Using Options for the Halving

Using options as a tool for the bitcoin halving

Options are a foreign language.

Literally… delta, gamma, rho, etc. come from the Greek alphabet…

But as fancy as those names sound, they lack any real intuition. I mean, consider for a moment that gamma is said to originate from a hieroglyphic that represents a club or throwing stick.

So when it comes to options, does gamma refer to a weapon? Not really…

Unless you’re caught on the wrong side of it… (Silence ensues as my options joke falls flat.)

Gamma represents the rate of change of delta… Which means it’s sort of the second order of delta… Which is a letter that falls after gamma in the Greek alphabet.

See what I mean? No intuition.

This lack of intuition makes learning options hard. It’s something J.J. and I have been realizing as we work on making educational video essays to help people intuitively understand options.

We reflected on our first batch of our educational videos that you can view here and realized our viewers need a thesis, not a dictionary, when it comes to using options.

Once you have a thesis, learning how to express such an idea using options makes it all much more intuitive.

I’m really excited for what J.J. is working on, and you can expect to see his mental framework for trading options very soon… In the meantime, let me give you a follow-up on what Benjamin and J.J. talked about in our latest LIVE episode of The Trading Pit with Marconi Wight at the XC Studios…

(Man, the shameless self-shill is so natural today.)

In that episode, they touched on using options for the upcoming Bitcoin halving in April. So to help address the flurry of questions that came in on the heels of the episode, we put this essay together to give you an idea.

And at the end, we feel strongly that the crypto options market is very inefficient, meaning lots of opportunity. That’s why we partnered up with Coincall, an exchange that lets you trade crypto derivatives like options on BTC, ETH, and some altcoins.

If you want to give it a try, consider using our referral link here when signing up. It’ll go a long way toward helping us allocate resources to put out more options content for you all in the future.

OK, the halving…

Time Is a Flat Circle With Premium

Let’s go back to 2020. The difference in Bitcoin’s price between the open of April 29 and the close of May 11 was $25… Negligible, no difference.

But that doesn’t mean there was no difference elsewhere.

The main difference we saw was in two things. First, the future rate of new Bitcoin being minted was cut in half. Second, the volatility of Bitcoin exploded.

That’s what the chart below is showing. The black line at the bottom subplot shows historical volatility (yes, this is our closed beta product of many things coming…until then, follow xChanging Good on YouTube for our biweekly live show).

We can see this reading rose from 58 to about 95 – significant. And in the weeks that followed, it bled below what it was.

This is pretty important here… The amount of volatility that Bitcoin was experiencing was significantly higher during the halving.

For options, we look at volatility through the lens of IV, or implied volatility. It’s a way to assess how much the price of an option is impacted by this measure.

Meaning for Bitcoin, around the halving… price was the same from April 20 to May 11… Yet, the price of the same options contract could be significantly higher because of the increased volatility.

That’s what we call “buying vol.” It’s going long on this measure of volatility, IV.

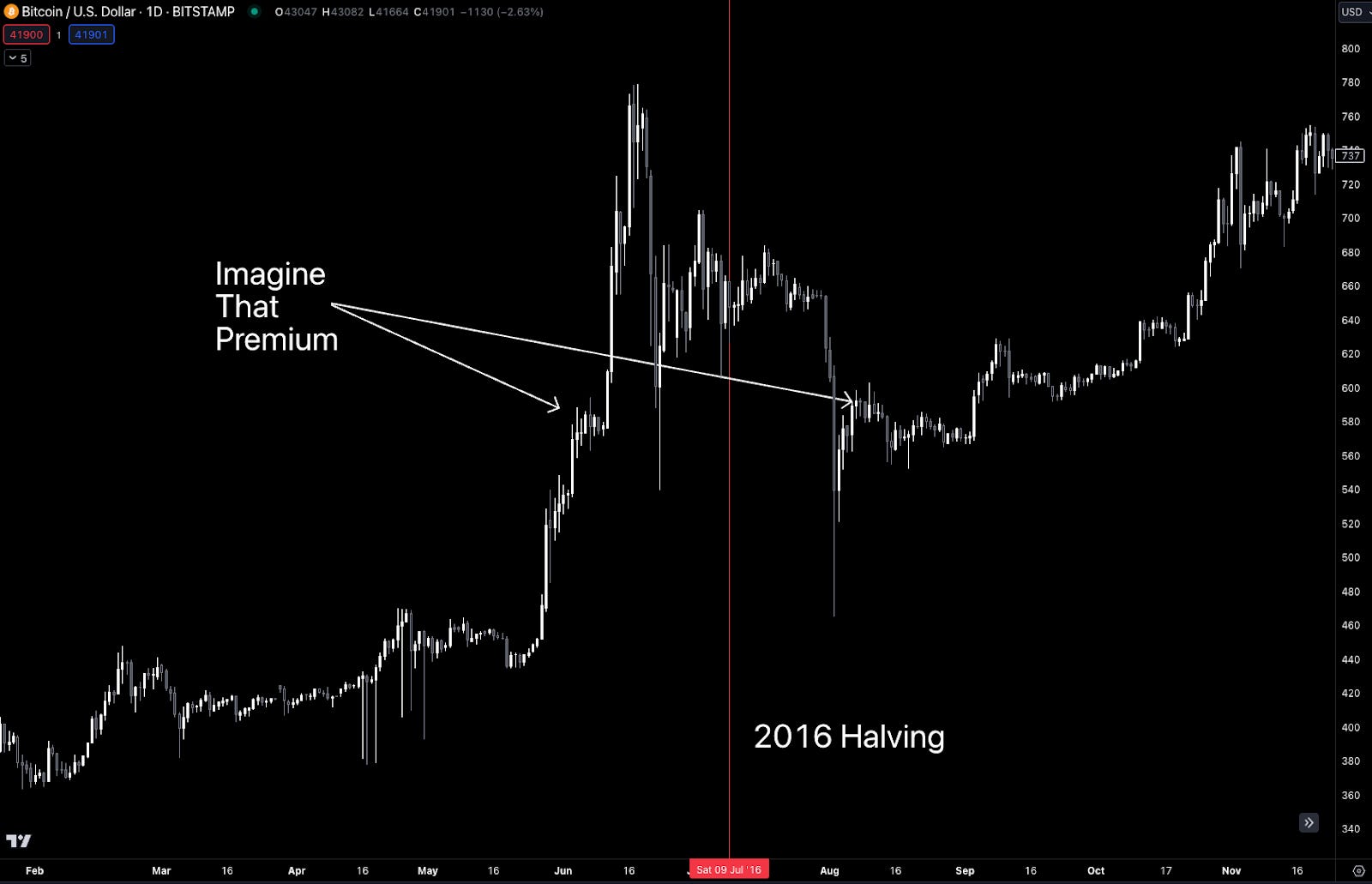

And this wasn’t unique to 2020. Check out 2016 price action…

Even more extreme. Which means executing a buying vol strategy (buying an option contract before and selling after) would have done very well in the last two halvings (not as much in 2012, though).

Hopefully, you’re not too confused at this point. To break it up and hopefully make it a bit more intuitive, here’s a hockey analogy…

When teams play the game of hockey at full strength, each side has five skaters. If the game is tied 1-1 at the end of the first period, the chances of multiple goals happening in, say, the next 10 minutes are pretty low.

But if we remove two skaters from each side of that 1-1 game, the volatility of the game’s score will increase.

Sure, after 10 minutes or so, the game could still be tied. But the whipsawing action of the game makes it more likely we’ll see multiple goals.

For Bitcoin, this is the likelihood that some price above or below what it’s being traded at will be realized.

This means IV is all about probabilities. What are the chances that the price might rise? Well, if volatility is high, those odds are higher… And you’re paying for that through higher IV costs.

No Greek letters needed, am I right?

Alright, so what to do with this information…

Timing is Everything

OK, so the halving did a number on volatility, or IV, during the last two events.

But that doesn’t mean you just start buying up options today. If you buy IV too high, it’ll cost a lot of money to simply sit and wait for the event.

That’s because the chances that price will rise or fall increase with time, meaning the value of options drops as time passes… So you really need to try and time your purchase of vol nearer to expiration and when it’s low.

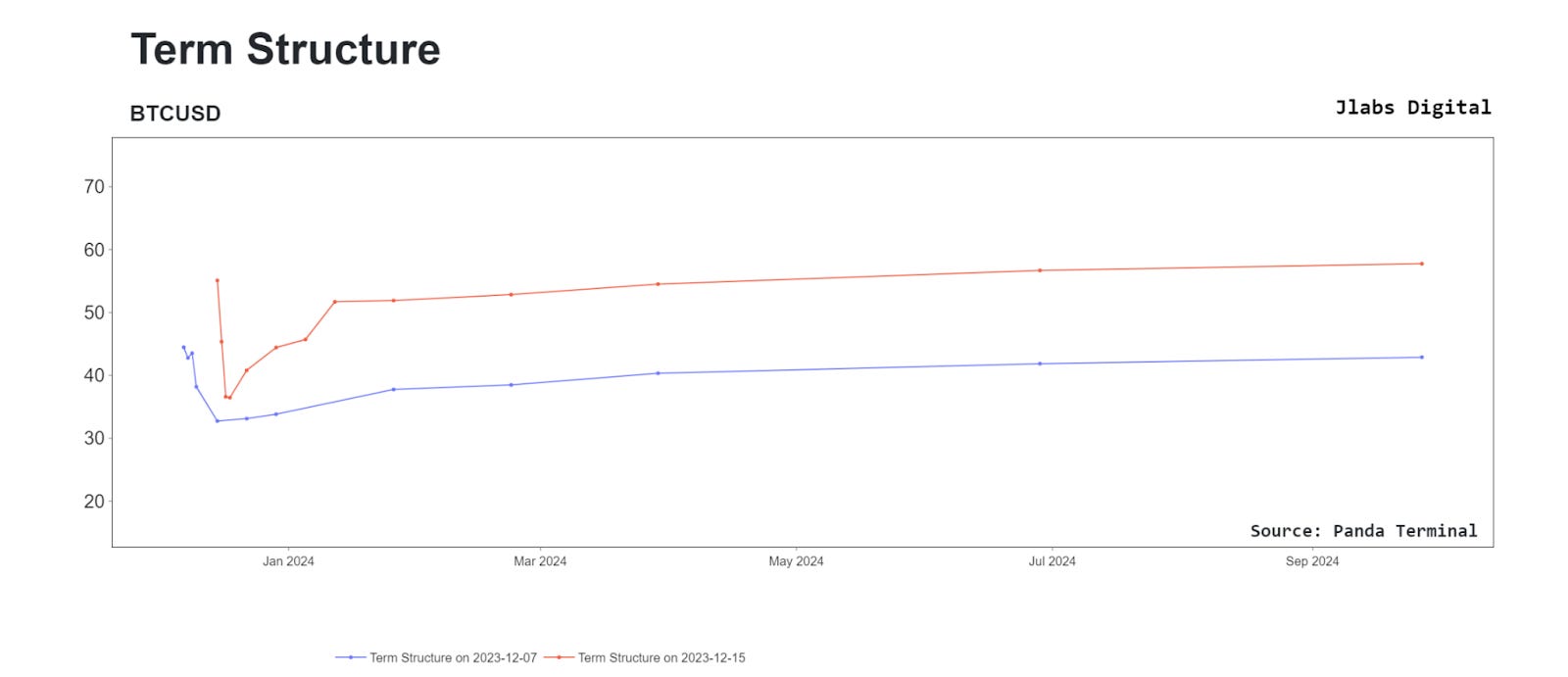

And what we see right now is IV rose quite a lot this month. In the chart below, we can see IV rose from the blue line to the red line. No need to get too specific here on the numbers and dates – just knowing the general movement is what we need to take away here.

What this tells us is maybe the time to load up on that IV is not now.

And as far as how to express this volatility idea and trade in options, well, we will cover that more as IV declines. For now… Let’s watch this IV reading.

With an ETF approval on the horizon, this trade might not be had this year… But perhaps, we can express this same volatility thesis just before the first week in January.

Stay tuned.

Your Pulse on Crypto,

Ben Lilly

P.S. Here is that Coincall referral link if you’re interested in opening a new account.