Tipping Point

Market Update: 12 Jan 2024

We’re talking about an ETF.

A group of self sovereignty touting, data ownership, permissionless, and decentralized minded traders and builders…

Are talking about a wrapped in protection permissioned asset that will be stuffed into portfolios around the nation like your overstuffed sock drawer - the one you haven’t seen the back of for years.

It’s perverse in a sense…

Throwing away all the Web3 values and ethos because we want “Number Go Up”?

Is it right though? Should we be celebrating this “win” of moving token assets into wrapped TradFi custodial rusty COBOL settlement infrastructure ETF shares? Ironic… Isn’t it?

So is it worth popping champagne over?

Hell yes.

If I can meme this moment, it’s here.

The moment started last year when Mr. Gary “shades” Gensler took the time on April fools day to poke fun at the crypto community.

His arrogance had been rising until then.

In fact, his self anointed power began to feel like a fallen from grace pimple laden eldest brother of eight picking on his youngest brother. He took any cheap shot he could.

But this moment marked the top for him… He was overextended on his power trip and and the recoil began.

He and the SEC soon lost to Grayscale and Ripple in short order. U.S. Senators began to press on him… And he was even being threatened with subpoenas.

Even the most reserved of the government figureheads - judges - started to push back with some heat. The snapback was beautiful to watch.

And the end result of this eight month-long snapback was on display when Mr. Gensler begrudgingly filed the deciding vote to approve a spot Bitcoin ETF. It was a moment where crypto collectively exhaled with a subtle smile.

And sure, we will likely celebrate options on these ETF products when they come and even Ethereum’s ETF. But nothing will have the same gravitas as what just happened this week… Likely ever again.

But back to the earlier point… Should we really be celebrating an ETF? I say yes. And here’s two reasons why…

Assuming these ETFs cause prices to rise across the board in crypto…

Those individuals and builders who were here early will get very wealthy. Which means the biggest advocates of Web3 will remove a major barrier to entry to a society that has been resistant to such technology - lack of money. Barrier lifted.

The second reason, those ETFs represent U.S. dollars leaving its current economy and buying into another economy.

In a society where decentralized and permissionless blockspace is a commodity… a commodity that has its own currency… there becomes a new pressure for sovereign money issuers to be better. To be more responsible. And to also listen to its constituents no matter what country you reside in… Because now there are other options out there.

The fiat currency that was taken for granted now needs to earn your business. The tables are turning.

It’s something I don’t think gets enough air space yet because it seems so far off…

But the truth of that matter here is this Bitcoin ETF will accelerate a progression that will put lawmakers, regulators, and monetary policy setters in a position to win back trust.

So celebrate this moment as it’s Malcom Gladwell’s tipping point for much more than just crypto assets… But perhaps for society at large.

The overton window shifted and there’s no turning back.

Well done everyone, now back to work…

Crypto Update

To start it off, spot volume in the equity markets were off the chart today with all the ETFs beginning to trade. We hit $2.3 billion before the 40 minute xChanging Good live show ended this morning.

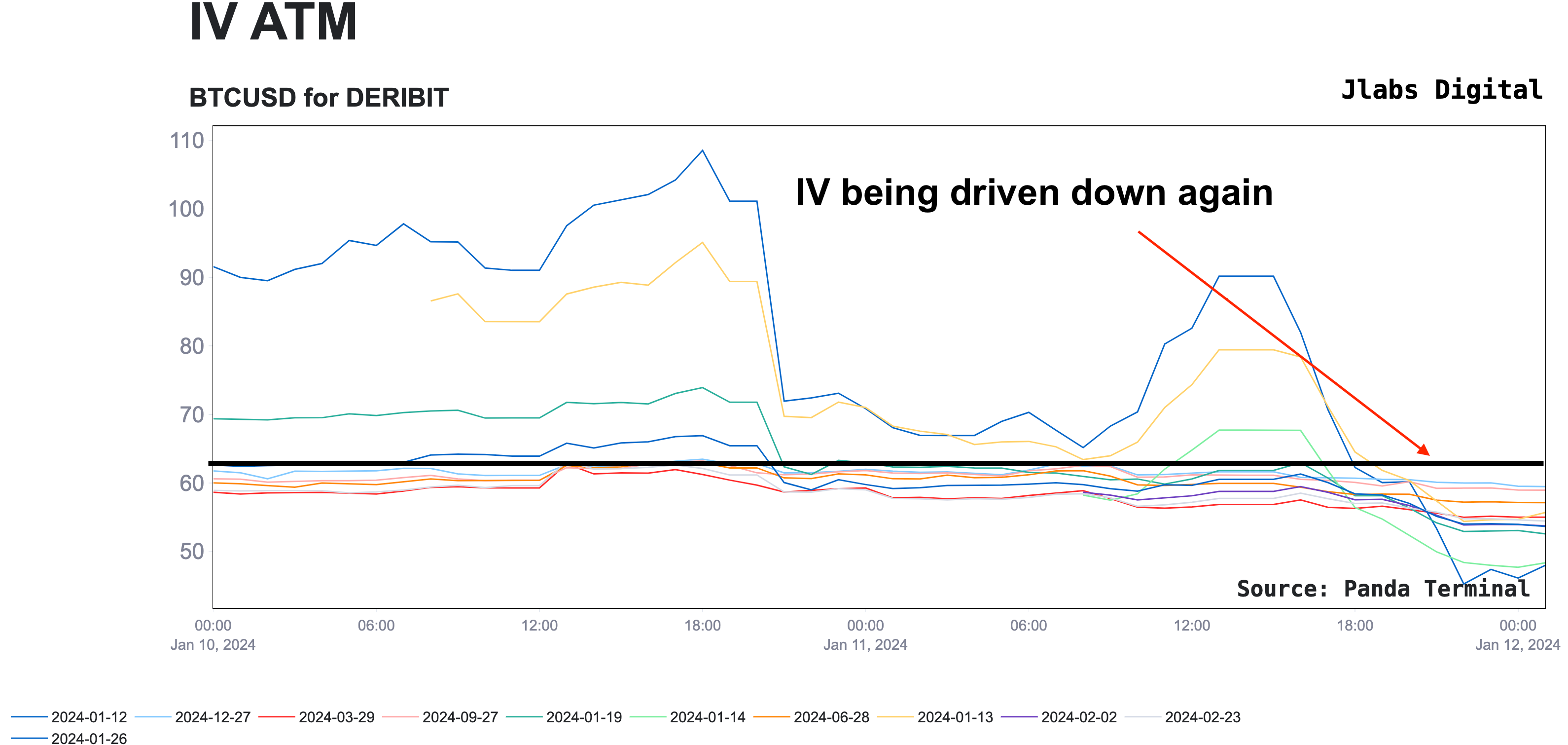

Yet, with all the price action and movement on the candlesticks, volatility continued to get smacked down in the options market.

It’s relentless. In the chart below, I dropped a black horizontal line so you can see that even longer dated options contracts were falling.

I’m surprised volatility has been so low for so long.

To break this constant drilling of IV lower, price needs to scare the market a bit. And it’s in part because as Jlabs Digital Managing Partner, Benjamin pointed out today, there hasn’t been a significant correction yet.

Even hitting these liquidation pools shown below with the red arrows wouldn’t do it… We would need to see price drive below the $40k level (red box) before the market is in a hurry to buy insurance on their positions.

I’ve been saying this for a week now, and I’ll say it again. Now is one of those times before the market rushes to the gates. It allows you to enjoy the upside without fearing the overextended correction. And with IV so low, it’s a cheap insurance policy to help you sleep at night.

So while the ETF is an unprecedented event that could allow us to just keep ripping higher, many things do show price is getting a bit stretched.

Here are whales selling of late…

And here are 30-day returns not having any reset…

Hedging let’s you not get blown out by a correction, but also helps you stay in the game incase BlackRock just rips everybody’s face off with sequential god candles.

OK, enough of Bitcoin’s low volatility issue, what it will take to change it, and keeping portfolios safe in such market conditions…

Ethereum

Let’s get to an interesting tidbit of the week that fell under the radar → Ethereum.

We saw a strong response on ETH/BTC over the last few days. It’s price reversed and looks to continue its trend higher.

Narratives were pulsing through the timeline like winter sets at Hawaii’s pipeline.

Much of the reason for why everybody was suddenly having a change of heart on ETH was that it was next in line for an ETF. The timeframe for that is currently in May, and top notch Bloomberg analyst, Eric Balchunas, has approval odds at 70%.

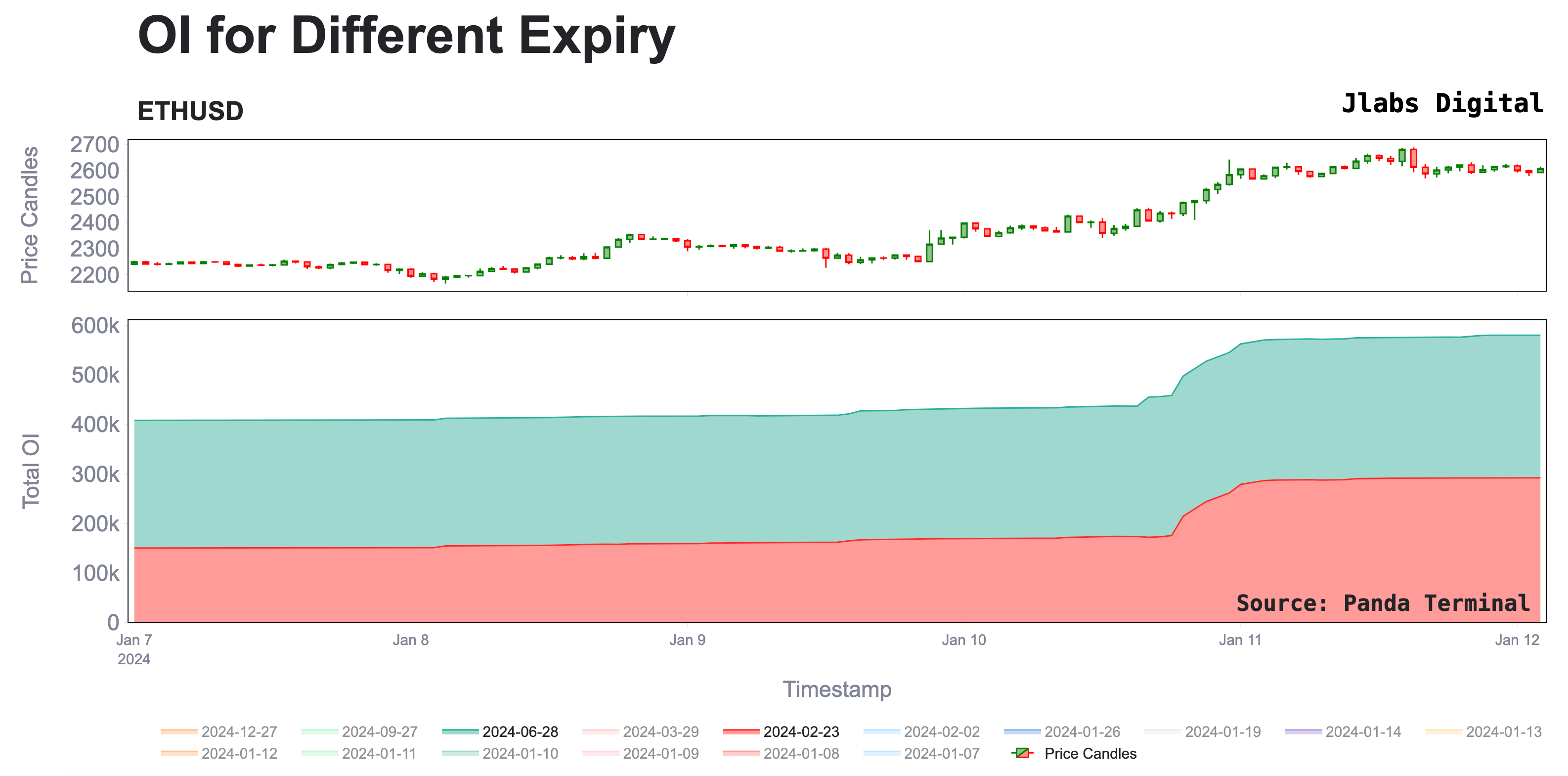

What was most interesting here is the options market exhibited some of this sentiment shift as well.

Below is the open interest for February and June contracts for Ethereum. Both saw a nice uptick in action over the last 24hrs.

What was a bit odd though is the June contract didn’t show anything significant. While the open interest did have a decent uptick, the call-to-put ratio didn’t move much.

We care about the call-to-put ratio to help find any anomalies. And again, June didn’t show anything odd. But February did.

The call-to-put ratio had a major uptick… Lots of open interest was seen at $2,700 and $3,100 strikes. This is something to watch for the rest of the month.

This action makes one wonder if we are about to see deja vu… For those that followed along with JJ’s commentary in the xChanging Good live stream that happens every Tuesday and Thursday at the New York open, you might recall how Bitcoin options had methodical like upticks.

Each month we would see higher price targets (strikes) realize large upticks in open interest… Then price would get suppressed in the orderbooks… And then once those sell walls were lifted, price would push into those higher price targets. It was masterclass like.

And seeing the February Ethereum contracts showcase similarities gives me flashbacks. It’ll remain something to watch in the coming week especially as the market shows continued signs of over-exhaustion.

That’s enough out of me today… Enjoy the fun here. Until next time…

Your Pulse on Crypto,

Ben Lilly