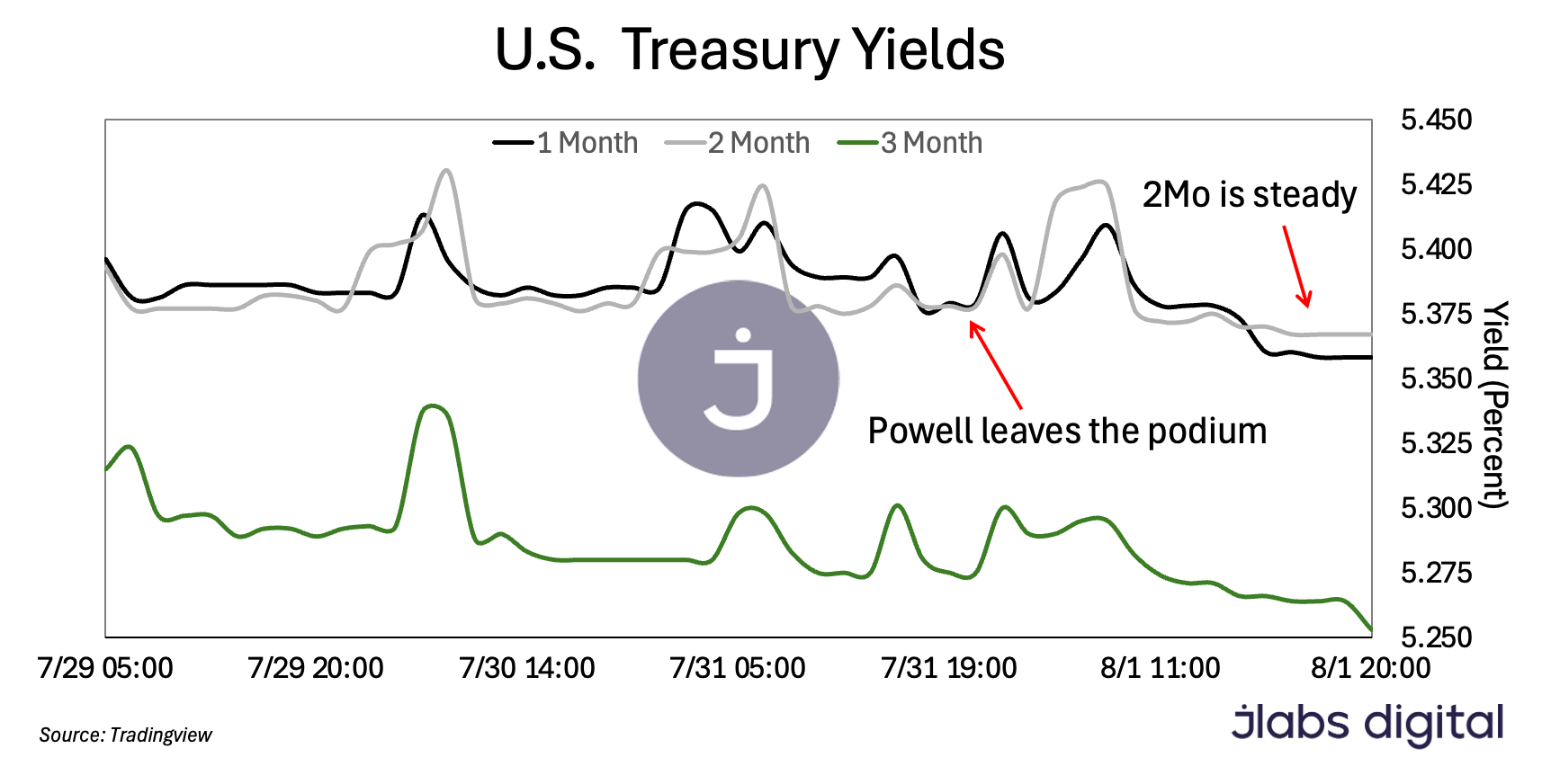

Now, to get a better idea for when the cut is coming, let's look at the treasury yields in the chart below... More specifically, let's zoom in on how the market reacted from when Powell took the stand to today through the lens of shorter duration treasuries.

The verdict, the 2-month treasury was steady as can be. And instead, the 3-month (green line at the bottom) continued its descent lower.

This tells us that the November timeline still looks to be the meeting.

But the market thinks that's not soon enough, per the heavy rate hedging assumed via the change in probability chart. And this divergence in opinion is spilling over into the crypto market.

Reading The Tape

The trade book is showing indecision.

Or better yet, a lack of aggression. It's a wait and see type of market.

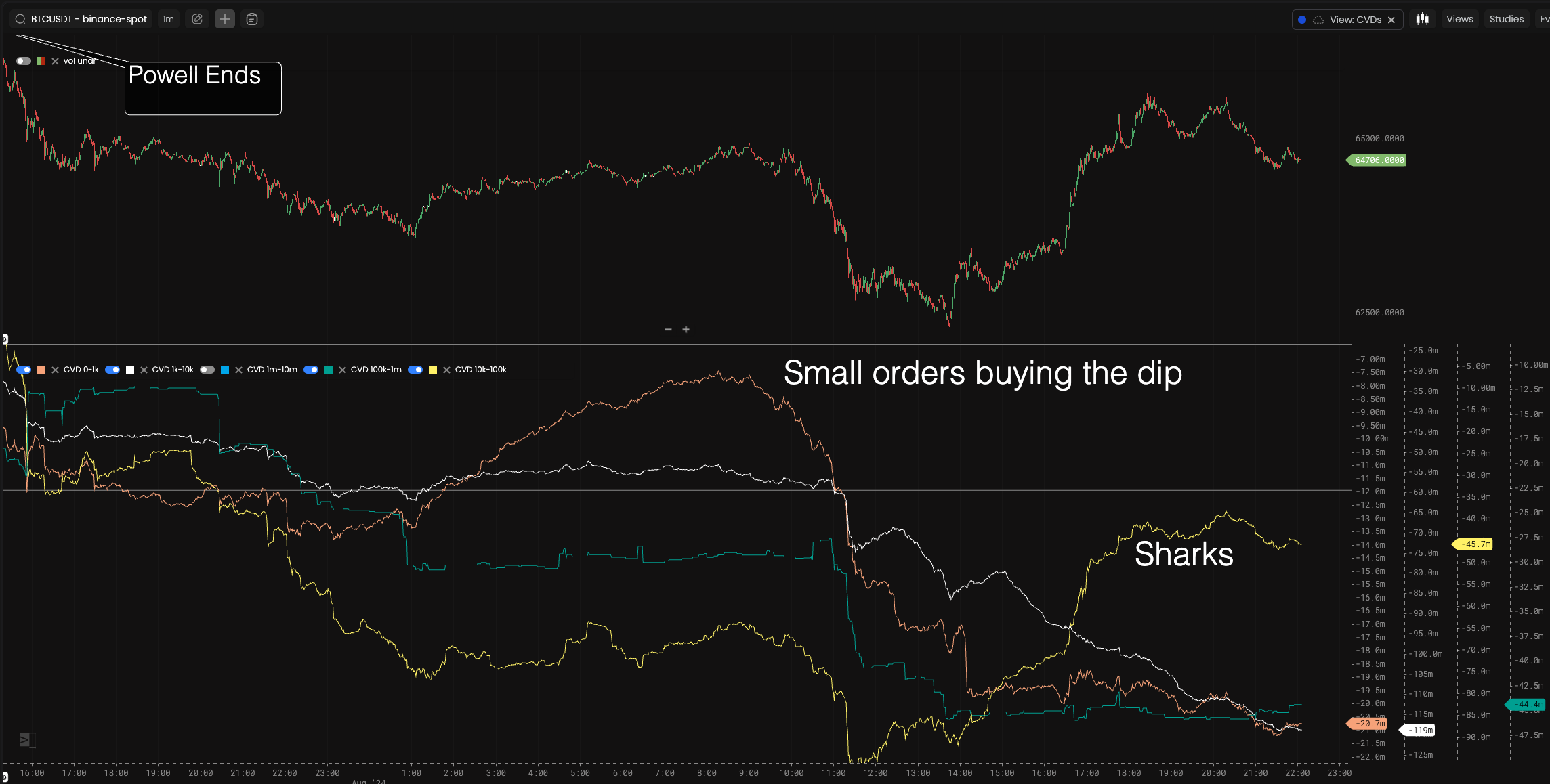

To better understand just what we're referring to, let's take a look at CVD. CVD is a metric that stands for cumulative volume delta. Think of it as a metric that tracks if buyers or sellers are being the aggressor in the market.

If the line goes down, sellers are being more aggressive. If the line goes up, buyers are more aggressive.

The metric below shows several of these lines because each one tracks a certain trade bracket. These brackets are trades that happen within these ranges:

- $0-$1k (light orange)

- $1k-$10k (white)

- $10k-$100k (yellow)

- $100k-$1m (green - "smarter money")

- $1m-$10m (blue)

This means if a trader sold $15,000 of BTC into the bid side of the order book, it would post a declining value on the yellow ($10k-$100k) line below.

Anyways, here's what we saw during Jerome's dead fish press conference...

The market didn't like the fact no rate cut was coming. And as each question came in, the selling aggression seemed to pick up as each syllable of uncertainty flew from Jerome's mouth to the microphone in front of him, and into language models that produced waves of sell signals.

Lots of aggression to the downside.

When we break down the trade flow during the speech, and see it like we do in the chart above, price had no chance.

And as things started to quiet down, the bracket we want to trend higher, never showed up. Instead, we got small orders buying the dip (light orange) as seen in the chart below. And then the more aggressive short-term bracket (yellow line - sharks) trend higher once price looked to be oversold on the short-term.

The price action gives the impression of a bounce. Not a trend reversal. And if we zoom out while showing how strong/weak the orders in the books are, we get confirmation of this bounce view.

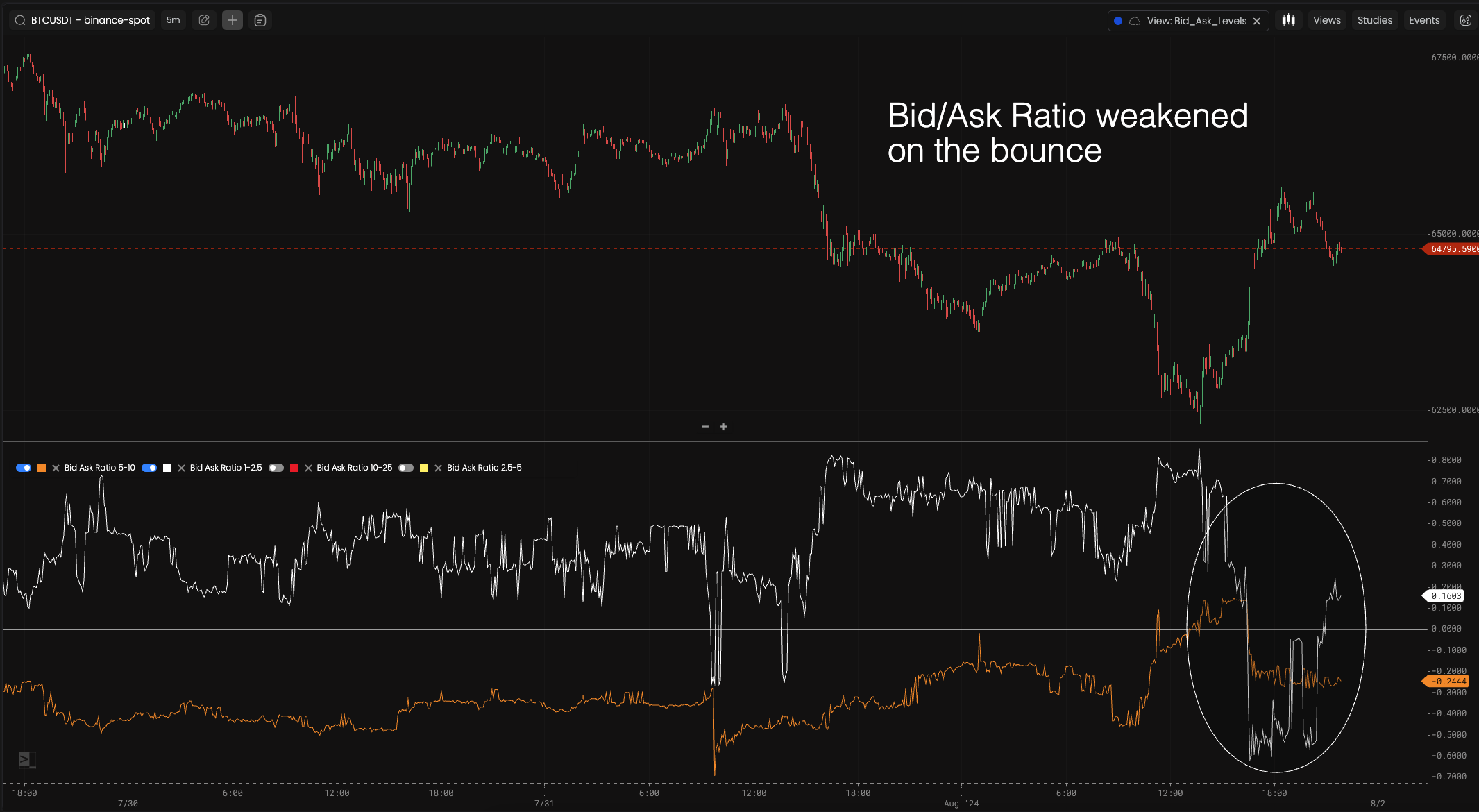

In the chart below, we have bid-to-ask ratio using a 5 minute chart. I'm using this timeframe as it's helpful to see how quickly price began to lose strength in terms of the orders.

As the ratio (white and orange lines) go from positive to negative, it's showing more asks relative to the amount of bids within that specific range.

Here we're showing a range of 1-2.5% (white) from current spot price and 5-10% (orange) from spot. White is more of a minute-to-minute way to look at the market while orange is a longer term view. Both dropped hard as the bounce began to top out.

There are a few more charts that we could highlight to show that the market is not willing to act with any sort of urgency yet. But I think these two charts illustrate the point well enough... Which is to say, in the wake of Jerome's press conference, buyers are not acting like a longer term breakout to the upside is imminent...

Just a bounce.

Meaning a retest of recent lows is likely on deck, and possible re-test of BTC's 200-day moving average is very possible over the weekend.

If we get it, I'll be waiting for J-AI to start scaling into positions due to some of its order flow models seeing strength or perhaps certain onchain wallet flow models lighting up, causing the trading software to act.

As Amit stated in today's X Spaces, this is a "no trade zone". You can find the recording here.

In the meantime, we wait for "beeps" to show up on J-AI's radar before acting. Stay tuned.

Until next week...

Your Pulse on Crypto,

Ben Lilly